Dividend.com analyzes the search patterns of our visitors each fortnight. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Nike has generated headlines in recent weeks with a bold move to sign football player Colin Kaepernick, a high-profile protester of police violence in the U.S. EPR Properties, a property developer, trended after it recently increased its dividend, while Verizon’s launch of 5G triggered interest. General Motors did it again with yet another recall.

Nike Signs Kaepernick in Controversial Campaign

Legendary sportswear company Nike (NKE ) has trended first in the past two weeks with a 386% rise in viewership. The company has sparked a national debate after naming football player Colin Kaepernick the face of its “Just Do It” advertising campaign.

Kaepernick generated controversy in 2016 after he refused to stand for the U.S. national anthem in protest to police brutality and racism. The move attracted rebuke from the Republican aisle of the country, including U.S. President Donald Trump, but was welcomed by the Democratic-leaning population.

Nike’s choice has stirred backlash for its overly political advertising campaign, with critics calling for a boycott of its products. At the same time, Kaepernick supporters welcomed Nike’s bold campaign. Sales appear to have risen since the ad was launched, with researcher Edison Trends claiming online sales grew by 31% during the last holiday weekend immediately after the launch.

Whether sales will suffer over the long term remains to be seen, but Nike’s controversial ad campaign will likely remain in the history of marketing.

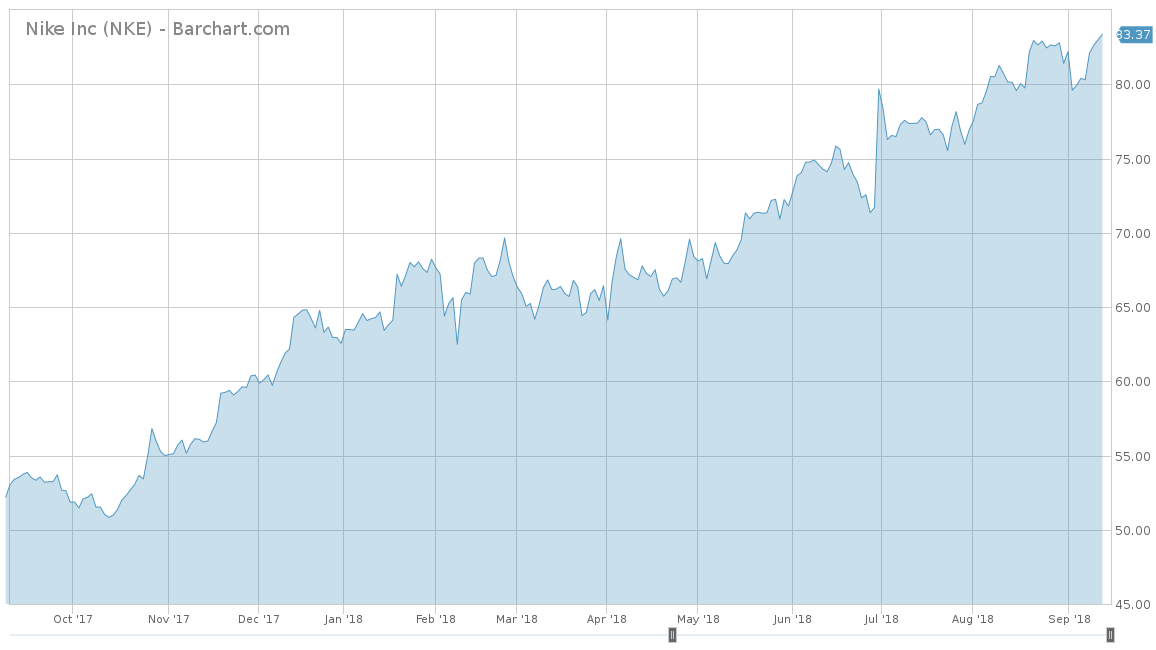

Nike’s stock dropped 2% after the ad was aired but is now up 3.4% as sales numbers came in. Amid a difficult environment for retailers, Nike has performed extremely well. In the past 12 months, the stock jumped by 55%, beating the S&P 500, which advanced just 15%.

Nike pays out 30% of its revenues to shareholders, amounting to an annual dividend yield of around 1%.

