Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on merger rumors and earnings. CVS was in the news, thanks to its bid to buy Aetna for $69 Billion. Bank of America announced it will be buying another $5 billion of stock back through June 2018. TD Bank missed earnings, as the stock remains flat. Finally, Disney was rumored to buy parts of 21st Century Fox.

You can view our previous Trends article here, which revolved around Cisco Systems, Home Depot, Wal-Mart and Nike all beating earnings expectations.

CVS Health to Buy Aetna

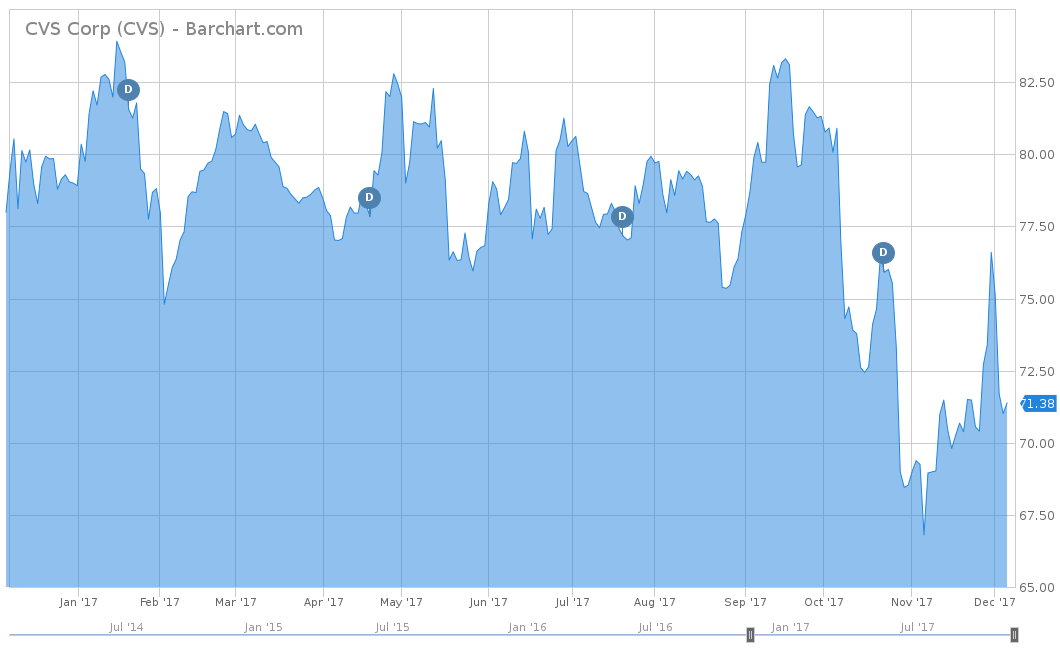

CVS Health Corp (CVS ) was this week’s top-trending topic with an increase in viewership of 108%. The healthcare company was in the news after it announced on Sunday that it would buy Aetna for $69 billion; thereby, combining one of the largest drugstore chains with one of the largest healthcare insurance providers in the country. A combined CVS and Aetna company could position itself as a formidable figure in the changing healthcare landscape. CVS operates pharmacies and retail clinics that could be used by Aetna to provide care directly to patients. The merged company could also be better able to offer employers one-stop shopping of health insurance for their workers.

But critics worry that customers could also find their choices sharply limited. The deal risks leaving patients with less choice of where to get care or fill a prescription if those with Aetna insurance are forced to go to CVS for much of their care.

Over the last five days, the market has not received the news well on the CVS side, with the stock down 2.75%. On a year-to-date basis, the stock has also underperformed and is down 9.54%. However, over the long term, the stock has performed moderately and is up 52.82% for the trailing five years. Even with the merger news, Aetna Inc. (AET) has seen little change and is down 0.37% for the last five days. However, unlike CVS, Aetna is up 44.26% on a year-to-date basis. On a dividend basis, CVS pays a fairly high dividend at 2.8% yield for an annual payout of $2.00 per share. The stock has also showed a history of raising its dividend since 2008.

To view other dividend paying drug store stocks, click here.

