Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Investors have been watching closely the earnings of companies with business links to China for a possible indication of the trade war’s effect. Cisco, first in the list and a harbinger of demand for technology products, reported strong earnings recently. Home Depot, third in the list, warned about the potential negative effects of the trade war, while sentiment around 3M continued to deteriorate. Finally, U.K.-based National Grid hit the news on fears it could be nationalized by the Labour Party.

Click here to see our previous edition of trends.

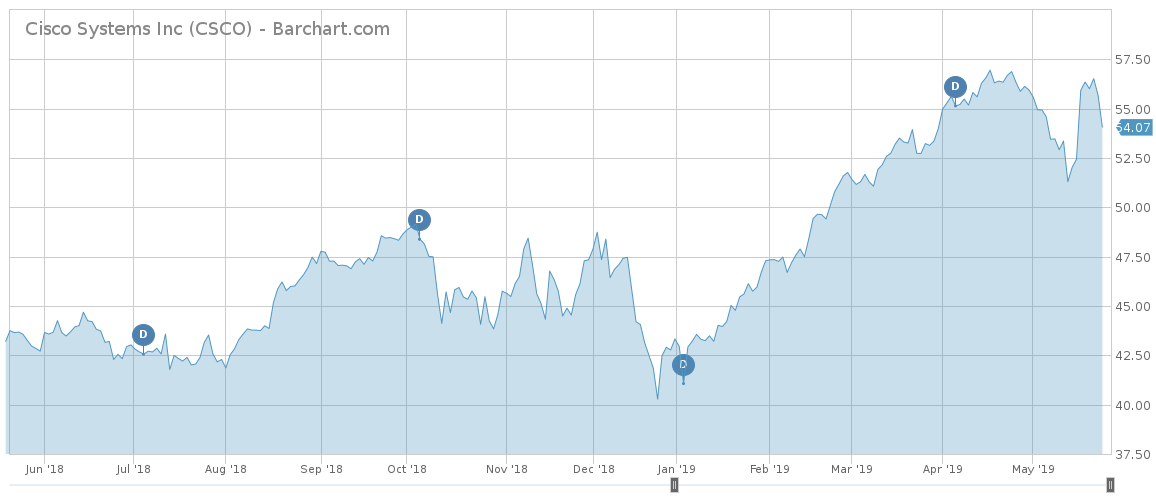

Cisco

Cisco Systems (CSCO ) has seen its viewership rise as much as 55% over the past two weeks, as the company has been watched closely for its earnings, which are often seen as a bellwether for the demand for technology products. With the trade war between the U.S. and China shifting into high gear, observers had anxiously awaited the results. Cisco reported results that largely beat expectations and said it had not felt the negative effects of the tariffs.

In part, the company said it countered the negative effects of higher tariffs with higher prices and the movement of contract manufacturing out of China. The company said it reduced its exposure to Chinese outsource manufacturers in order to minimize the negative impact. For the fiscal third-quarter, the company said its profit grew by 13% to around $3 billion or $0.69 per share. Cisco’s adjusted profit came in at $0.78 per share, up from $0.66 in the same period last year.

Cisco revenues rose 4% in the quarter to $12.96 billion, while its gross margin improved to 63.1% from 62.3% a year earlier. The company’s core business of selling switches grew by 5% to $7.5 billion in sales, while its fast-growing security segment saw revenues advance by 21% to $707 million.

For the current quarter, Cisco expects adjusted profit will increase by 4.5% to 5.5% to $0.80 and $0.82 per share. The company said the guidance accounts for potential damages from higher tariffs. The U.S increased its tariffs on $200 billion of Chinese goods from 10% to 25% last week.

Cisco gives out 50% of its earnings to shareholders via dividends amounting to a yield of 2.51%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

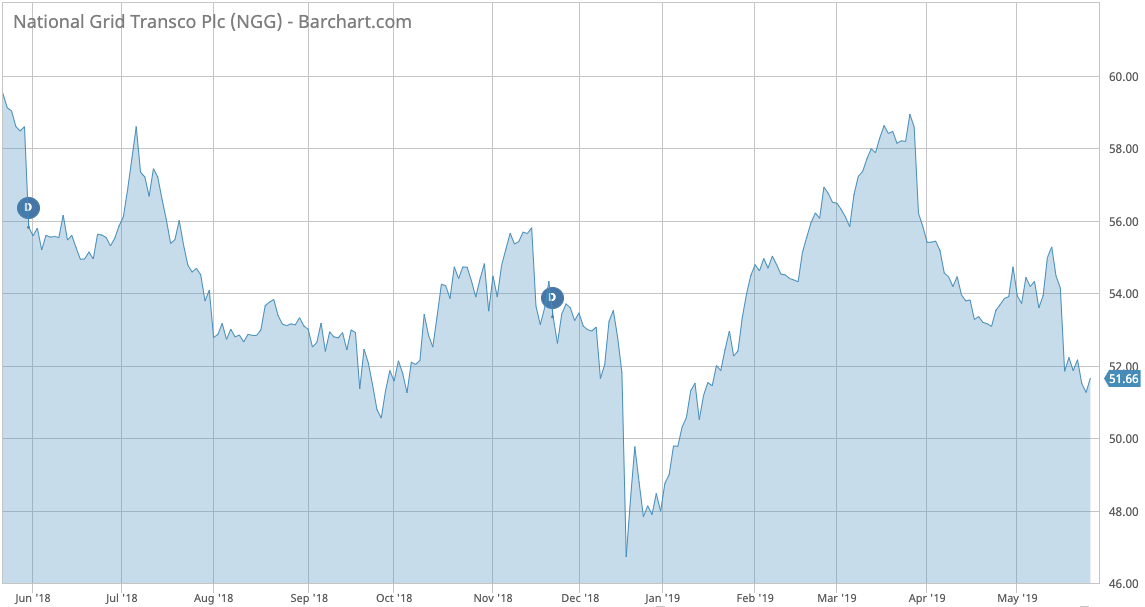

National Grid

U.K.-based National Grid (NGG ) is second in the list with an advance in viewership of 54%. The company that balances demand and supply of energy in the U.K. has been in the news after reporting weak financial results for the fiscal year ended in March, amid fears that a potential future government will privatize the company at below market levels.

