Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Microsoft trended these past two weeks after the technology juggernaut hiked its dividend and authorized a fresh round of share buybacks. Real estate firm New Residential Investment edged up, after the U.S. Federal Reserve cut interest rates for the second time in two months. Energy Transfer was also in the news, after the pipeline operator agreed to acquire SemGroup. Last on the list is Broadcom, the chipmaker that reported mixed results for the fiscal third-quarter.

Don’t forget to read our previous edition of trends here.

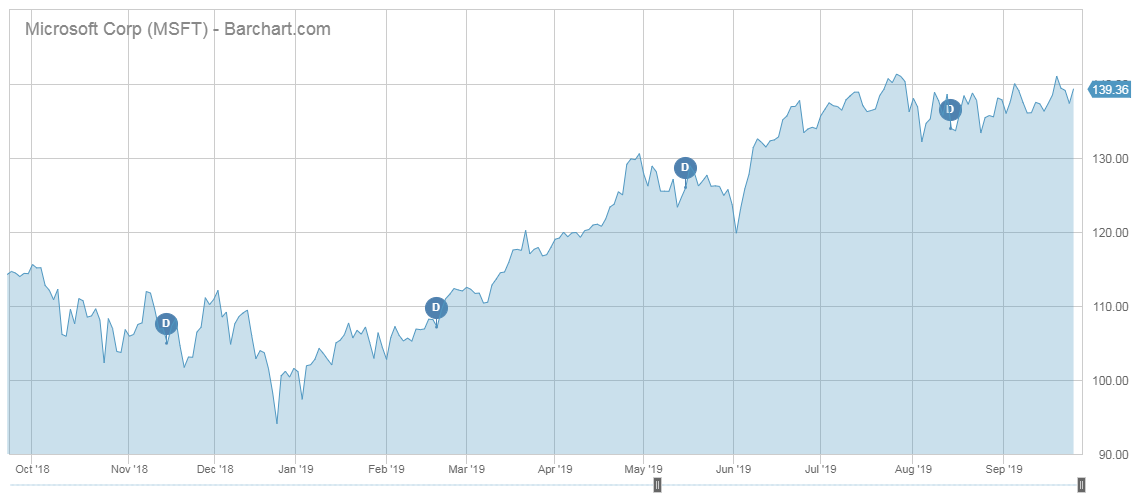

Microsoft

Microsoft (MSFT) has seen its viewership rise 61% these past two weeks, taking the first spot on the list. Microsoft was in the news after it announced a $40 billion share buyback program and a $0.20 increase of its annual dividend. The dividend hike was expected by analysts, although it beat their estimates by $0.08.

Microsoft, which has seen its stock appreciate nearly four times during the five-year tenure of CEO Satya Nadella, has been growing its dividend every year since it first announced a payout in 2003. Last year, the company hiked its quarterly dividend by 4 cents. Its dividend yield currently stands at 1.46%.

The company has been buying back its own shares aggressively in recent years. In the fiscal year ended June 30, it repurchased nearly $20 billion of its shares, and in the prior fiscal year, the buyback amounted to a little more than $10 billion.

Since Nadella took office in 2014, Microsoft has undergone a dramatic transformation, shifting its focus from devices and services to cloud and mobile. To do that, Nadella made a string of acquisitions, including the social network for professionals LinkedIn, developer platform Github and popular game Minecraft. At the same time, Nadella started a partnership with arch-rival Salesforce (CRM) and made its Office Suite available on Apple’s iPad. Nadella himself says the biggest change he implemented at Microsoft was cultural.

