Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on earnings calls. Starbucks stock initially fell after it missed revenue expectations but bounced back. QUALCOMM was in the news thanks to a $105 billion buyout offer from Broadcom. Apple continues to beat earnings with the recent success of the new iPhones. Finally, Teva Pharmaceuticals again missed earnings, causing the stock to continue its decline to over 67% YTD.

You can view our previous Trends article here, which revolved around earnings beat by Blackstone and IBM, while GE stock tumbled after missing earnings estimates by a significant margin.

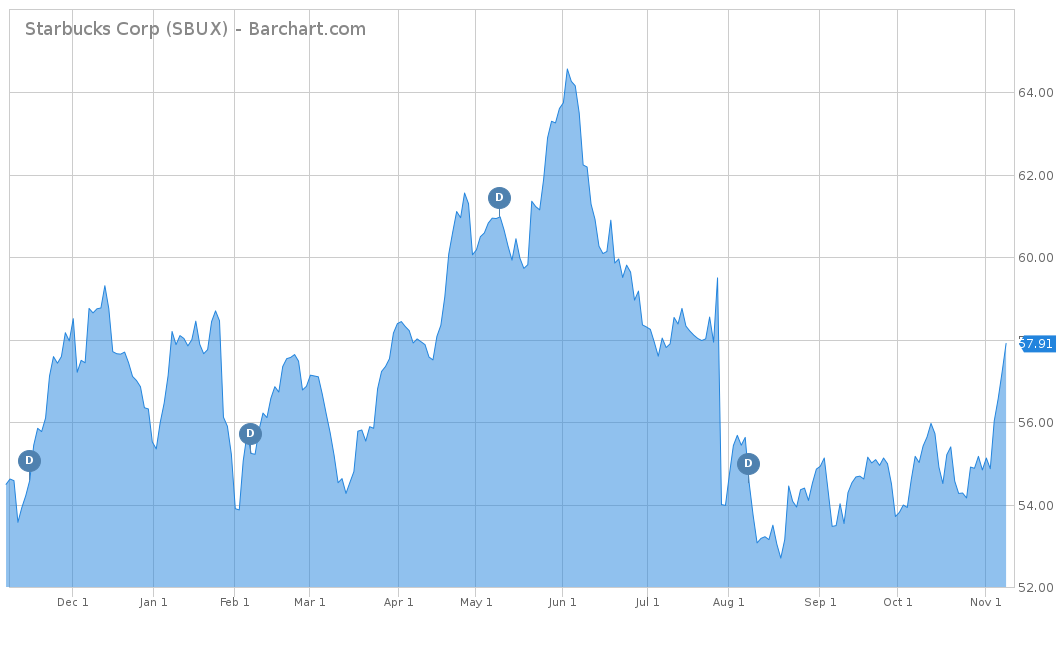

Starbucks Bounces Back After Revenue Miss

Starbucks Corporation (SBUX ) was this week’s top trending topic with an increase in viewership of 95%. The coffee giant posted earnings of $0.55 per share on $5.66 billion in revenues for the third quarter. Earnings came in as expected but revenues were off the $5.81 billion expectation. The company expressed that the revenue drag came from lower-than-expected results from the Frappuccino beverages as well as the Teavana mall stores. In fact, the company announced that it will close all 379 Teavana locations by spring 2018.

After the news hit, the stock was down nearly 6%. However, in the last week, the stock has rebounded immensely and is now up 5.52%. The company has been very sluggish on a year-to-date basis, up only 4.3% compared to the S&P 500, which is up over 15% during the same time. For the longer term, Starbucks has outperformed the S&P 500, with a return of 127.8% versus the S&P’s 83.4% over the trailing five years. From a dividend perspective, Starbucks is in line with its peer group, with a current yield of 2.08%. Starbucks has done well for its shareholders over the last six years by raising its dividend consecutively to its current payout of $1.20 per share.

To view a list of the top specialty eateries dividend stocks, click here.

Broadcom Offers $105 Billion for QUALCOMM

QUALCOMM, Inc. (QCOM ) was the second-most trending topic this week, up 89% after Broadcom offered $105 billion deal to buy the company. This would equal $70 per share in a cash and stock purchase to own QUALCOMM and make Broadcom the third-largest chipmaker. This caused the stock to skyrocket after the announcement as even if QUALCOMM decided to decline the offer, analysts believe the stock price should be valued at the $70 mark. In the week prior, QUALCOMM also announced its fourth-quarter earnings and that it beat on both earnings and revenue expectations.

