Honeywell (HON ) is a Fortune 100 diversified technology and manufacturing company that operates in several segments like aerospace, home and building technologies, performance materials, safety and productivity solutions. This makes it one of the best diversified businesses in the world.

IMF published its guidance in Dec. 2016 and they expect advanced economies to grow by a sluggish 1.8% in 2017, which is lower than expectations laid down in April 2016. Even though the U.S. seems to have rebounded in some ways after a weak start to 2016, output in the Eurozone remains below potential. Given the mixed economic outlook and oversupply hangover from 2016, would a company that manufactures and sells to many industries be a prudent choice for an investment?

Why Diversification Pays

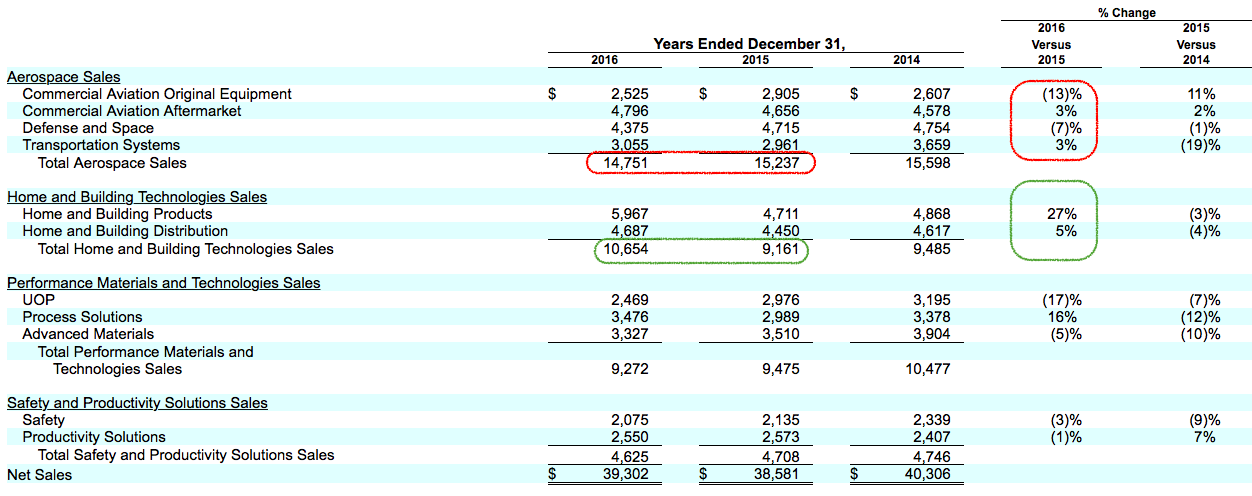

Before getting back to the company’s ability to maneuver the business environment, let’s look at its sources of revenue. Honeywell is a case in point of how a diversified and well-managed company can circumvent challenges in one segment with growth in another.

In the aerospace sector (the biggest contributor to Honeywell’s topline at 37%), the company competes with the likes of Garmin (GRMN ), GE (GE ) & Rockwell Collins (COL). For this sector, Honeywell has been under pressure due to higher incentives provided to original equipment manufacturers, leading to a decline in the company’s organic sales in the last couple of years. Honeywell Home and Building Technologies (the second-largest contributor to the topline at 27%) – which competes with the likes of Emerson Electric (EMR ), Schneider Electric and Siemens – has made up for the losses via organic sales and acquisitions.

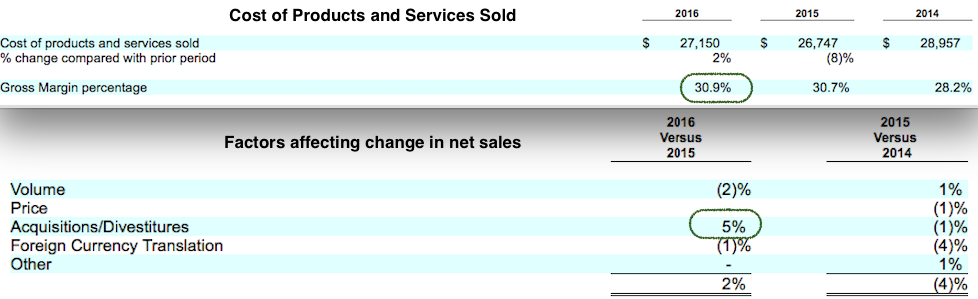

Positive movement in the topline in 2016 after a dismal performance in 2015 was primarily attributable to strategic acquisition-related decisions. Consider this: Honeywell has been disciplined in its acquisitions spending $2.5 billion distributed in each of its operating segments, which has had a significant impact on increasing net sales by 2% in 2016. Higher margins in the Performance Materials and Technologies segment (approximately 0.6 percentage point impact) has helped the company offset the drag from other segments (approximately 0.7 percentage point impact).

In short, cost management measures and diversified growth have helped Honeywell increase overall gross margins despite an increase in the cost of goods, products sold and administrative expenses.

