Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Walgreens Boots Alliance has taken the first spot in the list as the drugstore chain has been showing poor results amid heavy competition in the space. Second in the list is Progressive Corp, one of the largest vehicle insurers in the U.S. Verizon Communications follows as the telecom company hit the news after it increased the flexibility of its customers by ditching cable bundles. Last in the list is Wells Fargo, which reported a set of thoroughly weak results.

Don’t forget to read our annual edition of trends here.

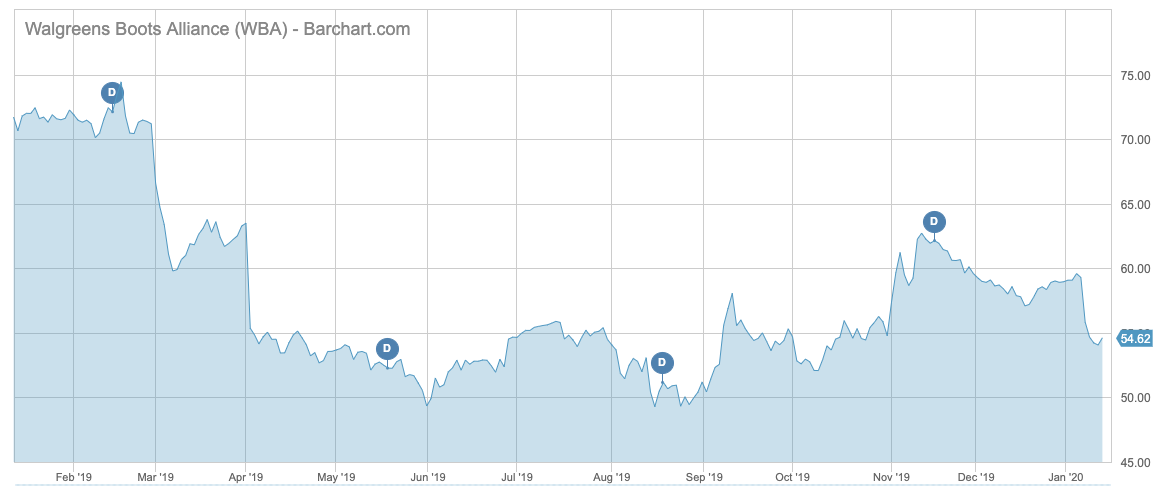

Walgreens Boots Alliance

Walgreens Boots Alliance (WBA) has seen its viewership increase 72% over the past two weeks, as the drugstore chain reported weak earnings for the first fiscal quarter of the year. The company’s earnings declined to $845 million despite overall revenues edging up. U.S. sales increased 1.6%, although that was well below analysts’ expectations.

Walgreens CEO Stefano Pessina warned that the turnaround will take time to complete, but reiterated the financial targets for the full year. Walgreens has been hit by competition from online retailers, including Amazon. Meanwhile, its drug business is getting hammered in the U.S. by tough negotiations with pharmacy-benefit managers.

It appears that part of the reason for the company’s struggle is the recently closed deal between health insurers Aetna and CVS Health (CVS), which also owns a prescription-benefit manager (PBM). However, Walgreens noted that it does not need to own a PBM to perform well.

Shares in Walgreens have declined around 9% since the results were announced on January 8. Walgreens stock was the worst performer of the S&P 500 Index last year with a decline of nearly 14%. The S&P 500 rose by 30% during the same period. Walgreens has been rumored to be the takeover target of private equity firm KKR, but talks regarding a deal appear to have stalled. Walgreens’ dividend yields a strong 3.2% on a payout ratio of 30%. The company has been increasing its dividend for the past 43 years.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

