Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Home Depot reported strong financial results although it lowered its guidance for the full year on account of the trade war between China and the U.S. Retailer Target might see an increase in traffic during the Christmas season, as it struck a deal with Disney to expand the presence of stores inside its supermarkets. Anglo-Australian miner BHP Billiton posted solid results for the full year and hopes this will help it fend off an activist investor. Lockheed Martin is last in the list as the defense manufacturer was awarded a large contract.

Click here to see our previous edition of Trends.

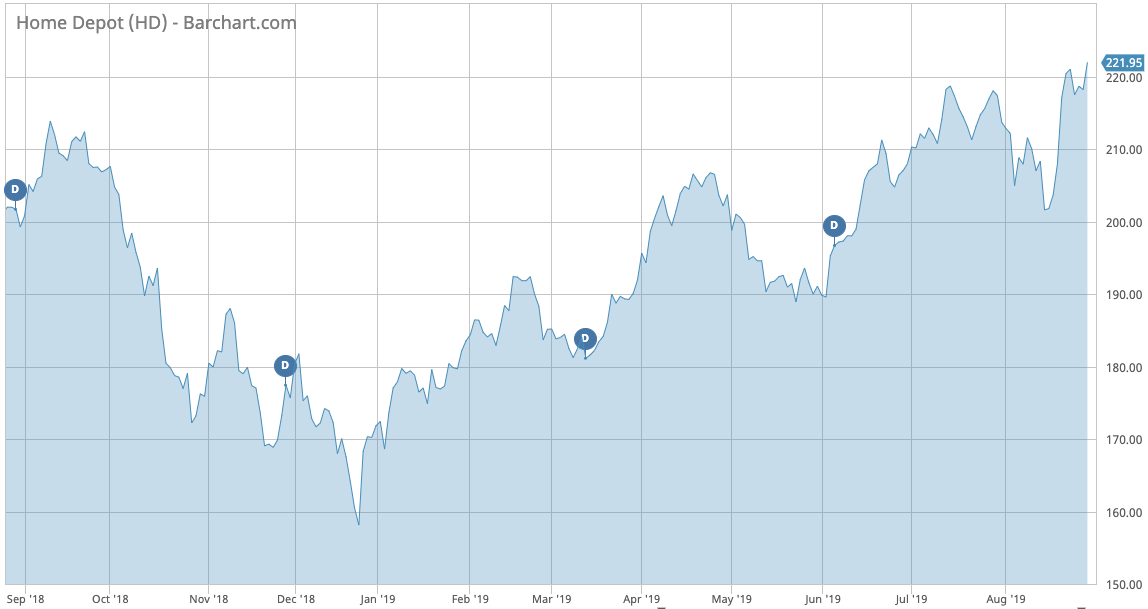

Home Depot

Home Depot (HD) has seen the biggest increase in viewership these past two weeks, up 107%. The home improvement retailer posted a mixed earnings report for the second quarter, something that appeared to encourage investors given that the stock climbed in the aftermath. Although sales came slightly behind expectations, Home Depot easily beat earnings per share forecasts by 9 cents to earn $3.17. Same-store sales were up 3% compared with 3.5% expected by analysts.

Home Depot warned that it expects full-year total sales growth of 2.3%–4% versus 3.3%–5% previously due to the negative impact of U.S. tariffs on Chinese imports. Investors were buoyed by the company’s assurances that most of its suppliers are moving production out of China to avoid higher tariffs. In most cases, suppliers are relocating in neighboring countries such as Vietnam, Thailand and Indonesia, but there are also those that are bringing production back to the U.S.

The company estimated the cost impact on U.S. sales from tariffs at about 2%, or $2 billion, but noted one percentage point is gained back by suppliers’ relocation.

Despite market jitters, Home Depot stock held up. Over the past 30 days, shares have risen slightly, extending year-to-date gains to more than 28%, double the gains of the S&P 500. On top of that return, investors should add the 2.5% annual dividend yield. The company has been growing its dividend for the past six years. It goes ex-dividend on September 4 and will pay the dividend on September 19.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