The Future of Honeywell

Honeywell has spent 5% of its sales on R&D, which is at par with the cross-industry average in North America. The company is also looking to realign its business segments to focus on growth sectors and regions (over $300 million of new repositioning investments in high-growth regions).

As of 2016, Honeywell is well diversified regarding its R&D, manufacturing and operations outside of the U.S. U.S. exports currently comprise 13% of total sales and non-U.S. manufactured products and services (mainly in Europe and Asia) contribute 43% of revenue. As with any company heavily involved in manufacturing, inflation affecting raw material prices will put pressure on margins and a weak price environment (as it currently has) will exert pressure on its topline numbers. As compared to its peers, Honeywell has managed to maneuver around these business challenges in a better way. At Aircraft Interiors Expo 2017, Honeywell showcased aircraft innovation that will unlock critical data like weather information, engine usage, maintenance reporting, etc., which will save the cost of maintenance, delays and improve fuel efficiency. Honeywell has also come to focus on software and now has well over 10,000 engineers working for that division. Late in 2016, Honeywell was exploring the option to acquire JDA Software, a well-established supply chain technology firm.

You can get an overview of major dividend-paying stocks, including Honeywell, in the Industrial Goods Space here.

After a leadership transition in all of its operating segments, there is an upcoming change for the top job as CEO David Cote is expected to retire in 2017 after 15 years of smooth leadership. He took over when the company had gone through several years of transition – from the merger with AlliedSignal and Pittway to the stressful takeover bid by GE in early 2000s – which led to a tussle between the Department of Justice and the European Commission. At the time, GE had bid for a $21 billion takeover and Honeywell is now valued as five times bigger at close to $100 billion (and GE is valued over $240 billion). Under Cote, the company has made more than a 100 acquisitions and divestitures.

As the company sails into the future, investors will closely monitor the performance of the incoming new top management. Honeywell announced plans in 2014 to spend $10 billion in acquisitions by 2018, which will be key for the company to make synergistic additions to their business and find new growth areas.

Honeywell as an Investment

Honeywell has been paying dividends for more than 20 years, but has been growing its dividends almost every year, barring a few patches of stagnation. The company’s current yield stands at around 2% and has been on a growth cycle recently, with an annualized rate of 12% in the last five years. The current payout ratio of just under 38% is comfortable, and the company has done well to increase its free cash flow from $2.63 billion in 2012 to $4.4 billion in 2016. These are positive signs for dividend-seeking investors.

Check out the dividend history of Honeywell here.

Even though the revenue has stagnated around $39-40 billion since 2013, Honeywell has managed to increase its net income from $3.9 billion to $4.81 billion in the last four years. As a result, earnings per share (diluted) has increased from 4.92 in 2013 to 6.20 in 2016. This is partly due to minor reductions in shares outstanding from 784 million to 764 million (repurchased 19.3 million shares for $2.1 billion in 2016) in the last three years, but it has largely been a function of good business and cost management.

Use our Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

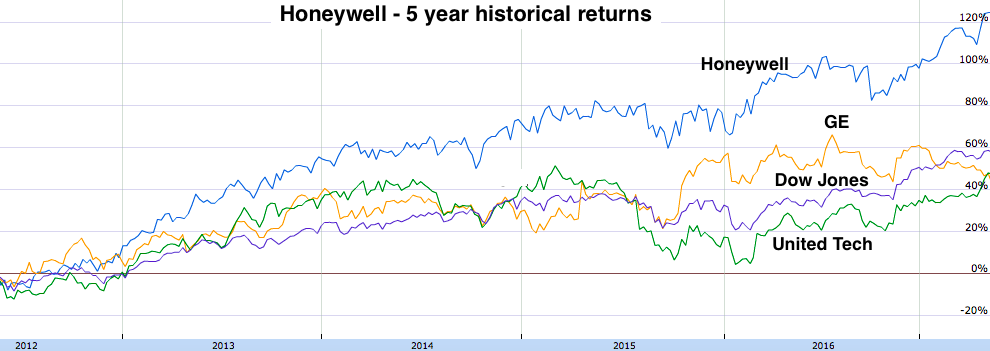

Investors have rewarded Honeywell with handsome returns based on its exceptional corporate performance. The stock has appreciated 124% in the last five years and that is substantially ahead of Dow Jones’s 58%. Among its peers, GE has managed to appreciate 43% and United Tech (UTX ) has returned 47%. Honeywell’s current P/E ratio is at par with the Dow Jones industrial, lower than GE and higher than United Technologies.

The Bottom Line

Honeywell has proven management who knows how to navigate through difficult business environments. It has delivered consistent results in the last few years where its peers have lagged behind. The company is on an upward trend for dividend payouts and has enough cash flow to continue paying them in the near future. At its current valuation, Honeywell – like a lot of good companies at this time – is competitive but not cheap.

Stay up to date with next week’s significant corporate changes regarding dividends in our News section on Dividend.com. Start your free trial to Dividend.com Premium account here.