For the past two decades, the Global Industry Classification System (GICS) has been the standard taxonomy used by the financial markets. As you’ll soon see, the GICS is more than just a classification system – it’s the lynchpin of indexing strategies employed by fund managers seeking exposure to certain sectors and industries.

First developed in 1999 by Standard and Poor’s and MSCI, the GICS categorizes companies on the basis of their sector and industry groupings. These groupings are then used by fund managers to create new investment products and investment strategies that cater to a specific segment of the market.

Therefore, investors with exposure to diversified portfolios, index funds, mutual funds and exchange-traded funds (ETFs) have a vested interest in understanding how this taxonomy works.

Following recent revisions to the GICS, which were implemented in September 2018, U.S. equities are broken down into 11 broad sectors:

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Healthcare

- Industrials

- Information Technology

- Materials

- Real Estate

- Communications Services

- Utilities

Changes in the GICS, no matter how small, can have a drastic impact on the broader market. Case in point: FTSE Russell, MSCI and S&P Dow Jones Indices have trillions of dollars in invested capital that track indexes tied to the GICS. At present S&P Dow Jones has over $4 trillion in assets invested in passive funds that track its indices, with another $7.5 trillion held in actively managed accounts that use its indexes as benchmarks. FTSE Russell has $15 trillion in combined capital tied to its indexes, while MSCI has nearly $11 trillion.

Learn about the different stock classification systems here.

The GICS Classification System

Below is a more detailed breakdown of each sector.

