Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Kraft Heinz trended first this week as the food company, backed by Warren Buffett, announced a new write-down and warned more could follow. CenturyLink was second in the list, with the telecommunications company unveiling a new investment strategy. Staples maker 3M is still feeling the pinch from the trade war, while Advanced Micro Devices is on a sprint.

Click here to see our previous edition of Trends.

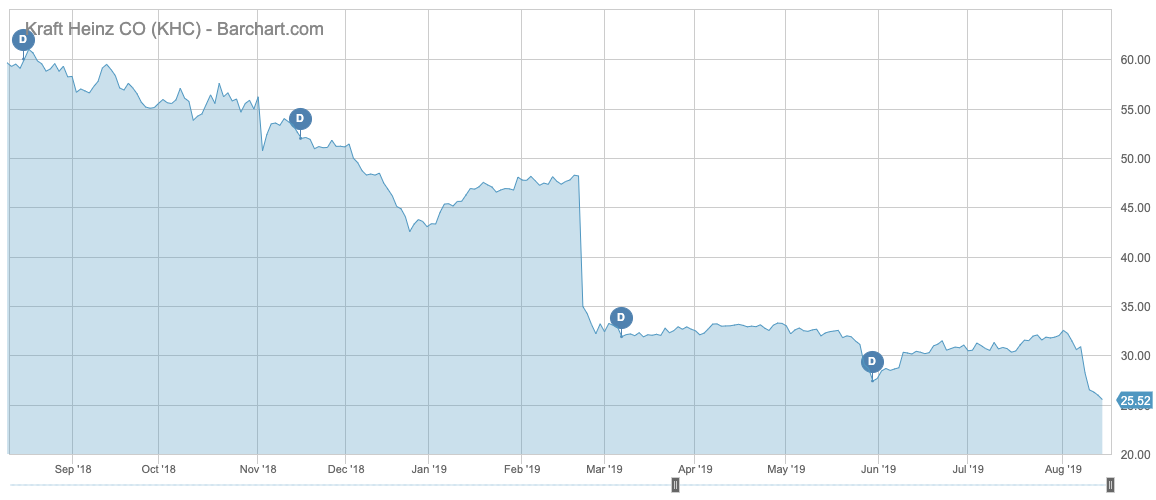

Kraft Heinz

Food company Kraft Heinz (KHC) has taken the first spot in the list, seeing its viewership increase by 245%. The company, backed by Warren Buffett’s Berkshire Hathaway, has been in the news for all the wrong reasons. After the firm posted another write-down, which impacted its bottom line, share prices have declined more than 15%, bringing year-to-date losses to 42%.

The company’s $1.2 billion write-down led to a decline in net profits to $852 million in the first half of the year through June from $1.7 billion a year ago. Net sales fell 4.8%, largely due to price cuts.

The maker of Heinz ketchup has been struggling with accounting irregularities, failing sales as its products are falling out of fashion and high levels of debt. In part, the company’s current difficulties were brought about by Buffett-backed 3G Capital’s aggressive cost cuts, which, until recently, had been considered the gold standard of profitability improvement. However, too aggressive cost cuts in areas such as marketing, advertising and R&D caused a drop in sales’ numbers.

The company’s recently installed CEO Miguel Patricio said the company needs a strategy “first of all for growth,” admitting the firm was too focused on the bottom line in the past. At the same time, Patricio said he might run a strategic review of some brands with a view to selling some of them in order to reduce its nearly $30 billion in debt, which almost equals its market capitalization.

