Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Brazilian oil major Petrobras has placed first as the company is facing pressure to cut its dividend. Bulk shipping services provider Torm is second as the company’s massive dividend drew readers. Home Depot, a stock known to weather recessions, is third in the list. Business development company Ares Capital, which has a big dividend yield, is last on the list.

Don’t forget to read our previous edition of trends here.

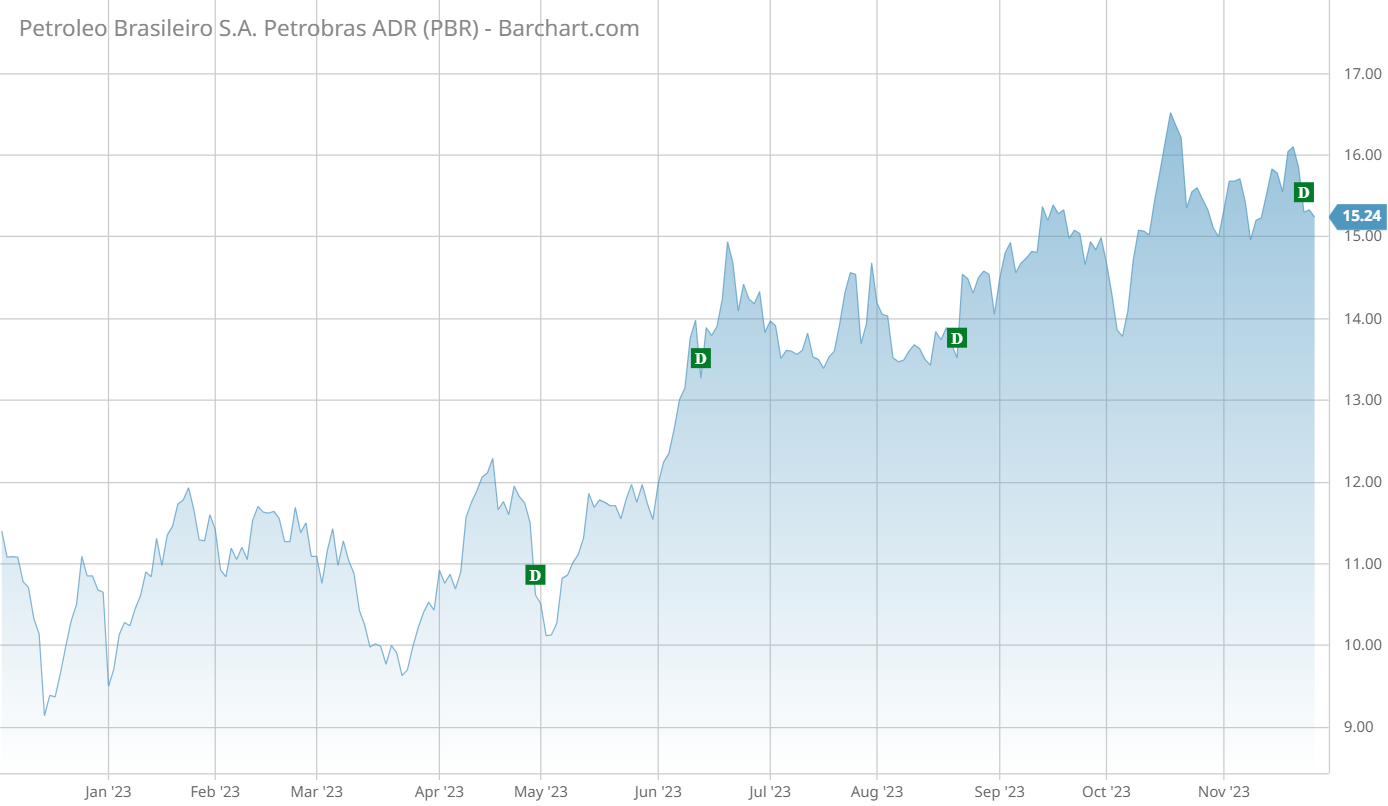

Petrobras Makes Changes That Might Reduce Dividend

Brazilian oil giant Petrobras (PBR) has taken the first position in the list with an increase in traffic of 67%. The oil giant controlled by the Brazilian government has been very generous with its shareholder payouts, handing out nearly half of its free cash flow via dividends. This resulted in a dividend yield of 7.2%.

However, the government led by Luiz Inacio Lula da Silva has been pushing the company to invest more in renewable energy projects and additional refining projects instead of paying dividends. The company took notice, making changes that could lead to a lower dividend in the future, like the creation of a capital reserve. This summer, the oil giant already cut its dividend from 60% of free cash to 45%.

