Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The monumental bidding war between Comcast and Twentieth Century Fox for British broadcaster Sky has generated headlines this week. Comcast, the winner of the battle, trended first this week, followed by General Mills, which recently declared its quarterly dividend. J.P.Morgan was third in the list as the legendary American bank is expanding its brick-and-mortar operations despite its rivals beating a retreat. Semiconductor manufacturer Micron Technology closes the list.

Check out our previous edition of trends here where Nike trended after it launched the controversial ad featuring Colin Kaepernick.

Comcast to Acquire Sky

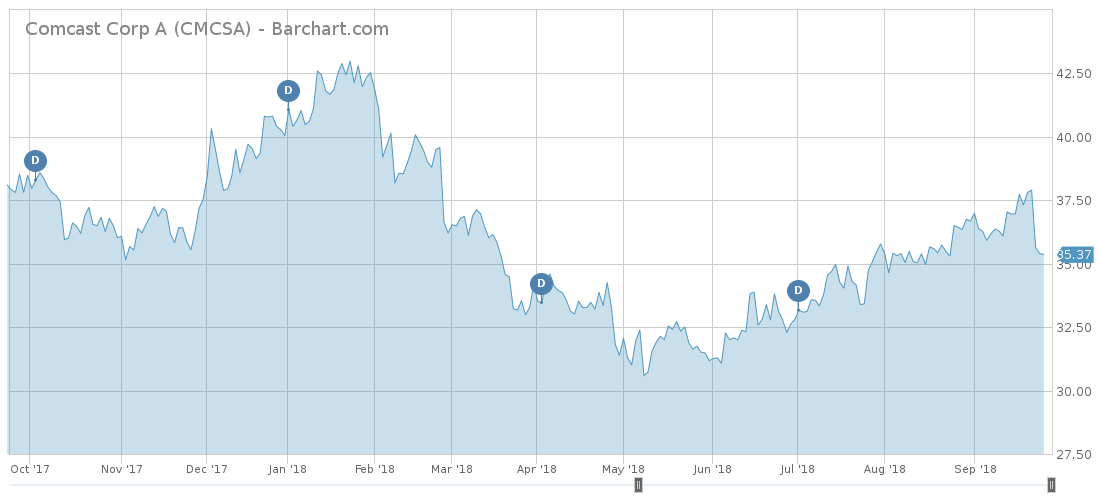

U.S. telecommunications juggernaut Comcast (CMCSA ) has won a bidding war for European broadcaster Sky, in a desperate move to expand its operations amid an ongoing consolidation in the sector. Comcast has seen its viewership rise 30% this week, as the bidding war with Twentieth Century Fox (FOX ) made the headlines of late. Comcast offered as much as 17.28 pounds per share for Sky, which has 27 million paying subscribers across Europe, considerably higher than Fox’s 15.67 pounds per share.

As Fox is being acquired by Disney (DIS ), Comcast’s victory represents a blow to the entertainment company led by Bob Iger. On the other hand, Comcast appeared to have a greater desire to acquire Sky, which currently is 39% owned by Fox.

Comcast shareholders certainly did not celebrate the victory. Shares in Comcast dropped nearly 8% on the announcement Monday, but recovered some of their losses since then and are now down 5.4%.

Comcast, which pays more than a quarter of its profits to shareholders, amounting to an annual dividend of 2.14%, was among the few telecommunication companies that had not participated in an industry consolidation amid growing competition from emerging rivals Netflix (NFLX) and Amazon (AMZN).

In addition to Disney acquiring Sky, AT&T (T ) bought Time Warner recently, while Shari Redstone attempted a merger between majority-controlled companies Viacom (VIAB ) and CBS (CBS ). Such a deal will be put on hold for at least two years, as part of an agreement between Redstone and the CBS board.

General Mills Continues to Disappoint

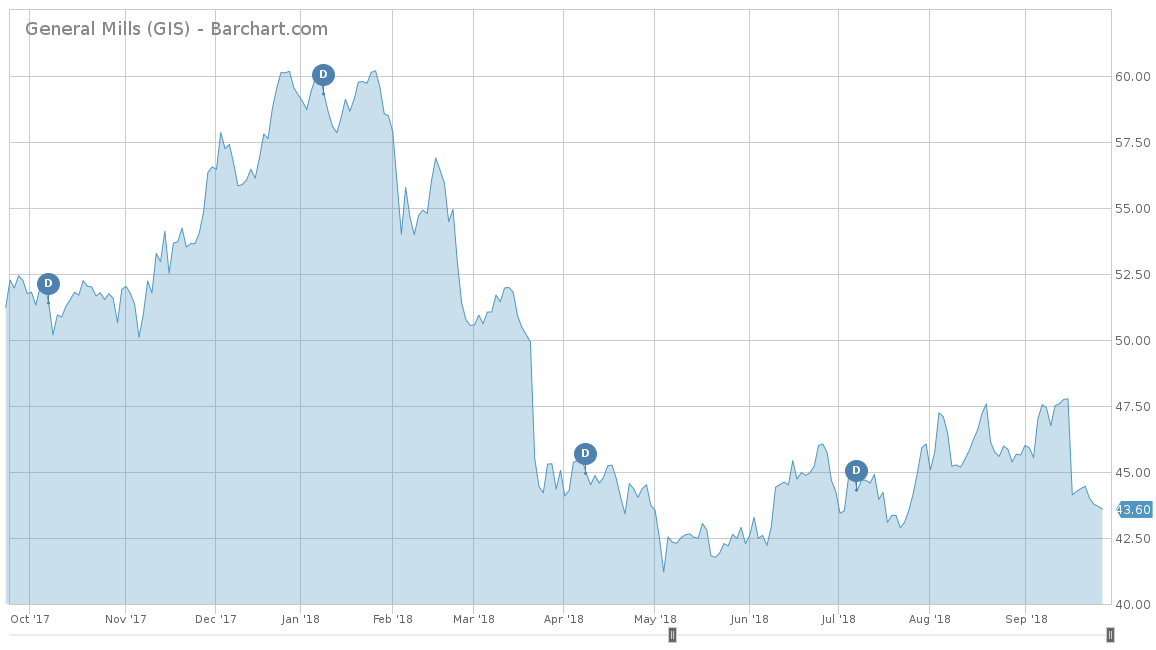

General Mills (GIS ) has seen its viewership rise as much as 138% this week, taking the first spot in the list for all the wrong reasons. General Mills has continued to disappoint investors after its revenues for the latest quarter came in lower than expectations. Shares in the company have declined nearly 5% over the past 30 days, extending 12-month losses to more than 16%.