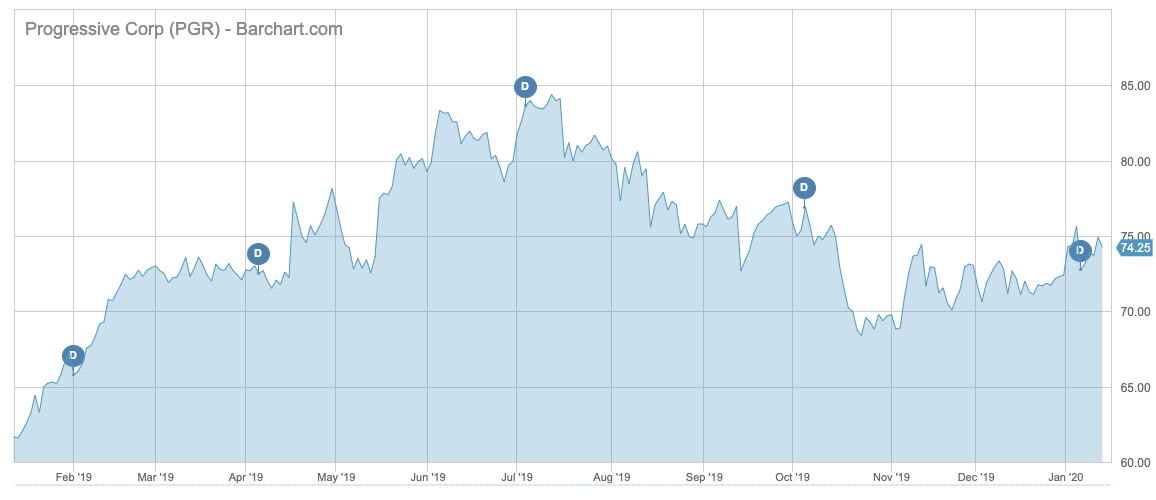

Progressive Corp

Progressive Corp (PGR) surprisingly has taken the second spot in the list with a rise in viewership of 52%. Progressive is a car insurer that has a meager dividend yield of 0.56% on a small payout ratio of just 7.4%. Progressive went ex-dividend on January 7.

Shares in Progressive have risen 21% in the past 12 months as the company gradually increased its revenues from premiums, while its earnings have largely been stable. Over the past fiscal five years, revenues have jumped from $19 billion to a little more than $32 billion in 2018. Last time the company reported its results was in December for the prior month’s period. Its net income increased from $242 million in November 2018 to $306 million in November 2019 largely due to higher net premiums earned and lower claims.

Check out our latest Best Dividend Stocks List here.

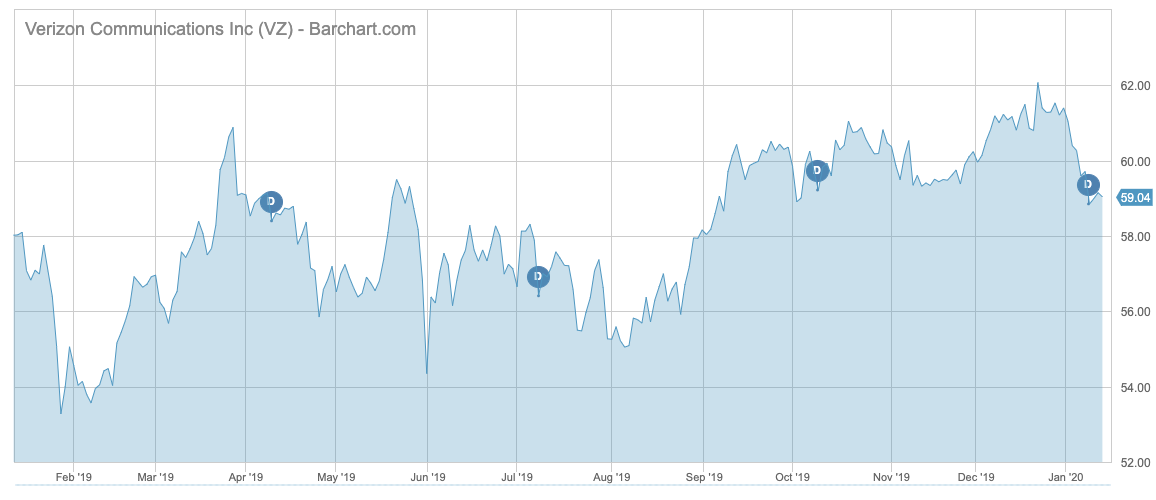

Verizon Communications

Amid intense competition from streaming services, Verizon Communications (“VZ”:https://www.dividend.com/dividend-stocks/technology/telecom-services-domestic/vz-verizon/) has removed its traditional cable bundles to offer customers more flexibility. Verizon hopes the move will stop the trend toward cord-cutting and bring in additional revenues as some customers might opt for some pricier options. The news has led to an increase in viewership of 49% for the past two weeks.