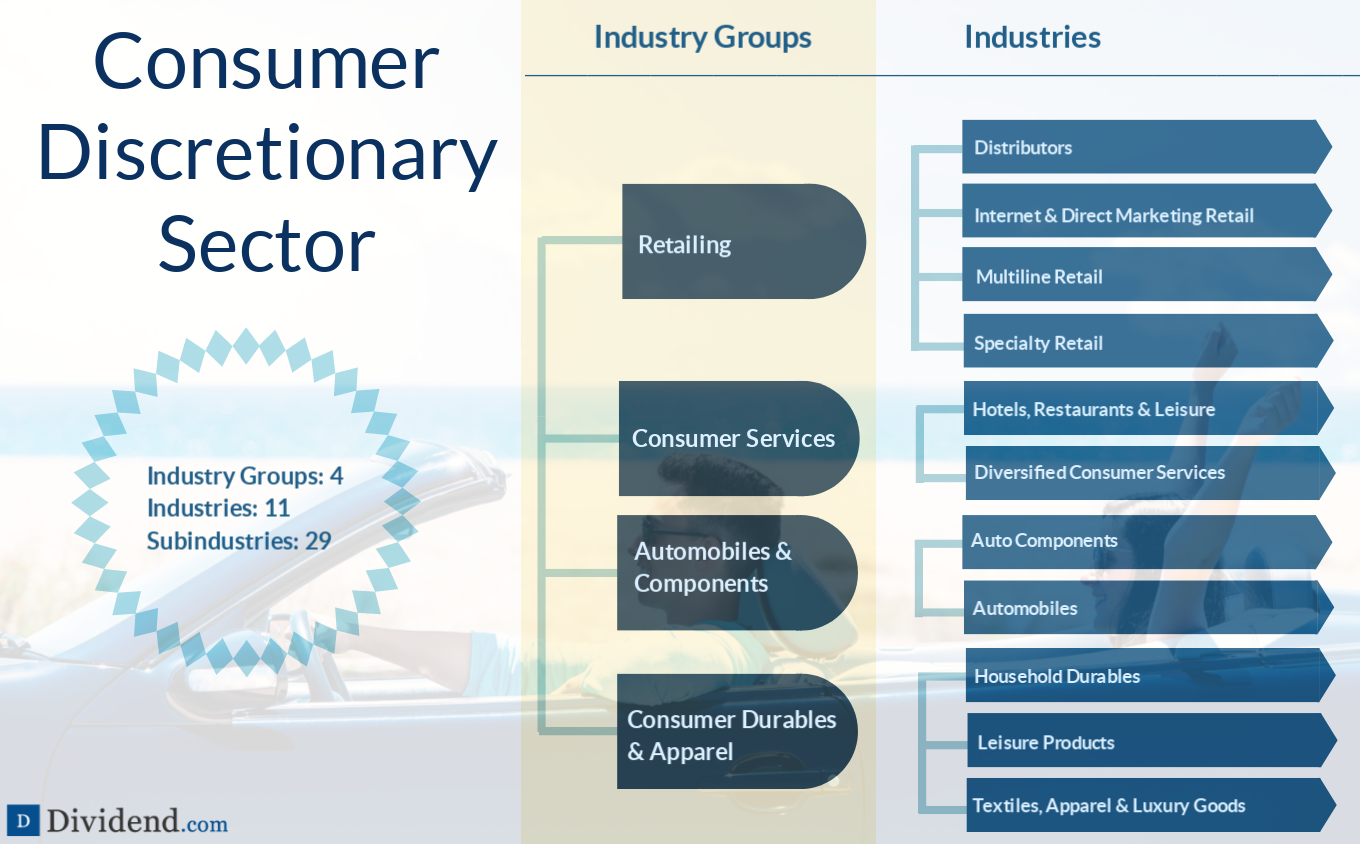

Consumer Discretionary

The consumer discretionary sector is a broad category of companies that are directly impacted by the business cycle and broader economic conditions. These companies tend to perform very well during boom periods but struggle when the market hits a downturn or the economy falls into recession. Examples include automotive, hotels, restaurants and leisure, and household durable goods.

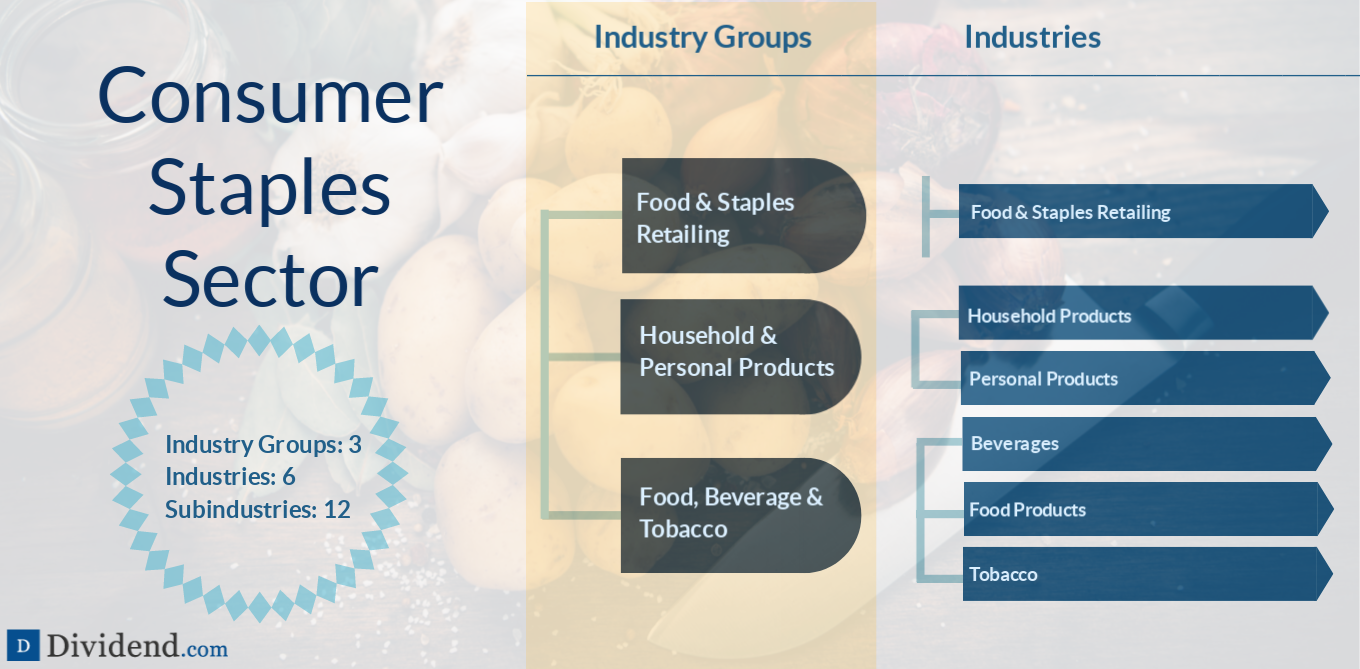

Consumer Staples

- Average dividend yield: 3.13%

- Dividend stocks: Procter & Gamble Co. (PG ), Coca-Cola Co. (KO ), B&G Foods Inc. (BGS )

The consumer staples sector comprises businesses that are said to benefit from high demand regardless of the business or economic cycles. These sectors typically outperform the market during recessions or cyclical downturns because demand for their products and services remains steady. Examples include food products, beverages, and household products.

