Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

U.S. equity markets declined at the start of the second quarter, as geopolitical tensions drove investors into the safety of traditional haven assets.

Syria continues to be an international battleground for major powers, with the United States and Russia backing opposing sides in the conflict. This recently translated into 59 Tomahawk missiles raining down on a Syrian airbase after U.S. President Donald Trump ordered a strike on government infrastructure in response to a chemical attack. The strike weakened investor morale, but drove defense stocks higher.

Amid the geopolitical malaise, investors are turning their attention to quarterly earnings and corporate news. The fundamental picture on U.S. equities could change favorably in the coming weeks should corporate earnings match upbeat forecasts.

Premium investors are invited to check out Dividend.com’s weekly Market Glance articles for a rundown of upcoming earnings reports and economic news events. The Market Glance can be found in the News section every Monday.

Compare this week’s Trends report with our March 31 edition, which looked at the impact of President Trump’s twitter tirade on the likes of Ford Motor (F ).

Trump’s electoral victory has profound implications on the global markets. Read about them here.

Syria Airstrike Drives Defense Stocks

It should come as no surprise that defense stocks were among the best performers after President Trump’s brief military intervention in Syria last week. Traffic to Dividend.com’s Best Aerospace-Defense Products & Services Dividend Stocks surged 95% to take the top spot on this week’s list.

Geopolitical unrest drove investors out of the equities, but for defense stocks the outlook improved somewhat. However, even bombs over Syria weren’t enough to keep the likes of Boeing Co (BA) and Lockheed Martin (LMT ) elevated for much longer. They too would eventually buckle under the weight of risk aversion in a trading week marked by lower volumes.

Last month, BA increased its quarterly dividend by 30%. Check here to see BA’s dividend payout history. At present both BA and LMT continue to yield more than twice that of their respective sectors. To learn more about LMT’s dividend-payout history, click here.

President Trump made it clear to the media earlier this week that the U.S. is not going into Syria. However, Secretary of State Rex Tillerson was in Moscow Wednesday to convince Russia to abandon its support of Syrian President Bashar al-Assad.

The Assad regime has denied any involvement in a deadly chemical attack that provoked Washington to respond last week.

In case you are wondering about other high-yield dividend stocks, check out our full list here.

