For investors, budgeting is more than just an act, but a mindset for preserving capital. Budgeting is, therefore, the most basic yet most effective way to manage money long term. As most successful investors can attest, there is no shortage of benefits to successful money management. Luckily, this process has been made easier than ever before through mobile apps and other digital tools that can help you stay on top of your income and outlays on a daily basis.

As part of its ongoing commitment to helping investors maximize their success, Dividend.com has collated the following list of five high-yield budget apps you can carry with you in your pocket. These apps can help you allocate your money in an effective way to help you delay immediate gratification for long-term wealth and success. By budgeting effectively, you are well on your way to directing more hard-earned capital to your dividend portfolio.

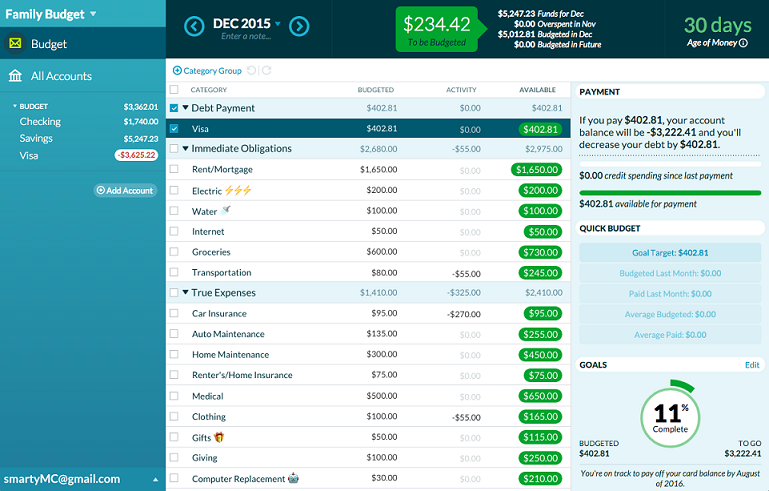

| Rank | App Name | Downloads | Platform(s) | Best Features | Reviews of the App | Pricing |

|---|---|---|---|---|---|---|

| 1 | Mint Personal Finance & Money | ~10M | Android & iOS | Powerful charting tools; automatically categorize transactions. | Great for monthly tracking; easy money management tool; provides large depository of information in easy-to-use format. | Free |

| 2 | You Need a Budget | 0.6M | Android & iOS | Powerful software; four easy trading rules; premium features. | Simple to use; stable app; great system that is easy to follow and execute. | $5/month |

| 3 | Every Dollar | 0.1M | Android & iOS | Provides a walkthrough of David Ramsey’s “baby steps” of budgeting; simple interface; clear budget goals. | User friendly; minimal training required; desktop add-on is a plus. | Free; $99/year for Every Dollar Plus |

| 4 | Quicken | 0.1M | Windows & iOS; Android & iPhone | Full-fledged budgeting program backed by powerful software; real banking features; sync capability across mobile and desktop devices. | Latest version offers significant improvement; ability to sync investments is a plus. | Starter Edition ($39.99); Deluxe ($74.99); Premier ($04.99). |

| 5 | HomeBudget | 0.1M | Android & iOS | Full-featured tool that provides quick summary and forecast options; sync option allows multiple devices to exchange expenses and income information. | Attractive interface and flexibility to set budgets with various periods; customizable with a large set of features that can be paired with PC. | Free; $5.99 for HomeBudget with Sync |

1. <a href="https://www.mint.com/" rel="nofollow">Mint Personal Finance & Money</a>

