The General Motors Company (GM ) has a history dating back more than a century, and despite falling on hard times in the last decade, this car manufacturing bellwether has played a big role in shaping the motorized transportation industry. Below we’ll take a walk down memory lane and review some of the major developments that led to GM’s rise, its fall, and its subsequent revival.

A Brief History

Founded by William Durant on September 16, 1908, in Flint, Michigan, GM was originally a holding company and initially had only the Buick brand under its belt. Within a matter of years, Durant’s business acquired more than 20 other brands, including Oldsmobile, Cadillac, and the Rapid Motor Vehicle Company, which was the predecessor of GMC Truck. Durant lost control of the company in 1910 after incurring a copious amount of debt as a result of all the acquisitions he had made. The following year, he co-founded the Chevrolet Motor Company with Louis Chevrolet and by 1918 the new brand was added under GM’s belt after a series of acquisitions.

Be sure to also see The Original Businesses of Dow Components.

In 1923, the company is said to have sold 800,000 cars and trucks, turning a handsome profit of $80 million, and by 1929, GM’s sales were just shy of 2 million units, raking in an annual profit of nearly $250 million; it is during these years that GM surpassed Ford (F ) as the leading car company in America.

Business continued to boom at GM as World World II created a surge in wartime production contracts, and at one point the company ranked as the largest corporation in the country and among the largest employers in the world. To put its growth into perspective, GM was the first corporation in U.S. history to pay over $1 billion in taxes, and it did so in 1955. From 1960 through the ’80s, GM’s product lineup expanded as the company began to offer high-performance engines across Chevrolet and Pontiac classes; furthermore, the company also expanded into subcompact models, like the Chevrolet Vega, to compete with foreign automakers who had just started to permeate the domestic auto market.

Setting the Stage for Failure

Despite maintaining its dominance in global market share and revenues between the ’60s and ’80s, GM’s reputation endured some blows during this era that would set the stage for the company’s eventual downfall.

See also What a Collapsing Company Looks Like in 5 Charts.

- Introduced in 1959, the Chevrolet Corvair attracted a ton of bad press as a result of its quirky handing; this prompted consumer advocate at the time, Ralph Nader, to include a chapter on the Corvair’s failure in his book “Unsafe at Any Speed.”

- The introduction of the Vega during the ’70s very much resembled the life cycle of the Corvair; the model was very popular upon launching, but in subsequent years quality problems led to its eventual downfall and termination of the name in 1977.

- Demand for Oldsmobile vehicles exceeded production in 1977 given the soaring popularity of the Rocket V8 engine. As a means of keeping up with demand, the company secretly began to produce some models with a similar Chevrolet engine instead. Loyal customers were appalled when this was uncovered and the company suffered from a class-action lawsuit.

Adding to the list of headwinds plaguing GM at this time was the passage of the Energy Policy Conservation Act in 1975. The new legislation set federal fuel economy standards and in turn pushed the development and popularity of more fuel-efficient models. Thought it was a blessing for consumers, this piece of legislation turned the tables against GM, and this problem is showcased in the following two charts.