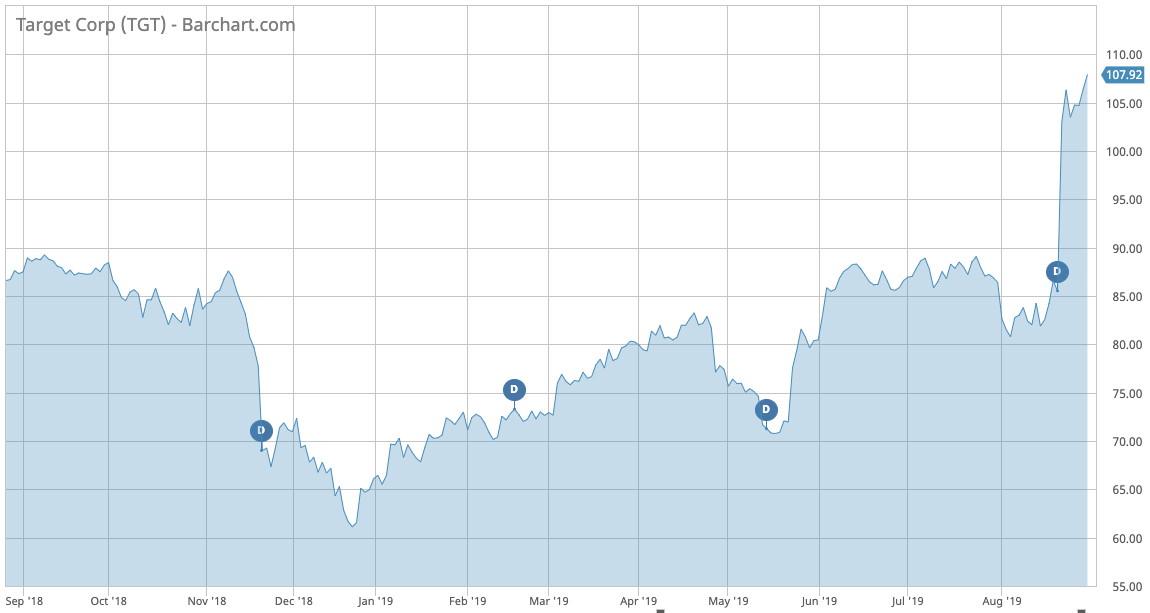

Target

U.S. retailer Target (TGT) has reported blowout earnings for the fiscal second quarter, triggering a 20% rise in the stock price. This has attracted an increase in viewership of 78% in the past two weeks.

Revenues were slightly ahead of expectations at $18.42 billion, but earnings were 20 cents higher than forecasts at $1.82. The company has been investing heavily in its online retail operations to compete with Amazon and has been working on speeding up delivery times while allowing consumers to pick their orders at nearby stores.

Shares in the company have advanced around 22% since the strong earnings report, extending year-to-date gains to more than 60%. Walmart (WMT), a competitor which has also been performing extremely well, is up only 20% this year. In part, the stock’s resurgence could be attributed to a 2017 plan by a then-struggling retailer to mix digital and brick-and-mortar to create a unique experience for customers.

Target was also boosted by an expansion of its partnership with Disney (DIS), as the company looks to grab market share from Toys R Us, which filed for bankruptcy in 2017 but seeks to mount a comeback. By October 4, Target hopes to open 25 Disney stores at certain locations in the U.S. and an additional 40 by October next year.

Target’s dividend yields an annual 2.5% on a payout ratio of 49%. It has been growing its dividend for the last 51 years.