Previously, customers were forced to choose a package that included TV and internet at various speeds, but now they will be able to select just one option and mix and match the internet speed and TV channels. Verizon will now sell three internet speeds ranging from $55 per month to $80, including the router. It will also offer several sets of cable TV channels with a starting price of $50 per month, while also providing YouTube’s TV streaming service at a cost of $50 per month.

While Verizon has been losing customers in its TV segment, the internet unit has gained nearly 6 million internet connections between mid-2016 and the end of September. Verizon’s stock has also performed relatively well. With a gain of 13.4% over the past two years, it outperformed arch-rival AT&T (T) by more than 10 percentage points but underperformed the S&P 500 Index by less than four percentage points.

Verizon’s dividend yields 4% annually and has been growing it for the past 14 years. The next dividend is expected to be paid on February 3 to shareholders of record on January 10.

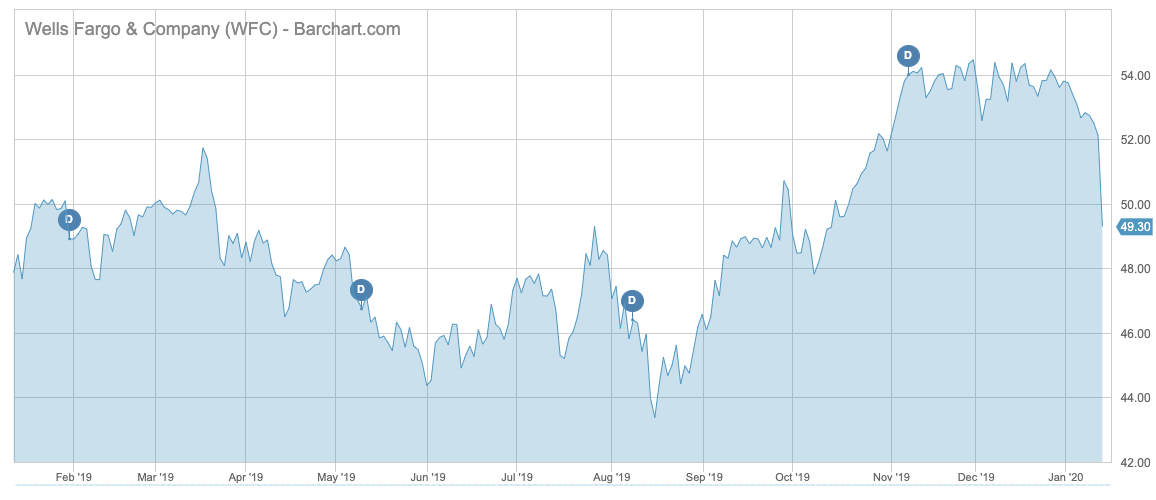

Wells Fargo

Scandal-stricken lender Wells Fargo (WFC) has taken the last spot in the list with a rise in viewership of 31%. Wells Fargo has just reported a massive drop in its fourth-quarter profits largely due to costs related to its fake-accounts scandal which surfaced in 2016.

The company took a charge of $1.5 billion for costs to settle a probe launched by the Justice Department and the Securities and Exchange Commission. This has led to a 53% decline in profits. This was the first quarter of newly-installed CEO Charles Scharf, who has the unenviable task of settling legal challenges with the regulators and restoring the bank’s reputation. Scharf said Wells Fargo has a valuable franchise but the company “made some terrible mistakes.”

Wells Fargo’s results were in contrast with its peers, JPMorgan Chase (JPM) and Citigroup (C), both of which posted rising revenues and profits for the fourth quarter. Shares in Wells Fargo declined 5.4% on the results, while JPMorgan and Citigroup were up 1.2% and 1.6%, respectively. Wells Fargo has woefully underperformed JPMorgan and Citigroup over the past five years; while its stock has declined 7% over the period, JPMorgan and Citigroup surged 144% and 68%, respectively.

Wells Fargo has a dividend yield of 3.75% and its payout ratio is 45%. The bank has been growing its dividend for the past seven years.

The Bottom Line

Walgreens Boots Alliance reported woeful earnings for the first fiscal quarter, extending its poor stock performance. Car insurer Progressive has a small dividend but the company’s stock has been appreciating thanks to steadily increasing revenues and profits. Verizon is doing away with cable bundles amid fierce competition with streaming companies. Finally, Wells Fargo stock abruptly declined on falling profits stemming from a long-running accounting scandal.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.