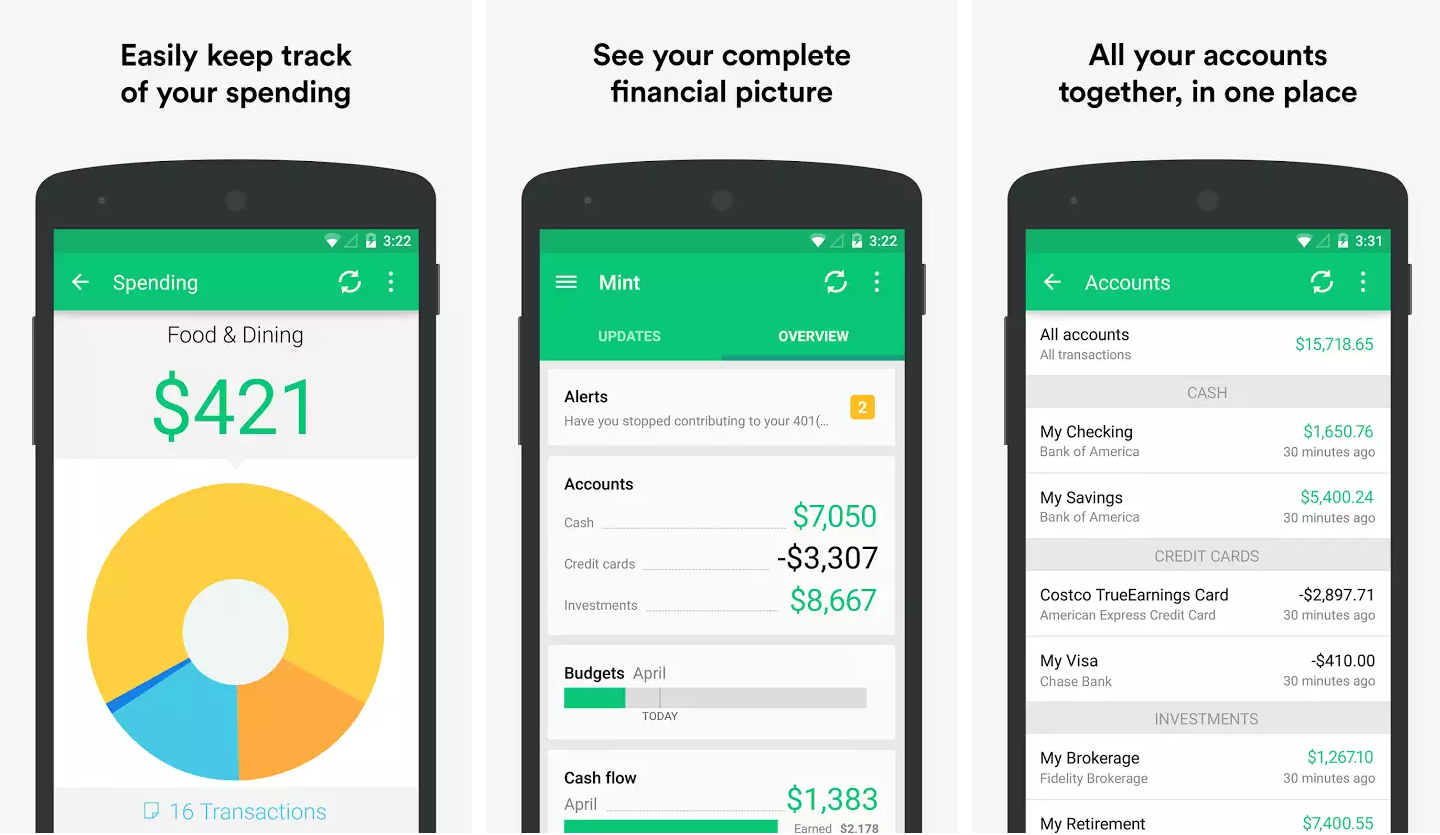

Mint Personal Finance & Money tops the list of budgeting apps. The platform, which has been around for a decade, is by far the most popular personal finance program with over 5 million downloads. Mint allows you to connect various financial accounts, including bank accounts and credit cards, that can then be tracked in real time.

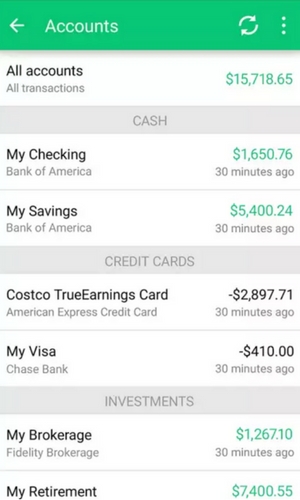

Mint’s primary strength lies in its ability to give you a big picture view of your personal finances. This high-level overview is intuitive and easy to use, offering colorful layouts and detailed transactions. It’s important to note that Mint is primarily a tracking app meant to give you a real-time glimpse of income and spending trends. It’s up to you to apply that knowledge to your overall budget aims and investing strategy.

The setup process requires that you add financial accounts, including bank accounts and credit cards, to your budget tool. The tool will then assign your previous transactions to various adjustable categories. This powerful categorization method takes the hassle out of budgeting. So, while it may take a while to verify your accounts and get set up, automatic categorization will save you a lot of time down the road.

How to use Mint

- After downloading the Mint app and creating an account, you will notice a screen that says, “See all your accounts in one place.” This is where you have the option to search for your bank.

- Log in to your bank account. This may take several minutes.

- Once you’ve connected to your financial institution, you can simply click the “Close” button to move on to the next step. After hitting “Close,” you’ll be taken to another screen that provides an overview of your financial situation.

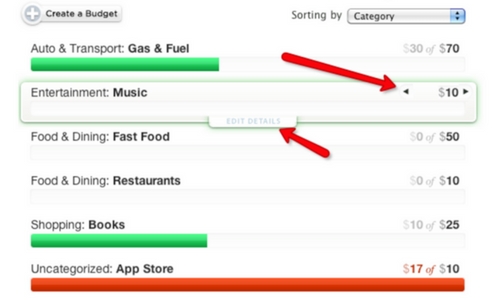

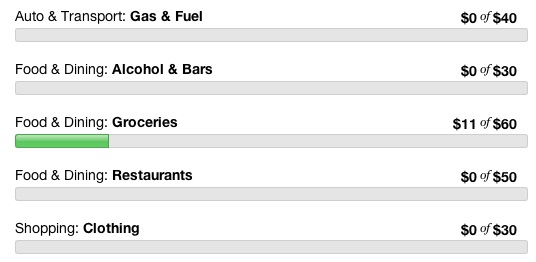

- Scroll back to the “Budget” menu item to get your suggested budget. The first item in your suggested budget will probably be “Auto & Transport: Gas & Fuel.” Here, you’ll see a recommended amount that can be adjusted manually.

- Repeat this step for your other budget expenses.

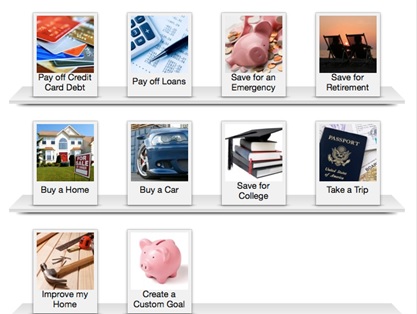

- You then have the option to set up financial goals, such as pay off credit, buy a home or save for college. That way you can link your budget to real-life goals that will help you stay motivated.