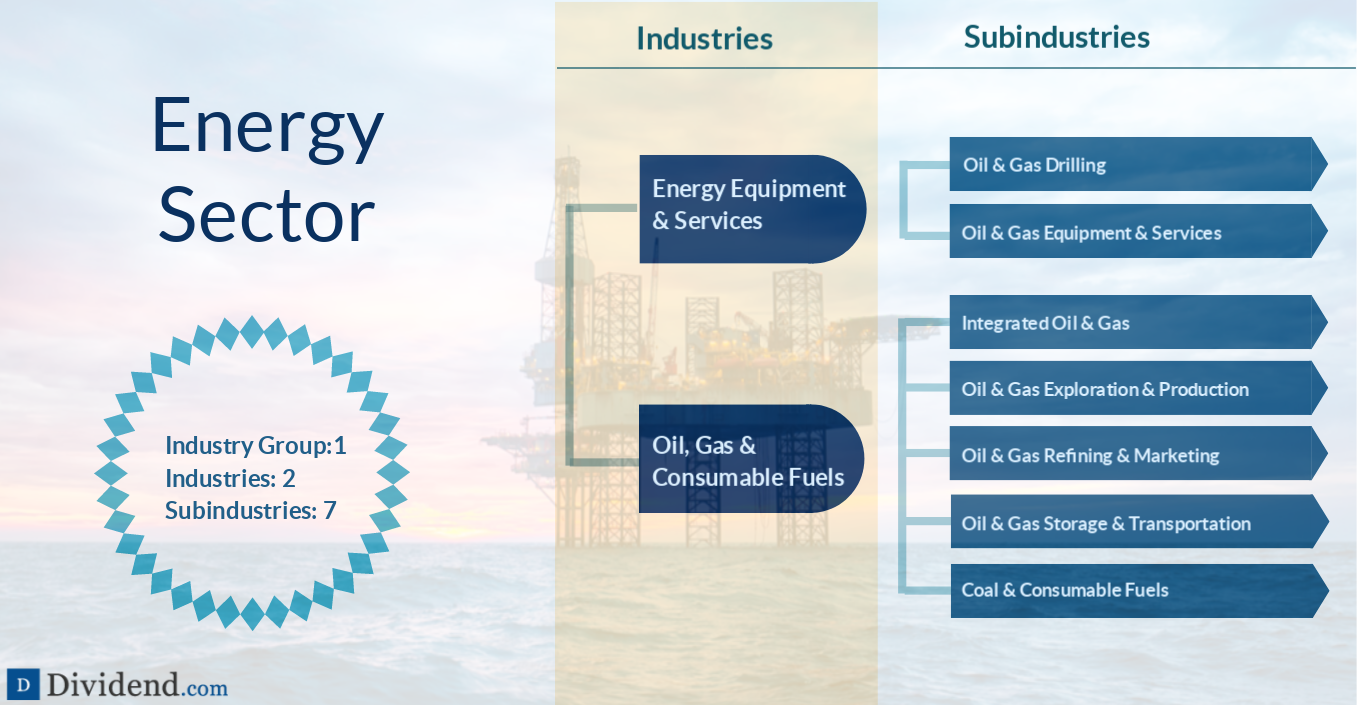

Energy

- Average dividend yield: 2.66%

- Dividend stocks: Exxon Mobil Corp. (XOM ), Chevron Corp. (CVX ), Vermillion Energy Inc. (VET )

Companies that are involved in the sourcing, drilling, extracting and refining oil and natural gas are grouped in the energy sector. The sector is further broken down into just two industries: energy equipment and services, and oil and gas and consumable fuels. As one would expect, energy companies are heavily influenced by commodity prices. Examples include energy producers and drilling service providers.

