Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week investors have been preoccupied with the health of the banking sector, as Britain’s referendum on staying in the European Union revealed new potential risks plaguing the fragile industry, which is still recovering from the 2008 financial crisis. Three U.S. banks are present in the list this week – JPMorgan Chase (JPM ), Bank of America (BAC ) and Wells Fargo (WFC ) – all of which were pummeled following the results of the referendum.

JPMorgan Chase

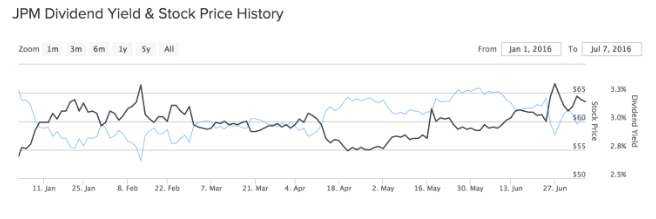

JPMorgan Chase has seen its traffic rise as much as 61% this week compared to last, taking first spot in our list. The bank, together with other financial institutions based in the U.S., have been the most resilient among their global peers, shielded by a relatively buoyant environment at home. JPMorgan’s shares have dropped 5.42% since the Brexit vote, extending year-to-date losses to 8.25%.

JPMorgan is expected to suffer from Britain’s exit from the European Union. Like almost all banks based in the city, it has the so-called ‘passport,’ giving it the right to serve clients across Europe. If Britain leaves the EU and does not strike a deal allowing its banks to keep their ‘passporting’ rights, JPMorgan will have to move part of its operations elsewhere inside the trading bloc. CEO Jamie Dimon said before the vote that the bank will probably have to move some of its operations outside of Britain.

However, these worries are not immediate. What has probably hit the stock most in the short term is the market volatility and investors’ expectations that the Federal Reserve will not raise interest rates any time soon as a result of the Brexit debacle. The company is expected to release its earnings for the second quarter on July 14, and analysts forecast net income to come in slightly lower compared to the same period last year. Whatever the financial results, the company will keep paying a hefty dividend of $1.92 per share annually, and may increase it soon if history is any guide. The bank has been steadily raising its payout to shareholders since 2011.

Bank of America

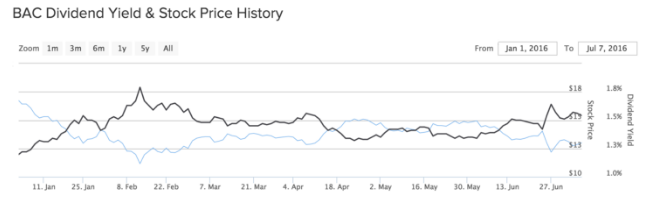

Traffic to Bank of America has grown 47% compared to the same period last week. The bank’s exposure to Britain is high, so it is no surprise that its stock has been battered following the vote. The shares have fallen 7.34% since June 23, extending losses since the start of the year to as much as 22.70%.

The company currently pays a quarterly dividend of $0.05 per share, representing an annual yield of 1.54%. But the company recently announced plans to increase its payout to shareholders by 50% to $0.075, after the Federal Reserve unconditionally approved its capital return plan following the successful passing of the stress test. In addition to hiking its dividend starting in the third quarter, the company will buy back $5 billion worth of shares as part of the $8 billion capital return plan.

Cisco Systems

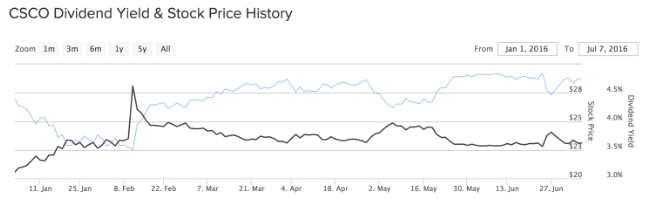

Cisco Systems (CSCO ) looks like a surprise component in our financials-heavy list. Except for a recent relatively small acquisition, the company has not hit the headlines. But perhaps its increased dividend attracted viewers. Cisco has seen its viewership rise 29% this past week compared to the week-ago period. The firm’s shares have steadily risen since the beginning of the year about 6%. In addition, it has steadily raised its dividend from a quarterly $0.06 per share in 2011 to $0.26 now.

Cisco recently announced the acquisition of cloud security start-up CloudLock for $293 million, in a bid to increase its presence in the growing cloud industry. Its revenues from security services currently represent just 4% of the total, but have been rising at a fast pace. For example, in the most recent quarter revenues from the security division rose 17%.

Wells Fargo

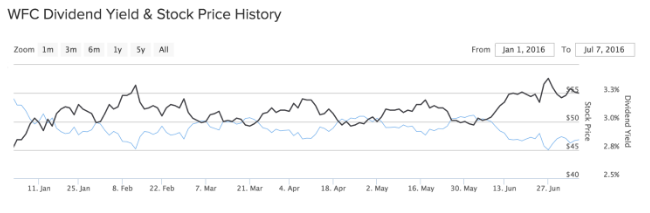

Wells Fargo has seen its traffic jump 24% this past week compared to the week-ago period, as the company has largely dodged the Brexit bullet. The bank’s shares have fallen just 2.34% since June 23, less than its more Britain-exposed American peers.

The company has a much smaller exposure to Britain’s economy and Europe’s. However, it is negatively affected indirectly through a stronger dollar and expectations of lower interest rates for longer. Year-to-date the stock is down 12.69%.

The Bottom Line

JPMorgan Chase has topped the weekly list together with Bank of America. Both banks have significant exposure to the Brexit fallout and their shares have dropped since Britain decided to leave the European Union. Meanwhile, Wells Fargo, another U.S. giant banking firm, has suffered less from Brexit on the back of its relative small exposure to Europe. And Cisco Systems attracted viewers this week for less obvious reasons.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.