2. <a href="https://www.youneedabudget.com/" rel="nofollow">You Need a Budget</a>

You Need a Budget (YNAB) has quickly emerged as one of the foremost budgeting apps for both investors and casual consumers alike. The app is built on four rules that are designed to help users save toward their financial goals:

- Rule One: Give every dollar a job.

- Rule Two: Save for a rainy day.

- Rule Three: Roll with the punches.

- Rule Four: Live on last month’s income.

Unlike other budget tools, YNAB is a complete system that helps you create a budget you can execute on a daily basis. This partially explains the $5/month price tag attached to it after the initial 34-day period.

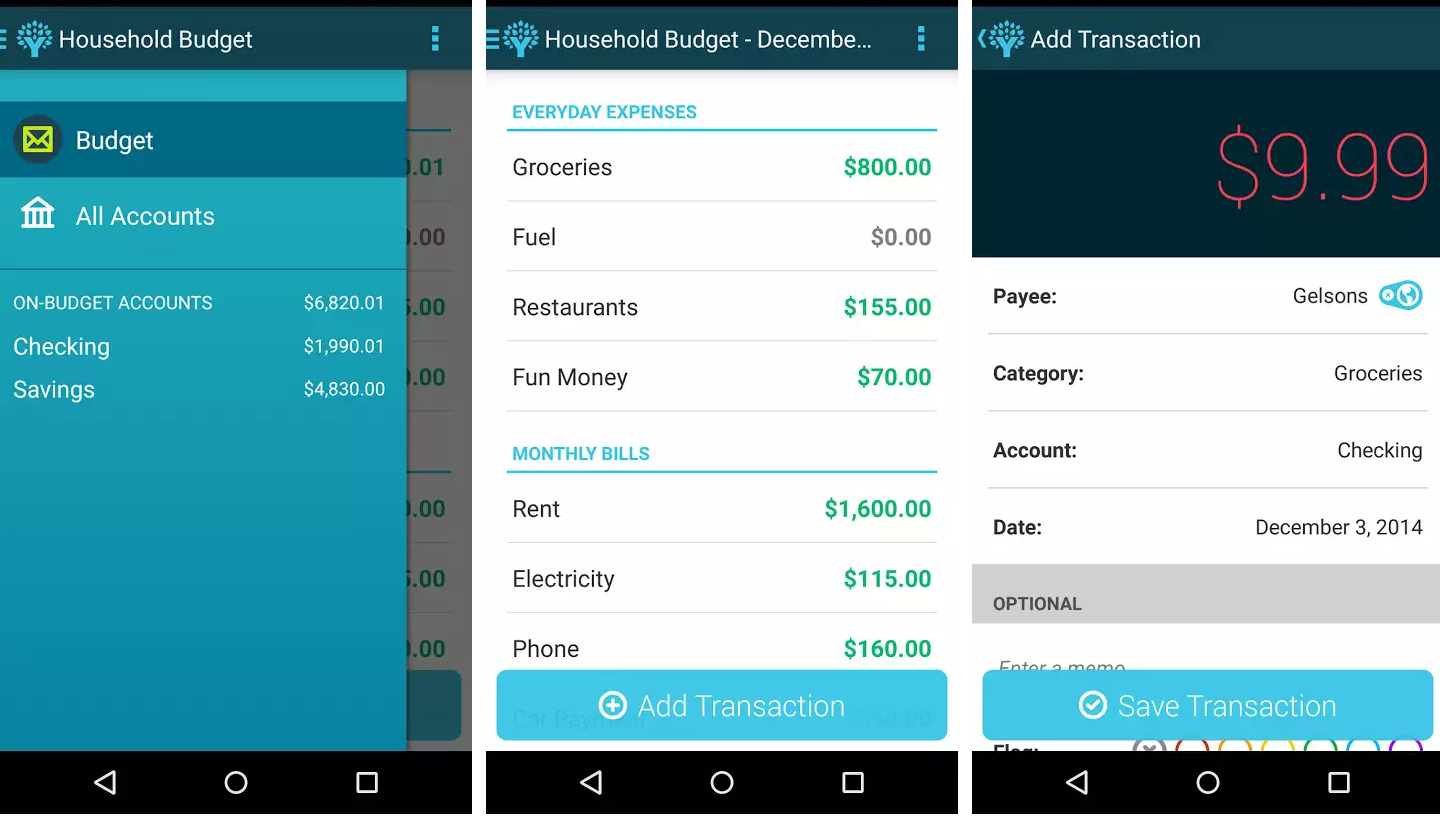

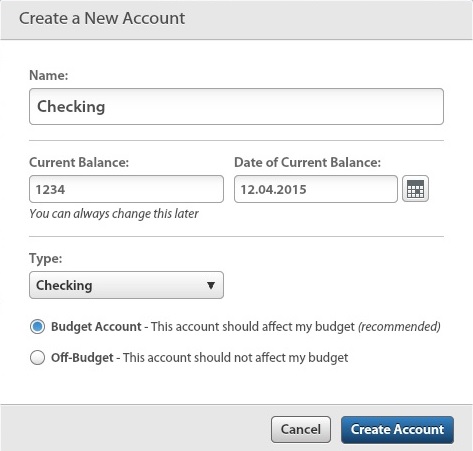

The setup process is straightforward. After installing YNAB, you are prompted to set up Cloud Sync, which allows you to integrate various electronic devices and the important information they store. This is especially useful if you decide to add on YNAB’s desktop software features. After installing Cloud Sync, users organize their budget categories and begin adding accounts. YNAB recommends keeping it simple and only including accounts you actually use, such as checking, savings and credit cards. You are now ready to budget your dollars. Despite the price tag, YNAB has a large following that swears by the program, making it one of the best choices for serious dividend investors looking to direct more capital into their investing account.