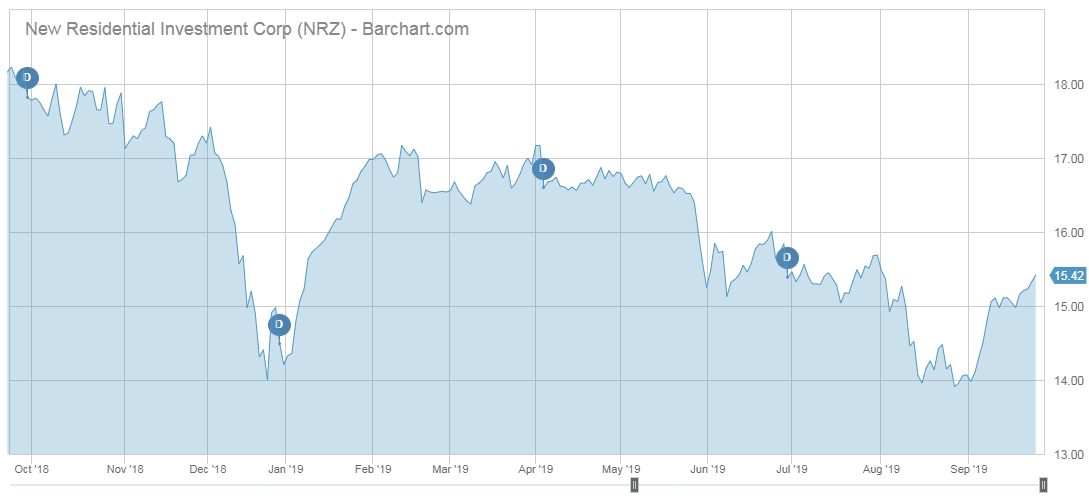

New Residential Investment

New Residential Investment (NRZ) has seen its viewership rise 42%, with the company likely attracting investors for its strong dividend yield and sound fundamentals. New Residential, which invests in mortgages, yields an impressive 13% annually and has been growing its payout for the past five years. The company’s payout ratio is 87%.

The company’s stock has advanced nearly 9% over the past 30 days, in no small part due to the Federal Reserve cutting interest rates, which prompted investors to hunt for yield. As a result, New Residential recovered some of the losses for the past six months and is now down nearly 8% over the period.

On September 23, the company declared a quarterly dividend of $0.50 per share, unchanged from the previous quarter. A few weeks before, the real estate investment trust gained momentum after BTIG analyst Giuliano Bologna said the company has sufficient cash flow to maintain its dividend intact.

The record date for the dividend is October 3 and the pay date is October 31.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

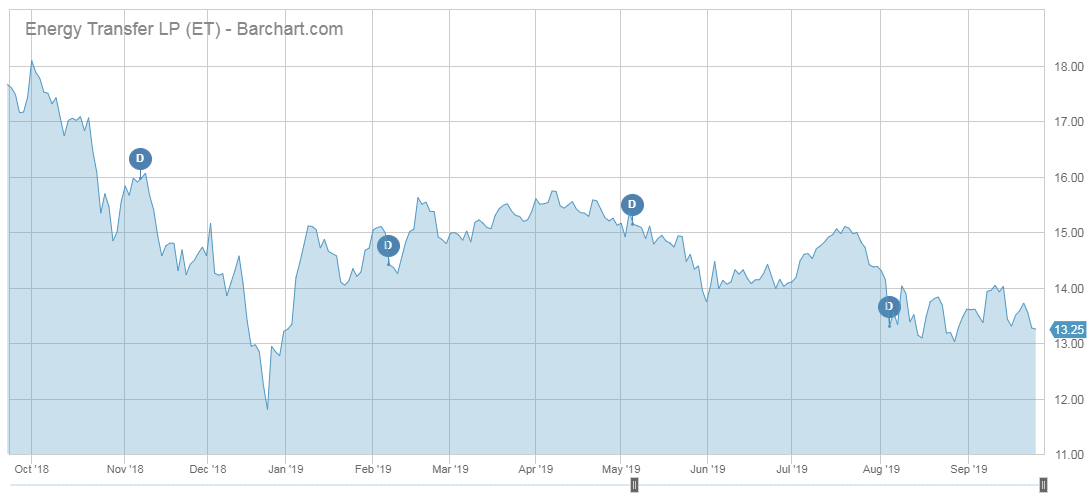

Energy Transfer

Energy Transfer (ET) has seen its traffic increase 41% on the back of an acquisition that was met with some skepticism by investors. The company agreed to pay $5 billion in cash and stock for the purchase of rival SemGroup (SEMG). Energy Transfer’s stock declined around 4% on the day of the announcement, despite peers surging as a result of the attack on key Saudi Arabia oil facilities.

