Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

These past two weeks were largely uneventful as traders and investors either headed to or returned from their summer vacations. First in the list is Stag Industrial, a REIT that has benefited from an analyst upgrade on the entire industry. Utility company Southern is second, as the stock experienced an impressive run this year. Bank of America is third as investors start to become bearish on the stock. Payment processor Visa closes out the list.

Don’t forget to read our previous edition of trends here.

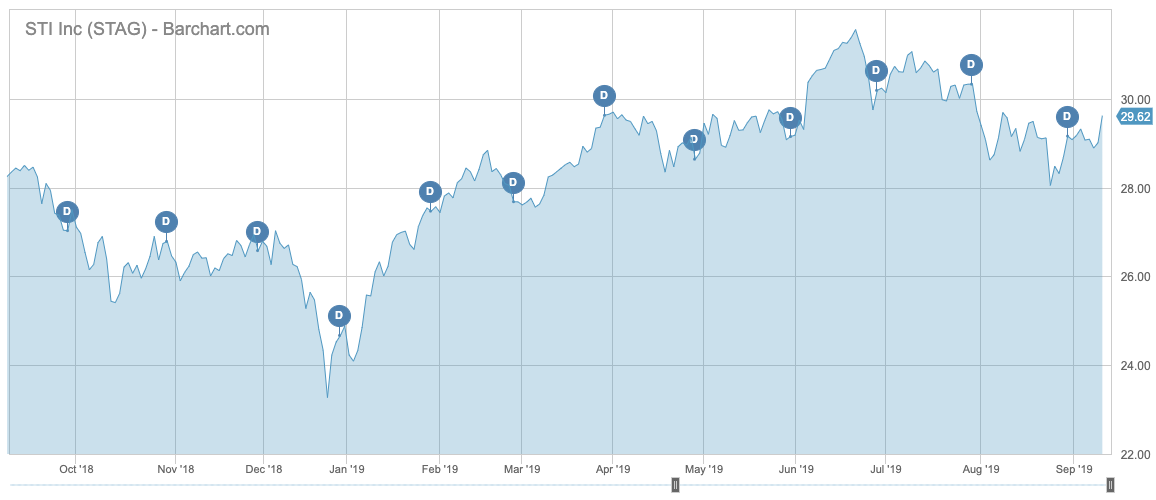

Stag Industrial

Stag Industrial (STAG) has taken the first spot in the list with an advance in viewership of 29%. The company – which focuses on the acquisition and operation of single-tenant industrial properties throughout the U.S. – is rarely in the news, but its stock recently benefited from a report from Jefferies analyst Steven DeSanctis, who said in a note that interest rates around the globe are either expected to stay still or fall, thus forcing yield-seeking investors into real estate assets.

Stag might be among the beneficiaries. The firm has a dividend yield of nearly 5% and has been growing it over the past eight years. Its payout ratio is nearly 80%, while its stock is stable. Since the start of this year, Stag shares have advanced nearly 20%, bringing its 12-month performance into positive territory at 4%.

In the second quarter of this year, Stag reported funds from operations (FFO) of $0.45, which was in line with consensus and unchanged from the prior year. However, second-quarter EBITDA rose 16% to $71.2 million compared to the same period a year ago. The company was busy buying 14 properties for $260 million during the quarter while selling five buildings for $19.1 million.