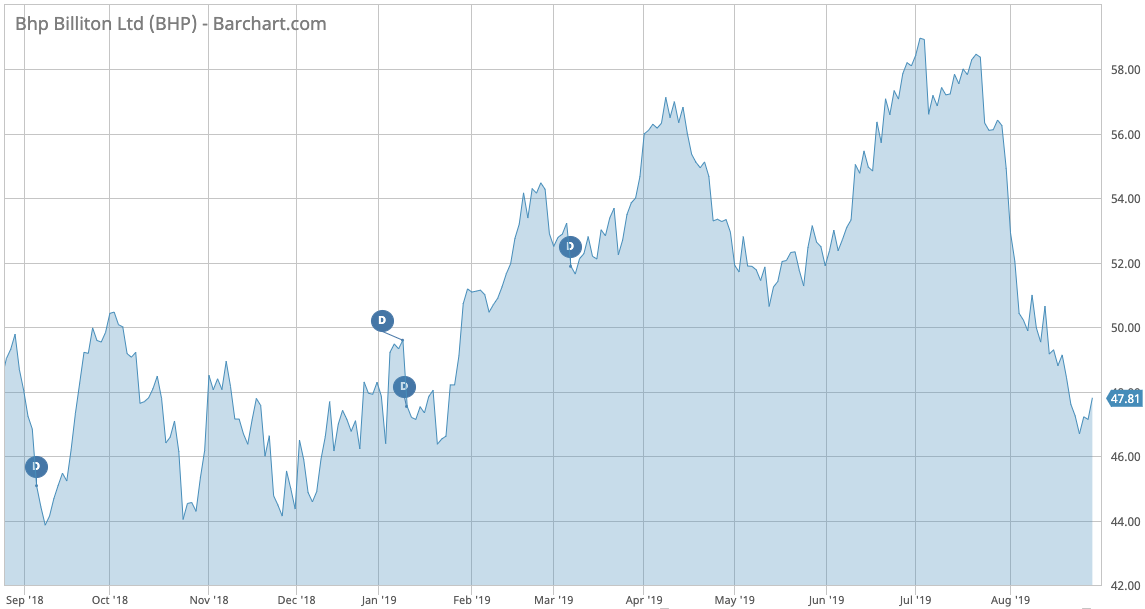

BHP Billiton

BHP Billiton (BHP) has taken the third spot in the list this week with an advance in viewership of 72%. The Anglo-Australian miner has been in the news with a 124% increase in its profits for the fiscal full year of 2019 to $8.3 billion. A large part of the strong gains were thanks to lower costs with a dam collapse in Brazil. The company’s iron ore operations drove the positive results, with the unit bringing in $11.1 billion in pre-tax earnings.

With BHP attempting to lower its costs to improve profitability, volumes have been hit, with all key commodities seeing lower production levels compared to last year.

The increased profitability allowed BHP to pay a record full-year dividend of $1.33 per share on top of a special dividend of $10.4 billion from the sale of its U.S. shale operations. Under pressure from activist investor Elliott Management, the company sold its shale assets to BP in 2018. However, the company has not budged on another hedge fund’s key demand to end its dual listing structure.

Shares in the miner are up 2% since the start of the year, although the company pays a solid dividend yield of 6.6%. BHP goes ex-dividend on September 5 and will release its payout on September 25.

Check out our latest Best Dividend Stocks List here.

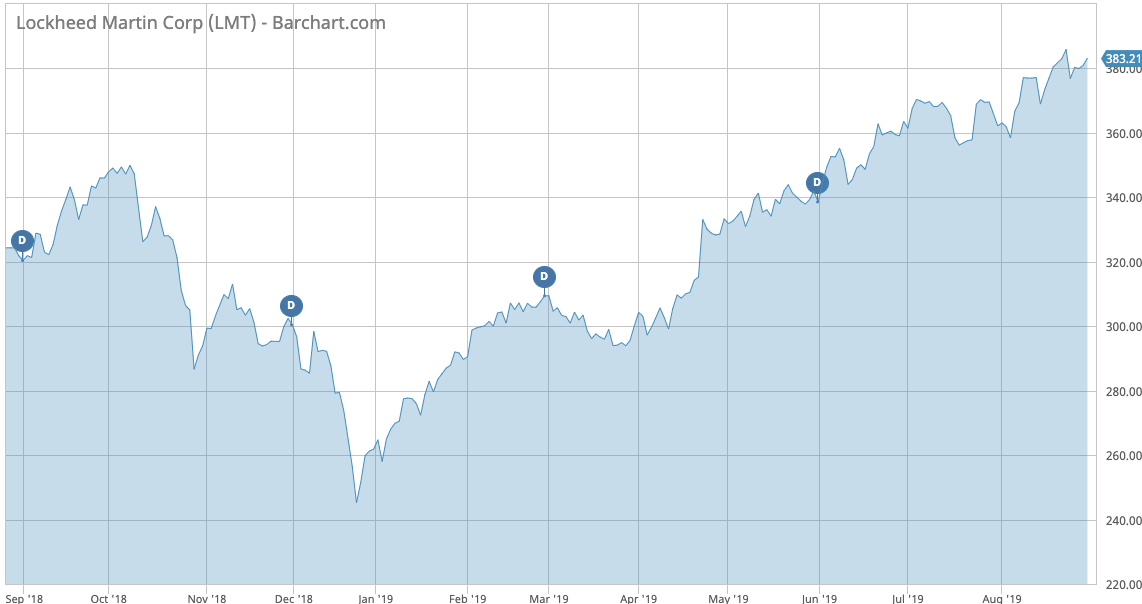

Lockheed Martin

Lockheed Martin (LMT) has taken the last spot in the list with an increase in traffic of 53%. The defense contractor was recently awarded an additional $2.4 billion spare parts contract for the F-35 Lightning II Joint Strike Fighter from the Pentagon.

The news is significant and is likely to drive further revenue growth at its F-35 program, which brings in 25% of total sales and is an important component of the Aeronautics division.

Lockheed stock has had an impressive run over the past five years, surging more than 110% on the back of higher military spending in the U.S. and Europe.

Lockheed Martin has a dividend yield of 2.3% and has been growing it for the last 16 years. The company goes ex-dividend on August 30 and will pay its next dividend on September 27.

The Bottom Line

Home Depot and Target have both benefited from strong earnings reports, with the latter seeing an impressive stock run in the aftermath. BHP Billiton said its profit more than doubled, but this has failed to translate into an improved stock performance. Finally, Lockheed Martin received another award from the U.S. government.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.