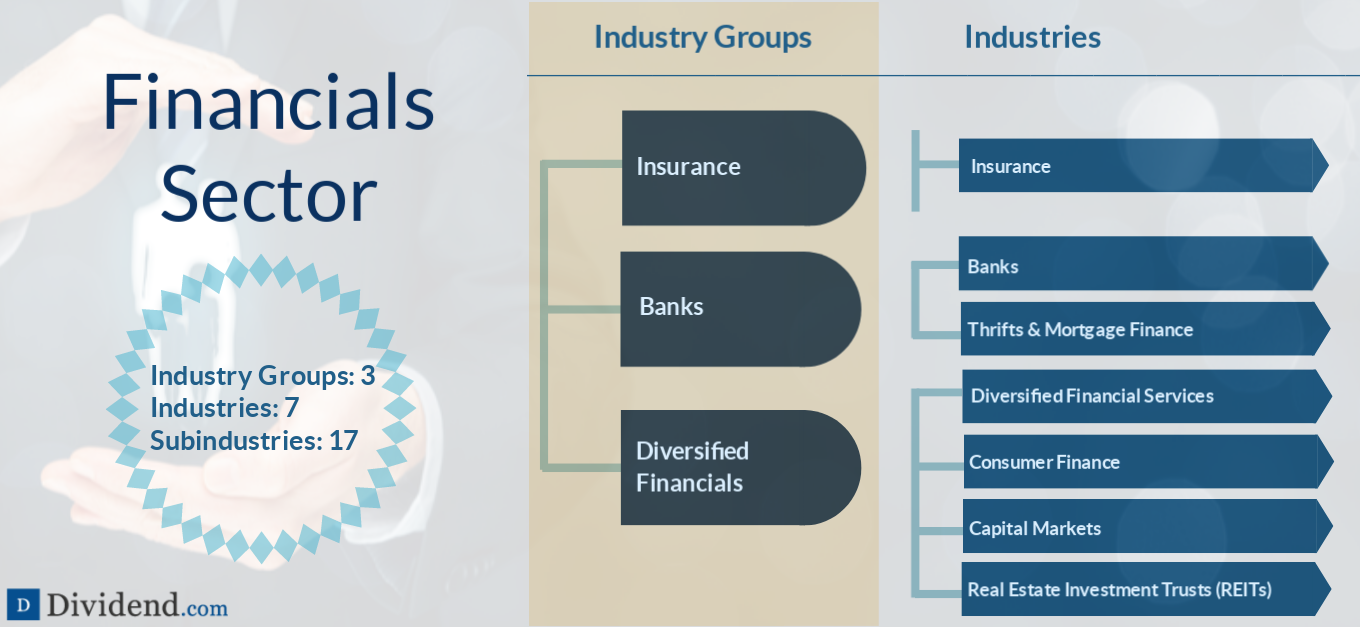

Financial

- Average dividend yield: 1.83%

- Dividend Stocks: Wells Fargo (WFC ), T. Rowe Price (TROW ), PNC Financial (PNC )

As the S&P 500’s second-largest sector by market cap, financials include any and all companies that are involved in the money business. This includes banks, insurance providers and credit card issuers. Financials are an important lynchpin of the economy and their performance is watched closely by investors at all stages of the economic and business cycles. Examples include banking, capital markets, and insurance companies.

