Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

U.S. markets saw their worst day on Monday since the financial crisis of 2008, following a double shock consisting of plummeting oil prices and coronavirus epidemic. The industries that suffered the most, namely oil producers, airlines and cruising, have unsurprisingly trended this week. American Airlines is first in the list as the firm cut its guidance on falling demand for flying. Royal Caribbean is second as the cruises provider’s credit rating fell into junk. Exxon Mobil was trampled by tumbling oil prices, while JP Morgan Chase closes the list.

Don’t forget to read our previous edition of trends here.

American Airlines

American Airlines (AAL) witnessed a 140% rise in viewership over the past two weeks, as the company was trampled by falling demand stemming from coronavirus fears along with the entire travel industry. American was the latest to slash international and domestic flights in order to cope with the spread of the coronavirus.

Initially, U.S. carriers had reduced the number of flights to China, the country where the virus is believed to have started. However, as the virus spread globally very quickly, American was forced to cut flying to other destinations, including major European cities such as Rome, Milan, Barcelona and Venice. The service to China has been suspended until October.

Overall, the firm said it will trim 10% of its peak summer flights, with the trans-Pacific route bearing the brunt of the cuts at 55%.

The full impact of the coronavirus on the company’s top and bottom lines is yet to be quantified, but the firm suspended its full-year and quarterly financial forecasts. Investors are quite pessimistic. Over the past 30 days, shares in American have lost 40% of their value and were down as much as 48% during the peak of the selloff on Monday. On Tuesday, shares recovered some of the lost ground, posting gains of 15%.

American has a dividend yield of 2.46% and its payout ratio is 8.8%.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Royal Caribbean Cruises

Royal Caribbean Cruises (RCL) has been crushed by the coronavirus epidemic, and its stock suffered a worse selloff than many airlines. In part because of that, Royal Caribbean has seen its viewership increase 125% these past two weeks.

Demand for cruises has fallen dramatically and might continue to be weak even after the coronavirus endemic is contained. Multiple cruises have been docked as part of an effort to contain the epidemic. As a result, Royal Caribbean’s debt recently received a notice from S&P Global Ratings that its investment-grade debt rating might be taken off.

The stock is in a precarious position too, as it has lost more than half of its value over the past month. Since peaking in January, shares have tumbled more than 60%. Royal Caribbean has not seen such lows since early 2014, when it was recovering from a brutal selloff that had happened during the financial crisis.

Royal Caribbean has been increasing its dividend for the past 8 years, although the dividend may now be at risk. Its dividend yields 6% on a payout ratio of 35%.

Check out our latest Best Dividend Stocks List here.

Exxon Mobil

Exxon Mobil (XOM) has taken the third spot in the list with an increase in viewership of 38%, as the company’s stock suffered a selloff in the aftermath of one of the worst one-day declines in oil prices. The OPEC, which is led by Saudi Arabia, and Russia have failed to reach an agreement to cut oil supplies, something that has kept oil prices stable since 2016. As a result, WTI crude declined as much as 30% and now trades in the region of $34 per barrel.

Saudi Arabia started an all-out price war with Russia at a time when demand for the black commodity is already weak due to the coronavirus epidemic. It is believed that Saudi Arabia wanted a deal, but Russia argued stable oil prices in recent years have effectively subsidized American shale oil producers.

Shares in Exxon Mobil crashed as much as 20% on the news before staging a recovery. They are now down less than 10%, although volatility is expected to be high in the coming days. Exxon on March 5 said it will trim production in the Permian basin due to weak demand and low prices, although it is still expected to invest more in production than its rivals.

JPMorgan Chase

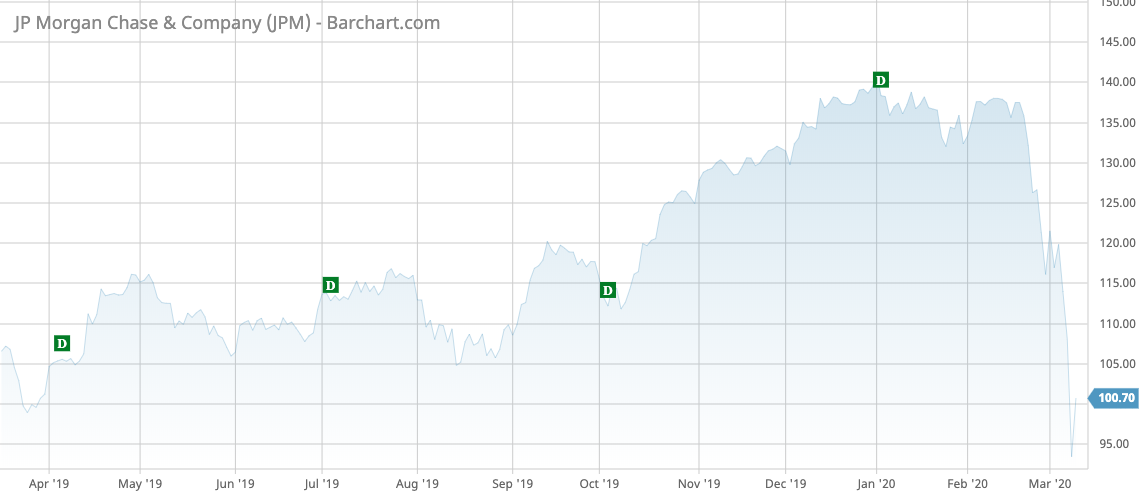

JPMorgan Chase (XOM) is last in the list with its viewership increasing 34%. JPMorgan’s stock lost 14% on Monday, its worst day since March 2009, the height of the financial crisis, as investors are weighing the possibility of a recession.

Banks typically thrive in high interest rate environments, but the U.S. Federal Reserve recently reduced rates by an unexpected 50 basis points. More monetary easing is possible if the effects of low oil prices and falling demand from coronavirus issue lead to low inflation. This would put further pressure on banking stocks as profits are expected to shrink given that the spread in the consumer lending business will decrease.

Falling oil prices are unlikely to hit banks’ balance sheets much, given that many of them do not have large exposure to loans in the sector.

JPMorgan has a dividend yield of 3.8% and its payout ratio is 33%.

The Bottom Line

American Airlines withdrew its financial forecasts as it slashed flying to a host of domestic and international destinations due to falling demand. Royal Caribbean has suffered a brutal selloff as a result of the weak expected demand for a longer period stemming from coronavirus epidemic. Oil major Exxon Mobil was hit by the collapse in oil prices, while JPMorgan Chase stock experienced the worst decline since the 2009 financial crisis on the possibilities of a prolonged low interest environment.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.