How to use YNAB

- After installation, your first step is to set up Cloud Sync. Simply follow the instructions and the app will take you through the installation process.

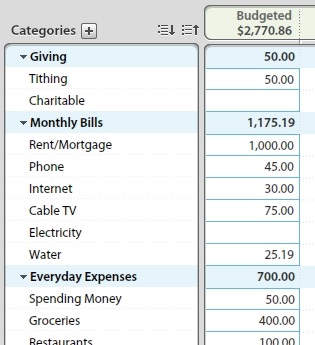

- Your next task is to organize your budget categories. If you don’t like any of the options, you can easily create a new category by clicking on the + sign that appears next to the “Categories” label.

- After setting up your budget categories, it’s time to begin adding accounts. It’s recommended that you keep it simple and only include accounts you spend from, such as checking, savings or credit cards.

- You are now ready to budget your dollars. Give your budget a name and begin assigning a job to every dollar you earn. YNAB recommends you start with essential items. This includes asking yourself what you absolutely need to pay until your next paycheck arrives. This will likely include rent, groceries and transportation bills.

- After setting up your account and budget, you’ll quickly see that YNAB uses a zero-sum system for allocating your funds. Since all the categories are available to you on one interface, it won’t be difficult to assign a job for every dollar.

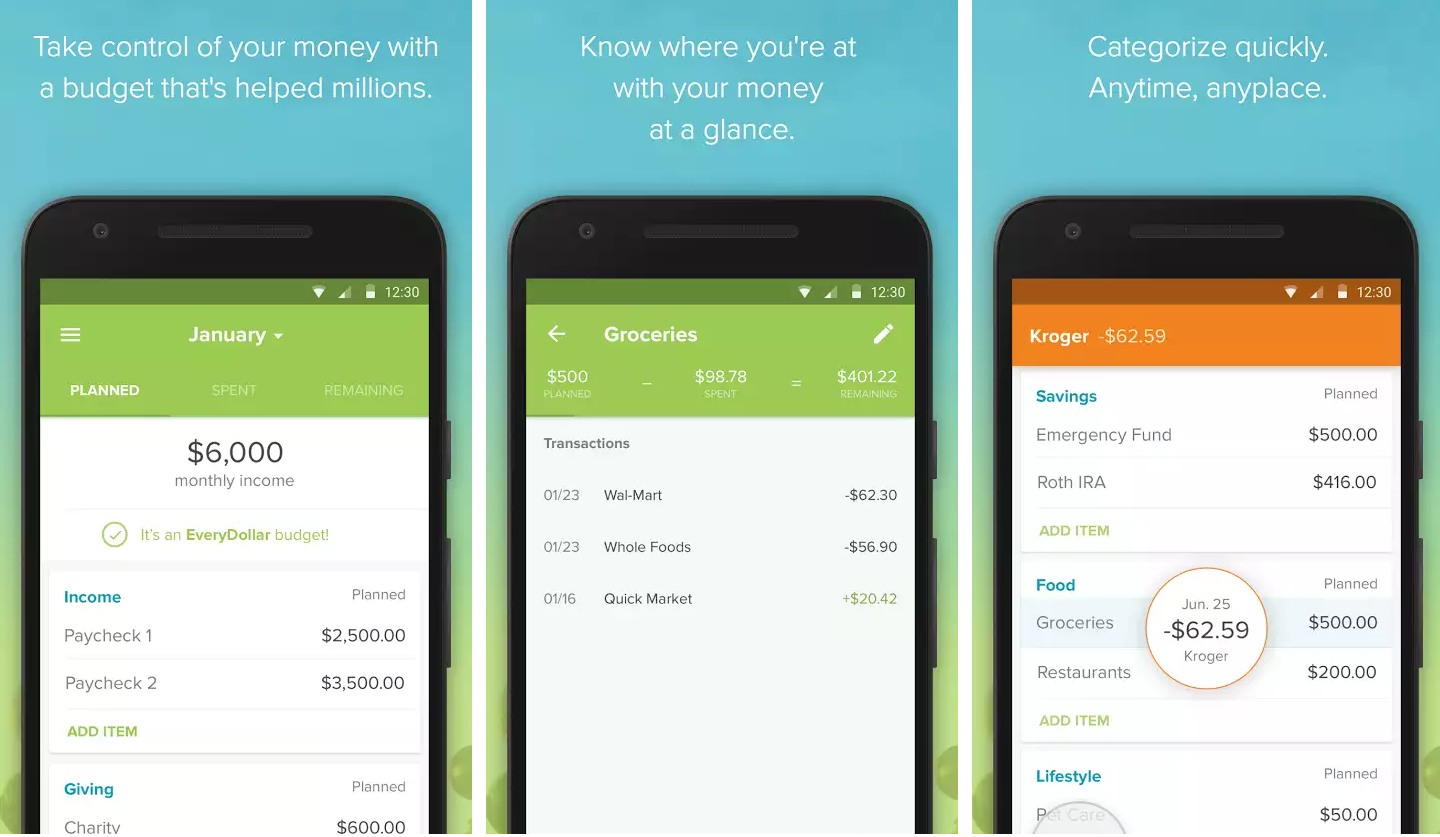

3. <a href="https://www.everydollar.com/" rel="nofollow">Every Dollar</a>

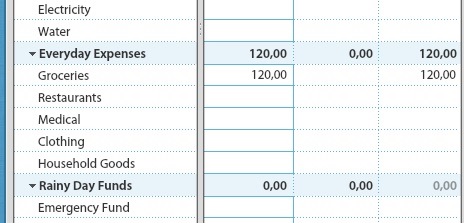

Every Dollar was designed by personal finance guru David Ramsey to appeal to the widest possible audience. The app is equipped with eight main budgeting categories, including Giving, Saving, Housing, Transportation, Food, Lifestyle, Insurance & Tax, and Debt. This easy layout covers all the basics without burdening users with information overload. The simple interface provides an overview of the eight categories with columns designated for planned, spent and remaining expenses. Users can easily track their monthly income, savings and expenses on one screen, giving them a high-level view of their income and expenditures.