Shares in Petrobras have lost about 5% over the past five days, cutting year-to-date gains to 44%. A lower dividend would certainly make the stock less attractive, especially since some of the proposed projects might not lead to higher returns.

Source: Barchart.com

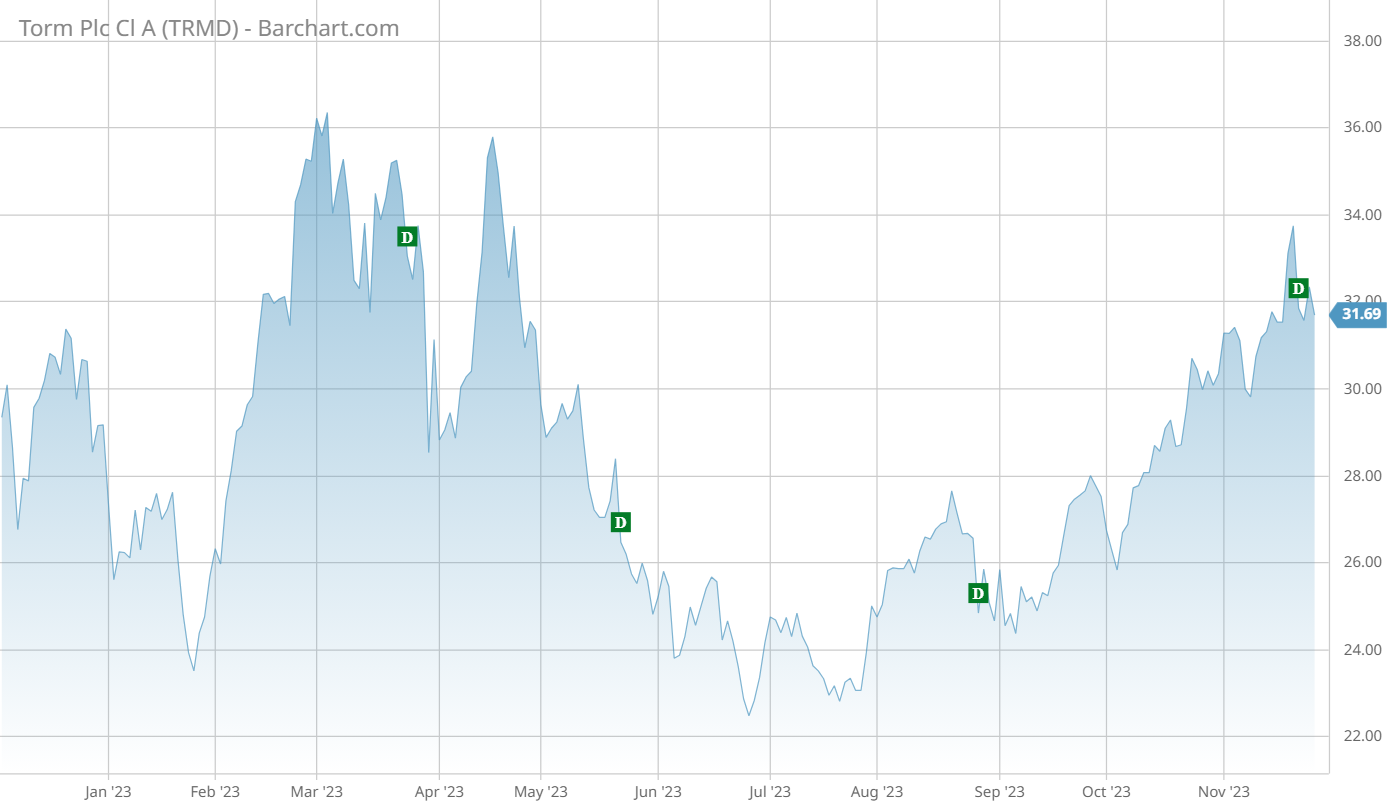

Torm’s Dividend Looks Too Attractive

Bulk shipping company Torm (TRMD) is second in the list as its dividend seems highly attractive. The bulk shipping company’s dividend yields nearly 20%, and the company has been doing relatively well financially.

Torm’s prospects look constructive. The war in Ukraine and the ensuing economic sanctions on Russia have benefitted Torm. The way things go geopolitically, this tailwind is unlikely to abate soon. Meanwhile, oil demand remains robust, further providing a boost to Torm.