For the first fiscal quarter of 2019, the company, which produces Cheerios cereal and Yoplait yogurt, said revenues jumped 9% to $4.09 billion, largely driven by acquisitions. Meanwhile, organic growth dropped 1%. Analysts had expected income of $4.12 billion.

General Mills has been desperately searching for growth and splashed $8 billion for Blue Buffalo, a premium pet food brand. As the company faces pressure to increase revenues at Blue Buffalo, CEO Jeff Harmening is defending the pricey acquisition. Harmening compared Blue Buffalo to the 2014 acquisition of Annie’s, saying there are even more growth prospects at the pet food company.

General Mills declared a $0.49 per share quarterly dividend on September 25, payable on November 1 for shareholders of record October 10. General Mills’ current dividend yield is 4.5% and its payout ratio is 64%.

You can keep track of securities initiating or changing their dividend payouts via our dedicated payout change tool here.

J.P.Morgan In Expansion Mode

With a 67% increase in viewership, J.P.Morgan (JPM ) is trending second this week, as investors remain impressed with the bank’s agility and performance.

Indeed, J.P.Morgan’s shares have surged more than 20% in the past 12 months amid a tough environment for global investment banks. Goldman Sachs (GS ) has fallen 2.5% over the same period, while Morgan Stanley (MS ) was largely flat. Meanwhile, SPDR S&P Bank ETF (KBE) is up 8% over the past 12 months.

It is unsurprising then that J.P.Morgan is in expansion mode as others beat the retreat. The company plans to open 50 new brick-and-mortar branches in Philadelphia, Delaware and New Jersey, as part of a plan to open 400 new offices across the U.S. The move comes as other banks are closing down branches in a bid to cut costs amid weak profitability due to low interest rates. J.P.Morgan is using the windfall from lower corporate taxes to expand its retail footprint in regions it considers as growth opportunities.

Explore our money center banks section here to know more about JPM’s competitors.

Micron Technology

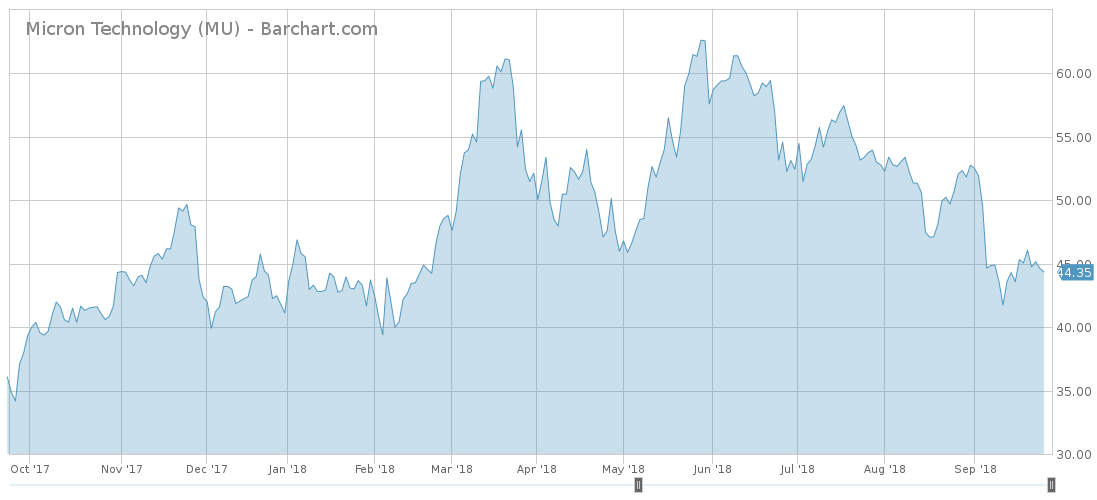

Micron Technology (MU ) has taken the last place in the trends list with an increase in viewership of 29%.

Micron stock has taken a dive after the company tamped down expectations for revenues, as the market of chips is slowing down after years of robust growth. Micron said it expects revenues of between $7.9 billion and $8.3 billion in the first quarter, down from $8.4 in the fourth quarter. Operating profit, meanwhile, is expected to come in at $2.95 per share versus expectations of $3.07.

Sanjay Mehrotra, the company’s CEO, said personal computer companies are reducing production due to microprocessor shortages, resulting in weaker demand for memory chips. In addition, tariffs on chips manufactured in China will hurt profitability.

Check out our Dividend Screener here to explore stocks not only by sectors but also by dividend-specific parameters like dividend yield and dividend payout ratio.

The Bottom Line

Comcast won a bidding war with Fox over European broadcaster Sky, expanding its global presence amid fierce competition with insurgent rivals Netflix and Amazon. General Mills is struggling to increase sales after its pricey acquisition of Blue Buffalo. J.P.Morgan is expanding its retail business as other banks are retreating. Micron is bracing for a potential slowdown in the memory chips market.

Be sure to check our news section for regular updates.