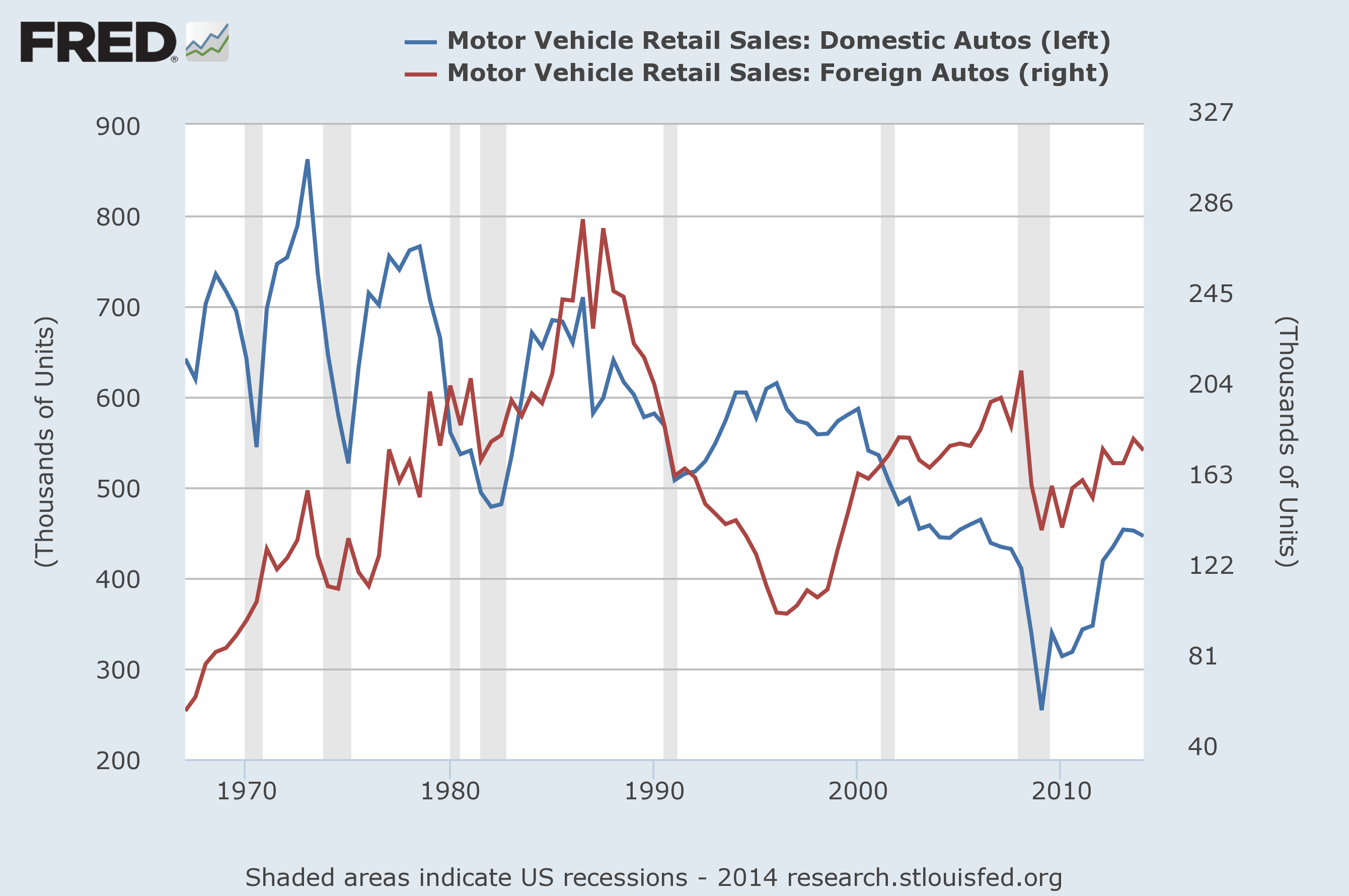

First, consider the graph below, which compares domestic (blue left-axis) and foreign (red right-axis) auto sales since 1967:

Without applying any transformation to the raw units data, the trend is clear: demand for domestic brand autos more or less topped out in the ’70s and has since been in a downtrend. On the other hand, demand for foreign cars during time of the 1975 fuel standard legislation, having earned a reputation as being “more fuel-efficient” than domestic counterparts, soared for the next two decades and has since tapered off. Stiffening competition from foreign auto makers played a key role in the overall contraction of the domestic auto industry and not just GM’s demise.

During the ’80s and more so in the ’90s, the push towards fuel efficiency crippled GM in another way. Because the company was accustomed to making the biggest profit on its larger, less fuel efficient models, it failed to innovate on the product development front and was left behind.

See also Investing in Single Product Companies.