The great thing about Every Dollar is it provides a walkthrough of David Ramsey’s “baby steps” formula of budgeting, which includes saving an emergency fund, paying off all debts using the snowball method, saving 3-6 months of expenses, saving 15% for retirement, starting a college fund for the kids, paying off the house and building wealth.

Every Dollar has a free option that requires users to manually add transactions. The Every Dollar Plus app is available for $99/year.

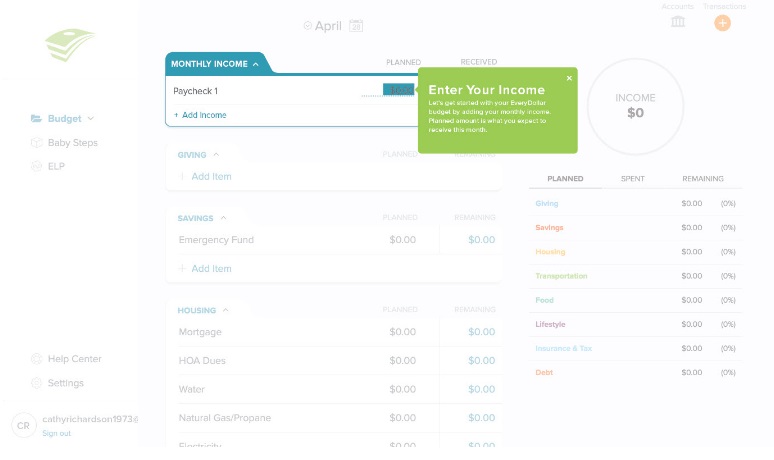

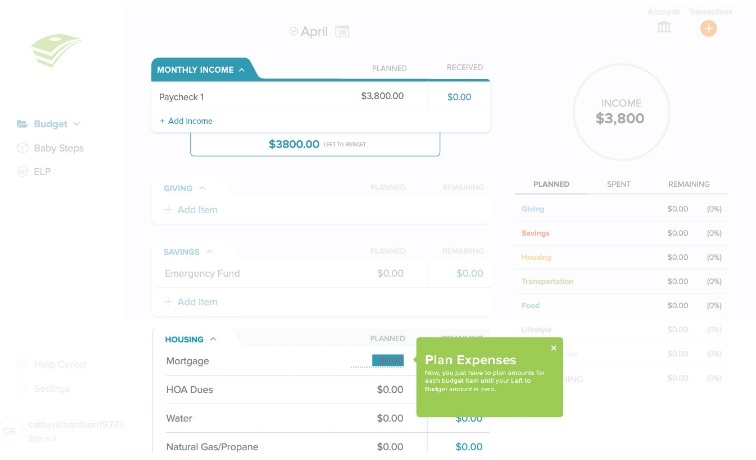

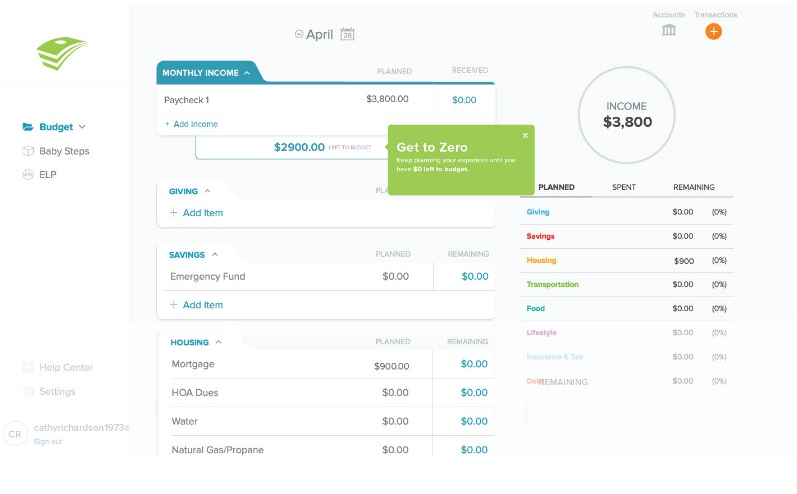

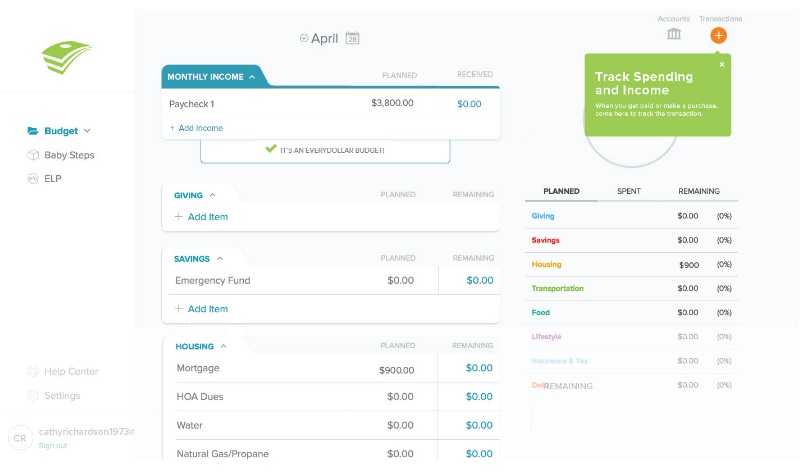

How to use Every Dollar

- After creating an account, users can quickly begin setting up their budget. You begin by listing your “planned” income.

