Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week Canadian energy distributor Enbridge trended first after a U.S. court dealt a blow to its plans to build a pipeline from Canada to the U.S. PepsiCo was second on the list for no apparent reason, while drugmaker Pfizer has hit some roadblocks in China. Finally, chemicals conglomerate DowDupont is finishing the first stage of its complex breakup, although the market is not necessarily cheering its efforts.

Click here to see our previous edition of trends.

Enbridge Hit by Court Ruling

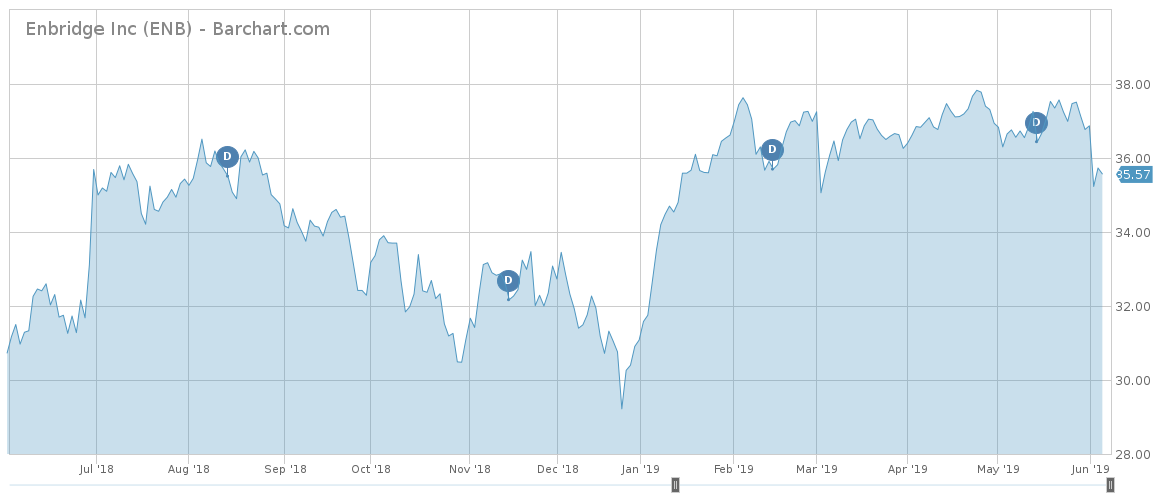

Enbridge (ENB) has seen its traffic rise as much as 32% over the past two weeks, with the interest spiking particularly after a Minnesota court in the U.S. dealt a blow to its plans to build an oil pipeline that would ease congestion at the border. The court said that Enbridge’s environmental impact statement was inadequate, reversing an earlier state regulator’s decision. In particular, the court said the statement failed to show how an oil spill would affect Lake Superior and its watershed.

Enbridge expressed its disappointment with the ruling, saying its impact statement was based on one of the most comprehensive studies of the impact of a pipeline on the environment. It remains unclear whether Enbridge will have to submit a new impact statement or make amendments to the existing one.

What is clear, however, is that the setback is likely to cause delays in building a pipeline that aims to increase the current daily capacity to 760,000 oil barrels per day, which would ease congestion at existing Canadian pipelines. In March, the company said it hoped to finish the pipeline in the second half of 2020, but it now may be forced to push the deadline further back.

Enbridge’s stock has fallen more than 4% over the past week, with most of the losses occurring after the ruling, although the stock remains up 14% since the start of the year. Enbridge’s dividend yields an impressive 8.3% and its payout ratio is 140%. The company’s long-term debt nearly doubled from 2016 to 2017 and remained at the same level in 2018.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

