Each week Dividend.com analyzes the search patterns of our visitors. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week has been marked by an increased interest in the energy market with Valero Energy (VLO ) and the Alerian MLP ETF (AMLP) taking the first two spots on our list. The aerospace and defense sector’s outperformance has also attracted visitors, and Disney’s (DIS ) bittersweet earnings results and its far from certain future have also made the headlines.

Valero Energy: The Last to Fall

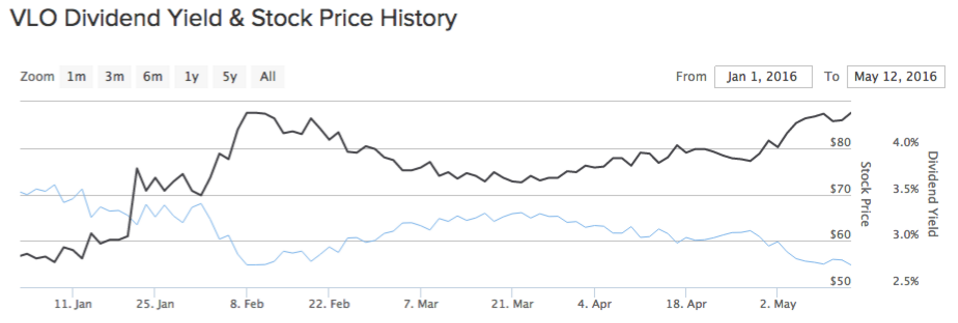

Our Valero Energy page has seen viewership rise exactly 100% in the past week as the global crude refiner was hit by a weak earnings report on May 3. However, despite announcing that net income halved compared to the same period last year, the company confirmed its healthy dividend on Thursday. Valero has been steadily increasing its payout to shareholders over the past five years, with the most recent hike announced in February. It raised its quarterly dividend from 50 cents to 60 cents. The increase came despite headwinds from weak oil prices. However, in all fairness, the company has largely weathered the storm with its stock falling just 7% over the past twelve months. Year-to-date figures are less encouraging though, given that shares are down 22%.

The company’s performance has disappointed lately, but that was mainly because of lower margins on many of its products. As a refiner, Valero is not exposed directly to oil prices but to the spread between crude oil and its derivatives, such as gasoline. In the past quarter, for example, the company estimated that lower gasoline margins removed about $120 million from its income figures, while a decrease in the distillate margins negatively impacted results by $870 million.

The spreads have begun to recover along with oil prices from two-year lows hit at the beginning of this year. For example, Gulf Coast Crack Spread Futures have nearly doubled since January. Thus, the results for the next quarter could be much better, particularly if spreads continue their upward trend.

Alerian MLP ETF: Lower Yield Is “Good”

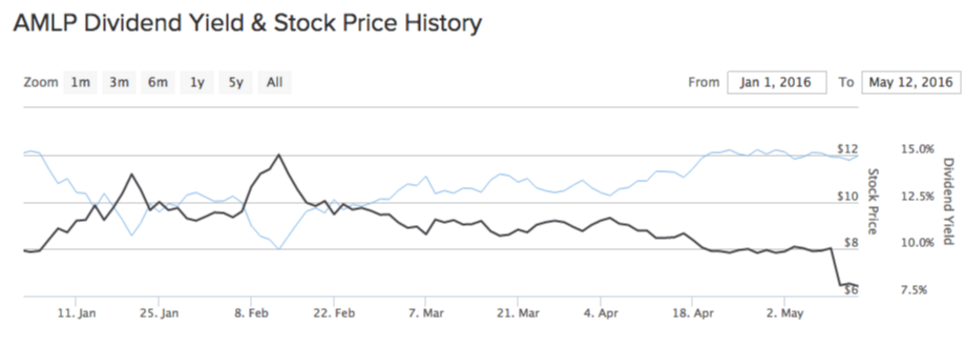

Alerian MLP, an ETF focusing on energy infrastructure companies, is the second on our list of most visited pages, with a 75% increase in viewership week over week. The fund has suffered lately, prompting it to decrease its dividend payout on Wednesday from a quarterly 30 cents per unit of stock to 24 cents. But Jeremy Held, director of research at ALPS, said in a conference call that the dividend cut was not a cause for concern, pointing out that none of the 24 underlying components had trimmed distributions.