Bank of America Issues $5 Billion Stock Buyback

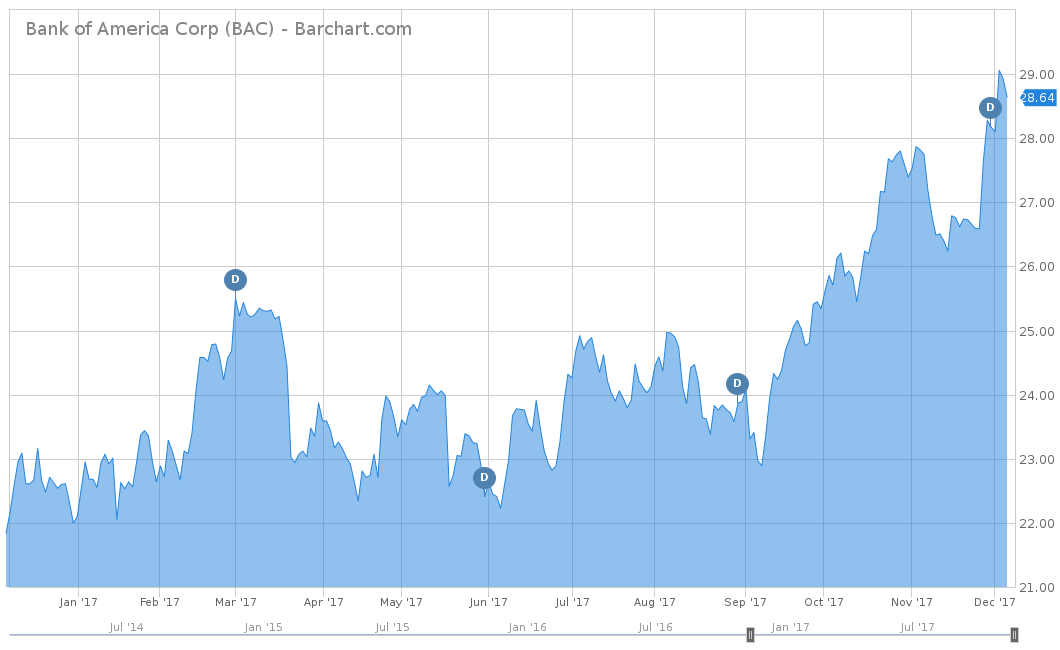

Bank of America Corp. (BAC ) was the second-most trending topic this week, up 87%, after the company’s Board of Directors approved an additional stock repurchase plan of $5 billion. The buyback will occur through June 2018 and is in already addition to a previous $12 billion repurchase plan.

Over the last five days, the stock is up 1.27%. Like most of the major banks, Bank of America has prospered in 2017, and is up 29.59% on a year-to-date basis. The stock is also currently trading near its current 52-week high of $29.31 and is seeing its highest levels since 2008. Over the last five years, the stock has really performed well and is up over 173%. The stock currently yields 1.68% for an annual payout of $0.48 per share. Although struggling during the financial crisis, the company has seen a turnaround, as evidenced by three consecutive years of dividend hikes.

For the best big bank dividend stocks, click here.

TD Bank Misses Earnings

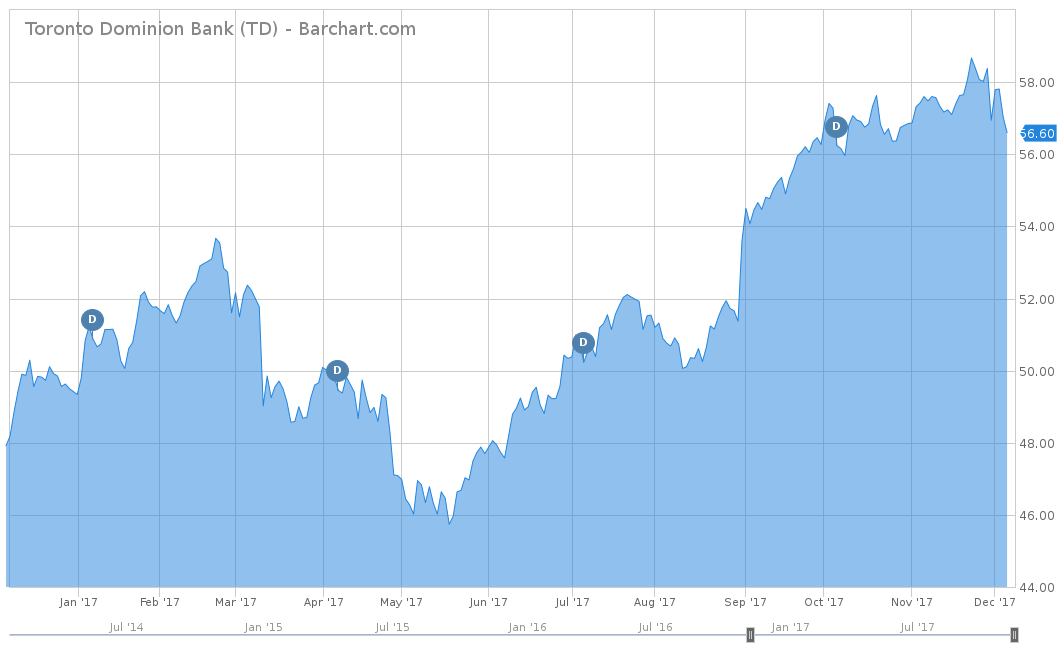

Toronto-Dominion Bank (TD ) was the third-most trending stock this week, up 73% after its earnings announcement last Thursday. The company posted its fourth-quarter earnings at a lower-than-expected result which caused the stock to drop over 3% for the week. Earnings missed expectations and reported at $1.36 per share, versus the expected $1.39 per share. However, TD’s earnings were up significantly from the same time last year, with earnings of $1.22 per share. Management attributes this decline as due to falling revenues in the company’s investment banking division.

