When investing in dividend stocks, there are a few important dates to keep in mind. These dates will tell an investor when they will receive the dividends and whether or not they are eligible to receive the latest dividend.

What Does the Ex-dividend Date Mean?

The ex-dividend date is the day on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. This is an important date for any company that has many stockholders, including those that trade on exchanges, as it makes reconciliation of who is to be paid the dividend easier. It is just as important for investors, however, since you must own a stock before the ex-dividend date in order to receive the next scheduled dividend.

Prior to this date, the stock is said to be cum dividend (“with dividend”): existing holders of the stock and anyone who buys it will receive the dividend, whereas any holders selling the stock lose their right to the dividend. On and after this date the stock becomes ex dividend (“without dividend”): existing holders of the stock will receive the dividend even if they now sell the stock, whereas anyone who now buys the stock now will not receive the dividend.

A Note on Dividend “Capture”

It is standard practice for a stock’s price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company’s assets resulting from the declaration of the dividend, and prevents people from “gaming” the dividend system. The company does not take any explicit action to adjust its stock price; in an efficient market, buyers and sellers will automatically price this in.

One investing strategy, called “dividend capture,” refers to an attempt to collect the dividend and immediately sell the stock. In a strong bull market, where stock prices are consistently climbing, this strategy can work very well. Otherwise, it is extremely difficult to time and can actually result in the investor losing money more often than not. To be clear, it is not a strategy we advocate here on Dividend.com.

Investors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. Ex-dividend dates are extremely important in dividend investing, because you must own a stock before its ex-dividend date in order to be eligible to receive its next dividend. Check out the below screenshot of the results for stocks going Ex-Dividend on October 30, 2018.

What Does the Record Date Mean?

Shareholders who properly registered their ownership on or before the record date (or “date of record”) will receive the dividend. Shareholders who are not registered as of this date will not receive the dividend. Registration in most countries is essentially automatic for shares purchased before the ex-dividend date.

What Does the Payment Date Mean?

The payment date (or “pay date”) is the day when the dividend checks will actually be mailed to the shareholders of a company or credited to brokerage accounts.

What Does the Declaration Date Mean?

The declaration date is the day on which a company’s board of directors announces its next dividend payment. Also known as the “announcement date,” this is the least important date for dividend investors to consider.

Key Lessons in This Chapter

- The ex-dividend date is the most important date in dividend investing, since it determines who and who isn’t eligible to receive the dividend.

- You must own a stock before the ex-dividend date to receive the next scheduled dividend.

- Stock markets have safeguards in place to ensure no one can “game” the dividend system by buying a stock before the ex-date then selling it immediately on the ex-date.

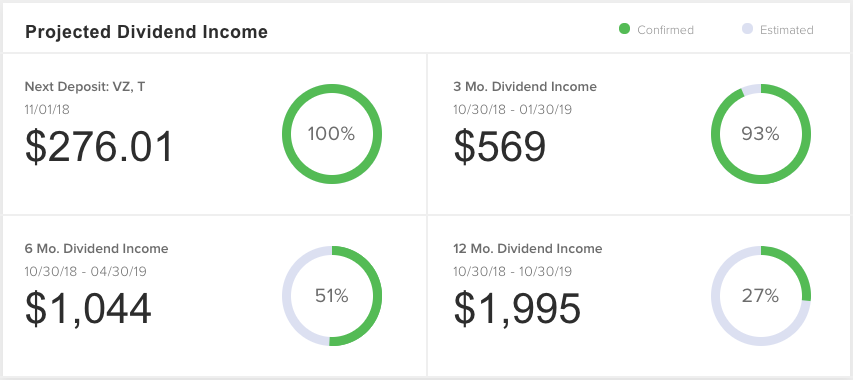

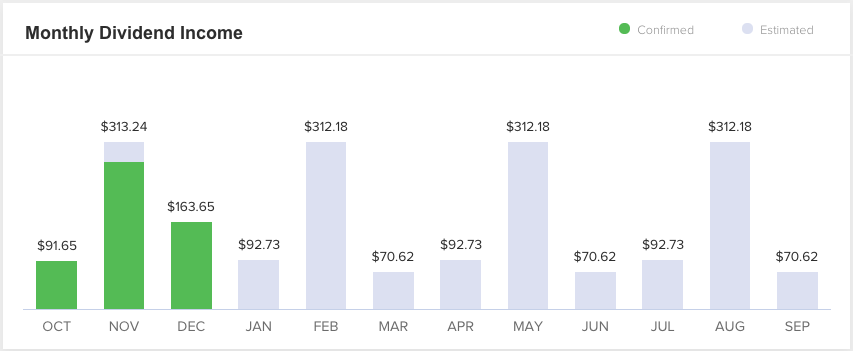

To better estimate your future dividend income, be sure to check out our Dividend Assistant tool. It’s free to use. The Dividend Assistant tool allows you to link your brokerage account or manually add your holdings in order to organize and track all dividend income for the upcoming 12 months. Investors can visualize the size of their dividend payments, which holding(s) the payment is from, and the certainty of the payment (confirmed vs estimated). Check out the sample portfolio screenshots below.

Related Articles

Also, check out Dividend.com’s tools. Our tools help investors make sound investment decisions. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks.