Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Biotechnology stock Gilead Biosciences has taken first position in the list this week, as the company appears undervalued, particularly as it might hold the key to the cure for the coronavirus epidemic. Oil and gas major BP has boosted its dividend, as CEO Bob Dudley waves goodbye. 3M has been struggling with weak results, while Ford Motor Co. saw surprising changes to its top echelon.

Don’t forget to read our annual edition of trends here.

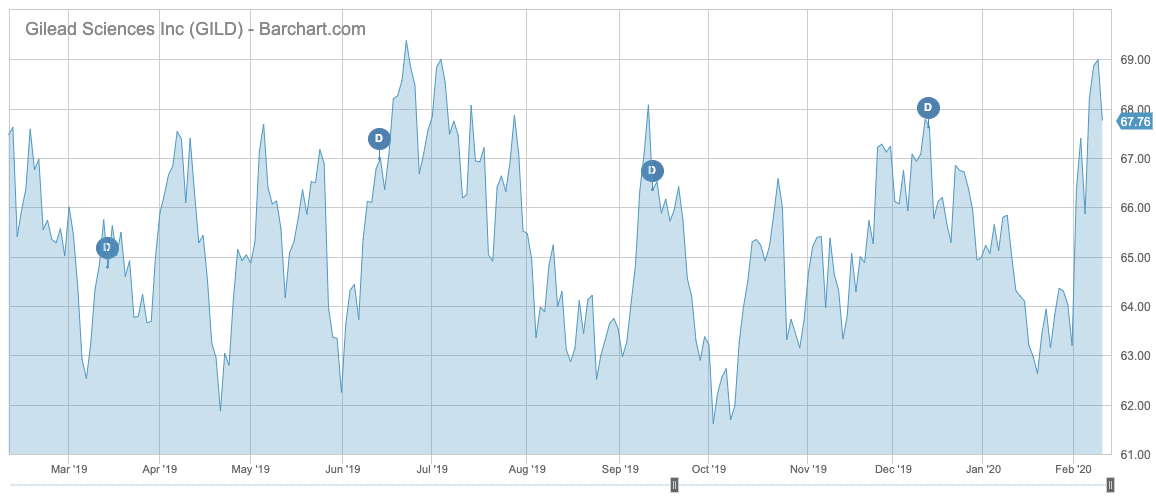

Gilead Biosciences

Gilead Biosciences (GILD) is the top stock these past two weeks in terms of viewership, as investors appear to be optimistic about the company’s prospects to be the first to find a cure for the coronavirus epidemic that broke out in China.

Gilead is already testing its experimental Ebola therapy in a small number of patients in China, and it has been working with the country’s authorities to implement a formal study. The firm is expediting the laboratory experiments of its drug named remdesivir against samples of the coronavirus in the hope this will be the first available drug to cure the illness that has spread panic across global markets.

Remdesivir has proven ineffective in a number of patients infected with Ebola but has shown to be more efficient in animals with Severe Acute Respiratory

Syndrome (SARS), which is very similar to the coronavirus symptoms. The competition is tough, though, with Johnson & Johnson (JNJ) the latest drugmaker to join the race in finding the cure.

Investors, however, have taken notice of Gilead’s pole position. The stock has appreciated nearly 6% in February, largely in line with iShares Nasdaq Biotechnology ETF (“IBB”:https://etfdb.com/etf/IBB/). Yet Gilead has woefully underperformed the IBB over the past two years, falling by 16% compared with a gain of 11% for the index. The stock also appears extremely undervalued, trading at nearly 11 times forward earnings versus IBB’s 89. Gilead also has a strong dividend yield of nearly 4% and payout ratio of 42%. It has been growing its dividend for the past four years.

A hit drug like the coronavirus treatment could at least make the valuation gap smaller.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

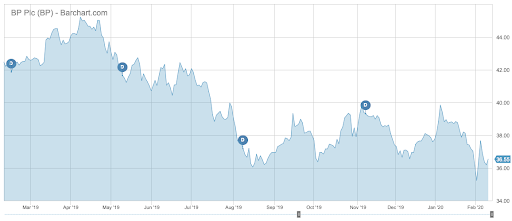

BP

BP (BP) has taken second spot in the list, as the oil major saw a 79% increase in viewership following a dividend hike. The company increased its quarterly dividend in the fourth quarter of 2019 by 2.4% to $0.63. As such, the company’s stock now yields an annual dividend yield of 6.7%, although its payout ratio is 79%.

The dividend hike came as CEO Bob Dudley waved goodbye to the company’s investors after almost 10 years in the role. Dudley will be replaced by Bernard

Looney, who previously ran the company’s upstream business.

BP shares have declined over the past five years, as the company has been dealing with a host of issues, including an oil spill in the Gulf of Mexico in 2010 and falling oil and gas prices. To cope with the challenges, the company has embarked on a series of divestments, which it expects to continue under the new CEO.