Over the last week, the stock is down exactly 3.05% but up 14.71% on a year-to-date basis. Over the long term, the stock has underperformed the S&P 500 and is up only 38.27% for the trailing five years. However, the company is Canadian and has slightly outperformed the S&P/TSX 60 INDEX, which is up 35.76% for the last five years. TD has a fairly high-paying dividend with a 4.24% yield, which is equal to $2.40 per share.

For the best foreign bank stocks that pay a dividend, click here.

Disney Rumored to Buy Parts of Fox

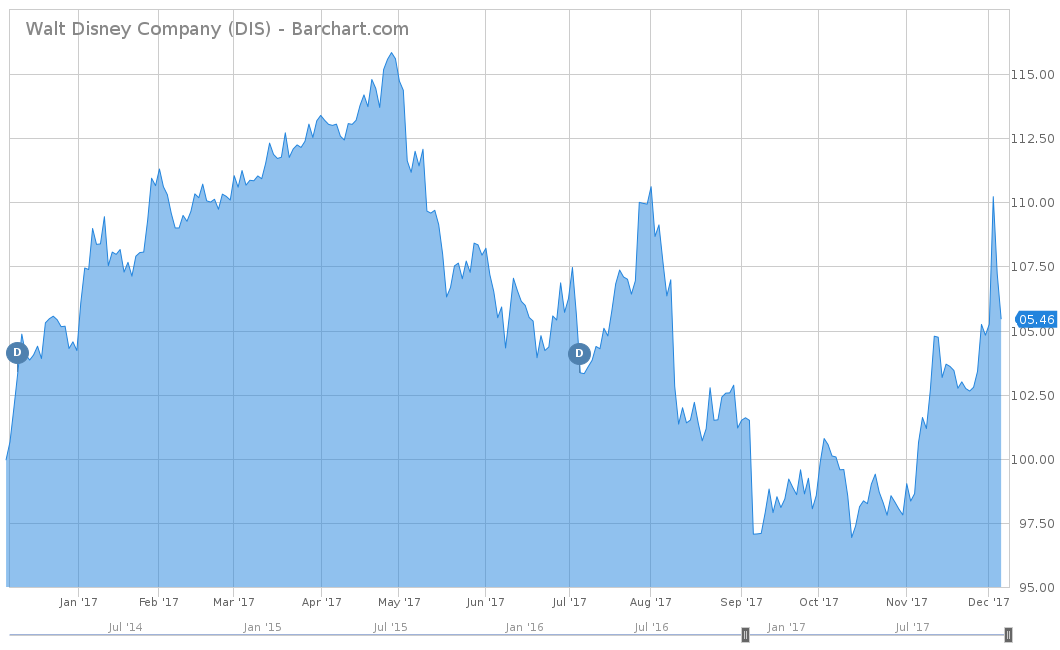

The fourth-most trending topic this week revolves around the entertainment company Walt Disney Company (DIS ), which is up 59% in viewership. The company has been rumored to be trying to acquire parts of 21st Century Fox (FOXA ) for more than $60 billion dollars. There have also been rumblings about Comcast (CMCSA ), which is also looking to make a bid for the broadcast network. Fox is considering selling its TV and movie studios, some international assets, and a few U.S. cable networks. However, Fox News, FS1 and the Fox broadcast network would not be included. Fox’s 30% stake in Hulu is also being discussed as a potential asset for sale.

On Monday, after the news broke, Disney’s stock rallied 4.97% for the day, but is up only 0.21% for the last five days. On a year-to-date basis, the stock is up slightly as well, but only by 1.19%. However, over the last five years, the stock has performed very well and is up 114.96%. Fox, on the other hand, has performed much better. It is up 3.46% for the last five days and is up 18.44% on a year-to-date basis.

Walt Disney currently pays an annual dividend of $1.68 per share, which is equal to a 1.60% yield, whereas FOXA pays an annual dividend of $0.36 at a yield of 1.05%.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this week’s trends were based on acquisition news, like CVS announcing its plan to buy the healthcare provider Aetna. Bank of America announced it will be doing a $5 billion repurchase program through the summer of 2018. TD Bank missed earnings expectations causing the stock to drop over 3% for the week. Finally, Disney, along with Comcast, is rumored to buy parts of Fox.

For more Dividend.com news and analysis, subscribe to our free newsletter.