Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on earnings calls. Cisco System’s stock hit its highest levels in 17 years after beating expectations. Home Depot saw an uptick in sales, thanks to recent hurricanes and wildfires. Wal-Mart stock hit an all-time high after seeing an increase in same-store sales as well as a 50% increase in e-commerce. Finally, Nike’s Board of Directors approved the company’s 11% dividend increase after last quarter’s earnings beat.

You can view our previous Trends article here, which revolved around Starbucks, Apple and Teva seeing big movements in their stock prices after their latest quarterly earnings releases.

Cisco Systems Hits Highest Price in 17 Years

Cisco Systems, Inc. (CSCO ) was this week’s top-trending topic with an increase in viewership by 52%. The stock rallied this week and reached its highest closing price in nearly 17 years. On Wednesday, November 15, Cisco topped Wall Street’s estimates for the third quarter of 2017. These results offered a forecast that would result in the first revenue growth for Cisco in over two years. Earnings reported at $0.61 per share versus estimates at $0.60 per share. Revenue also topped expectations and reported at $12.14 billion versus estimates of $12.11 billion. These higher results were boosted by the company’s growing security business and subscription software.

Over the last five days, Cisco stock is up 7.5% and trading near its 52-week high of $36.97. On a year-to-date basis, the stock is up nearly 21%, and for the last five years, the stock is up a cumulative more than 103%. For a technology stock, Cisco Systems pays a fairly high dividend of $1.16 per share on an annual basis. This equals a current dividend yield of 3.17%, which is by far the highest in the networking and communication devices industry. It is also of significance that in February of this year, Cisco raised its dividend for the sixth consecutive year in a row.

Cisco Systems is a member of the Dow Jones 30. To view a list of the Dow 30 stocks that pay a dividend, click here.

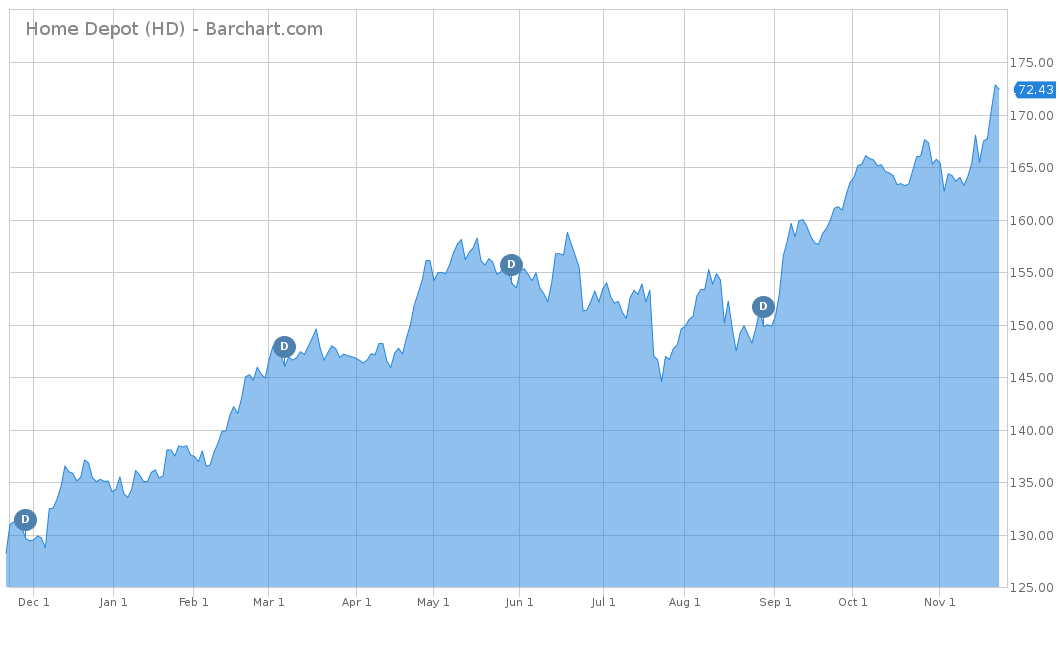

Hurricanes Increase Home Depot’s Sales

Home Depot Inc. (HD ) was the second-most trending topic this week, up 49% after the company had its third-quarter earnings call. On the call, Home Depot’s same-store sales blew past Wall Street’s estimates, thanks to natural disasters like Hurricanes Harvey and Irma and California wildfires. Revenue alone from the hurricanes added nearly $282 million in sales for the third quarter. This led to total third-quarter revenue of $25.03 billion, higher than the estimate of $24.55 billion. Earnings also beat expectations at $1.84 per share, versus $1.82 per share. Based on this quarter’s results, management expects Home Depot to have total sales for 2017 increase by 6.3%, up from a projected 5.3%.

As expected, the stock is up 4.99% over the last five days. On a year-to-date basis, HD stock has outperformed most of the major indices and has gained 28.5%. On a long-term basis, the stock has continued to show a positive trend, with a total gain of over 177% over the trailing five years. Along with price appreciation, HD stock also gives its shareholders a sizeable dividend of $3.56 per year or a 2.07% yield. The stock has also recently showed a pattern of raising its dividend, as it has over the last four years in a row. After the success of the last quarter, expect another dividend hike in Home Depot’s future.

