Dividend.com analyzes the search patterns of our visitors every two weeks. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

CVS hit the news after it made a nationwide recall of its eye drops, just as the company struggles to integrate a large acquisition. Cigarette-maker Philip Morris International is betting strongly on sustainability with a plan to eliminate tobacco burning. In a desperate search for growth, Procter & Gamble launched a new bug killer. Advanced Micro Devices stock is on a tear, as demand for its chips is increasing.

Click here to see our previous edition of Trends.

CVS

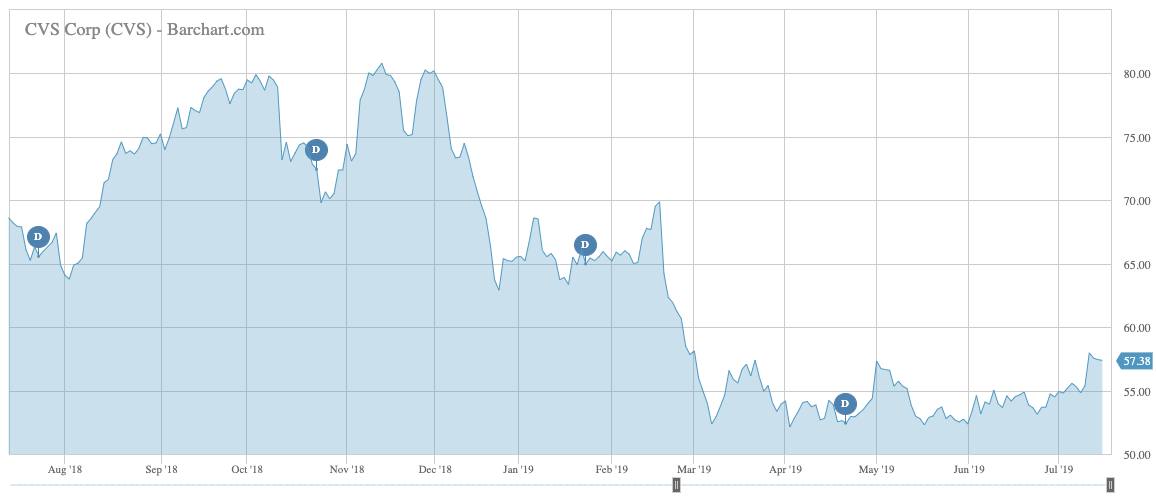

Pharmacy benefits manager CVS Health Corporation (CVS) has taken the first spot on the list with an increase in viewership of 58%, as the company was hit by a nationwide recall that could have a negative impact on its earnings and outlook. CVS recalled select over-the-counter eye drops and ointments sold at its CVS stores because they may not be sterile. The move came not long after it recalled drops of Walgreens and Walmart store-brand products, among others. The company said there was no registered injury related to the products, but warned about the potentially devastating health effects.

Although investor sentiment is particularly weak, CVS received a boost less than a week ago after the Trump Administration shelved plans that would eliminate the rebates drugmakers pay to benefit managers working with Medicare and Medicaid. Indeed, shares surged more than 8% on the news, although they’ve since lost some ground. The practice raised criticism across the political spectrum as pharmacy benefit managers seem to encourage drugmakers to raise prices. Because of its size, CVS can negotiate rebates with drugmakers, and as a result, it is hired by smaller healthcare providers to negotiate on their behalf.

Drugmakers have recently made a promise to delay price increases on their branded products, likely causing the government to stay still for a while. A White House spokesman said the decision was prompted by bipartisan legislation to control drug costs.

CVS shares have declined 12% since the beginning of the year, as a string of weak results and worries about the Aetna acquisition hampered sentiment. CVS will go ex-dividend on July 24, and the dividend will be paid on August 2. CVS has a payout ratio of nearly 30% and a dividend yield of 3.5%.

Philip Morris International

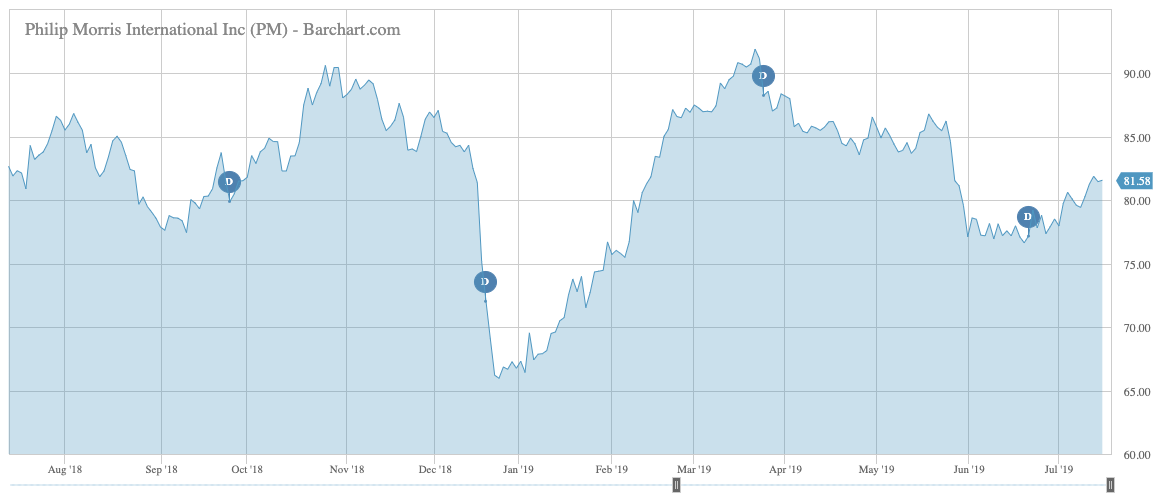

Philip Morris International (PM) has seen its traffic rise 33% as the cigarette-maker continues its charm offensive on ESG-oriented investors with smoke-free tobacco products. The company also recently received a boost from Goldman Sachs analysts, who claimed that tobacco stocks were undervalued relative to the broad market and other consumer discretionary stocks.

With its smoke-free product IQOS, Philip Morris aims to gradually move away to a more sustainable business model in the hope that investors managing trillions of dollars will consider buying the stock. Indeed, of its nearly $30 billion 2018 revenue, around 14% came from smoke-free products compared with just 0.2% three years prior. Philip Morris’ goal is to reach at least 38% of smoke-free sales by 2025.

Goldman Sachs noted recently that Philip Morris and other tobacco companies such as Altria (MO) trade at a deep discount considering their performance over the years. Indeed, while the company’s sales of traditional tobacco products have been in decline, Philip Morris has been one of the leaders in smoke-free products, a segment that has been growing quickly. At the same time, some of the regulatory hurdles have abated, although e-cigarettes continue to face scrutiny.

Philip Morris has a strong annual dividend yield of 5.60% on a payout ratio of more than 90%. Shares in the company have surged 21% since the start of the year.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

Procter & Gamble

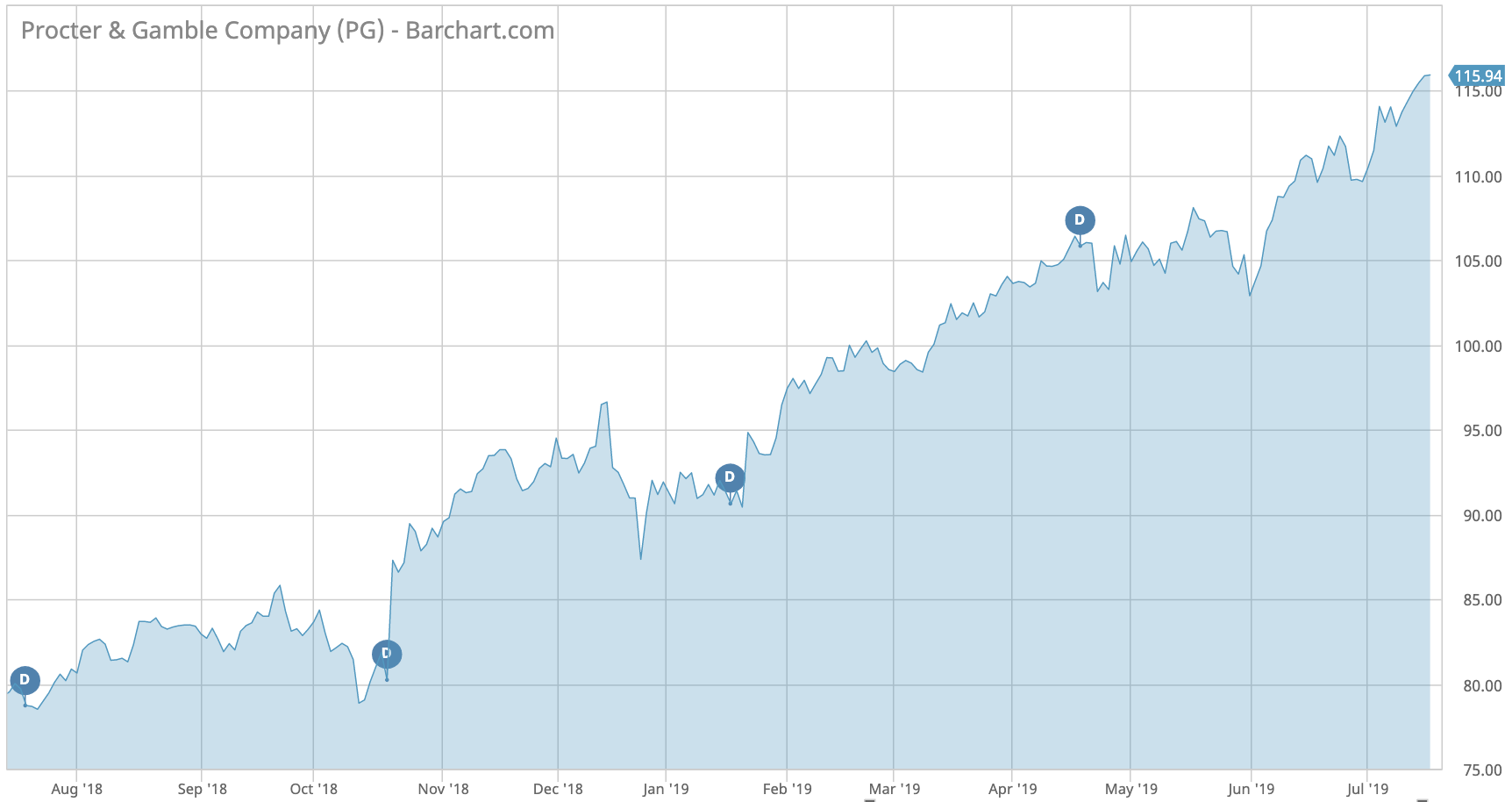

Procter & Gamble (PG) has seen its interest rise 30% as the company has been in the news with its latest product launch – a household insecticide that is safe for both people and pets.

With the launch of the Zevo brand, P&G is going after a market that has been dominated by S.C. Johnson’s Raid. The company hopes that the fact that its product is safe for people will allow it to gain market share, although it is likely to face a few challenges. For instance, shoppers typically buy their insecticides from home improvement retailers such as Home Depot and Lowe’s, where Raid has a strong positioning. P&G’s traditional products are typically sold in supermarkets such as Target and Walmart Stores.

Procter & Gamble is in a desperate search for its next source of growth after the launch of the Tide pods in 2012 were a great success. P&G was also plagued by complexity and bureaucracy in the decision-making process, something that attracted an activist investor in 2017. Sales have increased this year, thanks to price increases for a host of products and an internal reorganization. As a result, shares in the company have jumped 27% this year.

Procter & Gamble has a dividend yield of 2.6% and has been growing it for the past 62 years. The company pays out around 67% of its earnings to shareholders.

Check out our latest Best Dividend Stocks List here.

Advanced Micro Devices

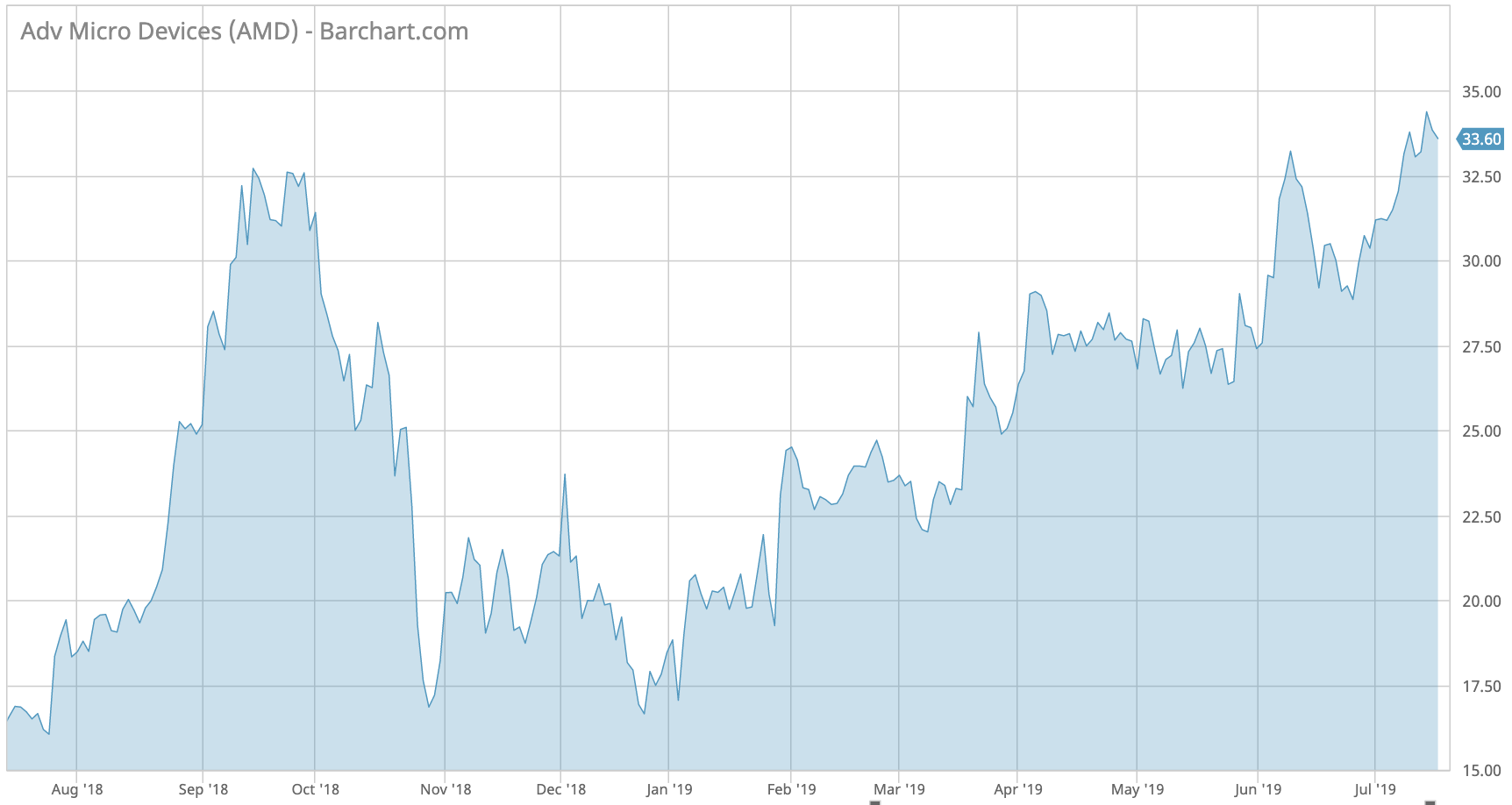

Advanced Micro Devices (AMD) has been on a tear this year, posting impressive stock gains as the company seems to eat into the market share of its competitors. The overall chip industry has faced tough times amid slowing demand and an ongoing trade war between the U.S. and China.

But the company’s stock is up 83% this year compared with 5% for its closest competitor Intel (INTC) and 30% for the iShares PHLX Semiconductor ETF (SOXX). The key reason for the outperformance is the more optimistic outlook it provided over its competitors. On July 30, the company will have to prove its optimistic estimates as it releases its second-quarter earnings.

AMD does not pay a dividend.

The Bottom Line

CVS Health received positive news from the government but negative from its business, as it struggles with the integration of its latest acquisition Aetna. Meanwhile, Philip Morris hopes trillions in ESG investor money will return after it launched its smoke-free charm offensive. Procter & Gamble is assaulting a new market in search of growth, while AMD posted a strong performance on the back of a better earnings outlook.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.