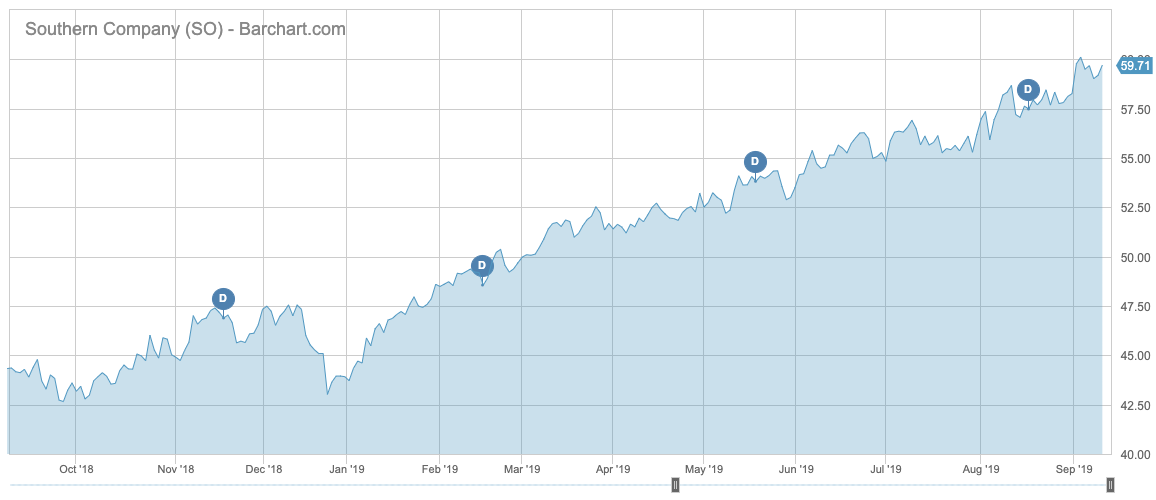

Southern Company

Recent market volatility has brought utility stocks back in fashion. Southern (SO), an electric and gas utility based in Atlanta, Georgia, has been among the key beneficiaries. In the past three months, Southern shares have added nearly 10%, extending year-to-date gains to more than 35%.

Southern is attractive for investors because it has been making the right steps recently. It has been selling non-core assets, which allowed it to decrease leverage. The company’s long-term debt shrank from $44.4 billion in 2017 to $40.7 billion in 2018, while its revenues rose 2% to $23.6 billion.

Southern has the only nuclear construction project in the U.S., namely Vogtle, which is on track to start producing electricity by late 2021. In August, the company said roughly 79% of the project is complete, having met all the major milestones for the year.

Southern pays a dividend of 4.2% compared with nearly 2% for the average utility company. The firm pays out more than 80% of its earnings to shareholders and has been growing its dividend for the past 17 years.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

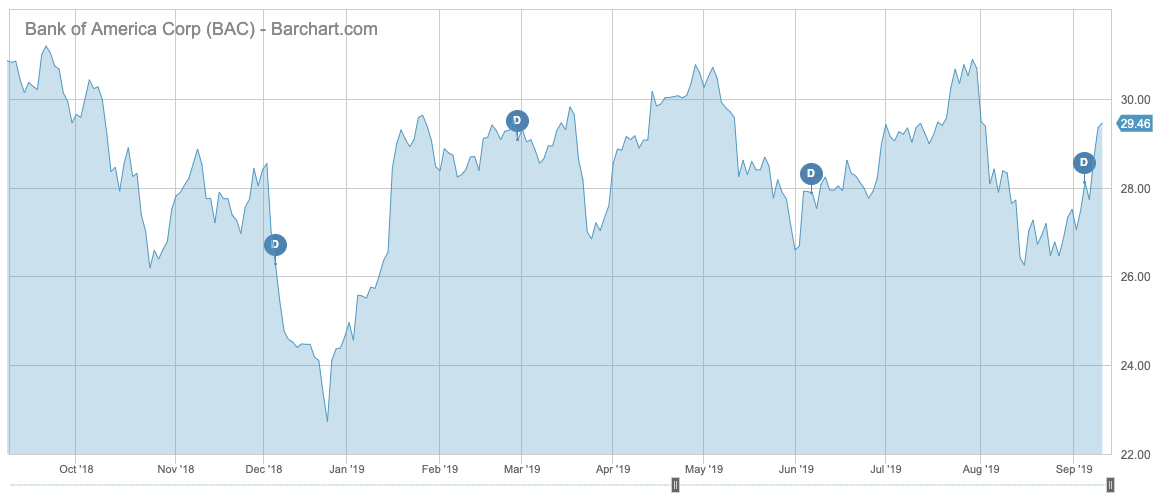

Bank of America

Bank of America (BAC) has seen it viewership increase 20% over the past two weeks, as the company’s shares posted a strong rally despite fears of an economic slowdown. Shares in Bank of America have advanced 4% over the past 30 days, extending year-to-date gains to more than 20%.