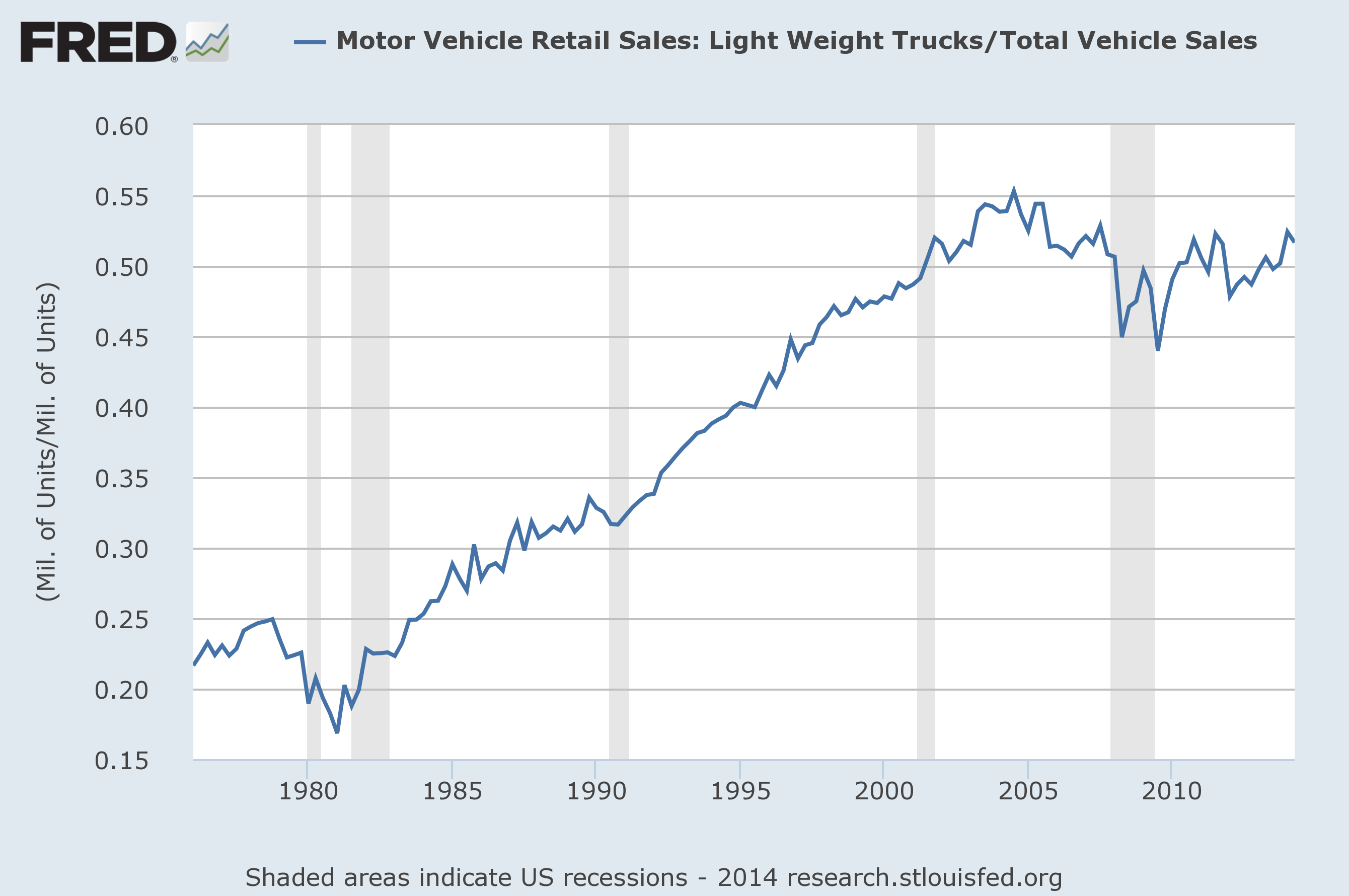

The chart below captures the evolution of consumer preferences regarding light trucks, or SUVs, since 1976:

As the chart above showcases, GM’s offering of pick-up trucks and SUVs allowed the company to capitalize on the booming demand for vehicles in this segment during the ’80s and ’90s; this is evidenced by the percentage of truck sales out of total vehicle sales rising from below 25% during the ’80s to just over 50% in the early 2000s.

