Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The drama behind the bankruptcy of Southcross Energy Partners has attracted investor interest this week after a court approved a settlement between the company and its parent. Second in the list is beverage and snacks manufacturer Pepsico, which recently reported climbing revenues and declining profits. Exxon Mobil hit the news this week thanks to news that were material to its business. Finally, private equity firm Blackstone Group was in the spotlight for an audacious bet on the growth of online commerce.

Don’t forget to read our previous edition of trends here.

Southcross Energy Partners

Bankrupt master limited partnership Southcross Energy Partners (SXE) was the surprise leader of the list these past two weeks, with a rise in viewership of 96%. Investor interest was likely spurred by Southcross’s agreement with parent Southcross Holdings Borrower LP, under which the former will receive $22.5 million in cash and stakes in non-bankrupt affiliates. Southcross Energy had sued its parent in August 2019, claiming fraudulent transfers and violation of an agreement related to the processing of natural gas.

With the court dispute now settled, Southcross is likely to start an auction of its pipelines on October 16, paving the way for an asset liquidation. In an August update, the company said it did not reach a restructuring agreement with its creditors, although it did launch a strategic review to sell assets. Under the so-called priority requirements, the company cannot distribute any gains to its unit holders unless creditors are paid in full. Southcross estimated, however, that unit holders will be entitled to little recovery, if any.

The company hired investment bank Evercore Group to market its saleable assets. Kinder Morgan (KMI), which pays a dividend yield of 5%, reached a deal at the beginning of September to be the stalking horse bidder for two Southcross pipeline systems in Texas. If an alternative bidder fails to emerge with a higher offer, Kinder Morgan will pay $76 million for the Corpus Christi Pipeline and Bay City Lateral systems.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

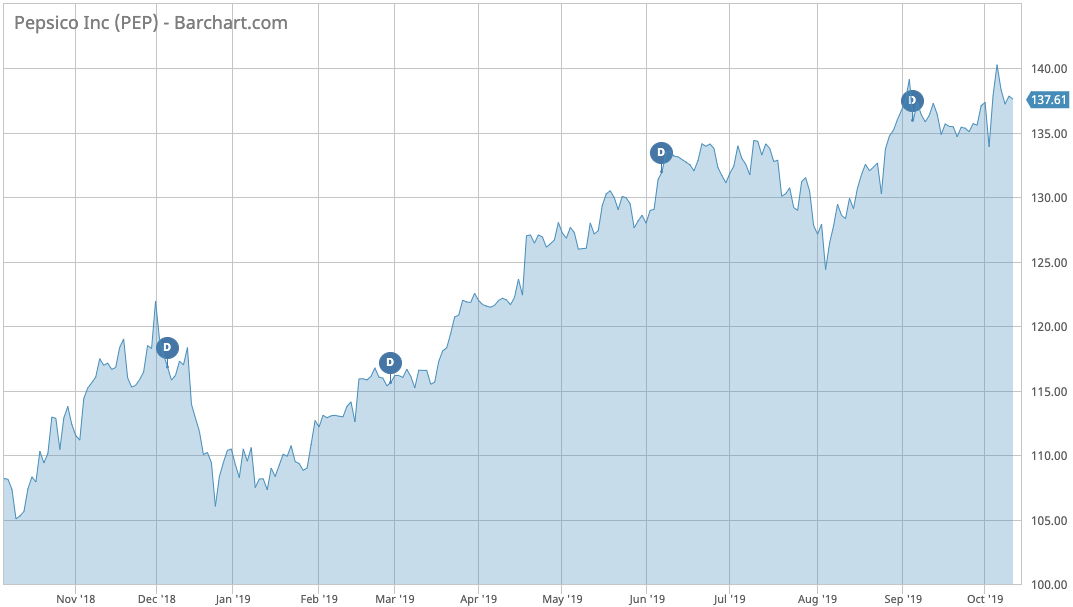

Pepsico

Pepsico (PEP) has taken the second spot in the list this week with a rise in viewership of 68%. The snacks and beverage giant reported a rise in sales for the third quarter of the year, although higher spending on advertising led to a drop in earnings. Organic revenue increased 4.3% during the quarter to $17.2 billion, and the company said it expects annual growth to top 4%. The number beat analysts’ estimates of $16.93 billion. In the North American division, the key profit driver, sales grew by 3.4%, with CEO Ramon Laguarta saying recent investments in advertising bore fruit, including an effort to promote Gatorade Zero, a sugar-free sports drink.

However, the company said its earnings declined to $2.1 billion in the third quarter from $2.5 billion in the year-ago period due to higher income tax provisions and increased spend on advertising. So far this year, ad spending grew by 12%.

Shares in Pepsico have continued their march forward, rising as much as 25% so far this year and hovering near record highs. The S&P 500 has risen 17% during the same period. Pepsico also pays investors a dividend that is equal to 2.7% of the value of its stock and has been increasing it for the past 46 years.

Check out our latest Best Dividend Stocks List here.