EPR Properties Declares Dividend and Stages a Small Recovery

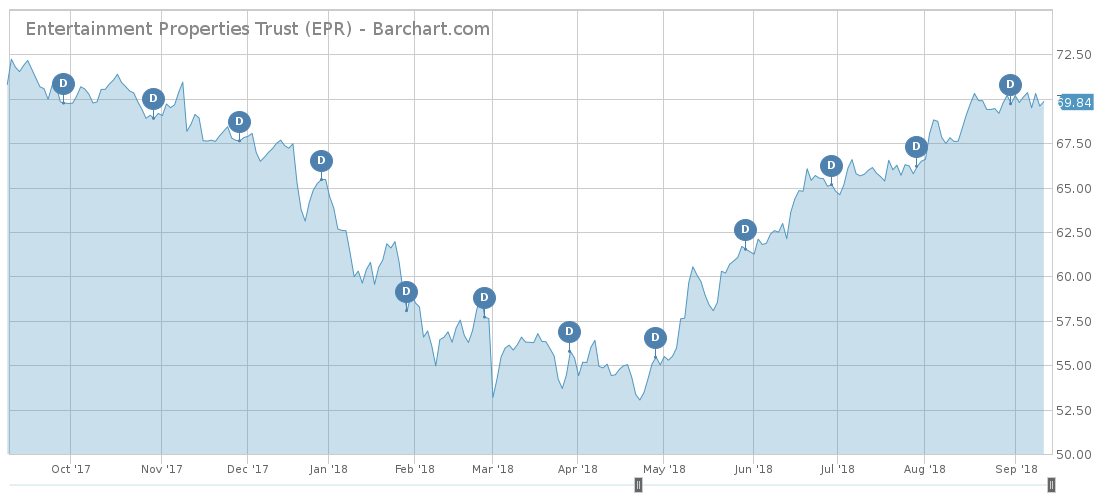

EPR Properties (EPR ), a real estate investment firm managing $6.7 billion in assets, is second in the list, seeing its viewership rise as much as 192% in the past two weeks. EPR recently declared its monthly dividend, giving investors reason to cheer, particularly as the event was accompanied by strong stock price performance.

On an annual basis, EPR increased its dividend by more than 6%. The company’s current annual payout stands at $4.32 and yields 6.15% – double the financial sector average of 3%. EPR has a payout ratio of 72%.

In addition to the dividend payable on September 17, EPR has seen its stock price rise nearly 7% since the start of the year, staging a small recovery after a two-year slump.

EPR has had a tough start of the year because Children’s Learning Adventure, a top-ten tenant, filed for bankruptcy. In addition, fears about falling visitor numbers at movie theaters rocked the company’s entertainment unit, which makes up nearly half of its assets. In July, EPR reached an agreement to renew the lease related to 21 properties rented by Children’s Learning and will continue the renewal if the tenant makes progress toward a restructuring. EPR is also pursuing an alternative plan for the properties, including renting them to a different operator.

Verizon First to Launch 5G

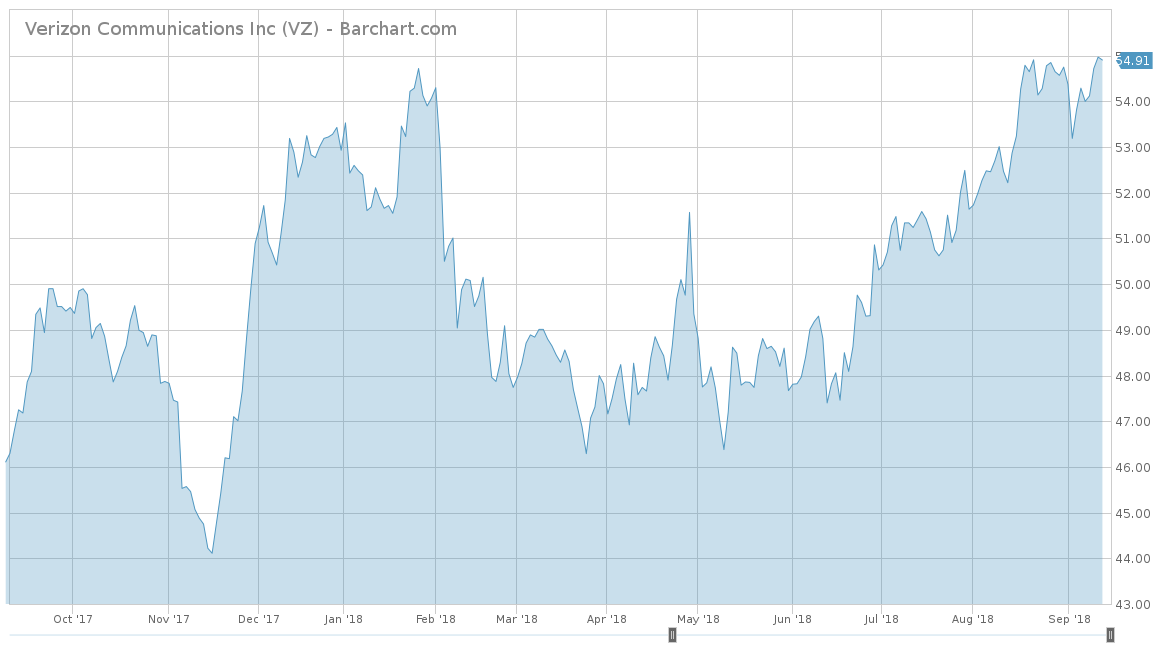

Verizon Communications (VZ ) is the first U.S. telecom company to launch the widely expected 5G technology, seeing viewership rising 22% as a result. In a blog post this week, Verizon said it would roll out 5G to a few cities in October. Residents of Houston, Indianapolis, Los Angeles and Sacramento, among others, can sign up to be the first households getting 5G speeds.