Kraft Heinz, which pays an annual dividend of 6% on a payout ratio of 43%, is a rare investment mistake made by Buffett, who conceded that he overpaid for his 27.5% interest in the company.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

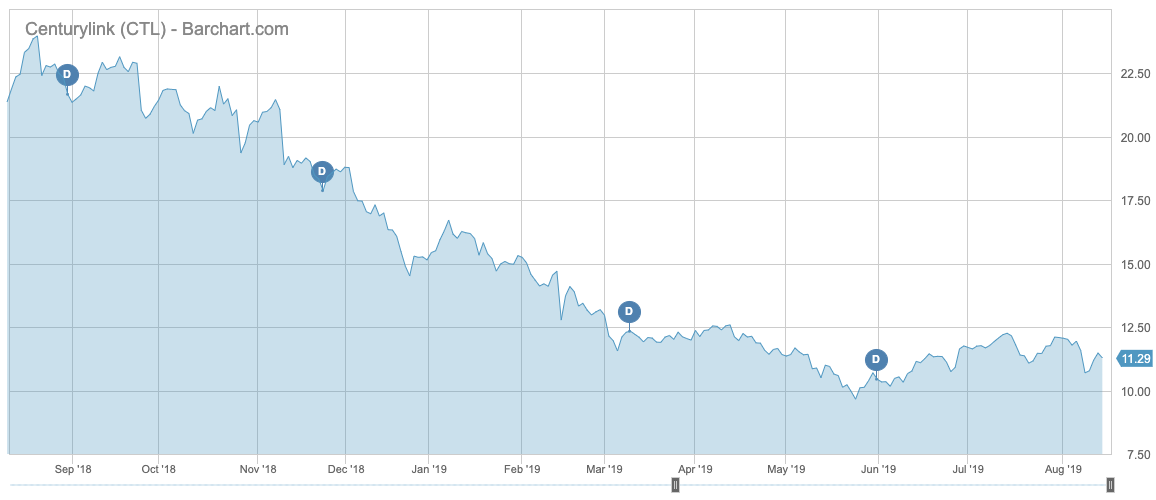

CenturyLink

Telecommunications services provider CenturyLink (CTL) is second in the list with an advance in traffic of just 59%.

The firm was in the news after it announced plans to invest a few hundred million dollars in so-called edge compute services to be able to store client data closer to their locations, allowing for speed improvement and lower bandwidth usage.

The August 12 news was well received by investors, with the stock rising 5% on the news, although it gave up some of the gains since then. Analysts were also optimistic on the move, with Wells Fargo’s Jennifer Fritzsche arguing the company will likely gain from the trend of the wide adoption of edge computing.

CenturyLink, which yields an annual 9%, has mostly struggled in recent months, along with the entire industry, as competition led to price cuts, while high debt levels proved a burden on the stock. Share prices have shed nearly half of their value over the past 12 months.

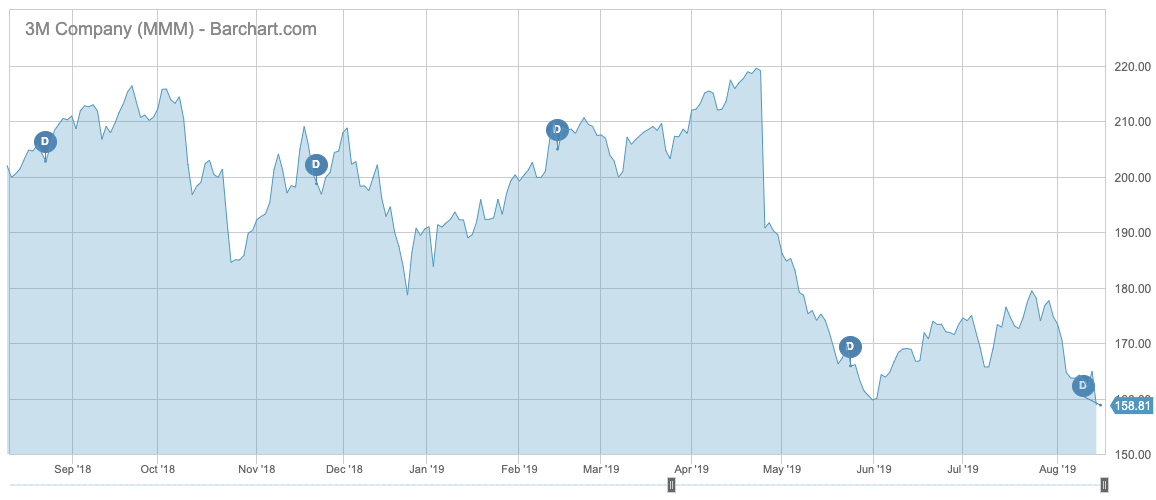

3M

Industrial conglomerate 3M (MMM) has experienced a 31% increase in viewership, as the company continues to be in the news with its worsening financial results.

