Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Chipmaker Taiwan Semiconductor has taken the first position in the list this fortnight, boosted by a bet from legendary investor Warren Buffett. Giant retailer Target is second, as the company issued a stark warning about foot traffic during the holiday period. Brazilian oil giant Petrobras is third, after the stock slipped recently on the presidential election win of Luiz Inácio Lula da Silva. Cisco Systems closes the list.

Don’t forget to read our previous edition of trends here.

Taiwan Semiconductor Boosted Following Buffett’s Stake Disclosure

Taiwan Semiconductor (TSM) has taken the first position in the list with an advance in viewership of 120%. Shares in Taiwan Semiconductor have taken a hit this year due to rising tensions between China and Taiwan, with investors fearing a potential invasion. Yet Taiwan Semiconductor’s fundamentals could not be better, with demand for chip manufacturing surging and the company investing heavily in new plants.

Legendary investor Warren Buffet sensed an opportunity and invested $4.1 billion in the company in the third quarter. The company’s stock is trading relatively cheap at 14x earnings, and its moat is strong. Taiwan Semiconductor is the only manufacturer in the world that can produce 7-nanometer and 5-nanometer wide chips. The company’s revenues have increased 48% in the last quarter, with net income rising nearly 80%.

If geopolitical clouds clear, something that is possible given the latest meeting between the U.S. President Joe Biden and his Chinese counterpart Xi Jinping, Taiwan Semiconductor stock could re-rate.

Taiwan Semiconductor pays a dividend of $1.72 per share, yielding 2.17%.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

Target Cuts Sales Forecast for Fourth Quarter

Large U.S. retailer Target (TGT) is second in the list with an advance in viewership of 47%. The company has been in the news after it cut its earnings forecast for the fourth quarter, which includes the holiday season.

While sales in the third quarter were slightly higher than estimates at $26.5 billion, earnings per share of $1.54 were much lower than forecasts of $2.13. Inventory, Target’s key problem in recent quarters, increased by 14% year-over-year, an improvement from the first and second quarter. However, Target was forced to slash prices, which ate into margins.

Target also lowered its top-line and bottom-line guidance for the fourth quarter and the full year and warned that tough conditions are expected to persist. It said it now expects comparable sales to decline, with the operating margin to drop to around 3% from 3.9% in the third quarter.

Shares in Target are down nearly 30% so far this year. The company pays a dividend of $4.32 per share, resulting in a yield of 2.62%.

Source: Barchart.com

Petrobras Slides After Left-Leaning Lula Da Silva Wins Presidential Elections

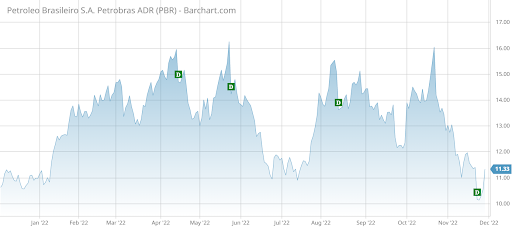

Petrobras (PBR) has seen its traffic jump 34% over the past two weeks, taking the third position in the list. Petrobras has trended after its shares slid following the stunning presidential victory of left-leaning candidate Lula Da Silva over incumbent Jair Bolsonaro.

Da Silva’s win comes as Petrobras is slated to pay a dividend of more than $8.5 billion to shareholders this quarter, after approving a record-shattering dividend of $17 billion in the previous quarter. The high payout has come under criticism from politicians, including Da Silva, who may call for a cut. Shares in Petrobras have declined more than 10% over the past 30 days.

Da Silva is more likely to push Petrobras, in which the Brazilian government owns a third of the stock, to invest cash in domestic drilling in the hope more supply will push down fuel prices and inflation.

Source: Barchart.com

Cisco Posts Solid Results in Latest Quarter

Cisco Systems (CSCO) is last in the list with an advance in viewership of 13%. Cisco has reported solid results for the first fiscal quarter, with the company continuing to reward shareholders with stock buybacks and solid dividends.

Cisco reported adjusted earnings per share of 86 cents compared with 84 cents expected by analysts. Revenues were up 6% to $13.6 billion. For the next quarter, Cisco said it expects to earn between 84 cents per share and 86 cents.

Cisco shares have outperformed the tech-heavy Nasdaq 100 so far this year, thanks to strong results, share buybacks and a high dividend. Cisco’s dividend yields 3.17% compared with 1.37% for the technology average.

Source: Barchart.com

The Bottom Line

Taiwan Semiconductor is a good value stock, according to legendary investor Warren Buffet, who disclosed a sizable stake in the company. Target’s sales have been declining, as consumers are cutting spending on non-discretionary items. Petrobras is likely to cut its dividend after Lula Da Silva won the presidential election in Brazil. Cisco shares have outperformed the broader technology market thanks to share buybacks and dividends.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.