Shares in Verizon were up on the prospect of the 5G launch, with the stock rising 1.2% in the past five days. Year-to-date, the telecom company’s stock is up nearly 4%.

To get to the customers first, Verizon is using nonstandard equipment to roll out 5G, which would be available only to households for $50 per month. The data plans are unlimited and the speeds will be up to 1 gigabit per second, Verizon boasted. Yet the CEO of its arch-nemesis AT&T (T ), Randall Stephenson, casted doubt about Verizon’s move to use nonstandard equipment, saying he is curious how the consumers would react.

Stephenson said Verizon is the first to rollout 5G with nonstandard equipment, but AT&T “will be first with a standards-based 5G service, and it will be mobile.”

General Motors Falls After Brake Recall

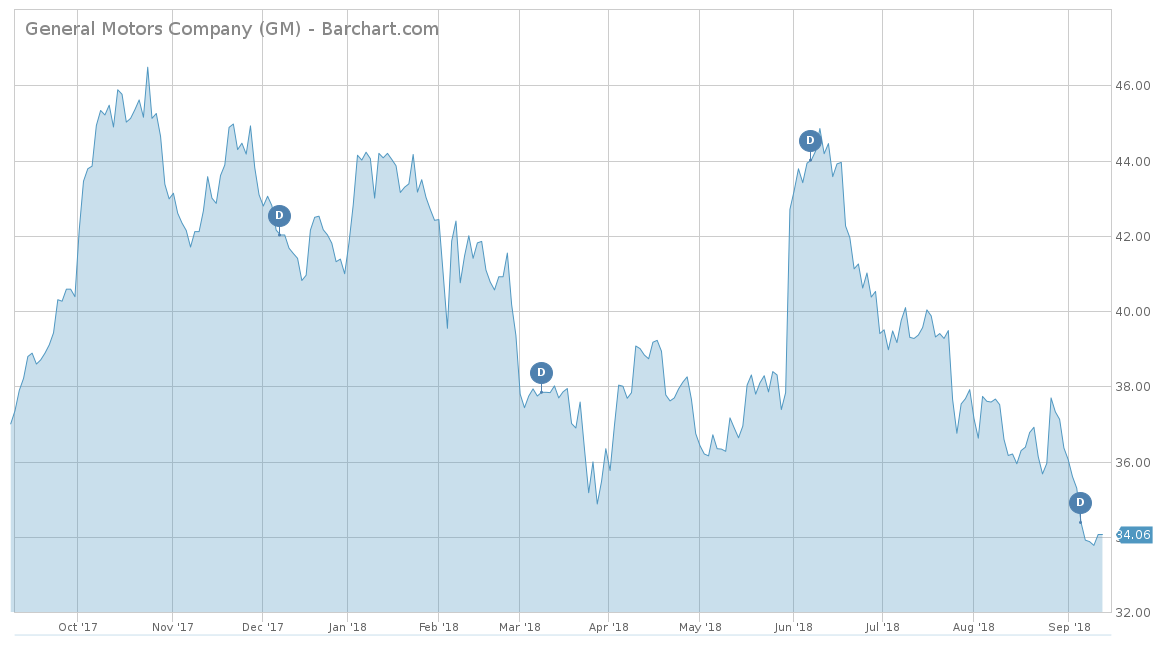

General Motors (GM ) has seen its viewership advance 15% this week, taking the last spot in the trends list. The legendary U.S. car company made headlines for all the wrong reasons, after it issued a recall of more than 200,000 vehicles in the U.S. for faulty brakes. Shares in General Motors have fallen nearly 6% over the past 30 days, extending year-to-date losses to as much as 17%.

The recall impacts a range of 2018 and 2019 models, including Chevrolet Bolt, Cruze, Equinox, Impala, Malibu and Volt as well as Buick Cadillac XTS, LaCrosse and Regal. The news comes fresh on the heels of another major recall made earlier this year.

GM has a payout ratio of 25% and its dividend yields 4.44%.

The Bottom Line

Nike made headlines with a controversial advertising campaign involving football player Colin Kaepernick. Real estate firm EPR Properties maintains its monthly dividend payments, but the company faced a spate of issues related to its tenants’ ability to pay rent. Verizon rushed to be first to launch 5G but AT&T doubted the use of nonstandard equipment. Meanwhile, General Motors issued yet another recall, which negatively impacted the stock price.