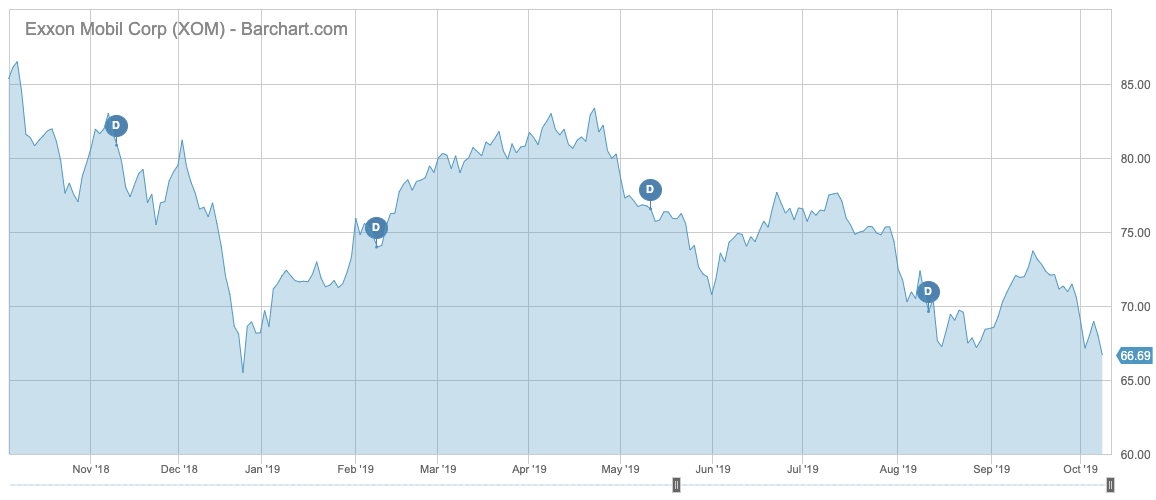

Exxon Mobil

Exxon Mobil (XOM) has seen its traffic increase by as much as 50% these past two weeks, as the U.S. oil major hit the news with several projects. In late September, Exxon agreed to sell almost all its oil assets in Norway to a consortium named Var Energi for $4.5 billion in order to focus on its shale assets in the U.S. The combined production capacity of the sold assets is around 150,000 barrels per day.

The company does not intend to stop here in its bid to reach a self-imposed $15 billion divestment target by 2021. It is also mulling the sale of stakes in about 40 North Sea oil and gas fields in the U.K., or roughly 80,000 barrels of oil a day.

Meanwhile, press reports said Exxon will delay a decision on a massive $30 billion investment in a liquefied natural gas project in Mozambique. Exxon’s project, which is operated together with Italy’s Eni, is expected to produce, liquefy and sell natural gas from three fields in Mozambique. The company believes production will start in 2024 and it expects 17,000 tons of liquefied petroleum gas per year.

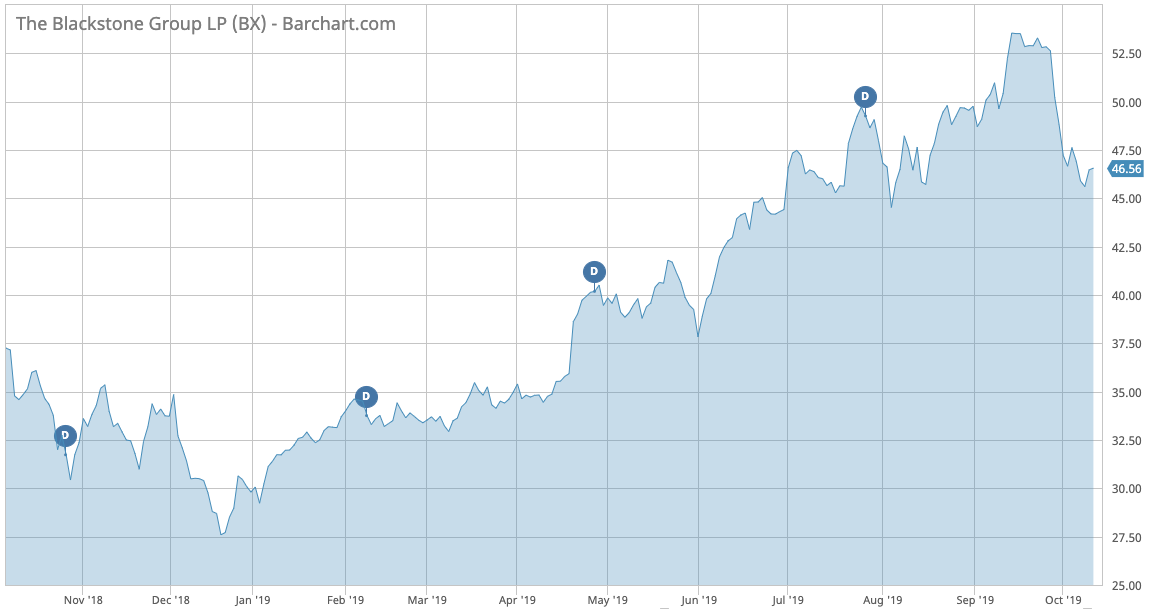

Blackstone Group

Blackstone Group (BX) has seen its viewership rise 48% these past two weeks, as the stock of the private equity giant slumped more than 9% over the past 30 days.

The drop came shortly after the company closed its largest-ever commercial real estate fund at $20.5 billion. Not long after that, the company, which manages $153.6 billion in real estate assets, agreed to buy industrial warehouses from Colony Capital for $5.9 billion in a bet on the ongoing expansion of online eCommerce.

Over the years, Blackstone has followed a more risky strategy of money management, taking on leverage to increase returns. As a result, it has delivered annual average net returns of 15% over the past 27 years. Blackstone also has a solid dividend yield of 4.2% and has been growing its dividend for the past 6 years.

The Bottom Line

Southcross Energy Partners settled a lawsuit with its parent paving the way for an asset auction to pay creditors. Unitholders are unlikely to receive anything. Pepsico reported strong sales figures for the third quarter thanks to a ramp-up in advertising spending, although that hurt earnings. Oil major Exxon Mobil is exiting its Norway business to focus on its shale operations at home. Finally, Blackstone has raised new funds to double down on its bet that demand for commercial warehouses will grow.