- The next step is planning your expenses. Simply enter how much you expect to spend on the eight main categories discussed above.

- Unlike other apps, Every Dollar wants you to get to zero. This means assigning a job to every dollar you earn. After expenses, this should go toward savings and giving.

- Now you’re ready to track your spending and income. After each purchase, come back to this section to review the transaction.

- You’ll notice that on the left side of the app there’s a “Baby Steps” tab. This gives you a lesson plan of David Ramsey’s popular budgeting and saving formula.

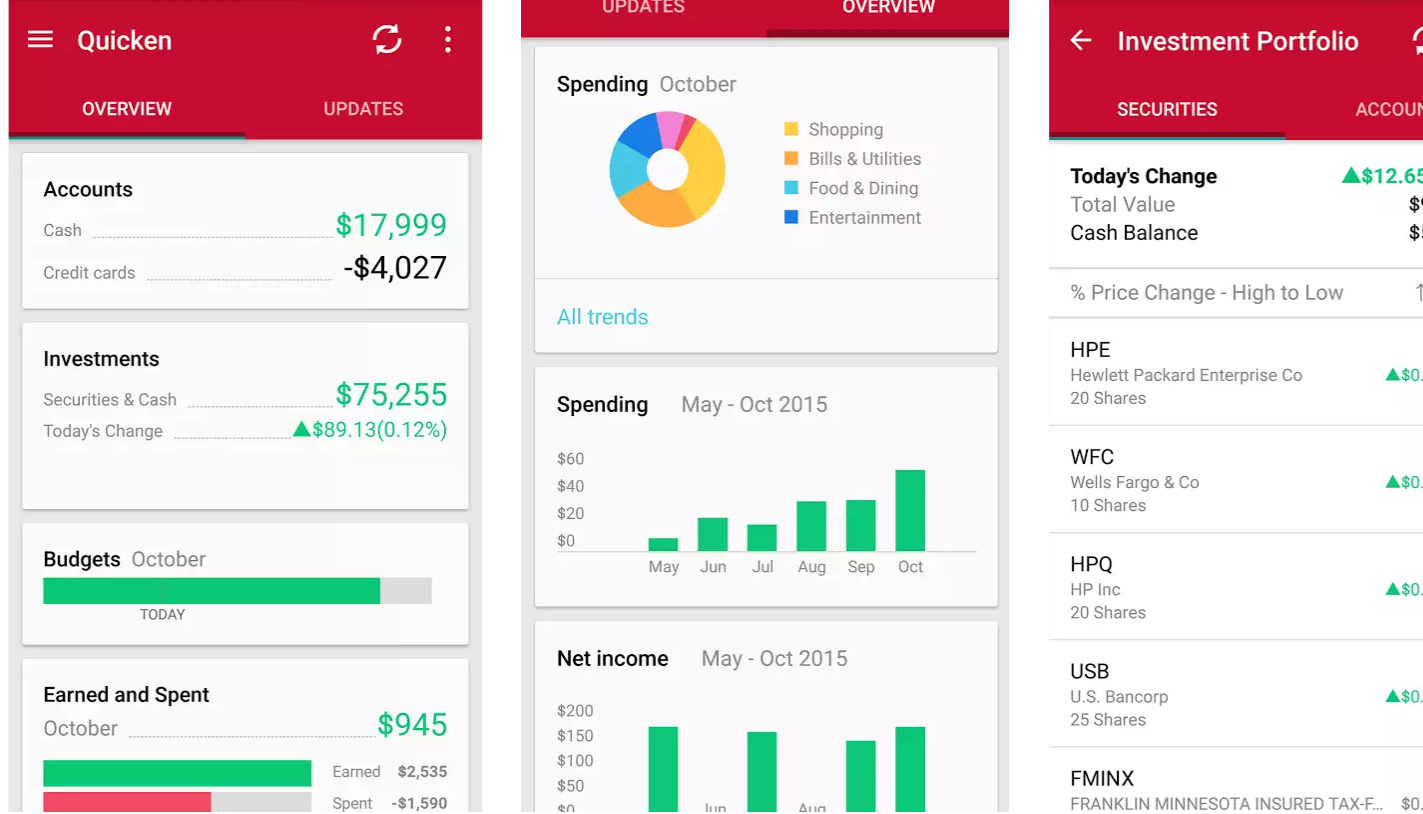

4. <a href="https://www.quicken.com/" rel="nofollow">Quicken</a>

Quicken is an established budget planning platform that made its name on Windows before migrating to the mobile environment. The version of Quicken you download to your phone is the mobile companion app that is meant to run alongside the desktop or tablet version. Quicken provides seamless integration across all connected devices, allowing you to sync data from desktop to mobile devices and vice versa. Because Quicken must be downloaded to your desktop before it can be used as an app, it is quite literally one of the most full-featured budgeting programs on the market. This is a strong value proposition for dividend investors looking to control expenses and maximize their investments.