In fact, he blamed the cut on the rising stock prices of energy infrastructure firms, as these have been helped lately by a rebound in crude. When the stock price rises, the dividend payout falls. Despite the dividend cut, the ETF still yields an impressive 8% annually.

Industrial Goods/Aerospace Defense Products and Services: Gaining From Turbulence

This week, our page tracking aerospace-defense companies has seen its traffic grow about 20% compared to the week-ago period as many companies in the sector delivered upbeat earnings reports for the latest quarter.

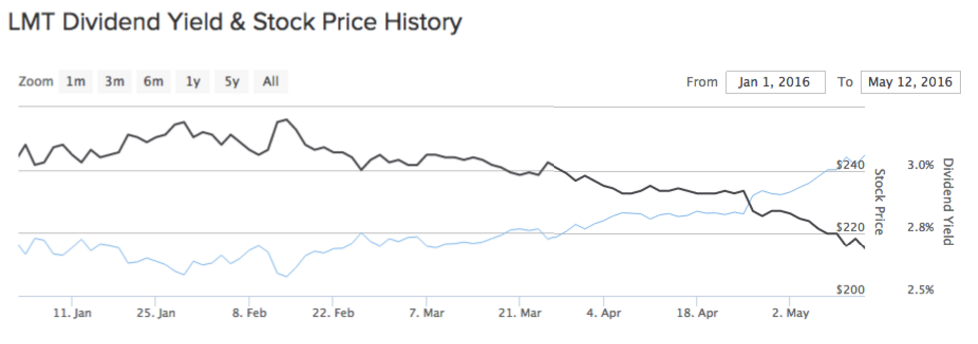

Lockheed Martin (LMT ), for instance, has risen 12% since the beginning of the year, in a largely tepid environment for stocks, on the back of better-than-expected earnings and a string of good news.

On Thursday, several media outlets reported that the company was set to win a $3 billion contract from Denmark for the production of stealth fighters; the country is looking to boost its defense in the face of emerging threats from the Middle East. Lockheed Martin pays an annual dividend of 2.7%, higher than the industrial average of 2.2%.

But Lockheed Martin is not the only defense company to beat earnings estimates in the past quarter and experience a rising share price. Northrop Grumman (NOC ), a $40 billion market-cap giant offering a 1.5% annual dividend, has seen its shares jump 15% year to date, reaching all-time highs on Thursday. In addition to posting strong earnings results for the past quarter, the company was awarded a contract from the U.S. Air Force on May 10 to study its next generation GPS III program. Shares are up nearly 3% in the past week.

Walt Disney: Rough Patch

Perhaps the least surprising presence on our weekly list is Walt Disney with a surge of 20% in viewership week over week. The company grabbed the headlines on May 10 after it reported its first earnings miss in more than five years. Shares have tumbled nearly 4% since then, bringing year-to-date performance into negative territory.

Although the company’s film unit posted strong results on the back of box-office hits such as “Captain America: Civil War” and “Zootopia,” its TV business snagged; its sports network ESPN is particularly a cause for concern. ESPN, which brings about half of the company’s profits together with other networks, has been losing subscribers in the past year as many of them flee to other alternatives. The network has lost about seven million subscribers in the past two years alone. Further complicating Disney’s stance is the lack of a CEO succession plan; Bob Iger is set to leave in two years. However, he reassured investors in the last conference call that there is plenty of time for the company to find a successor.

The Bottom Line

Valero Energy’s bad financial results have had a positive effect on its annual dividend yield, particularly considering that it was recently increased. By contrast, the Alerian ETF, second on our list after Valero, decreased its payout but asked investors not to worry about that. The industrial goods and defense sectors together with Disney registered the same week-over-week increase in viewership, though for vastly different reasons. Disney has missed earnings estimates for the first time in five years, while many defense companies have beaten consensus forecasts.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.