PepsiCo

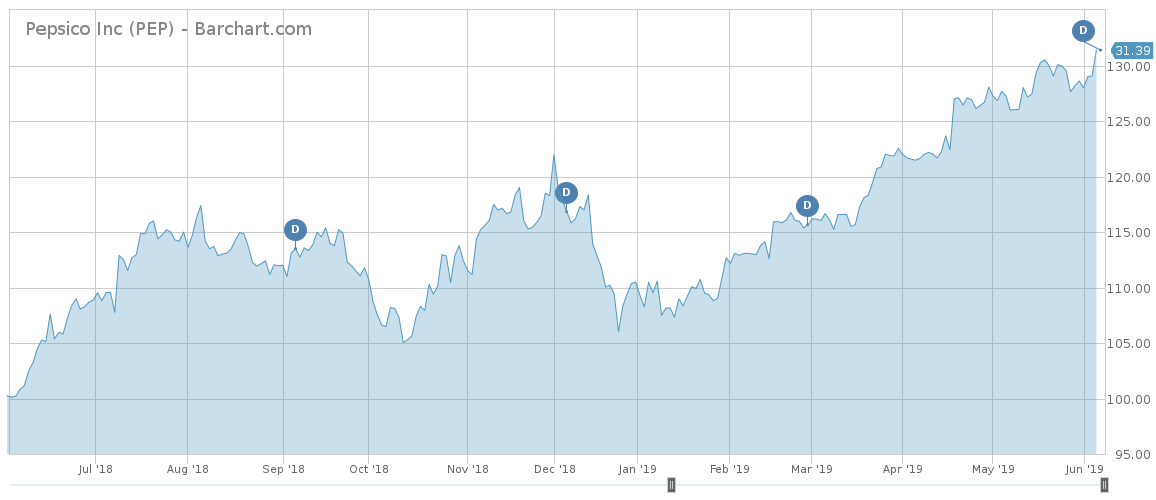

PepsiCo (PEP), the beverage and snacks giant, is the second-most popular stock for the past two weeks, with a rise in viewership of 27%. With the exception of the fact that the ex-dividend date is approaching, the company has not been in the news since its April announcement that it experienced the biggest sales increase thanks to its Super Bowl marketing.

As the Super Bowl broadcasting created strong sales, resulting in being a big driver for the 5.2% increase in sales for the first quarter, the company also announced a quarterly dividend of $0.955 per share, a 3% increase compared with the same period last year. This was the 47th annual dividend increase.

The dividend will be paid on June 28 to shareholders of record at the close of business on June 7.

Under the new leadership of Ramon Laguarta, who replaced Indra Nooyi at the helm in October, PepsiCo is increasing spending on marketing and is betting heavily on new product categories such as juices, teas, and sports drinks in order to catch up with consumer tastes, which are rapidly changing towards more healthy alternatives.

Shares in PepsiCo are up nearly 3% over the past 30 days, extending year-to-date gains to as much as 19%.

Pfizer Heads for Turbulence in China After Contract Loss

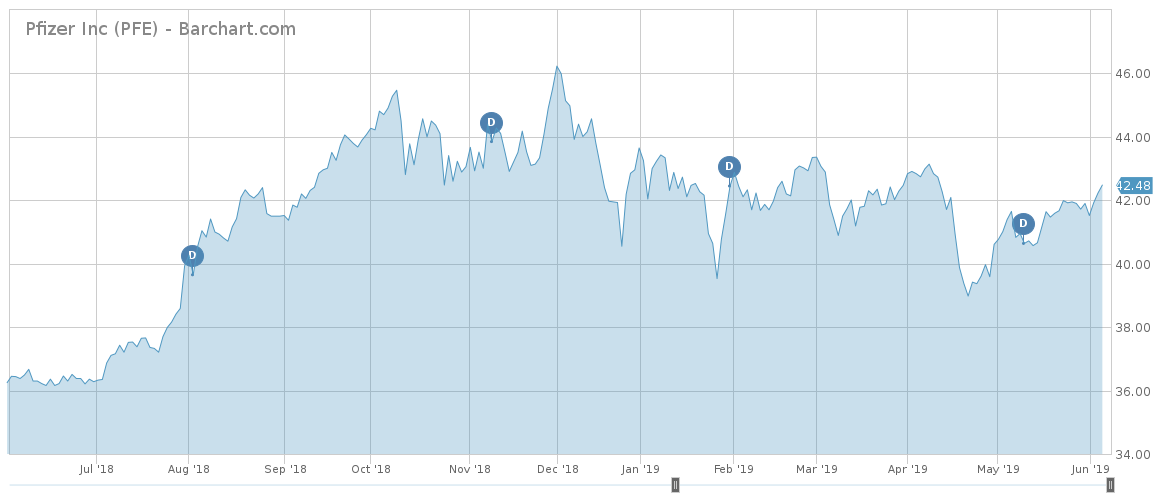

U.S. drugmaker Pfizer (PFE) has seen its viewership rise as much as 25% this week, as the company is preparing for rough times in China, one of its key markets. Pfizer lost a key contract with hospitals in major cities after it was undercut by a local generic drugmaker on price. The company said it expects a slowdown in sales volume but hopes to sell more privately, which still account for two-thirds of all drug sales.