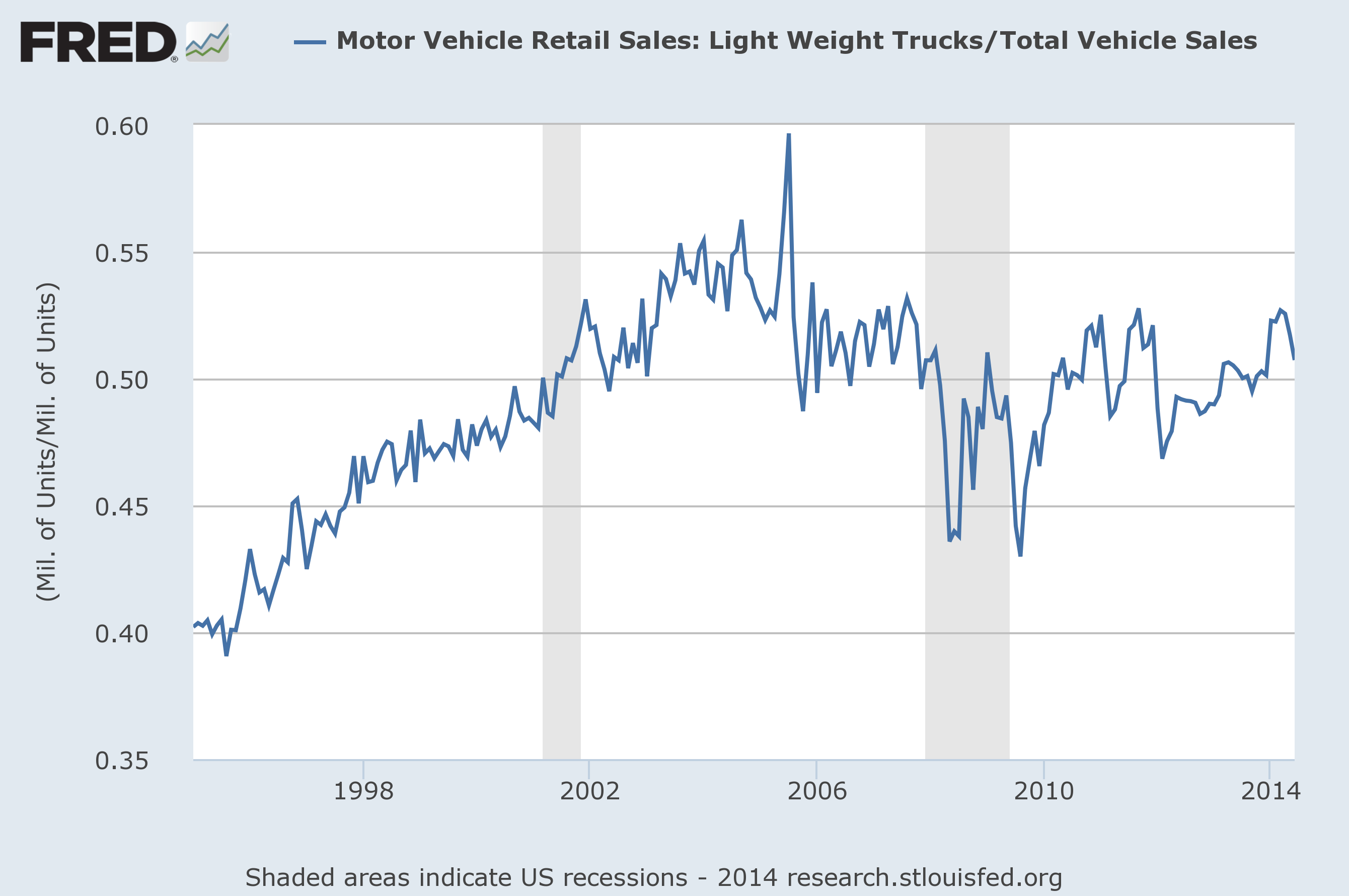

As with most trends, this one didn’t last forever and the change in consumer preferences is further showcased in the chart below, dating back to 1995:

It became clearer during the 2000s that demand for less fuel-efficient vehicles, typically trucks, was losing momentum. Rising gas prices and changes in consumer preferences collided to make for a powerful storm that would help knock down the already financially-fragile GM.