National Grid, which has a strong dividend of 7.8% on a payout ratio of 104%, saw its profit fall by a third in 2018 to 1.8 billion pounds due to one-off write-downs related to the connection of two new nuclear power stations. Adjusted profit, which excludes one-time items, dropped 3% to 2.5 billion pounds.

National Grid’s dividend is at risk as the company faces pressure for British utility regulator Ofgem to decrease returns to investors to around 4-5%. The company itself said in its results that a 5.5% return to shareholders would be fair.

Amid disputes with Ofgem, Britain’s Labour Party said it plans to privatize National Grid if it comes to power in the U.K. and said compensation to shareholders should be decided by the Parliament. The Party cited the privatization of Northern Rock, a bank that was teetering on the brink of collapse, as a precedent.

However, National Grid’s CEO said he was prepared to mount a legal challenge if the government decides to take over the company at a price below market value. He noted that the circumstances are different from the company he leads, with National Grid thriving compared with failing Northern Rock.

Home Depot

Home Depot (HD ) has seen its viewership rise 36% over the past two weeks, as the company reported disappointing financial results due to weak demand for lumber and negative effects from the trade war. Shares in Home Depot have declined nearly 7% over the past 30 days, although the stock remains up 12% year-to-date.

Bad weather in the U.S. in February put builders’ construction on halt, causing low demand for lumber, which is a key building component. At the same time, the company said it expects a $1 billion impact from levies on Chinese imports. However, a company executive said the hit was manageable, noting that it represented less than 1% of total annual income. Last fiscal year, the company reported net sales of $108.2 billion.

Still, same-store sales edged up 2.5% in the quarter ended May 5, missing expectations for an increase of 4.5%. Net income, meanwhile, rose $2.51 billion, or $2.27 per share, beating analysts’ expectations of $2.18 per share.

Home Depot’s dividend yields 2.8%, with the company paying out a little more than half of its earnings.

Check out our latest list of the Best Dividend Stocks here.

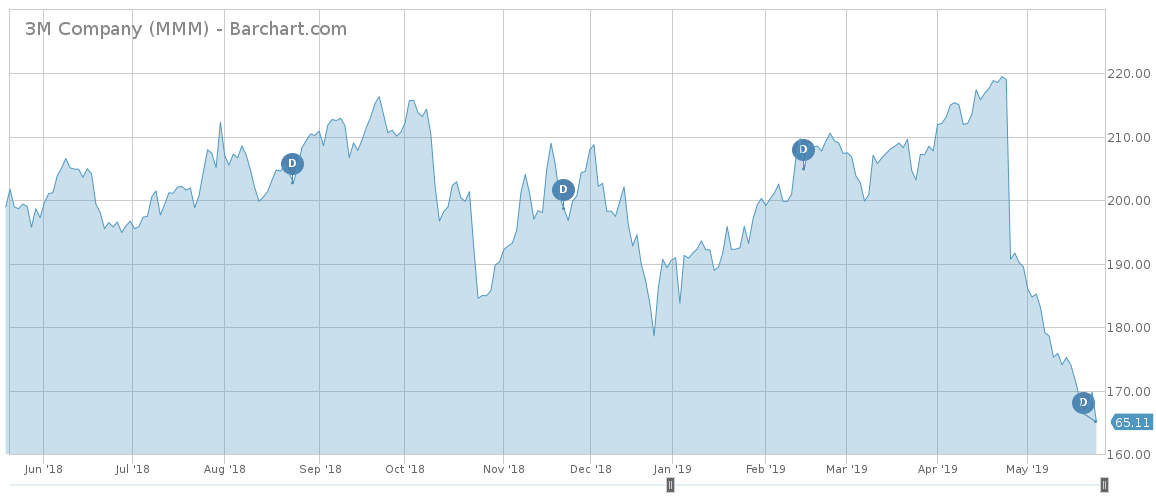

3M

3M (MMM ) has continued its descent over the past weeks, stirring investor attention and leading to a rise in viewership of 28%. The company’s shares have declined 24% over the past 30 days and are now down nearly 13% for the year.

Analysts have been increasingly bearish on the stock and challenged management’s guidance that sales will pick up in the second half of the year, given the headwinds from the China-U.S. trade war and integration costs with Acelity, which was acquired for $6.7 billion.

With the results deteriorating, the company’s dividend may be cut. The dividend yield currently stands at around 3.5% on a payout ratio of 56%. If the dividend is decreased, 3M will end a period of 60 years of dividend increases.

The Bottom Line

Donald Trump’s trade war has taken a toll on some stocks, although most companies have managed to weather the headwinds so far. Cisco took precautions to minimize the impact of a rise in levies on Chinese imports, while Home Depot said less than 1% of its sales were affected. 3M stock’s performance continued to deteriorate as the company faces a number of internal and external challenges, while National Grid is battling with the U.K. government on two fronts.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.