The stock market over the next few years may look markedly different than over the last few years. Aside from political changes, the markets are also facing a different dynamic with the Federal Reserve – interest rate hikes.

The Fed cut interest rates from more than 5% in 2007 to as little as 0.25% by 2009. These cuts were intended to help stimulate and stabilize an economy suffering from the worst recession since the 1920s. The Fed’s actions alone were not enough to stabilize the economy, so the federal government stepped in and lent large amounts of money to major financial institutions in the US, and Congress passed the American Recovery and Reinvestment Act of 2009 which featured a range of economic support measures including tax breaks and infrastructure spending.

The combination of actions from the Fed and the Federal Reserve helped to stabilize the financial markets and since that time, the unemployment rate has consistently crept lower. Today the US unemployment rate stands at 4.7% – the same rate as January 2006. Against this backdrop, the Federal Reserve appears poised to reverse its monetary easing and start hiking rates over the next few years.

Investors need to prepare themselves for a future where the Fed is not trying to stimulate the economy. The means understanding what will happen to the market as a whole and to specific securities. Read about what the history of the Fed shows us about rising interest rates.

In December, the Fed raised rates by 0.25% to the range of 0.50 – 0.75%. That rate hike probably will not be the last the Fed takes over the next few years. While economists differ on many aspects of monetary policy, the conversation has shifted significantly in the last few years. Gone is the talk of more Quantitative Easing, and over the last 12 months, there has been significant speculation about when the Fed would begin hiking rates and how quickly it would act once it began. We now know the answer to the first question, while the jury remains out on the second.

Check out the other major market catalyst that is currently moving the market.

For investors, there is a clear and important issue up ahead then – how will markets react to increasing interest rates? The first interest rate hike seemed to cause little concern among traders, but will that trend continue? History offers a clue.

The chart below shows the last 10 interest rate hikes and the one-day and one-month performances of the S&P 500 following those hikes.

| Date of Announcement | Percent Hike | 1-Day Market Performance | 1-Month Market Performance |

|---|---|---|---|

| 29-Jun-06 | 0.25% | 2.02% | 2.59% |

| 10-May-06 | 0.25% | -0.05% | -5.43% |

| 28-Mar-06 | 0.25% | -0.55% | 1.19% |

| 31-Jan-06 | 0.25% | -0.64% | -0.07% |

| 13-Dec-05 | 0.25% | 0.70% | 1.79% |

| 1-Nov-05 | 0.25% | -0.07% | 5.07% |

| 20-Sep-05 | 0.25% | -0.93% | -4.49% |

| 9-Aug-05 | 0.25% | 0.27% | 1.25% |

| 30-Jun-05 | 0.25% | -0.87% | 2.93% |

| 3-May-05 | 0.25% | 0.46% | 3.52% |

Want to know more about how rising rates might impact stocks? Check out ETFdb.com’s superpage on rising interest rates.

As the chart illustrates, Fed rate hikes usually have a modest impact on the overall market in a one-day time frame. Over the next one month, rate hikes have a more significant impact, but the effect is mixed. Overall, the average one-day return on the S&P 500 for a 25-basis point rate hike was 3 basis points. Over a one-month time frame, that average return swelled to 83 basis points.

There is a considerable amount of heterogeneity in those figures though – in some cases the market was down by as much as 5.5% in the month after a rate hike, while in other cases, stocks rose more than 5%.

In other words, for the market as a whole, rate hikes are a modest positive at least for the last 10 times the Fed has hiked rates. The caveat here is that all 10 of these rate hikes occurred more or less in sequence. For context, in the time frame in question, the economy was coming out a recession and the Federal Reserve under Alan Greenspan opted to hike rates consistently as the economy strengthened. This was in part driven by the need to get rates back to a normal level following a period in which they were as low as 1%.

Sounds familiar?

The situation in 2005 and 2006 following the 2001-2002 recession has some striking similarities to where we are today. None of the rate hikes in the 2005-2006 period came as much of a surprise after the first one because the Fed telegraphed its intentions well in advance. Again, the situation is very similar today.

Investors interested in finding specific opportunities around rate hikes should consider drilling down and looking at specific sectors to find good opportunities. In our Dividend Stock Screener, you can screen stocks by utilities, REITS, banking, financial, and other sectors and industries as you do your research on stocks that you should play in a rising interest rate environment. You can also download the entire list in a spreadsheet as you look for investment ideas.

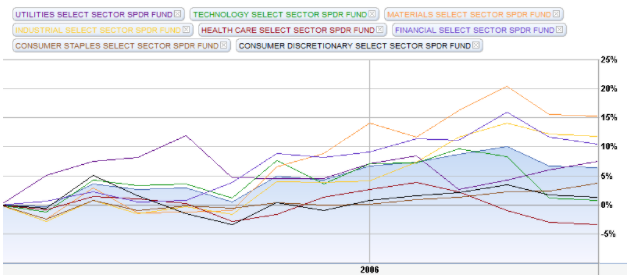

During the last rate hike cycle, the materials sector, the industrial sector, and the financial sector all outperformed, while healthcare, technology, and consumer discretionary all underperformed. The graph below illustrates these sectors’ performance versus the S&P 500 during the period from April 2005 through June 2006 encompassing the last 10 rate hikes.

Check out our Best Dividend Stocks page by going premium for free.

Value stocks also outperformed growth stocks during that time period as the graph below shows.

Given these patterns, investors considering how to position their portfolios for a future of rising rates should consider value stocks in sectors that do well in a rising economy such as industrials and financials. MetLife (MET ) and United Technologies (UTX ) are two companies that should probably do well in a rising rate environment and might be good long-term choices, while IDEXX Labs (IDXX) might be a good stock to short or at least avoid. The firm has a rich P/E ratio and is in the healthcare sector; both areas which did poorly the last time rates went dramatically higher.

The Bottom Line

In summary, there is a lot of apprehension around rising rates. The Fed is likely to hike multiple times going forward – perhaps 10 times or more over the next few years if the rate hike cycle after 2002 is any indication. As history shows, these rate hikes will probably have a muted impact on the market since traders are likely to price the hikes in well before they are actually announced. Still investors can position themselves by holding stocks that should do well in a strengthening economy, and by investing in value stocks over growth stocks.