The company recruited 600 employees in new sales staff this year in order to drive growth in the country going forward, as it decreased the price of its key drug, Lipitor. The strategy could work as Chinese consumers are very attracted to brand-name drugs.

Pfizer returns around half of its earnings to shareholders every year, resulting in a dividend yield of 3.4%. The company’s stock has traded sideways since the start of the year, although it remains up nearly 17% over the past 12 months.

Check out our latest list of the Best Dividend Stocks here.

DowDupont

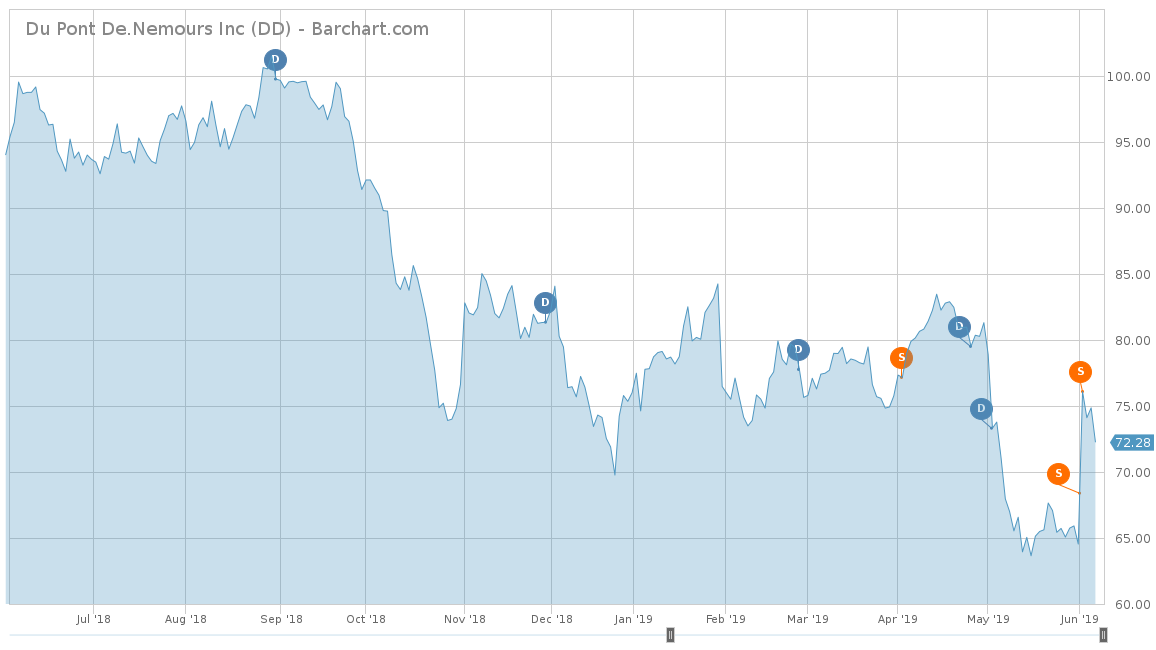

DowDupont (DWDP) is last on the list this week with an advance in traffic of 20%, just as its three-way breakup is nearing its conclusion. The company recently spun out its agricultural unit Corteva from Dupont after finishing its split of commodity chemicals Dow in April. The company recently announced a reverse stock split and changed its name to DuPont de Nemours, Inc. It began trading on NYSE from June 3 under the ticker DD.

The complex combination consisting of a merger between Dow and DuPont and a subsequent three-way separation was pushed by activist investors, including Trian Partners and Third Point Partners. The argument was that three more focused companies would create increased value for shareholders, but the market seems to disagree. Shares in DowDupont have lost around half of their value over the past 12 months.

Meanwhile, Corteva has lost around 3% since it was floated at the end of May. In no small part, Corteva’s issues stem from its Sorona unit, which produces material that is used for the production of textile fibers, as well as floods in the Midwest. Corn planting was difficult, leading to lower demand for its products. Corteva CEO-elect Jim Collins said this year has been “the worst” that he has seen in terms of flooding.

The Bottom Line

Enbridge is most likely to delay the construction of a key pipeline that is designed to ease traffic at the Canadian-American border after a court ruled its impact statement was inadequate. PepsiCo shareholders are preparing to receive their dividend. Pfizer has a plan to avoid turbulent times in China stemming from its loss of a key contract with city hospitals, while DowDupont’s three-way breakup may not have been decided at the best time.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.