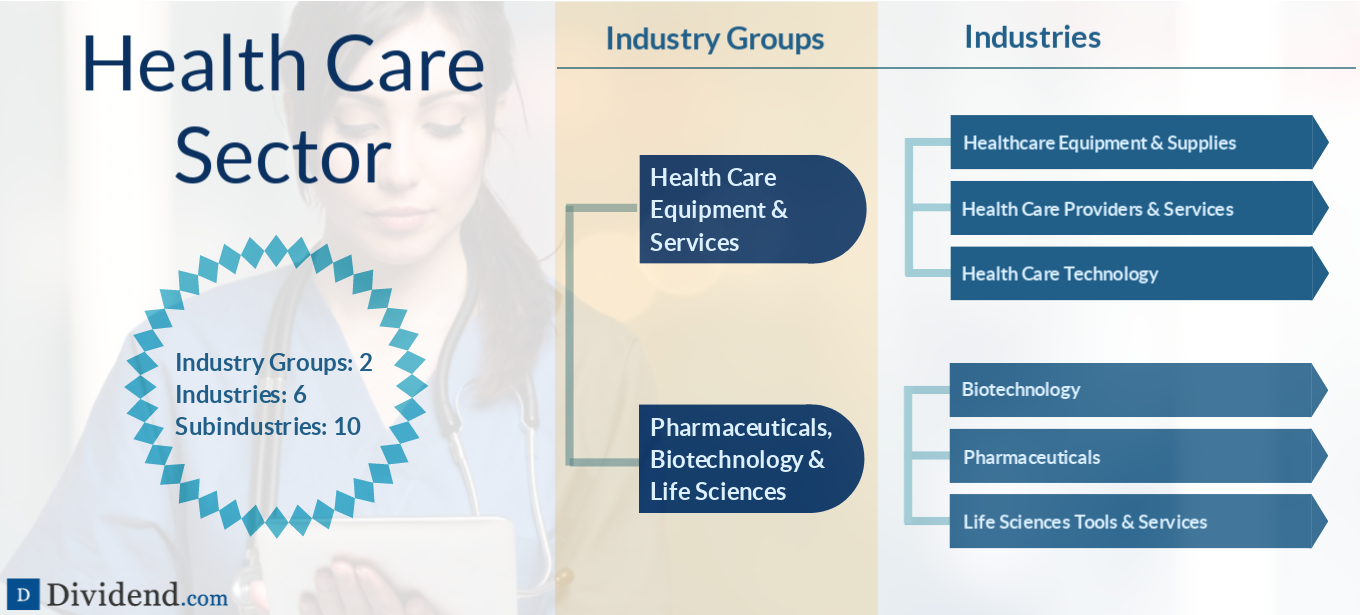

Healthcare

- Average dividend yield: 1.64%

- Dividend stocks: AbbVie Inc. (ABBV ), Pfizer Inc. (PFE ), Welltower Inc. (WELL )

Healthcare is a dynamic sector that includes everything from life science companies to hospitals and pharmaceuticals. The rich and rapidly growing biotechnology industry is also grouped in with healthcare, which gives investors access to young companies at the cross-section of health and technology. Examples include drugmakers, equipment suppliers, and healthcare technology providers.