The company said it expects to meet its divestment target of $10 billion by the end of 2020 and also expects to sell another $5 billion by mid-2021.

In the fourth quarter, BP reported a profit of $2.6 billion, taking the full-year profit to $10 billion. The company also reported a series of charges, including a $2.4 billion one for the Gulf of Mexico spill.

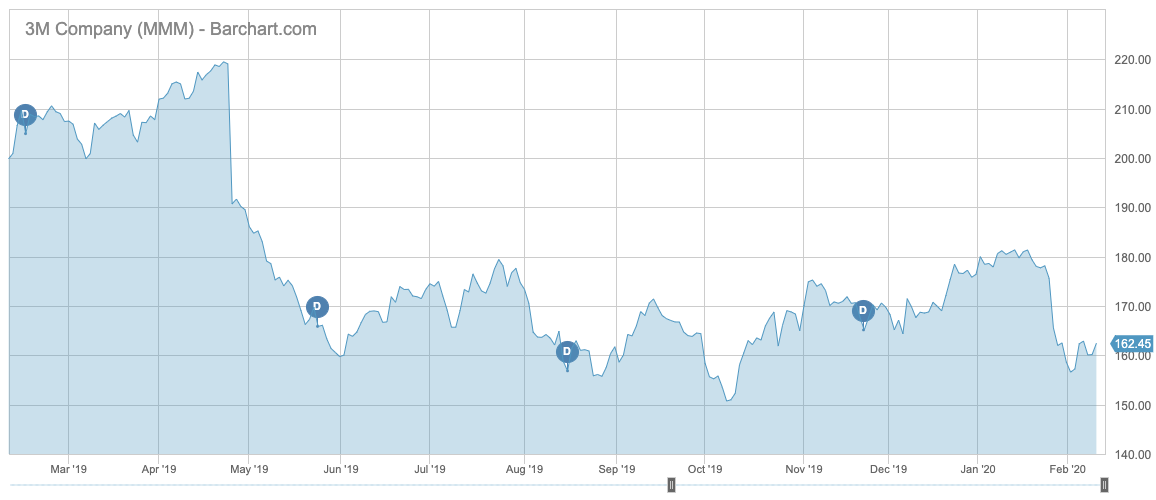

3M

Industrial goods manufacturer 3M (MMM) has seen its viewership

rise by 51% these past two weeks, as the company launched a restructuring effort amid weak financial results. 3M, which pays a dividend yield of 3.61%, missed revenue estimates for the fourth quarter of 2019 by $10 million, while earnings per share of $1.66 came in $0.44 below expectations.

As a result, 3M stock took a beating, falling as much as 12% on the news before recovering some of the losses. 3M launched a restructuring effort that will lead to around 1,500 job cuts. The company also took a restructuring charge of $134 million in the fourth quarter but expects pre-tax savings of up to $120 million.

3M shares have been battered due to ongoing litigation and a global manufacturing recession amplified by the trade war between the U.S. and China. Shares are down 27% over the past two years. A recovery in the stock likely hinges on the success of the restructuring efforts as well as an improvement in the macroeconomic environment.

Check out our latest Best Dividend Stocks List here.

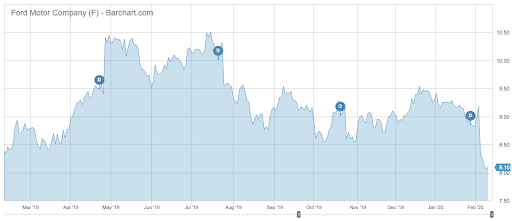

Ford

Ford (F) is last in the list with a comparatively small advance in traffic of 37%. The car manufacturer made headlines last week after Chief Operating Officer Joe Hinrichs and potential successor to CEO Jim Hackett abruptly resigned, leaving question marks over succession planning. Hinrichs was replaced by Jim Farley, who will assist the CEO in executing a global restructuring that, so far, has not been going as planned.

The company has had a weak rollout of its redesigned Explorer SUV and can now barely afford execution mistakes.

Shares have continued to fall on the news of Hinrichs’ departure on February 7, extending a slide that started days earlier following the presentation of weak results.

Ford currently pays an impressive dividend yield of 7.4% and its payout ratio is more than 52%. The dividend might be at risk if the restructuring continues to stall.

The Bottom Line

Gilead Sciences received a boost after a drug that was ineffective in curing Ebola might be able to cure the coronavirus illness. Oil major BP is preparing for a leadership change as it continues to divest assets in order to cope with the decline in commodity prices. Industrial goods manufacturer 3M has suffered from a global industrial recession and the trade between China and the U.S., while Ford announced a surprise top executive departure amid a restructuring effort that has been stalling.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.