In the last five days, QCOM is up 22.5%, which was mostly attributed to the 12.7% gain on Friday, November 3 after the announcement. However, on a year-to-date basis, the stock finally broke into the positive and is up only 0.44%. The company has also been sluggish over the long term, up 10.44% for the trailing five years. However, QCOM has been popular with income investors because of its consistent and higher-than-average dividend for a technology company. Currently, QCOM yields 3.51% for an annual payout of $2.28 per share. Even though the stock has only seen recent movement, the company has raised its dividend every year since 2011.

For the best communication equipment dividend stocks, click here.

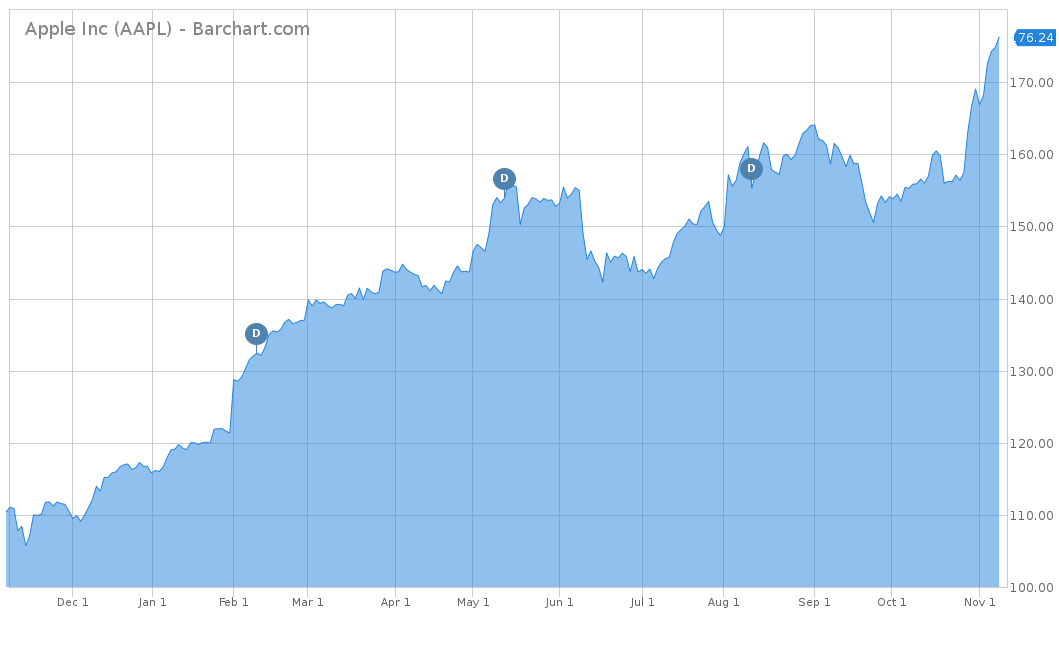

Apple Surpasses the $900 Billion Market-Cap Mark

The largest company in the world, Apple Inc. (AAPL ), was the third-most trending stock this week, up 84%. Apple reported its fourth-quarter earnings last Thursday, beating expectations across the board in a big fashion. On an earnings-per-share basis, Apple beat estimates of $1.87 and reported at $2.07. Revenues came in higher as well at $52.6 billion versus $50.9 billion estimated. The iPhone unit sales in the fourth quarter also came in higher, at 46.7 million versus 46 million expected. These were all attributed to the newly released iPhone 8 and iPhone 8 Plus models instantly becoming the top two selling products in the company. The company also raised its future guidance with the expectation that the newly released iPhone X will help the company grow even more. With the news of this earnings beat, the stock continued to rise enough on Wednesday to give the company a market capitalization of $904 billion.

Apple stock is one of the most heavily traded and owned stocks in the world. Over the last week, Apple is up 8.09% and up over 52% on a year-to-date basis. Apple also has one of the best-performing stocks over the long term, up 113% for the trailing five years. One feature that differentiates Apple from most of its technology competitors is that the company began paying a dividend in 2013. Since then, it has raised its dividend every year and now currently yields 1.43%, or $2.52 per share on an annual basis. If Apple’s management prediction on its new iPhone X is correct, expect the company to pass the $1 trillion market cap threshold in the near future.