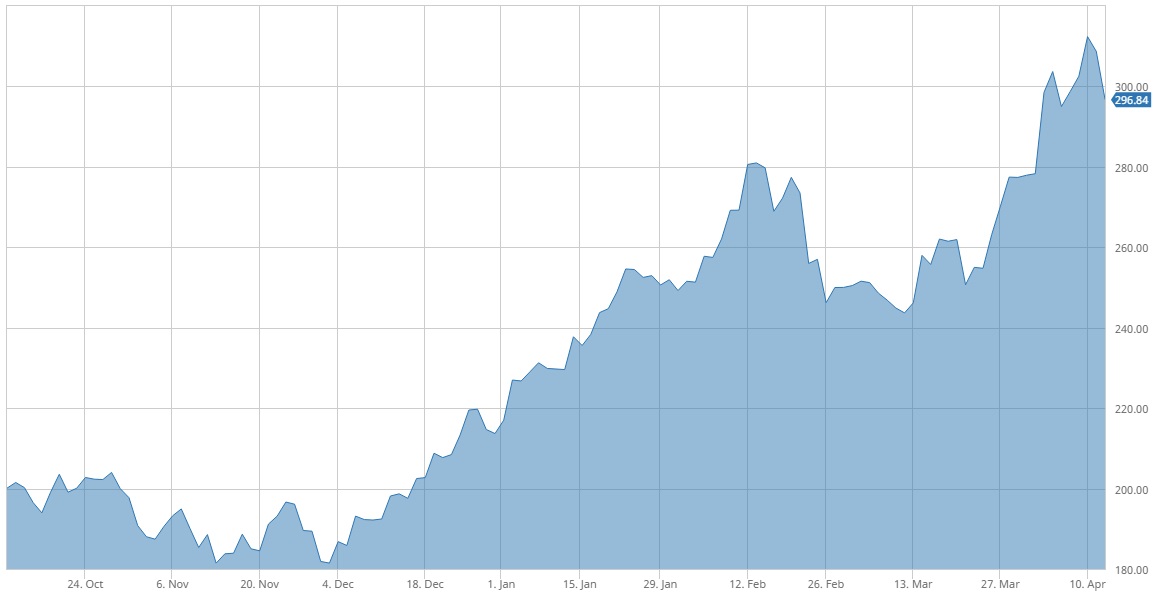

Procter & Gamble Raises Dividend by 3%

Procter & Gamble Company (PG ) is a boon to any dividend investor’s portfolio. News of a 3% dividend increase raised the stock’s exposure on Dividend.com by 41% this week.

Beginning May 15, P&G will begin paying shareholders 68.96 cents per share. That’s the 61st consecutive year the consumer staple has increased its dividend.

Procter & Gamble is a leading member of the 25-Year Dividend Increasing Stocks, a very select group of companies that have increased their annual payouts every year for at least two-and-a-half decades. By upgrading to premium, you can review every stock’s DARS rating for a more granular view of performance.

P&G is also a member of the illustrious Dow 30 Dividend Stocks. A flurry of Dow blue-chips are scheduled to report earnings in the coming weeks. P&G will report fiscal third-quarter earnings before the opening bell on April 26.

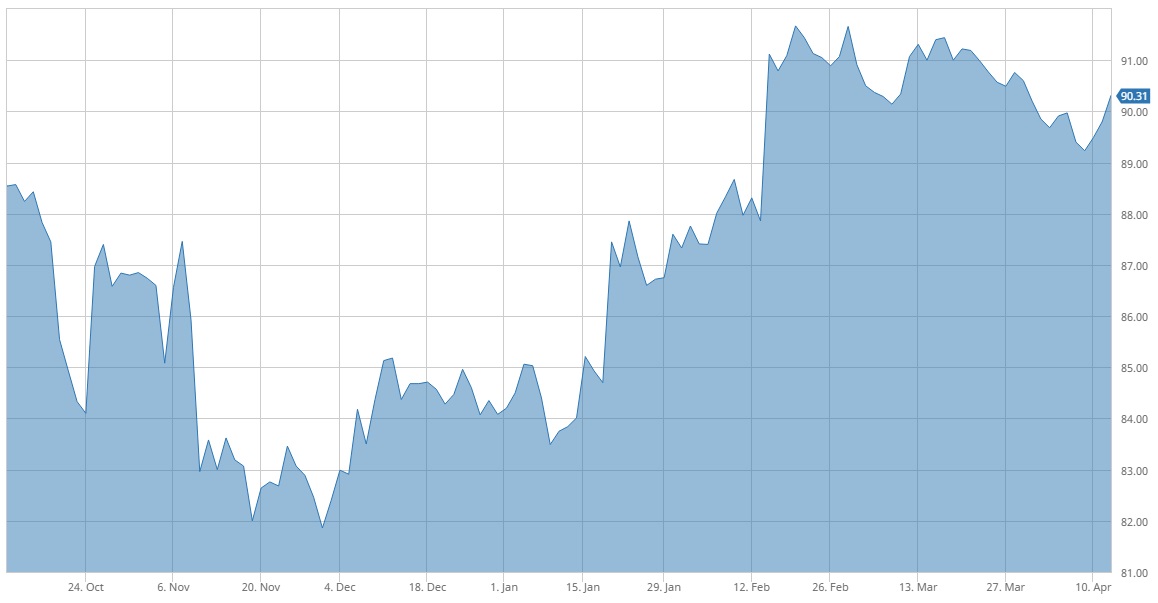

Tesla Overtakes GM as America’s Biggest Automaker

Some say Tesla Motors (TSLA) is ridiculously overvalued. Others say the pioneer automaker is in the fast lane to higher growth. Elon Musk’s company takes the No. 3 spot on our weekly list with a 32% rise in traffic.