However, the bank may be facing tough times ahead. Interest rates are expected to fall or at least stay at the same level in the upcoming period, which is likely to hit the profitability of the entire banking sector. The Federal Reserve cut interest rates to sustain the economy, but it appears the ongoing trade war between the U.S. and China is likely to outweigh the benefits. As a result, the Fed might further cut interest rates, which, in turn, will take a toll on Bank of America’s profitability.

The company appears to be doing the right things, though, with its growth relatively strong and coming from prudent underwriting.

Bank of America has a dividend yield of 2.45% and has been growing it for the past five years. Its payout ratio stands at nearly 30%.

Check out our latest Best Dividend Stocks List here.

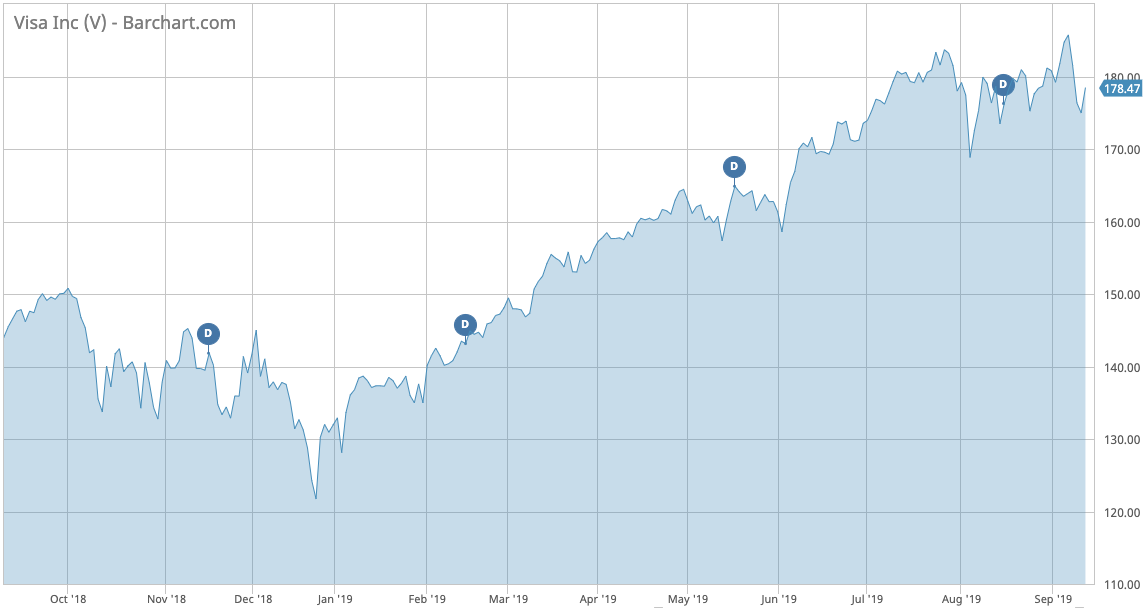

Visa

Visa (V) is last in the list this week with an increase in traffic of just 18%. The company has not been much in the news of late, although it unexpectedly tumbled roughly 4% during the past five days. Still, the stock remains up 33% since the start of the year.

Visa’s results have been strong this year as consumers increasingly shifted from cash payments to card transactions. An uncertain macroeconomic environment and potential economic slowdown could lead to a drop in consumer spending across the globe. This could have a negative impact on Visa’s revenues and profitability.

In unrelated news, Visa recently announced a partnership with money transfer service MoneyGram to allow a person-to-person money transfer option to customers in the U.S. With the new feature, customers are able to send money domestically to Visa debit cards.

Visa pays a small dividend yield of 0.57% on a payout ratio of 22%. The company has been growing its dividend for the past 10 years.

The Bottom Line

Stag has benefited from increased attractiveness of real estate assets as investors are in search of yield. Utility firm Southern has been on a tear, with its stock appreciating by a third this year. Bank of America might suffer from a return to a low-yield environment, while Visa sees hiccups ahead stemmed from the trade war and falling consumer spending.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.