One of the ways in which Quicken differentiates itself from other budgeting tools is the ability to pay bills and transfer money between financial accounts. As one might expect, these features come with a cost. Depending on the version you choose, the Quicken desktop app can run between $39.99 and $104.99. Many investors view this as money well spent, as Quicken provides a window to all their accounts in one place.

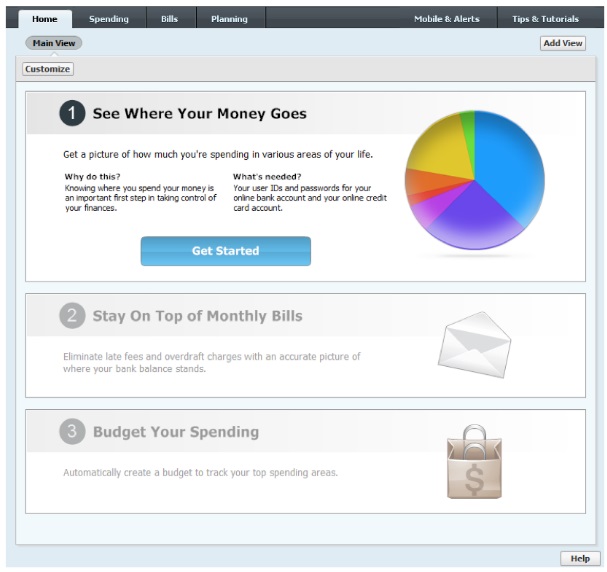

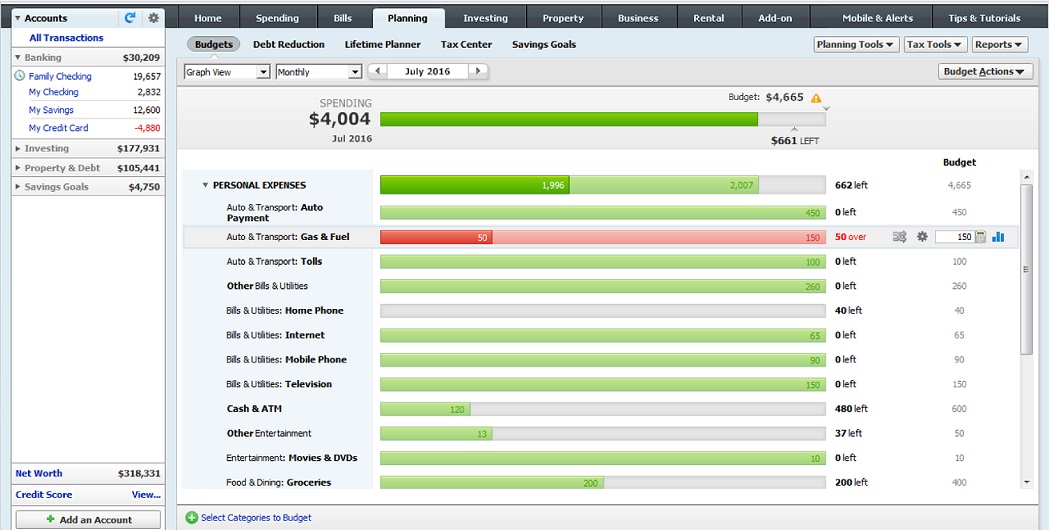

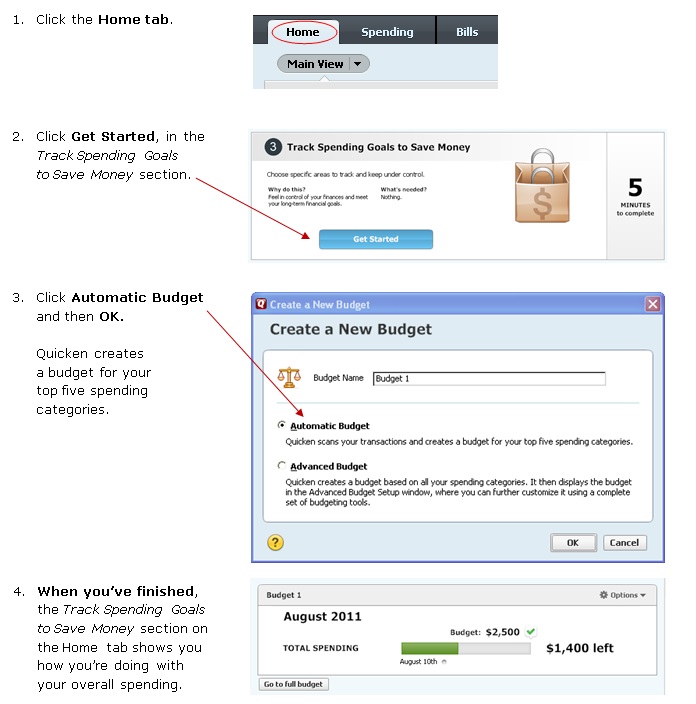

How to use Quicken

- Although Quicken makes use of a companion app on your mobile device, account setup is done via PC.

- Once you’ve set up your accounts, they will appear under the “Accounts” bar on the left side of the screen. Each account lists the transactions completed through that payment method.

- After setting up your account, begin categorizing your transactions to see where your money is going. Quicken does this automatically when it downloads transactions from your bank and credit card accounts. However, it doesn’t always do this correctly. Each category the app assigns can be edited to make it easier for you to find and track.

- Now that you know where your money is going, it’s time to set up a budget. Toggle over to the Home section and click “Get Started” to create your budget. You have the choice between an automatic budget and a more advanced option. Once this is set up, you can monitor the “Track Spending Goals to Save Money” section on your Home tab to monitor your overall spending.