Apple Inc. is the largest company in the Dow Jones Industrial Average. To view a list of the Dow 30 stocks that pay a dividend, click here.

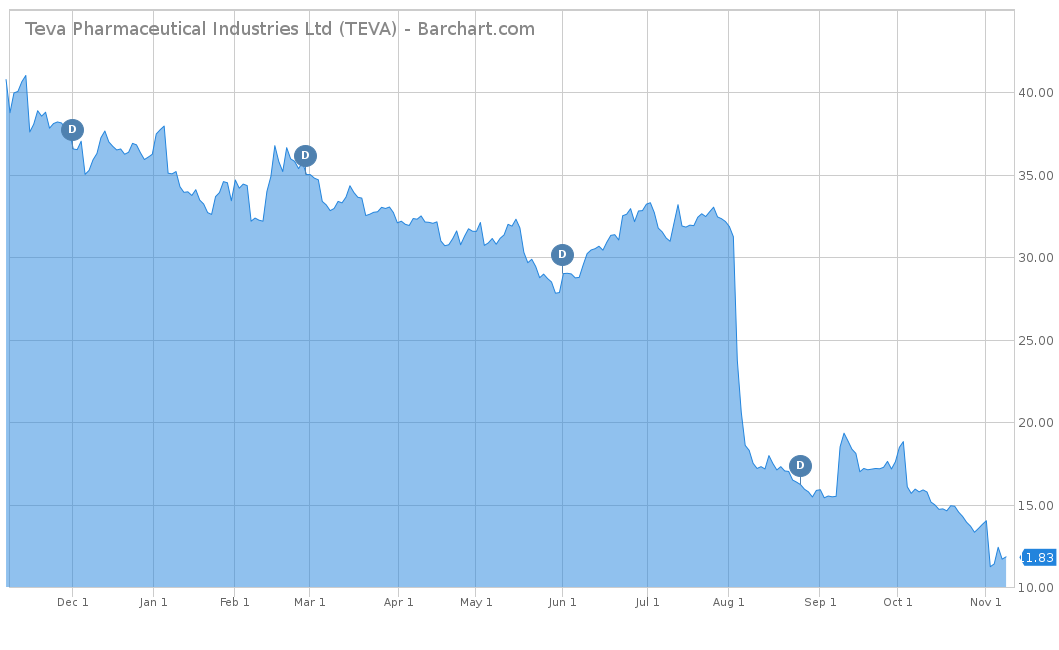

Teva Continues to Plummet After Earnings Miss

The fourth-most trending topic this week revolves around Teva Pharmaceutical Industries Ltd (ADR) (TEVA), up 66% in viewership. Teva, the world’s biggest generic drug maker, announced its Q3 earnings last Thursday. It reported EPS of $1.00 missed $1.05 estimated by Zacks. However, the company managed to meet revenue expectations by reporting $5.6 billion in quarterly revenues. The cause of worry revolves around profit from the generic drugs unit, which fell from $982 million in the year prior to $619 million this year. This was caused by lower-than-expected sales of generic launches in the United States as well as a decline of 7% in sales of its MS drug Copaxone. After the call, management cut its forward EPS guidance from $4.30-4.50 to $3.77-3.87.

Since the call and the earnings revision, the stock has been in freefall, declining 18% the next day. Over the last five days, TEVA is slightly recovered but still down 11.19%. This is only furthering the bad year the stock is already having, being down now 67.37% on a year-to-date basis. The stock has a relatively high-paying dividend, especially for a pharmaceutical company. It is currently yielding 2.43% for an annual payout of $0.29 per share. However, the company has not had a recent dividend hike, and don’t expect it to going forward given the company’s negative forecast.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

All the trends this week were based on earnings calls, with three-out-of-the-four companies seeing success. Starbucks missed earnings estimates and is forced to close its Teavana stores, yet the stock is up nearly 6% for the week. QUALCOMM skyrockets over 22% in the last five days, after Broadcom offers a buyout. Apple surpasses the $900 billion market-capitalization mark this week after the stock grew over 8% after its earnings call. Finally, Teva continues its freefall after it failed to meet earnings estimates last quarter.

For more Dividend.com news and analysis, subscribe to our free newsletter.