Torm’s results for the September quarter were substantially lower, largely due to challenging base effects, as tanker rates have normalized after a period of strong growth. Revenue of $358 million was 20% lower than the same period last year, while net income fell 42% to $124 million.

Source: Barchart.com

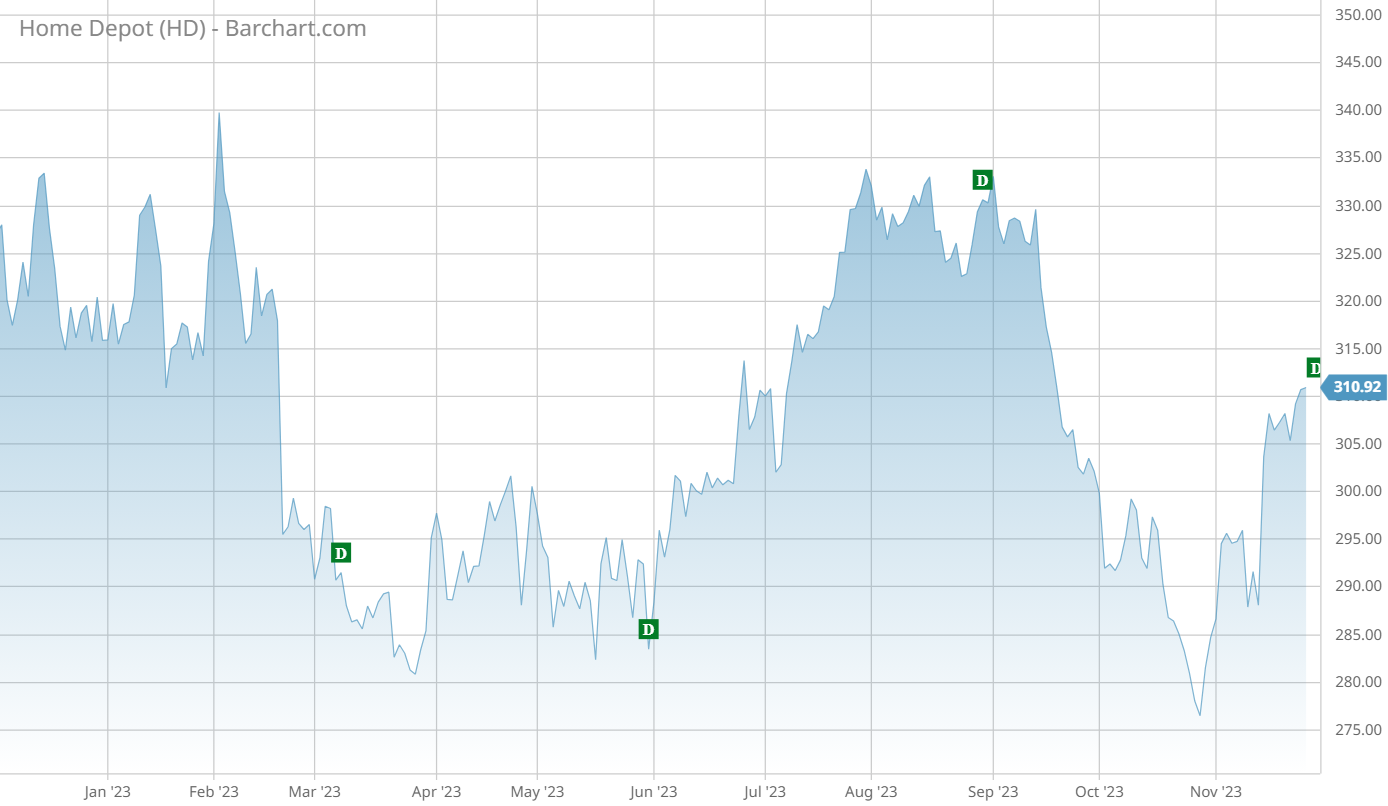

Home Depot Sales Decline

Home Depot (HD) has taken the third position in the list with an increase in viewership of 31%.

The home improvement retailer has again reported falling sales at its stores, although the decline was lower than analysts had expected. In the October quarter, revenue declined 3% to $37.7 billion, while net income swooned 12% to just about $3.81 billion.

The results were better than expected, with the company saying that consumers are not spending as they did during the pandemic on home projects, but they are still interested in smaller improvements.

Shares in Home Depot have fallen about 5% this year, and are down about a quarter from the high reached in 2022. Home Depot’s dividend currently yields 2.7% and it has been increasing it over the past 14 years.