5. <a href="http://www.anishu.com/" rel="nofollow">HomeBudget</a>

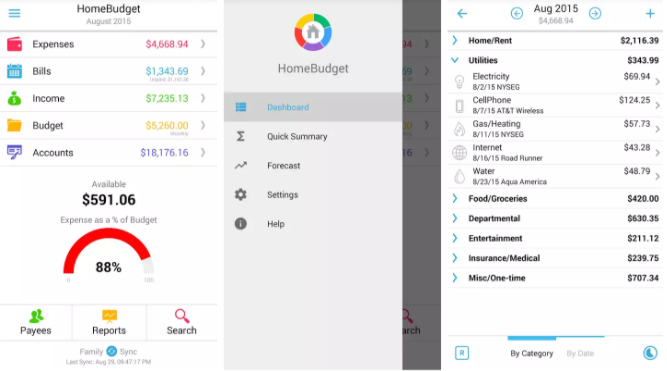

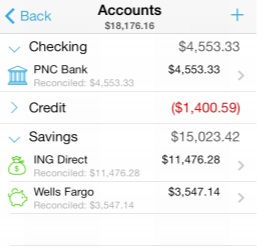

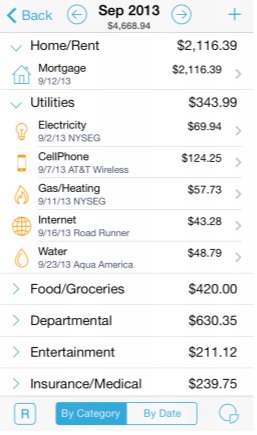

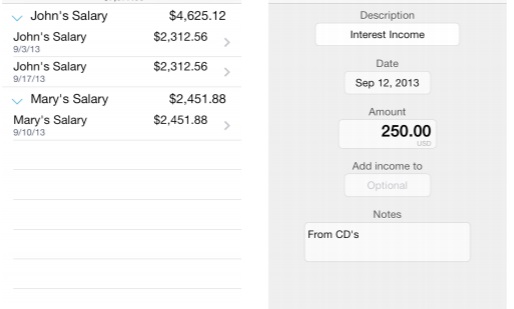

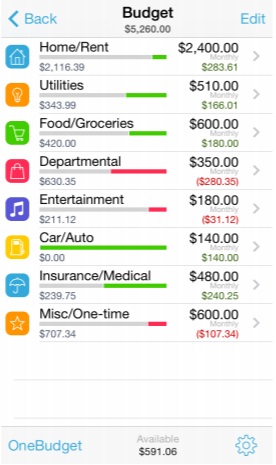

HomeBudget is a powerful expense tracker designed to help users control their monthly outlays. The app provides integrated features to help users manage cash flow and expenses. This includes an attractive home screen that provides a snapshot of expenses, bills, income, budget and accounts. Users are free to track their spending through pre-installed categories and by creating new ones. Once downloaded, the app prompts users to begin adding expenses and income to build a balanced budget.

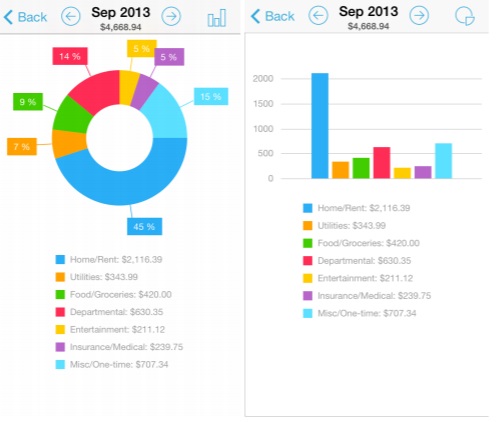

HomeBudget is also available in a premium version that offers sync capability with PCs and other devices, allowing family members to share data and budget information. Combined with the Reports feature, the sync capabilities allow households to track income and spending trends over a 12-month period. The Lookback feature also provides a detailed breakdown of fixed, variable and discretionary expenses, allowing users to better manage their expenses.

How to use HomeBudget

- After downloading the app, the Settings screen takes users through the setup process. Premium users will also be able to configure the Family Sync feature. If you’re interested in setting up a forecast period, this is the place to do it.

- Account setup is straightforward. Simply add your checking, savings and credit accounts to the app.

- The Expenses screen then lets users add, modify or delete expense entries. As you begin using the app, you’ll be able to track expense entries on a monthly basis.

- Monthly expenses can then be displayed in chart format.

- After setting up expenses, users can then enter their income through the Income screen. Like expenses, incomes can also be set to recurring, saving you time from having to manually enter the amounts each month.

- By setting up expenses and incomes, users will be able to view their budget. Categories and subcategories can be edited manually. HomeBudget supports budget rollover, allowing you to carry over unspent amounts.

Remember, you can supplement these apps with Dividend.com’s compounding returns calculator and calculate returns by entering the money you want to invest, rate of return and time horizon. The money you save can go toward high dividend stocks. This page on Dividend.com lists all the stocks that have consecutively increased their dividends for more than 25 years.

The Bottom Line

There is no shortage of benefits to budgeting your money. As an income investor, budgeting allows you to divert more of your resources to growing your net worth. Budgeting tools you can carry in your pocket and synch with other electronic devices can ensure your efforts are streamlined toward your investing goals. For a list of other tools that can complement your budgeting apps, check out a list of top free and paid investment tools available on the internet. Make sure to check out our list of retirement apps you should know about as well.

Be sure to follow our Investment Resources section where you can find a wealth of resources regarding other investment tools.