It’s been an interesting couple of quarters to say the least. After a few years of the post-COVID-19 surges, the markets have been less hospitable for investors. There have been plenty of risks – from recession to inflation pressures to the Fed’s path of increased interest rates. And with that, calm sailing turned into rough seas.

It’s enough to make investors seasick.

But they don’t have to be. Becoming BFFs with low-beta stocks can be the antihistamine they need and smooth out their rides. Better still, by doing this they can actually have better long-term returns. All in all, low-beta and low-volatility stocks make for a top-notch portfolio play for any investor.

Sleepless Nights

It’s no secret that last year wasn’t the best for investors. The declines in the major stock and bond indices kicked off a world of worry for the economy, consumers and corporations. We’ve had some major layoffs, rising inflationary pressures, geopolitical problems like the debt ceiling and dwindling consumer spending. And with recession risks growing, the stock market has started to circle back and welcome some big swings.

The popular gauge of volatility, the CBOE Volatility Index (VIX), has spent much of the last year hovering in the 25 to 27 range. The CBOE’s new one-day VIX has also been elevated.

For investors, particularly those near or in retirement, this poses a major issue. As they say, time heals all wounds, which is the case with equity prices. Pull up any long-term chart of the S&P 500 and you’ll see periods of big price declines, only to have the market move higher over the next resulting quarters and months. The issue is, what if you don’t have the time to let equities bounce back?

For those in and near retirement, this is exactly the case. Often, they have already begun drawing down their savings. And if stocks are down, they’ve now locked in losses. This exacerbates portfolio declines and increases the chance that an investor will outlive their money. Last year’s bond rout also showed that “safe” asset classes can also experience declines as well.

In the end, this creates a lot of sleepless nights and additional worry.

Taking a Look at Beta

However, investors may have a way to reduce the worry and reduce the risk in their portfolios, which includes taking a hard look at low-beta and low-volatility stocks.

Beta is essentially a measure of a stock’s volatility with regards to the overall market –typically, the S&P 500. Basically, it measures a stock’s “jumpiness” versus the broader market. Stocks with a beta of 1.0 will move in line with the broader market. Those with a beta above 1 will bounce more and those with beta less than 1 will bounce less. While beta can’t protect against losses, it can reduce them and that reduction is key to long-term returns.

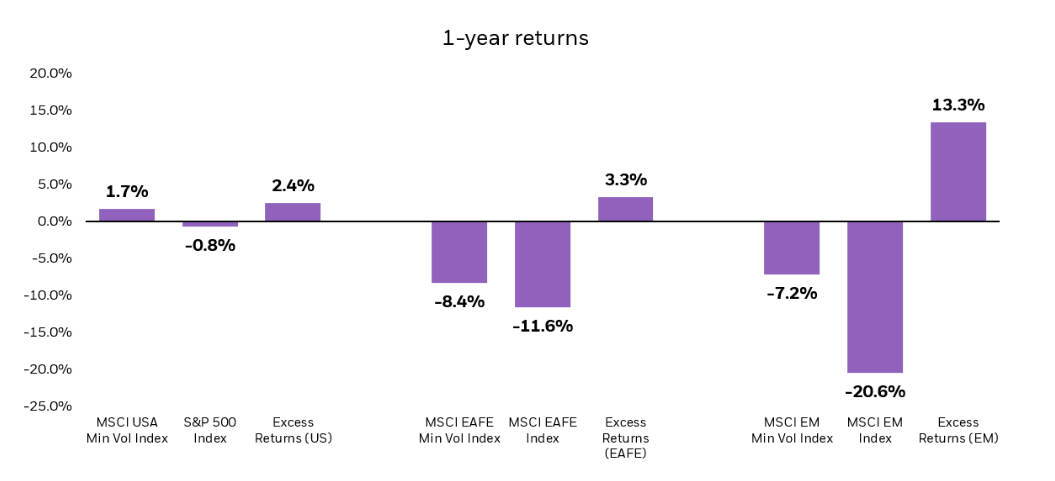

This chart from BlackRock underscores how focusing on beta, via the MSCI low-vol indexes for their respective markets, can reduce drawdowns and provide excess returns.

Source: BlackRock

Losing less money can be a godsend for those in their golden years or in pre-retirement stages. This can reduce the sequence of withdrawal risks and allow investors to keep their nest egg longer.

And it turns out, reducing losses can work wonders for long-term compounding as well. Data from S&P Global shows that, over the last 30 years, the S&P 500 Low Volatility Index gained 10.7% compared to the S&P 500’s 9.8%.

Putting Low-Beta Securities Into Your Portfolio

For investors getting ready to enter their golden years, exploiting the low-beta factor could be a great idea. Reducing the bumpiness of a portfolio can ultimately reduce risks, drawdowns and help you to outlive your money.

Getting low-beta exposure is really quite easy. Here at Dividend.com, a quick screen shows that Duke Energy (DUK) has a beta of 0.4, while Microsoft (MSFT) has a beta of 0.9. Simply adding more low-beta stocks to a portfolio could be all you need. Some sectors feature low-beta stocks as well. As you’d expect, consumer staples, utilities and healthcare are the three lowest beta sectors on the market. Buying a fund like the Consumer Staples Select Sector SPDR Fund could be an easy low-beta choice as well.

Speaking of funds, the smart-beta and fundamental indexing boom has made low-beta investing easier. There are now numerous funds that exploit the factor, both actively and passively. The biggest remains the passively managed iShares MSCI USA Min Vol Factor ETF, while the Vanguard Global Minimum Volatility Fund offers a global and active touch. Investors also have the ability to combine low-beta with other factors. Research shows that low-beta plays very well with dividend investing and many long-term dividend growers feature a beta below 1. The Invesco S&P 500 High Dividend Low Volatility ETF combines both factors to produce a portfolio of top dividend names that feature less bounciness. The monthly dividend payout is a nice touch for retirees.

Low-beta ETFs and Mutual Funds

| Name | Ticker | Type | Actively Managed? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Goldman Sachs ActiveBeta(R) World Low Vol Plus Equity ETF | GLOV | ETF | Yes | $731 million | 9.5% | 0.25% |

| MFS Low Volatility Equity Fund | MLVHX | Mutual Fund | Yes | $451 million | 7.7% | 0.67% |

| iShares MSCI USA Min Vol Factor ETF | USMV | ETF | No | $29.1 billion | 4.4% | 0.15% |

| Vanguard Global Minimum Volatility Fund | VMVFX | Mutual Fund | Yes | $2.42 billion | 4.3% | 0.21% |

| Fidelity® U.S. Low Volatility Equity Fund | FULVX | Mutual Fund | Yes | $354 million | 2.9% | 0.77% |

| SPDR® SSGA US Small Cap Low Volatility Index ETF | SMLV | ETF | No | $190 million | 2% | 0.12% |

| Invesco S&P 500® High Dividend Low Volatility ETF | SPHD | ETF | No | $3.31 billion | -2.5% | 0.30% |

The Bottom Line

With volatility rising and various risks growing, it could be time for investors to look at low-beta stocks via various ETFs and mutual funds. This is especially advantageous for investors near or in retirement. Reducing drawdowns and smoothing out returns can help keep a nest egg growing and reduce the risk of outliving their money.