Be sure to also see the 5 Stocks that are Bellwethers for the U.S. Economy.

What Pushed GM to Bankruptcy

GM’s financial stability had been crumbling prior to the 2008 economic recession and many blame management as being more concerned with turning a profit than pursuing quality and innovation. In 2005, the company reported a massive loss of $10.6 billion; this loss grew to $38.7 billion in 2007, and the following year the company warned that it would run out of cash around mid-2009 without the support of government funding, a merger, or selling off its assets. One of the many financial burdens the company struggled to cope with was its staggering “legacy costs,” which refers to the expenses associated with providing healthcare and pension plans to scores of retired workers.

Be sure to also see The Biggest Dividend Stock Disasters of All Time.

The global financial meltdown finally struck in 2008 and GM failed to stand on its own two feet and was prompted to file for Chapter 11 reorganization on June 1, 2009. The bankruptcy filing is said to have totaled an estimated $82 billion in assets and $172 billion in debt. Following months of corporate restructuring, and the sale the Hummer, Saturn, and Saab brands among other assets, GM emerged from a government-backed Chapter 11 reorganization in less than two years time.

Back in Business (Sort of)

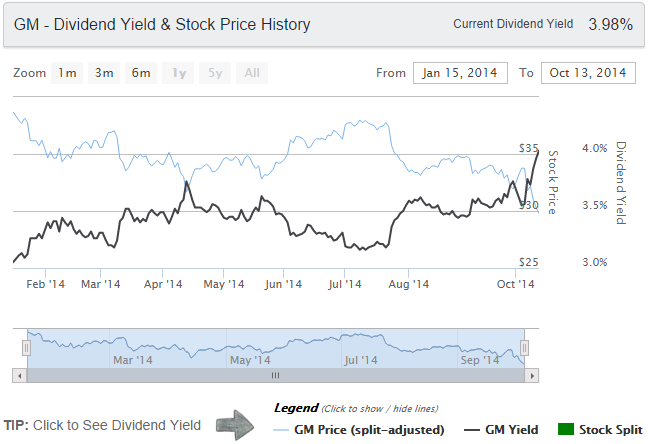

The company made its initial public offering (IPO) on November 18th, 2010, resurrecting the old “GM” ticker on the NYSE, with shares re-launching at $33. On January 15, 2014, the company announced it would re-instate its dividend, which undeniably garnered attention from many investors at the time.

The chart above showcases GM’s stock price (blue) and its respective dividend yield (black) since it re-instated a quarterly distribution following its emergence out of bankruptcy. The automaker has since paid out two distributions and the stock’s yield has hovered well above 3%.

GM’s resurrection efforts hit a roadblock in the summer of 2014 after the company embarked on a series of recalls following a number of fatalities related to faulty ignition switches. During 2014 alone, the company has recalled nearly 25 million vehicles in the United States. Only time will tell if GM’s brand can weather yet another blow, but if history serves as a guide, it’s probable that this auto bellwether will live on.

Be sure to also see The 7 Most Famous Product Recalls.

The Bottom Line

Studying the rise and subsequent fall,of multi-billion dollar corporations can provide worthwhile insights into the business world that may transpire into valuable investing lessons. In the case of GM, we are reminded that failure is rarely attributed to just one factor; the company struggled with lackluster financial management, had failed to innovate in time, all the while waging a losing war against changing consumer preferences favoring fuel efficiency.

As proponents of investing for the long-haul, the lesson we can come away with here is that doing your homework before you buy isn’t enough; you need to stay up to speed with news related to any major investments in your portfolio so that you can assess any changes in the underlying business over time in a more disciplined manner, rather than risk giving into emotions when a “panicky” earnings report hits.

Be sure to follow us on Twitter @Dividenddotcom.