For several years, China’s yuan renminbi has been one of the most talked-about subjects in the financial markets, as investors have sought to understand Beijing’s seemingly enigmatic currency policy. Since 2015, the People’s Bank of China (PBOC) has been actively devaluing the yuan against the U.S. dollar to boost trade competitiveness and ensure its place as one of the world’s premier international currencies.

Those efforts were vindicated on October 1, 2016, when the yuan finally joined the International Monetary Fund’s basket of reserve currencies.

The yuan’s devaluation in recent years has had a major impact on the global economy and financial markets, forcing U.S. dividend investors to pay close attention to the latest developments. This includes developing a deeper understanding of Beijing’s economic and monetary policies, and how they impact equity and currency markets at home.

Why Yuan Devaluation Matters for U.S. Dividend Investors

It is often said that investors deal in two currencies: reality and perception. For the investing public, a yuan devaluation is equivalent to a financial earthquake. This was clearly the perception back in August 2015, when the PBOC devalued the yuan by the most in two decades, triggering a series of events that eventually led to the “Black Monday” market crash of August 24, 2015.

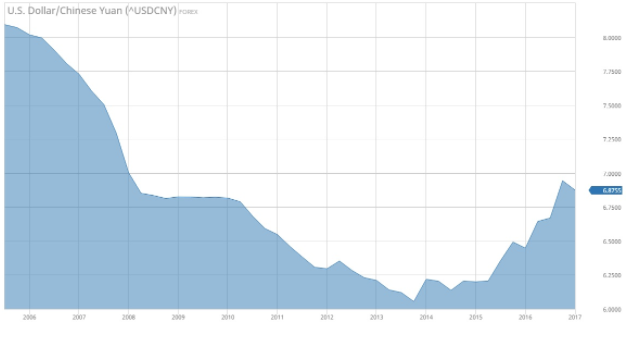

A weaker Chinese currency also has real implications on the market. For decades, the yuan had been appreciating against the U.S. dollar. With Beijing taking the opposite approach, market participants have been forced to revise their expectations of the yuan’s trajectory.

Many U.S. dividend investors have exposure to Chinese markets, which makes any move by the PBOC to devalue the yuan of primary importance. Whether for good or for bad, yuan devaluation has a direct impact on portfolios that are exposed to the Chinese market. This is especially the true if a particular company derives its revenue from China. In this scenario, a weaker yuan may lead to lower revenues. On the flip side, if a company has outsourced its production to China, a lower yuan may boost operational effectiveness, thereby making it even cheaper to produce in the world’s second-largest economy.

Check out a detailed analysis of the reasons for yuan devaluation here.

Impact of Yuan Devaluation on China

The PBOC’s unexpected yuan devaluation in 2015 fueled fresh fears about a growing trade war between East and West. While evidence of a trade war has yet to emerge, a weaker yuan makes Chinese exports cheaper for the global market. However, for domestic markets, a cheaper yuan also makes imports more expensive. In theory, this could undermine China’s buying power.

Greater export competitiveness is critical for China at a time when its economy is struggling to maintain its momentum. Gross domestic product (GDP) expanded 6.7% in 2016, the slowest since 1990, the National Bureau of Statistics reported last week. GDP growth is expected to slow further in coming years as Beijing reorients its economy toward consumption and services and away from traditional growth drivers tied to investments and exports.

How the Yuan Renminbi Trades

Managing the yuan’s exchange rate is a critical aspect of China’s economic policy. Rather than let its currency float on the open market, where its value is determined by supply and demand, the Chinese government pegs the yuan to the U.S. dollar. In this scenario, the yuan is allowed to fluctuate within 2% of the daily reference rate, which is set by the PBOC.

This pegged currency system makes Chinese exports cheaper and therefore more attractive to holders of other currencies. By controlling the yuan’s value, China gives other nations more incentive to buy its goods.

One of the main motivations behind China’s recent devaluation efforts is to control the impact of a surging U.S. dollar. As the Federal Reserve began signaling for higher U.S. interest rates, the dollar rose sharply against a basket of other major currencies. Since the yuan is pegged to the dollar, a stronger greenback pulled the Chinese currency higher relative to others. This made the yuan, and by extension Chinese goods, less competitive on the global market. In this way, expectations surrounding U.S. interest rates have a direct role in shaping China’s currency policy.

Below is a look at the exchange rate performance of the USD/CNY over the past 20 years.

