The current political environment is bringing a heightened focus on the costs and benefits of international trade. While Mexico is in the spotlight right now, China is by far a bigger market, and, for many U.S. firms, that means increased exposure to the Chinese yuan.

Despite China being the second largest economy in the world (behind the U.S. and just ahead of Japan), many U.S. firms have limited exposure to the Chinese market. Put simply, China is not a big importer of U.S. goods. The firms that do have a large exposure to China tend to be the firms with direct operations in that country. This is because China is largely an importer of raw materials and unfinished goods for manufacturing, while the majority of U.S. companies produce finished goods and services, and then sell them to domestic or developed foreign markets.

Among the companies with large levels of Chinese yuan exposure are Wynn Resorts, YUM China (formerly part of YUM Brands), Las Vegas Sands Corp, Mead Johnson and AO Smith.

These five firms have the highest levels of revenues derived from China and semi-autonomous Chinese markets (e.g. Macau) – firms with high levels of exposure to Taiwan are not on this list, since Taiwan is not part of what most investors consider China.

Find out how rising interest rates are affecting the markets.

Why Investors Care About Yuan Devaluation

One primary concern for firms operating in China is the prospect of yuan devaluation. All companies operating internationally have to be concerned to some extend about foreign exchange risk. However, unlike many of the more developed countries, China does not have a free floating exchange rate. As a result, currency changes in China can be sharp and unpredictable.

There is considerable speculation right now about the possibility of another drop in the value of China’s currency, the yuan. When the yuan falls or depreciates versus the U.S. dollar, it means that 100 yuan will not buy as many U.S. dollars. One yuan today is worth about 15 U.S. cents. That number used to be closer to 17 cents, as the graphic shows below.

China’s economy is slowing, which is why the yuan has fallen in value over the last several years versus the U.S. dollar. China’s economic growth is continuing to slow and the outlook for the future is murky at best, which would result in a depreciating currency were it not for the fact that the Chinese state tightly controls the value of its currency.

China can only keep the yuan from falling by spending its own currency reserves – essentially its savings – to buy yuan on the market and prop up the currency. China is running out of currency reserves, however, and it may be forced to devalue the yuan soon, though.

Keep track of our Yuan Devaluation superpage for the latest on how this market catalyst is playing out.

The yuan devaluation can have either positive or negative effects for companies in the U.S. U.S. firms that sell products in China are generally hurt by yuan devaluation, while those that import products from China and sell them to U.S. consumers are hurt.

Take YUM China (YUMC) – previously part of YUM Brands (YUM ), which owns Pizza Hut and KFC among other restaurants. YUM China is a U.S. company but it operates Kentucky Fried Chicken restaurants in China. When the yuan falls, KFC still sells food in China and earns a profit there. But when it goes to convert that yuan profit back to dollars, the yuan earned convert to fewer U.S. dollars. As a result, their USD profit shrinks.

Tupperware is a frequent victim of this effect in the Indonesian rupiah because Indonesia is its largest market. Bloomberg described this effect in 2015 in the following article.

Companies with the Most Exposure to China

The five U.S. companies with the largest exposure to China based on the percentage of their revenues derived from the country are below.

- Wynn Resorts (WYNN ) – Wynn operates casinos in many jurisdictions around the world, but the Macau region of China is the most important locale for the company. Around 70% of Wynn’s revenue comes from China. Wynn’s stock gets hit hard every time the Chinese economy suffers or the yuan falls.

- YUM China (YUMC) – As the name implies, YUM China has a lot of exposure to China. YUMC was spun out of YUM Brands as a way to isolate the mature and steady U.S. business from the rapidly growing, but volatile, Chinese business. While WYNN primarily has exposure to one Chinese region, YUM China owns restaurants across the entire country and, thus, has diversified interests in the region. Yum China has not reported a full year of earnings yet, so we can’t measure how much direct exposure the firm has to China but it’s likely to be close to 100%. Parent company Yum Brands previously had about 50% of its revenues coming from China.

- Las Vegas Sands Corp (LVS ) – Like WYNN, Las Vegas Sands Corp operates casinos, and Macau is a big part of the firm’s portfolio. Roughly 45% of the firm’s revenues come from China, so while LVS is not as exposed as WYNN, Macau is still enormously important to the company.

- AO Smith (AOS ) – AO Smith is one of the few western manufactures that sells a lot of its finished goods in China. As a result, the firm may be particularly susceptible to a trade war with China. AOS makes water heaters and water treatment equipment, which is something China badly needs. Despite perceptions of China as a modern economy, the reality is that most Chinese citizens still have a third world living standard, and the country does not have universal indoor plumbing. This development need and the similar need of many other countries around the world leads to a robust business for AOS. AO Smith gets about 30% of its revenue from China.

- Mead Johnson (MJN)– Mead Johnson is in the news right now thanks to a potential takeover by Reckitt Benckiser, the European consumer products giant. But MJN shareholders should also be thinking about the possibility of yuan devaluation. Mead Johnson makes baby food, and in China, U.S. products are widely regarded as healthier and safer. As a result, MJN has seen tremendous demand for its products. Around 30% of the firm’s revenue comes from China.

This type of analysis is available with our Dividend Screener. Using the screener, you can find high-quality dividend stocks by applying more than 15 dividend specific parameters. As a premium member, you can download the entire list in a spreadsheet to do your own custom analysis.

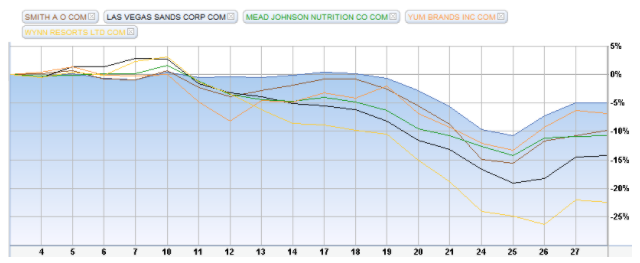

The last time there was a major yuan devaluation was in August of 2015 when the Chinese devalued the yuan by 2% overnight. The chart below shows the S&P 500 in blue versus the stock price of the five firms above.

The Bottom Line

It’s important to remember that yuan devaluation is just one factor that can affect a company’s bottom line. Economic growth, new products, new locations and marketing can all play a role as well. As a result, yuan devaluation might have only a modest impact on any of the companies discussed above. In addition, President Trump is talking about the U.S. dollar being too strong.

While the U.S. has a floating market exchange rate that prevents the U.S. government from directly devaluing the dollar, there are indirect actions that could be taken. If the U.S. dollar drops in value against the yuan, then all of the companies mentioned might actually see a benefit.

The broader point is that investors need to keep these risks in mind going forward.

Dividend.com has over 100,000 subscribers. Go premium for free and get access to the daily dividend newsletter where we will deliver daily dividend specific news straight to your inbox.