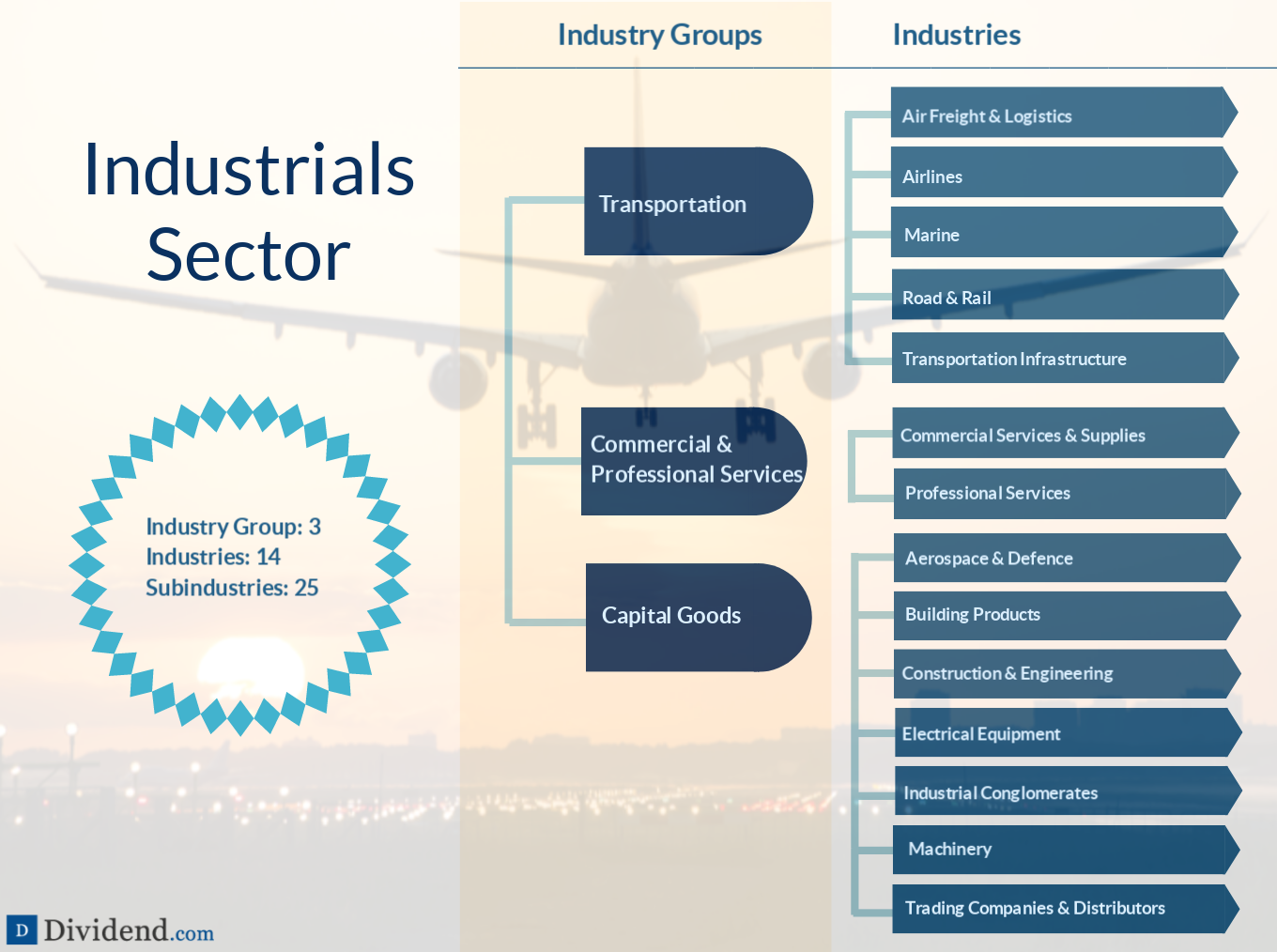

Industrials

- Average dividend yield: 2.02%

- Dividend stocks: Mueller Water Products, Inc. (MWA ), Timken Company (TKR ), MSC Industrial Direct Co. (MSM )

Industrials companies form the bedrock of the economy, connecting people, businesses and nations through various industries and sub-industries. Industrials include everything from aerospace and defense to machinery and electrical equipment. This sector benefits from large capital investments and state-sponsored infrastructure plans. Examples include airlines, construction companies, and defense contractors.

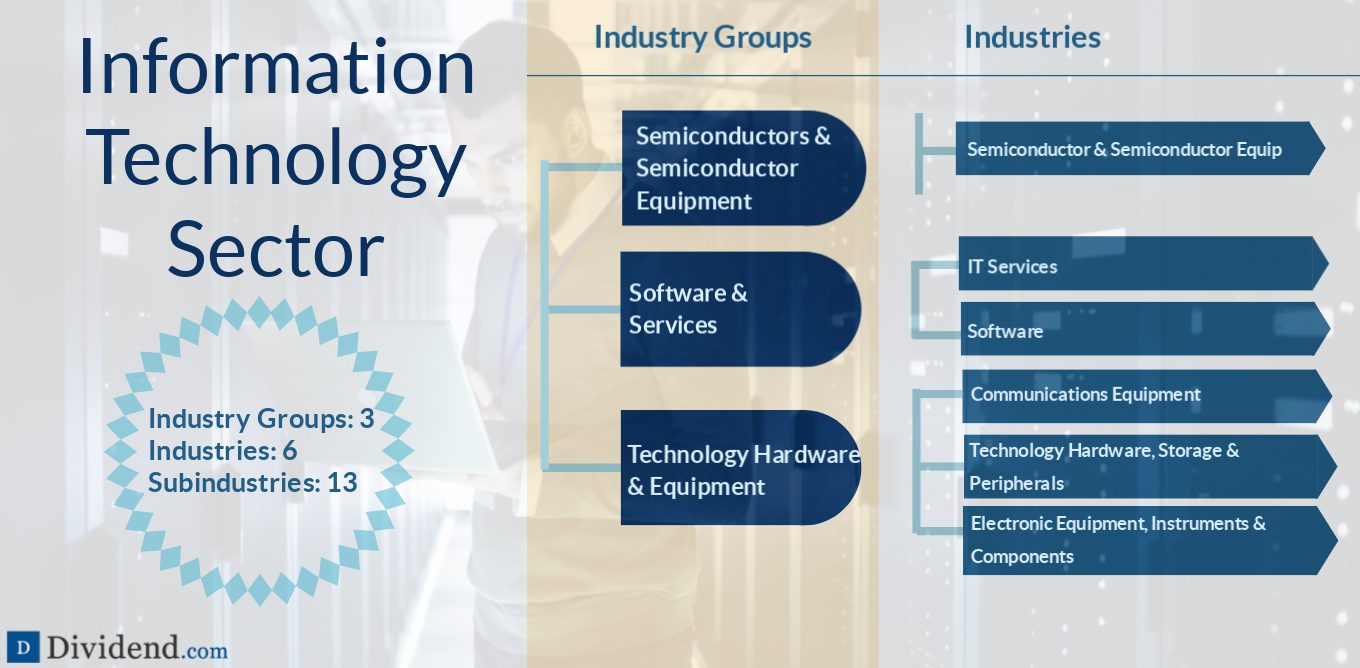

Information Technology

- Average dividend yield: 1.18%

- Dividend stocks: Cisco Systems Inc. (CSCO ), IBM Corp. (IBM ), Qualcomm (QCOM )

