Why Is Historical Dividend Data Important?

Anyone who has spent time researching investment opportunities has more than likely run into the following disclaimer: past performance is no guarantee of future results. While it would be foolish to entirely ignore this timeless piece of advice, as humans, we are naturally drawn to analyzing the past in an effort to contemplate the future. Dividend investors especially have a lot to learn from analyzing historical dividend data and a stocks dividend history.

For starters, investors can gauge the state of the broad market by looking at the S&P 500 historical dividend yield; one way to utilize this sort of data is to focus on companies that are potentially undervalued at the time, as they happen to offer a distribution yield above that of the broad market.

Digging deeper, looking at an individual stock’s historical dividend payouts can give investors a good idea of emerging dividend trends, and it also provides insight into the company’s overall dividend philosophy. Ticker pages on Dividend.com make this sort of stock dividend history analysis relatively easy and straightforward; simply search for a ticker using the search box at the top of the page, and scroll down to the Dividend Yield & Stock Price History and Dividend Payout History sections for a visual representation of its historical dividends data. Premium members can easily download and export this data with a single click.

While most dividend-paying companies will always claim that they have no plans to reduce their dividends, the results can be quite different. The historical numbers, however, don’t lie. Simply put, companies that have a history of dividend cuts are more likely to make cuts in the future. The same holds true for companies with a history of increasing their dividends.

Stagnant dividend payouts is also unattractive to dividend-minded investors. In general, investors should look for stocks with industry-leading (but sustainable) dividend yields, with a solid history of increasing their dividends.

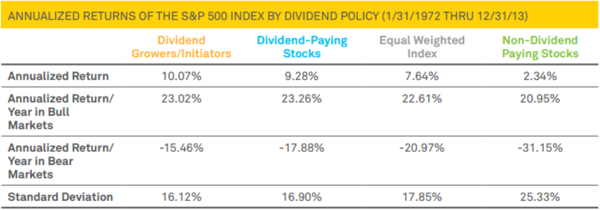

Being aware of a stock’s dividend history, like its historical dividend yield, and the company’s payout policy is important for a number of reasons; for starters, it may shed more light on how it will perform over the long-haul. There is extensive academic research that suggests companies with more favorable dividend policies tend to perform better during bull, as well as bear, markets. Consider the findings below from Ned Davis Research:

There are two important takeaways here. First, notice how dividend-paying stocks as a whole tend to outperform their non-dividend-paying counterparts over the long-haul. Next, and more importantly, notice how companies labeled as dividend growers tend to perform even better than those that simply pay out a distribution. This should serve as compelling evidence for income-focused investors as to why it’s important to consider historical dividends data when researching potential investment opportunities.

Additional Research

There are a number of resources at Dividend.com aimed at helping you make the most out of historical diviend data analysis. Please be sure to consider the following articles:

- The S&P 500: A Dividend Yield & Growth Overview: this is a great starting point for those looking to familiarize themselves with the S&P 500 dividend history over the years.

- Dividends in Focus – The Dow 30: this piece takes a look at the dividend history of another coveted benchmark, the Dow Jones Industrial Average, while also profiling the individual companies with the most impressive payout track records.

- 6 Signs of Unsustainable Dividend Yields: this is a great starting point when it comes to analyzing high-yield stocks; investors can use this piece to familiarize themselves with the differences between a bargain stock and a potential value trap.

To view Dividend.com’s Highly Recommended list of stocks, be sure to check out our Best Dividend Stocks List. The list features Dividend.com’s top-rated dividend stocks, geared toward traditional long-term, buy-and-hold investors. All stocks on this list are rated using Dividend.com’s proprietary Dividend Advantage Rating System – DARS™.