The latest bad news is a 37% drop in earnings in the second quarter versus the previous year, with the company blaming weak demand from China, Europe and Latin America. This comes after the company’s stock posted its biggest intraday decline in its history in May, after reporting poor results for the first quarter. The company also blamed macroeconomic headwinds, although inefficiencies in operations led to operating income to fall in all five business sectors.

Yet the company’s CEO Mike Roman sounded upbeat, saying “execution was strong in the face of continued slow growth conditions in key end markets,” thanks to the effective management of costs.

3M has an annual dividend yield of 3.6% and its payout ratio is 56%.

Check out our latest Best Dividend Stocks List here.

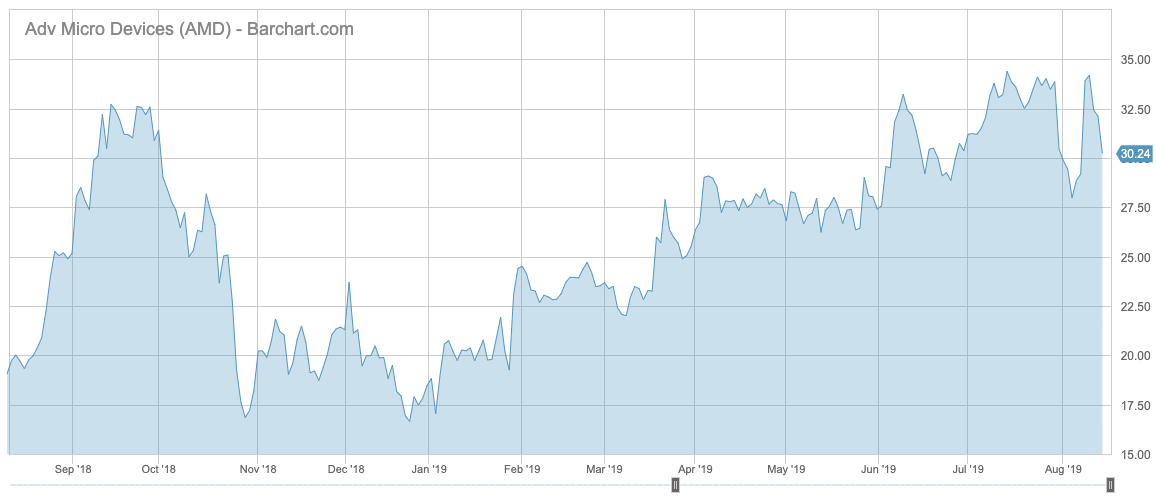

Advanced Micro Devices

The only strong performer in the list this week is Advanced Micro Devices (AMD), which has seen its viewership rise 25%.

AMD, which, for long, sat in the shadow of its competitor Intel (INTC) is apparently now set to surpass it. AMD, which makes processors for personal computers, servers and graphics cards, has been aggressively eating market share from Intel.

Indeed, Cowen analysts recently said AMD’s market share gains from Intel will be better-than-expected. Alphabet’s Google was the latest technology giant to publicly say that it is using AMD’s latest server chips in its massive cloud data centers. Among its existing customers are Microsoft (MSFT), Amazon (AMZN) and Tencent. AMD boasted that the second generation of its Epyc server chips, announced a week ago, deliver twice the performance of its Intel rival for each dollar spent.

Share prices of the company are up 53% this year, while Intel is down more than 5%. However, the difference between the companies’ market capitalization remains large. With a market capitalization of $208 billion, Intel is six times larger than AMD.

The Bottom Line

This week, Kraft Heinz trended after the company unveiled another write-down. CenturyLink hopes new investments in communications infrastructure will boost its stock price, while 3M is struggling under macroeconomic pressures. The only bright spot in this list is Advanced Micro Devices, which is eating market share from arch-rival, Intel.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.