In terms of market capitalization, no sector compares to information technology. Technology is Wall Street’s most explosive sector, offering investors unrivaled access to some of the world’s fastest-growing companies. This extends far beyond internet and e-commerce to include communications equipment, semiconductors and electronic equipment. Examples include IT service providers, chip processors, and cloud computing businesses.

Materials

- Average dividend yield: 2.09%

- Dividend stocks: Dow DuPont Inc. (DWDP),Westlake Chemical Partners LP (WLKP ), Caterpillar Inc. (CAT )

The materials sector is comprised of a large cross-section of companies that extract and process raw materials used by other companies. Much like energy stocks, materials companies are heavily influenced by the price of commodities. Examples include chemical manufacturers, forestry companies, and miners.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with DARS ratings above a certain threshold.

Real Estate

One of the newest additions to the S&P 500, the real estate sector is an outgrowth of the financials cluster and includes companies directly involved in property management and investment. This includes real estate investment trusts (REITs), one of the highest dividend-paying industries. Examples include REITs.

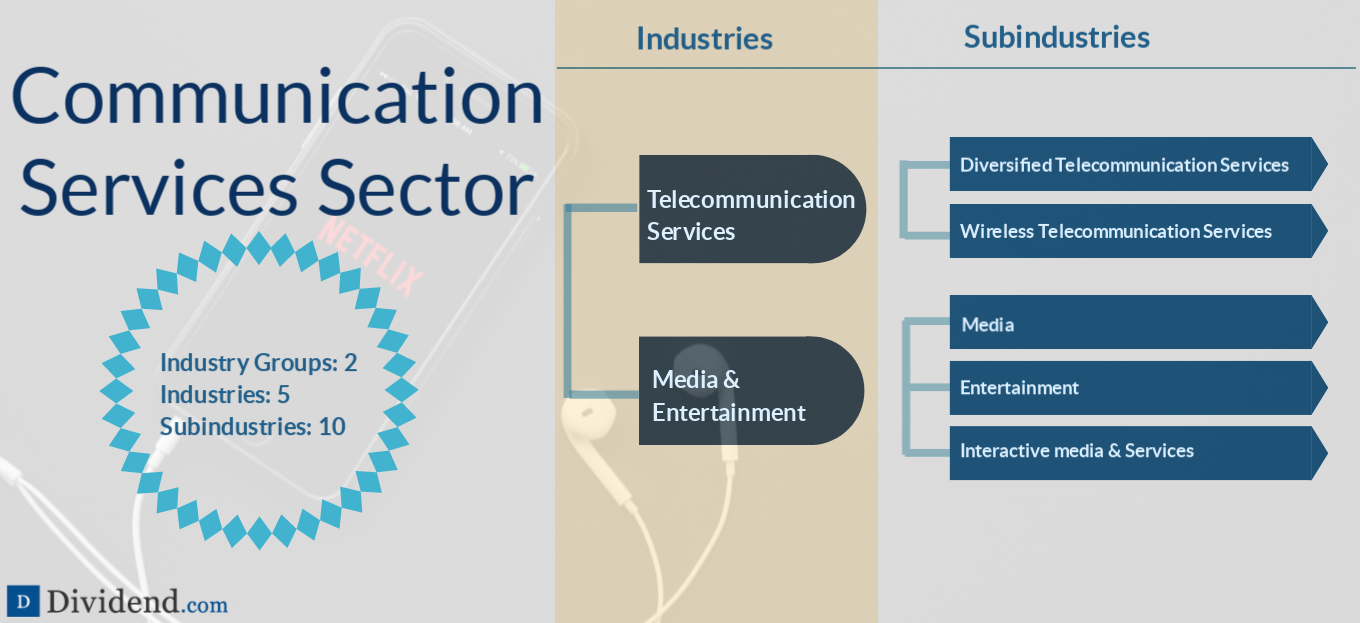

Communication Services

- Average dividend yield: N/A

- Dividend stocks: Verizon Communications Inc. (VZ ), AT&T (T ), Vodafone (VOD )

Communications services is the newest addition to the S&P 500 Index and consists of some of the world’s biggest companies, including Alphabet Inc. (GOOG) and Facebook Inc. (FB ). The sector was created after the GICS developers realized that a new classification was needed to account for content developers and other forms of online media. Examples include direct online marketing, social media networks, and content creators.