For the Best Home Improvement Dividend Stocks, click here.

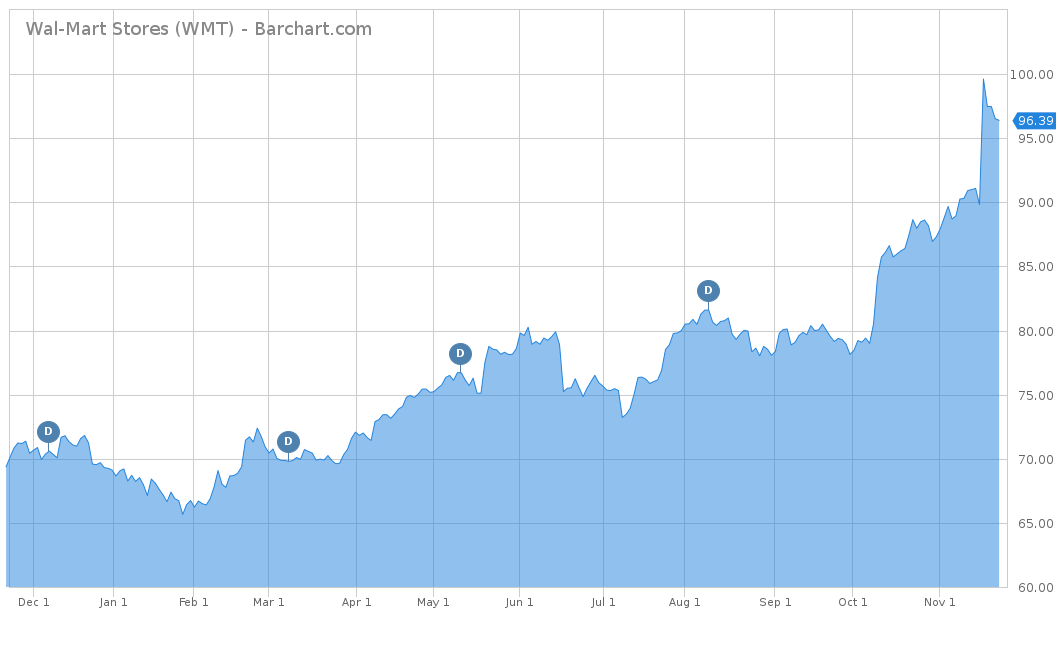

Wal-Mart Crushes Expectations and Hits New All-Time High

Wal-Mart Stores Inc. (WMT ) was the third-most trending stock this week, up 41% after crushing earnings. Wal-Mart’s same-store sales for its U.S. locations climbed for the thirteenth consecutive quarter. The company also saw its e-commerce sales grow by 50% in the fiscal third quarter, after acquiring Jet.com last year. Earnings reported at $1.00 per share, beating expectations of $0.97 per share. WMT also beat revenues, earning $123.18 billion versus an estimate of $121 billion. These outstanding figures caused management to raise its full-year earnings expectations as it heads into the holiday season.

Over the last week, Wal-Mart stock is up 6.05%. After the earnings call, shares jumped nearly 10% to reach an all-time high of $100.13 before settling to its current level in the $96 range. On a year-to-date basis, Wal-Mart has nearly doubled the return of most major indices with a total gain of 39.5%. However, over the last five years, the stock is up only 41.73%, much of which was gained in 2017 alone. Wal-Mart is also known for its consistent dividend, which is currently paying $2.04 per year or a 2.12% yield. Although the company has not raised its dividend in 2017 yet, expect it to follow its trend of raising its dividend for the 43rd consecutive year in a row.

For the best discount variety stores that pay a dividend, click here.

Nike Raises Dividend by 11%

The fourth-most trending topic this week revolves around the athletic apparel maker, Nike Inc. (NKE ) which is up 35% in viewership. The Board of Directors approved a quarterly cash dividend of $0.20 per share, an increase of 11% from the previous quarter’s dividend of $0.18 per share. This hike would mark the 9th consecutive year of dividend increases for Nike. This dividend increase stemmed from the successful third-quarter earnings Nike posted last month, especially thanks to its strong sales growth from China.

Investors approved of the dividend hike as well, as the stock is up 4.13% for the past week and up 16.01% on a year-to-date basis. Nike has also performed well over the longer term, up over 154% for the trailing five years. Nike’s dividend is currently paying an annual amount of $0.80 per share to equal a current yield of 1.35%.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

All the trends this week were based on earnings calls, causing most of the stocks to trade near new highs. Cisco Systems saw this week’s biggest increase in viewership after the company announced better-than-expected earnings, causing the stock to hit a 17-year high. After Hurricanes Harvey and Irma and the California wildfires, Home Depot saw an increase in sales. Wal-Mart continues to see success with its Jet.com acquisition, which helped drive up e-commerce sales by 50%. Finally, Nike raised its dividend for the 9th consecutive year in a row after seeing sales growth from China.

For more Dividend.com news and analysis, subscribe to our free newsletter.