Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Visitors have not converged around a central theme this week in our trends list. Energy infrastructure, construction machinery, and real estate are three sectors that have drawn interest, with Kinder Morgan (KMI ), Caterpillar (CAT ), and HCP (HCP) all present in the list. Coffee shop chain Starbucks (SBUX ) took the last spot, while a story comparing dividend yields by sector was fourth.

Kinder Morgan: Staging a Recovery

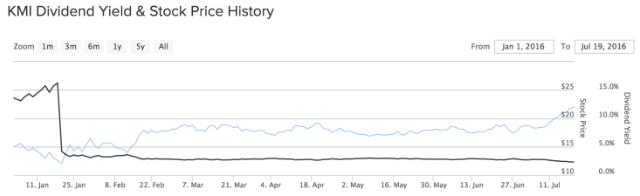

Energy infrastructure company Kinder Morgan has experienced 36% more viewers in the past week compared with the previous one, as the stock has jumped as much as 10% over the past five days. The company has yet to announce its earnings results, but investors are apparently upbeat about its prospects. The infrastructure provider’s stock is up 47% since the beginning of the year, staging a recovery from the commodity downturn. Still, the shares are down 50% from their peak reached in April 2015.

The downturn in oil prices forced Kinder Morgan to dramatically cut its quarterly dividend from $0.51 at the end of 2015 to $0.13 at the beginning of this year. Management said the move will allow the company to service a large portion of its big debt pile and fund capital investments over the next few years. Despite the dividend cut, the company has largely been shielded from the commodity debacle over the past years, mostly due to its fee-based assets, which represent 91% of the company’s cash flow. Crucially, it has had stable inflows from these type of arrangements during the downturn. However, an aggressive debt-fuel growth model has left the company somewhat exposed to the sudden deterioration of commodity prices. It is also now selling assets to pay down debt. For example, just days ago it announced that it had disposed of a 50% stake in a natural gas pipeline for nearly $1.5 billion.

Caterpillar: Fearing Brexit Aftermath

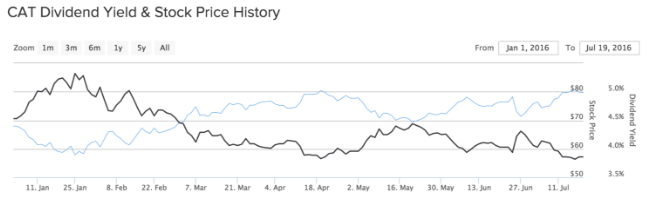

Construction equipment manufacturer Caterpillar has seen its viewership climb about 33% in the past week compared with the same period a week ago. The stock has proved resilient in the aftermath of the Brexit vote, rising more than 4% and extending year-to-date gains to as much as 17%.

The surprise decision by Britain to leave the European Union has added to the company’s headwinds and uncertainty. Its results have suffered from the plunging commodity prices and the resulting lower demand for its equipment in China and Brazil, which are important growth drivers for the firm. Britain is both an important customer and a manufacturing hub for Caterpillar. The company could postpone investments in the region and more importantly face challenges in running its operations across Europe smoothly, particularly its supply chain. Indeed, the company’s executives emphasized that Britain and the EU need to resolve their issues swiftly, preferably with no changes in trade agreements.

Despite a heavy debt load and industry headwinds, the company recently increased its dividend from $0.70 per share quarterly to $0.77. Its annual dividend yield now stands at nearly 4%.

HCP: Removing the Rotten Apple From the Barrel

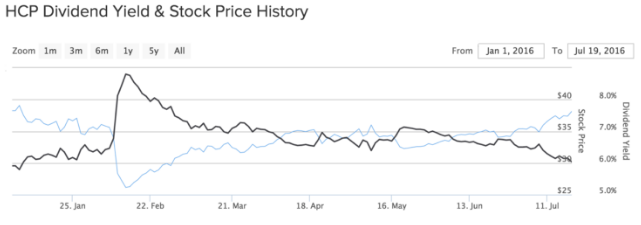

Health care real estate firm HCP has taken the third place in our weekly list with a 13% increase in viewership, as the company recently announced a leadership transition and prepared for a new chapter in its history of delivering outsized returns to investors. After a rough start to the year, when the stock melted down following the company’s disclosure that its skilled nursing business was struggling, the stock recovered completely, erasing all losses since then. Over the past five days, the company’s shares have jumped 1.23%, trimming year-to-date losses to less than 1%.

Just over a week ago, the company announced the departure of CEO Lauralee Martin, who resigned abruptly for unknown reasons. The company has initiated a CEO search process, and Executive Chairman Michael McKee will take the role on an interim basis. The move comes as the company is in the process of spinning off its struggling skilled nursing business, HCR ManorCare, which was responsible for the stock’s meltdown at the beginning of the year. By separating the troubled business, the company hopes to improve its portfolio quality.

The firm has not yet cut its 6% dividend, but there are expectations it will do so in the future.

Average Dividend Yield by Sector

An article from the end of 2014 putting head-to-head average dividend yields in a litany of industries has taken the fourth spot in our weekly list with a 10% week-over-week growth. Back then, the basic materials sector was the highest yielding, with a dividend of 4.96% annually, followed by financials and utilities — 4.18% and 3.96%, respectively. These three sectors still yield the highest dividend on average. The basic materials dividend currently stands at 8.65%, largely on the back of a commodity meltdown since 2014. Utilities follow closely with 7.89%, while financials yield 5.34%.

Starbucks: Growth Mode Still On

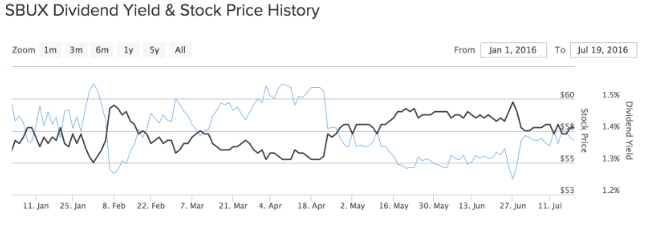

Coffee shop chain Starbucks has seen its viewership grow about 9% in the past week, as the company heads into the earnings season. The company is expected to issue its second quarter results on July 21, and analysts anticipate the company to produce great results, confident that it has not yet reached its growth potential. Shares have risen 1% in the past five days, trimming year-to-date losses to 4.9%.

The giant company has been steadily increasing its dividend payouts over the past years, even as it expanded rapidly in international markets. It currently pays an annual yield of 1.40%, which is expected to increase as Starbucks reaches maturity and growth opportunities fade out.

The Bottom Line

During this disparate week that failed to get investors clustering around one theme, Kinder Morgan and Caterpillar have drawn interest for their relative resilience in the face of difficult industry environments. Real estate operator HCP attracted visitors for its leadership change and swift removal of a bad business in order to preserve its health and hefty dividend yield. Starbucks, meanwhile, is about to release its earnings report.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.