Want to know about the recent GICS Structure changes? Click here.

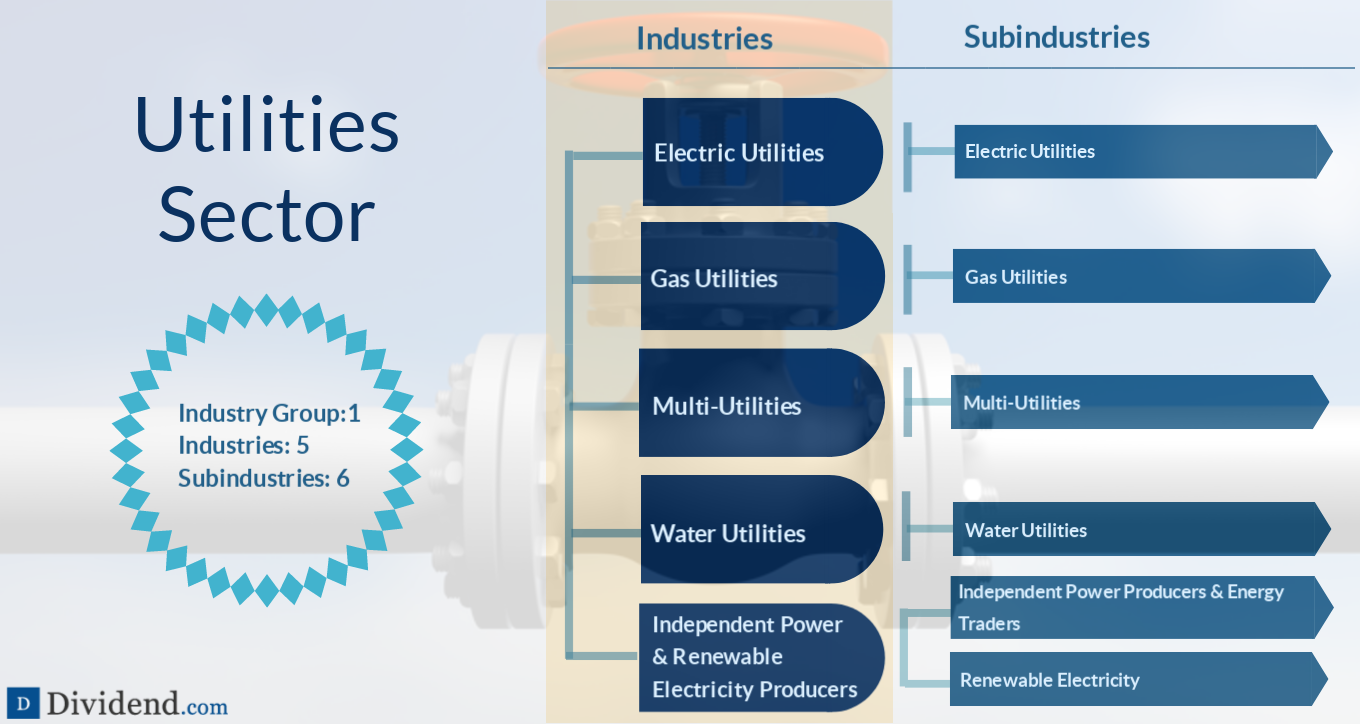

Utilities

- Average dividend yield: 3.46%

- Dividend stocks: Dominion Energy Inc. (D ), OGE Energy Corp. (OGE ), Duke Energy Corp. (DUK )

One of Wall Street’s most dependable sectors, utilities represent a narrow cluster of companies that provide electrical, gas and renewable energy solutions. These essential services ensure steady demand for utilities stocks at all stages of the economic cycle. Examples include electricity providers, renewable energy, and water or hydro providers.

Check out here to learn more about the recently launched tool by Dividend.com for traders.

The Bottom Line

Getting your sectors and industries in order is critical in order to successfully navigate the financial markets. With this information in hand, you can better identify new investment opportunities as they arise.

Check out our Best Dividend Stocks.