Some analysts have questioned the rationale of the deal given that the company promised capital discipline and accelerated deleveraging. Energy Transfer took on $3.8 billion of debt to finance the acquisition, which is subject to SemGroup shareholders’ approval.

The company said the deal will increase its scale across multiple regions and provide increased connectivity for its oil and gas transportation business. In addition, the combination will generate more than $170 million of annual run-rate in synergies, including commercial and operational synergies of $80 million and cost savings of $50 million, the company said.

Shares in Energy Transfer are down more than 5% over the past three months.

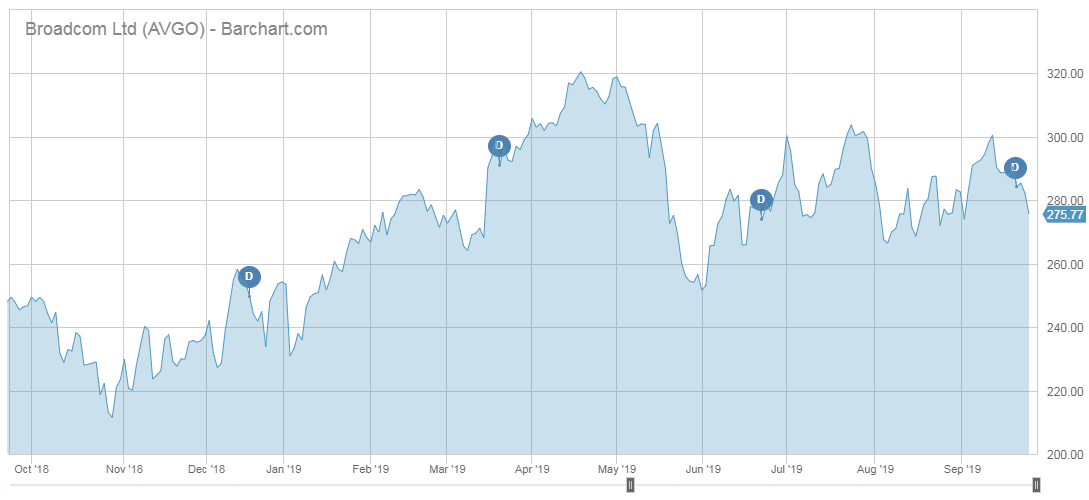

Broadcom

Broadcom (AVGO) is last on the list with an advance in viewership of 39%.

Although Broadcom reported better-than-expected results for the fiscal third-quarter earlier this month, its guidance largely disappointed analysts. The stock dropped further on September 24, after the firm announced a public offering of $3 billion in mandatory convertible preferred stock. Broadcom shares are down more than 7% over the past two weeks.

Revenue for the quarter was up 9% to $5.5 billion, compared to the same period a year ago, and roughly flat versus the previous quarter. Gross margin was 55%, more than 3 percentage points higher than last year and down 1 percentage point from the previous quarter. Meanwhile, operating income declined to $865 million from $1.34 billion a year ago.

Broadcom currently yields 3.82%.

The Bottom Line

Microsoft increased its share buyback authorization and dividend as the company has thrived under the leadership of Satya Nadella. New Residential Investment shares received a respite after the Federal Reserve cut interest rates. Energy Transfer announced another acquisition, although investors and analysts seem skeptical about the deal’s rationale. Broadcom reported better-than-expected financial results for the third quarter, although its full-year guidance disappointed investors.

Check out our latest Best Dividend Stocks List here.