Three Stocks to Buy

As China’s yuan devaluation intensifies, the following stocks could be solid plays for investors. The stocks listed below are not pure dividend plays, but rather capitalize on Chinese companies that report in the yuan and have broad exposure to international markets. Dividend investors may feel compelled to diversify into these stocks or their industries to capitalize on down moves in the Chinese currency. For an ETF perspective on yuan devaluation, click here.

Fuyao Glass {HKG: 3606}

Chinese companies like Fuyao Glass that generate a large bulk of their revenues from overseas are primed to reap the benefits of a falling yuan. The company, which is one of the world’s largest makers of auto windscreens, generates about one-third of its total revenues from outside China. Analysts note that Fuyao will earn hundreds of billions of yuan in foreign exchange gains alone from Beijing’s most recent devaluations, making the company ideally suited for a declining-yuan environment. The stock has gained more than 40% over the past 12 months.

Shenzhou International Group Holdings Ltd. {HKG: 2313}

Shenzhou International has emerged as one of the world’s biggest knitwear exporters. The company manufactures high-end materials used in Nike (NKE ) shoes and other products used by Olympic athletes. Its customers include some of the world’s biggest athletic companies, including Adidas and New Balance. The company reports in the Chinese currency and benefits from a low-cost base, giving it plenty of upside in a declining-yuan environment. Shenzhou shares are up nearly 30% over the past 12 months and have nearly doubled compared to two years ago.

China High Speed Transmission Equipment Group Co. Ltd. {HKG: 0658}

China High Speed Transmission Equipment, a Hong Kong–based gearbox manufacturer, operates mainly within the clean energy sector. It has quickly emerged as a global player in the wind turbine and alternative energy industries, having grown its international revenues by an annualized 70% in the first six months of its financial year. The company’s international revenues shield it from yuan instability at home. The company’s stock has surged 55% over the past year. It boasts a dividend yield of 2.32%.

Get a complete list of foreign companies that have ADRs listed in the U.S. on our dedicated page tracking foreign dividend stocks.

Three Stocks to Sell

A weaker yuan could impact companies that import valuable goods to China. Below are three companies that stand to lose.

General Motors Co. {% dividend GM %}

Transportation products were the most valuable U.S. exports to China in 2014, generating tens of billions of dollars for domestic manufacturers. A softer yuan adds to growing long-term concerns about shrinking auto sales in the country, forces that could weigh on companies such as (GM ). This comes at a time when the Detroit-based automaker is looking to expand its presence in China through state-owned Shanghai Automotive Industry Group. The company recently delivered record sales to China on strong demand for small and mid-sized cars and luxury vehicles.

(GM ) has been a strong dividend payer in recent years thanks to strengths across multiple areas, such as solid net income growth, steady cash flow and an impressive earnings-per-share record. However, growing exposure to the Chinese market may hurt its bottom line should Beijing’s devaluations become systemic.

Boeing Co. {% dividend BA %}

(BA) has expanded its operations in China through strategic partnerships with state-run carriers, which have ordered billions of dollars’ worth of airliners from the Seattle-based company. (BA) has capitalized on China’s growing middle class, which is increasing its appetite for air travel. However, yuan instability has harmed investor sentiment in the country, as people look to diversify away from the Chinese currency. A decline in air travel due to yuan instability could spell trouble for (BA), which boasts solid revenue growth and return on equity, but weaker net income.

Unilever Plc {% dividend UL %}

(UL ) announced a partnership with Alibaba Group Holding Ltd. (BABA ) before the PBOC’s major yuan devaluation in mid-2015. The agreement allows (UL ) to improve its service delivery to the mainland market. However, the company has since acknowledged that it has reduced the amount of inventory it keeps in the country and has resorted to online offerings to boost sales. As a consumer discretionary company, (UL ) relies on China for its overall growth and stability. Given the considerable uncertainty facing China’s economic prospects and currency policy, now is not the ideal time to invest in the company. Click here to find out the best dividend stocks offered by the consumer goods sector.

Dividend.com tracks over 6,500 securities. We have dividend data for these securities that goes as far back as 1993. By signing up for a free Premium 14-day Trial, you can get access to all this data, as well as a list of the best dividend stocks, which is made up of the highest-rated companies based on our proprietary DARS rating system.

The Bottom Line

China’s evolving yuan policy is a major catalyst for the global financial markets, and since 2015 has been one of the main sources of instability. Though the yuan has succeeded in joining the ranks of the global elite currencies, its devaluation will likely continue as Beijing seeks to bolster trade competitiveness and hedge against the U.S. dollar’s continued strength.

For more news and analysis pertaining to the yuan and other dividend investment themes, be sure to check out our News section.