Following almost seven years of zero interest rate policy from the Federal Reserve, interest rates are finally back on the rise again.

In response to the financial crisis, the Fed slashed the target Fed Funds rate from 5.25% all the way down to 0% over a two-year period from 2007 to 2009, in order to help spur economic activity, business lending and provide liquidity to financial institutions. When the zero interest rate policy didn’t fully serve its purpose, the Fed took the additional step of purchasing billions of dollars in Treasury securities (known as quantitative easing) in order to inundate the market with additional capital to promote further lending and economic growth. At its December 2015 meeting, the Fed indicated that it was satisfied enough with the health of the economy to begin raising rates again and lifted the Fed Funds rate to 0.25%, the first rate increase by the Fed since 2006.

Check out ETFdb.com’s superpage on rising interest rates.

A History of Market Performance During Tightening Cycles

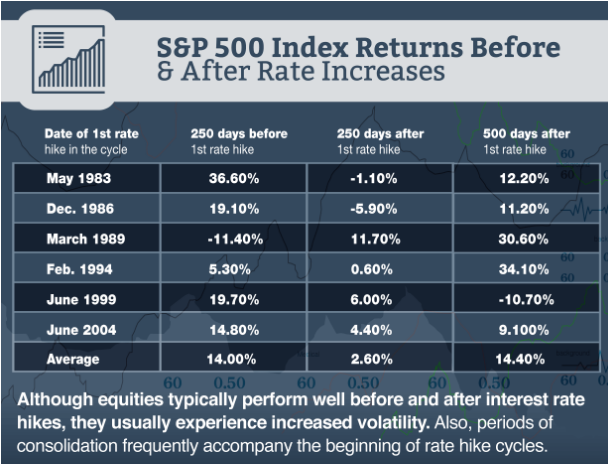

Interest rate tightening cycles have historically lasted anywhere from a few months up to three years, although most cycles last somewhere between 12-18 months. Stock market performance around and during interest rate tightening cycles can vary greatly depending upon factors such as economic health, inflation, energy prices, and the magnitude and speed of the tightening cycle. Generally speaking, the market has historically performed well in the months leading up to the tightening cycle.

The Fed is primarily concerned with balancing economic growth and inflation. The beginning of tightening cycles are often marked by a healthy economy, but with concern over the near-term path of inflation. A rate hike typically tightens the monetary supply and helps keep a cap on inflation, but it also has the side effect of contracting growth and making spending more expensive. This can impact corporate earnings growth. As a result, the markets have typically been marked by periods of muted equity returns following the first rate hike. As the tightening cycle approaches its conclusion, however, the market generally delivered solid returns for investors.

Check out what the history of the Fed shows us about rising interest rates.

Sector Performance During Rate Tightening Cycles

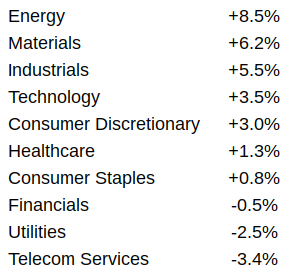

Interest rate increases affect different areas of the economy in different ways. Traditionally, defensive sectors of the market have underperformed during tightening cycles, while economically sensitive areas have done better. Consider sector returns over the past seven rate-tightening cycles relative to the S&P 500.

Utilities has been a traditional underperformer. These companies are known for their high dividend yields, since they are big cash generators and typically don’t require much growth capital. In rate tightening cycles, those high yields become less attractive and shareholders begin drifting back to the fixed income markets.

Check out our Market Catalysts page to understand why rising interest rates are considered a market catalyst.

REITs, however, are a rate sensitive area that tend to do well since higher rates benefit them in multiple ways. Mortgages typically become more expensive, which can lead to a greater number of people renting instead of buying. Additionally, borrowers who have adjustable rate mortgages will see their monthly interest payments rise. Both situations tend to result in greater income for REITs.

Four Dividend Stocks to Consider in a Tightening Cycle

How can you benefit from a rate tightening cycle? In our Dividend Screener, you can screen stocks by utilities, REITS, banking, financials, and other sectors and industries, as you do your research on stocks that you should play in a rising interest rate environment. You can also download the entire list in a spreadsheet as you do your research.

In the meantime, consider one of these dividend payers.

Bank of Hawaii Corporation {% dividend BOH %}

This company is the second-largest bank in Hawaii and provides retail banking, commercial banking and investment management services. The stock has a yield of 2.2%, but a dividend payout ratio of just 45% suggesting a sustainable dividend. Earnings are forecast to grow around 9%, as management has focused on improving margins and should benefit from rising rates. The stock is up 30% since it was added to our Best Dividend Stocks list and we recommended exclusively to premium members. Check out

PS Business Parks, Inc. {% dividend PSB %}

PSB is a diversified real estate investment trust that owns commercial property, office buildings and industrial space. The stock has a yield of 2.5% and a dividend payout ratio of 56%. Occupancy rates of properties within the REIT are well over 90%, which should continue to support forward earnings. The stock remains highly rated in our DARS Model and is up 16% since it was recently recommended to premium members. Check out

SJW Corporation {% dividend SJW %}

SJW is a water-service provider that provides service to more than 200,000 customers primarily on the west coast. The stock has risen 45% since it was recommended to premium members and is highly ranked in our DARS Model. While the rapid rise in stock price has pushed the dividend yield down to 1.6%, the dividend is supported by just a 36% payout ratio and nearly five decades of dividend growth history. Earnings are forecast to continue growing at a 5% annualized rate. Check out

Idacorp, Inc, {% dividend IDA %}

Idacorp is an electric utility, with its primary operations in Oregon and Idaho. The stock’s quarterly dividend has nearly doubled since 2011 and currently sits at 2.8%. Its 56% payout ratio is modest by utility company standards and its 5% forecast earnings growth rate should help support future dividend growth. The stock is up 5% since its original recommendation to premium members. Check out

The Bottom Line

Rising interest rate environments don’t necessarily need to be feared by investors. History suggests that the equity markets can actually do fairly well during periods of rising rates. Certain sectors have also demonstrated the ability to outperform the broader market during these cycles. Using the past as a guide, investors can position their portfolios appropriately to both help protect the value of their investments and enhance the income produced by them.

Check out our Best Dividend Stocks page by going premium for free.