Tesla recently topped General Motors Company (GM ) as America’s most valued automaker. The company, which boasts the Model S electric vehicle, saw its market capitalization surge above $50 billion earlier in the week. By end of day Monday, Tesla’s market capitalization exceeded GM’s by about $64 million.

Unlike Tesla, which doesn’t pay a dividend, GM boasts a yield of 4.48%. That’s well above the consumer goods average of 1.83%. To explore the best auto manufacturers from a dividend perspective, click here.

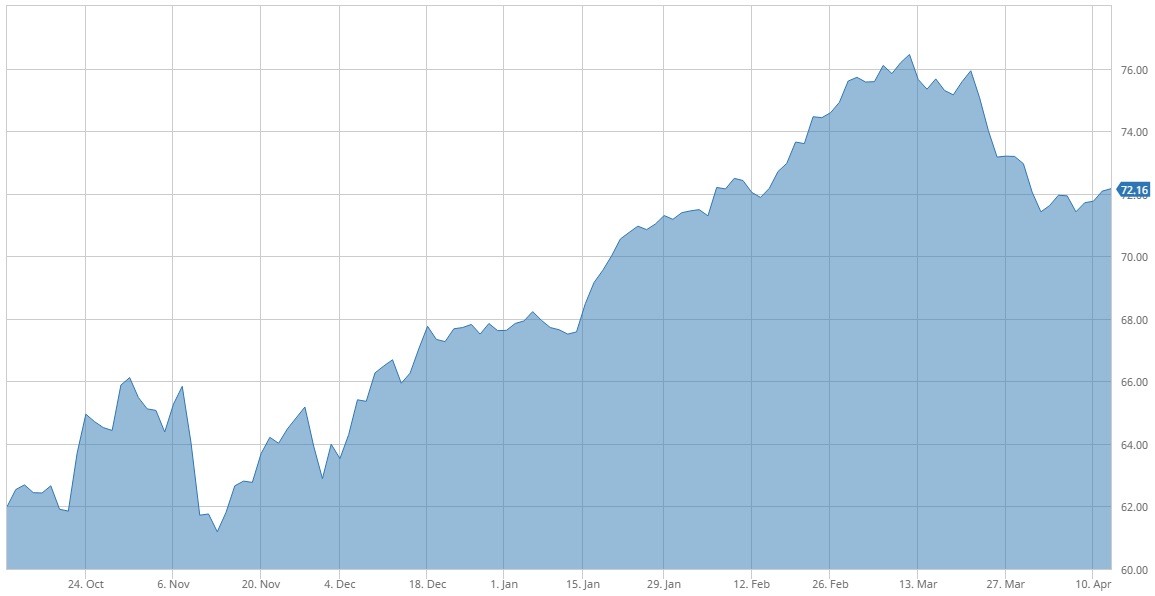

Tobacco Maker Outshines Market with Steady Gains This Week

Altria Group (MO ) has been a major wealth generator for shareholders lately, boasting average annual returns of more than 23% over the last five years. The corporation behind the iconic Marlboro brand gained in five consecutive sessions through Wednesday to close at nearly two-week highs. For this reason, it takes the No. 4 spot on our weekly list with a 30% bump in traffic.

Altria’s long-term business prospects are appealing for investors looking to tap into established markets with plenty of growth potential. The company’s source of strength comes not just from its core tobacco business, but also from its smokeless tobacco and wine products.

Find out Altria Group’s next ex-dividend date by using our free Ex-Dividend Date Search function.

Looking for new investment ideas? The Market Wrap for April 7 has some interesting ideas for our Premium members.

The Final Word

Geopolitics will continue to drive investor sentiment as multiple global hotspots dominate the headlines. Against this backdrop, investors are gearing up for the bulk of earnings season, which is expected to deliver another solid quarter of year-over-year growth.

For the latest dividend news and analysis, subscribe to our free newsletter.