[Updated by Sam Bourgi on Mar 29, 2018] Ford Motor Company (F ) is one of the oldest, most well known companies in the world. The company has been around since the 1800s, and it has seen its share of ups and downs. Below, we look at Ford’s history, including how it started, the companies it has acquired and its dividends.

A Brief History of Ford

Prior to the company becoming Ford Motor Company, it was founded as Detroit Automobile Company in 1889. Ford Motor Company was established in 1903 by Henry Ford. For its entire history, Ford has been led by a member of the Ford family – making its the largest family run business in the United States. When the company was incorporated in 1903, there were just 12 investors with a total of 1,000 shares. Henry Ford made his son Edsel Ford president of the company, while he took the vice-president position.

In 1904, Ford made its first international expansion and created Ford of Canada. By 1911, the company had started to expand overseas. Around this time, Ford also became famous for creating the first moving assembly line, which changed the manufacturing industry [see also The Ten Commandments of Dividend Investing].

By the 1920s, Ford had increased its production to industrial levels, allowing the company to survive The Great Depression.

When the U.S. entered World War II in the 1940s, Henry Ford was hesitant to contribute production efforts for the war, but later agreed. During this time, Edsel Ford became ill and passed away in 1943. Following his son’s death, Henry Ford took over control of the company, but he passed away just four years later.

In 2006, William Clay Ford hired former Boeing (BA) president Alan Mulally to help turn around the company, which had been struggling. Mulally had previously led Boeing through its struggles after the 9/11 attacks and the early 2000s recession.

By 2008, Ford was turned into a penny stock after the financial crisis and the bankruptcy of General Motors (GM ). Since the crisis, the company has been turning itself around.

By 2015, Ford had recorded record profits as automakers continued to feed off a faster domestic recovery. In recent years, the company has emerged as a leading player in the hybrid vehicle market, with the focus being dedicated to boosting smart mobility. This has required greater capital expenditure and investment, which has eaten into corporate profits. In 2018, the company expanded its mobility unit by acquiring two transportation software companies, Automatic and TransLoc.

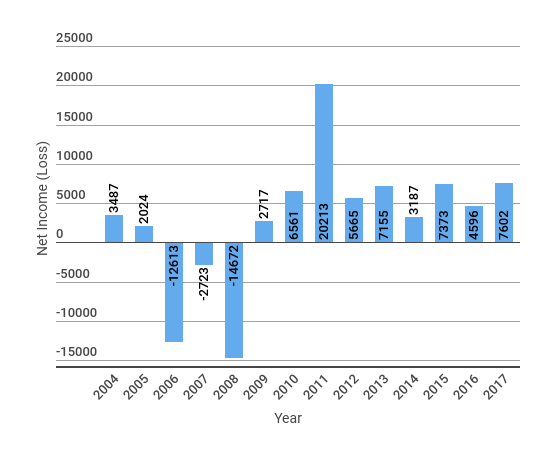

Annual Net Income

This chart displays Ford’s annual net income over the last decade:

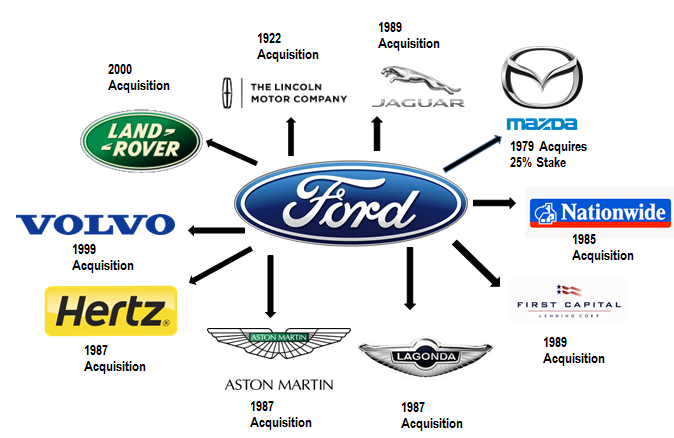

Ford’s Acquisitions

Below, we present a flow chart that visually represents Ford’s history as a company, including any mergers, acquisitions, and spin-offs:

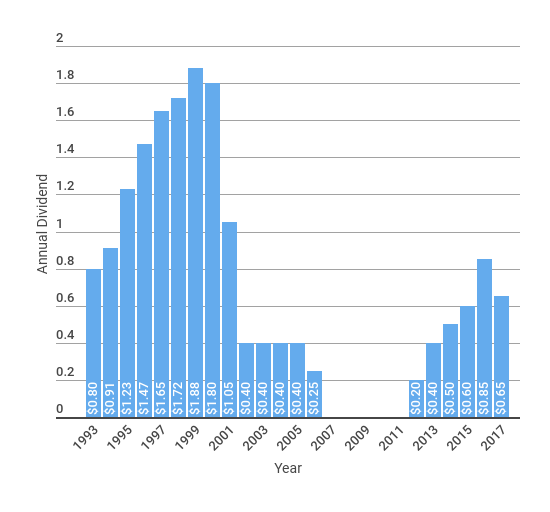

Ford’s Dividend

Ford’s dividend history was marked by a steady, increasing dividend until the company was faced with the early 2000s recession. By 2001, Ford began slashing its quarterly dividend until it eventually eliminated it altogether in 2007. The company resumed its dividend in 2012 and boosted its earnings each year until 2017, when higher costs and investment outlays forced payouts to stall. During the prior year, Ford issued a one-time dividend of around $1 billion, or $0.25 per share, following record profits in 2015.

Ford’s dividend yield remains significantly higher than the consumer goods average, although this alone hasn’t been enough to boost its standing among yield-seeking investors. Operating in a highly cyclical industry, and Ford is sensitive to shifts in consumer spending. The combination of record household debt and rising interest rates could affect the automaker’s 2016 sales in the near future.

This chart displays the annual payout per share from F:

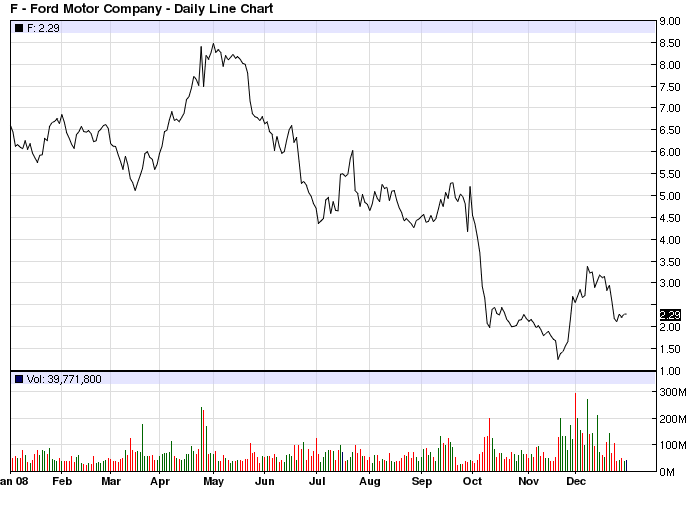

Worst Day Ever

Ford’s stock saw its worst trading day on November 19, 2008. The stock fell 33.33% after reports were released that suggested a possible bankruptcy of General Motors (-link" href=“/stocks/consumer-discretionary/automotive/automobiles/gm-general-motors-company/”>GM ). At the time, Ford was trading at less than $2.00 a share. Despite the fall, just a few days later, Ford saw its best trading day ever.

Best Day Ever

On November 26, 2008 shares of Ford surged 22.79% after news broke that the U.S. government would spend $7 trillion to save the U.S. economy. With the possibility of a government bailout, investors could finally see an upside in the automobile company.

The Bottom Line

With over 100 years of history, Ford is one of the most well known companies in the world. As a company, Ford changed the way that manufacturing companies are operated. Although the company was hit by hard times during the 2008 financial crisis, Ford has shown an upside with its turnaround story. The company’s recent emphasis on fuel efficiency and smart vehicles is paving the way for a bright future in a highly cyclical industry.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.