Source: Barchart.com

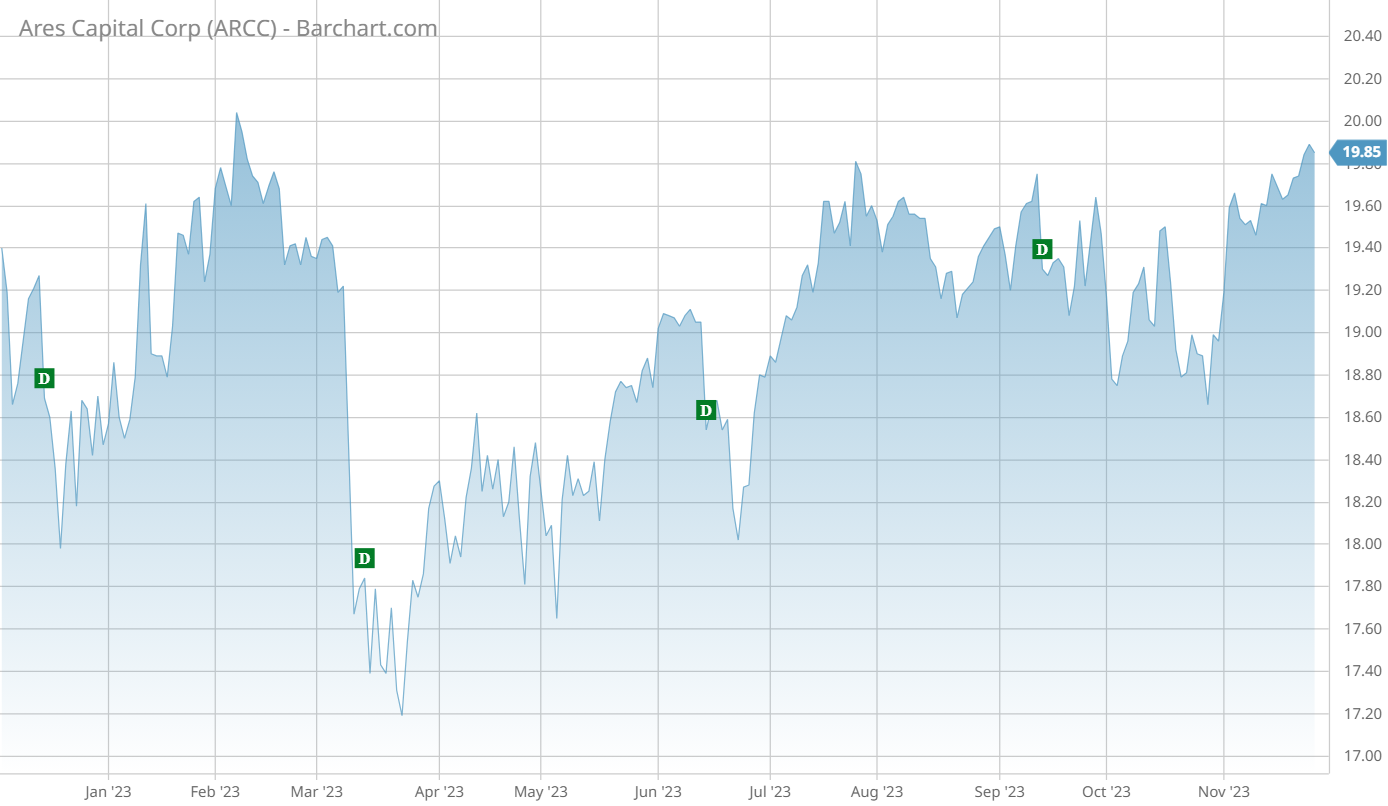

Ares Capital

Ares Capital (ARCC) has placed last, seeing its traffic jump 28%, not far from Home Depot. Ares Capital, a business development company with a strong dividend yield of 10%, has seen strong stock performance recently thanks to solid results.

For the third quarter, Ares reported core earnings per share of 59 cents compared with 50 cents in the year-ago period. Meanwhile, the dividend payable jumped from 46 cents to 48 cents. The company’s portfolio investments at fair value rose from $21.78 billion to $21.92 billion.

Source: Barchart.com

The Bottom Line

Petrobras is more likely than not to cut its dividend. Torm’s dividend and prospects remain strong, despite deteriorating results. Home Depot is seeing its sales decline, albeit not as much as pundits’ expectations. Finally, Ares Capital posted strong results.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.