Dividend.com analyzes the search patterns of our visitors every two weeks. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

J.P.Morgan Chase has taken first position in the trends’ list this week, as the giant U.S. bank made headlines after it announced plans to shutter its app designed for Millennials. AbbVie, the healthcare company facing industry challenges, is in second place, after it acquired peer Allergan in a transformative deal. Two large banks close the list – Bank of America and Wells Fargo – as their capital allocation plan was approved by regulators.

Click here to see our previous edition of trends.

JPMorgan Closes Down App Catering to Millennials

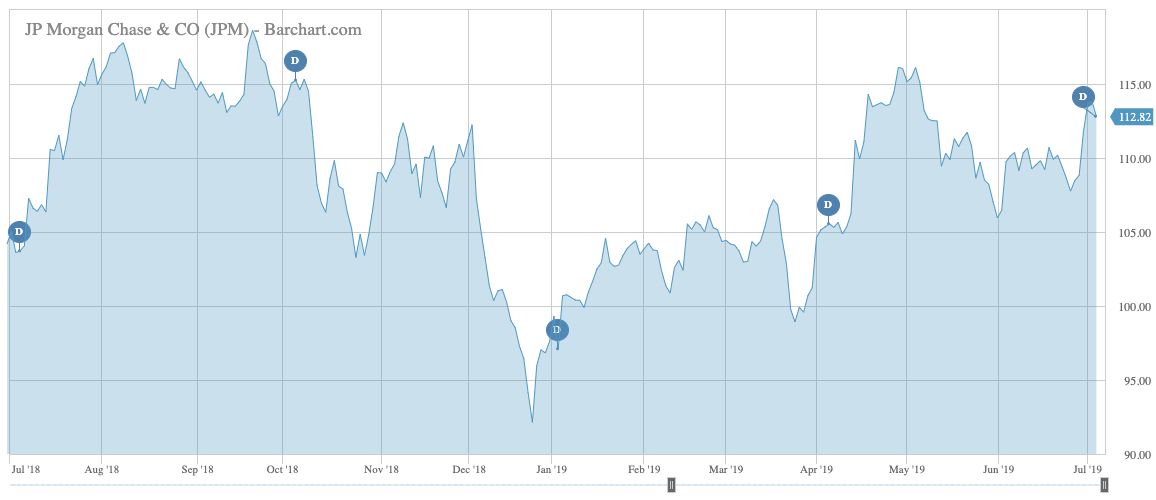

J.P.Morgan Chase (JPM ) has seen its traffic increase 77% these past two weeks, as investors digested the news that the company is closing its mobile banking app catering to Millennials. J.P.Morgan, one of the best-performing banks in the financial space, is shuttering Finn, the mobile banking app, after just one year. The company said Finn customers will move their accounts to the Chase mobile app, noting that already half of them were already its customers.

The bank said Millennials were already using its services heavily, and it does not need a tailored product to cater to them specifically. It said it integrated the most important features of Finn, including automatic rules to save money, into the existing Chase banking app. Yet the shuttering of Finn also underscores the troubles of traditional banks to compete with banking startups that are offering attractive incentives to customers, such as low red tape, high interest rates on deposits and zero-cost current accounts.

While devising ways to attract Millennials, J.P.Morgan is also betting on the old way of doing business. Last year, it announced plans to open around 400 physical stores across the U.S. just as other banks were winding down. One of the reasons for the move was the fact that many of its customers are still used to doing their banking needs in branches.

Shares in J.P.Morgan have advanced more than 6% over the past month, extending year-to-date gains to 16.5%. J.P.Morgan, which has a yield of 2.85%, started trading ex-dividend on July 3, and the payout will be disbursed on July 31.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

AbbVie Snatches Allergan in Search for Growth

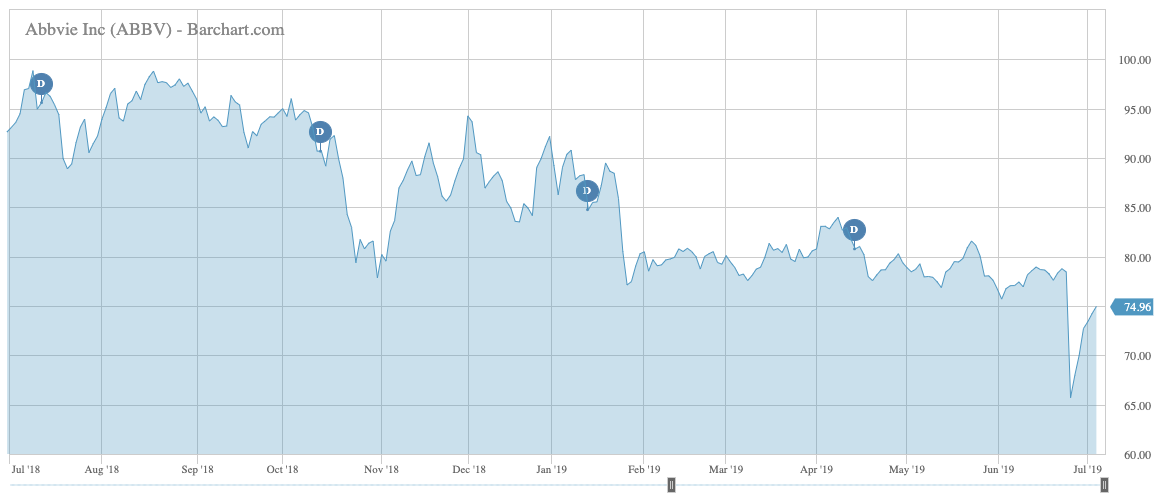

AbbVie (ABBV ) acquired Allergan for $63 billion in a desperate move for diversification away from its key drug Humira, triggering a rise in viewership of 46%. The deal came unexpectedly as few expected Allergan CEO Brent Saunders to sell the company, although he faced pressure from shareholders to improve performance. Many had instead bet on Allergan to break up.

While AbbVie touted the cash-and-stock deal as transformational and accretive to earnings per share, investors were rather skeptical, judged by the stock price performance. AbbVie shares dropped 15% on the news, although they recovered two-thirds of the lost ground and are now down 5% since the deal was announced.

The disappointing performance could be explained by the challenges both companies face in their sectors. Allergan’s chief drugs Botox and Restasis, both from which it derives the majority of its revenues, are expected to see increased competition, while AbbVie’s main drug Humira will soon see the end of its patent protection, opening it to competition from cheaper generic alternatives.

AbbVie has a dividend yield of 5.8% and its payout ratio is 55%. AbbVie will start trading ex-dividend on July 12 and its next quarterly dividend will be paid on August 15.

With AbbVie taking on additional debt of $38 billion to finance the transaction, the dividend may be at risk, particularly if the combination does not bring the touted benefits. What AbbVie needs to squash doubts is a new hit drug.

Bank of America Increases Dividend and Announces Buyback

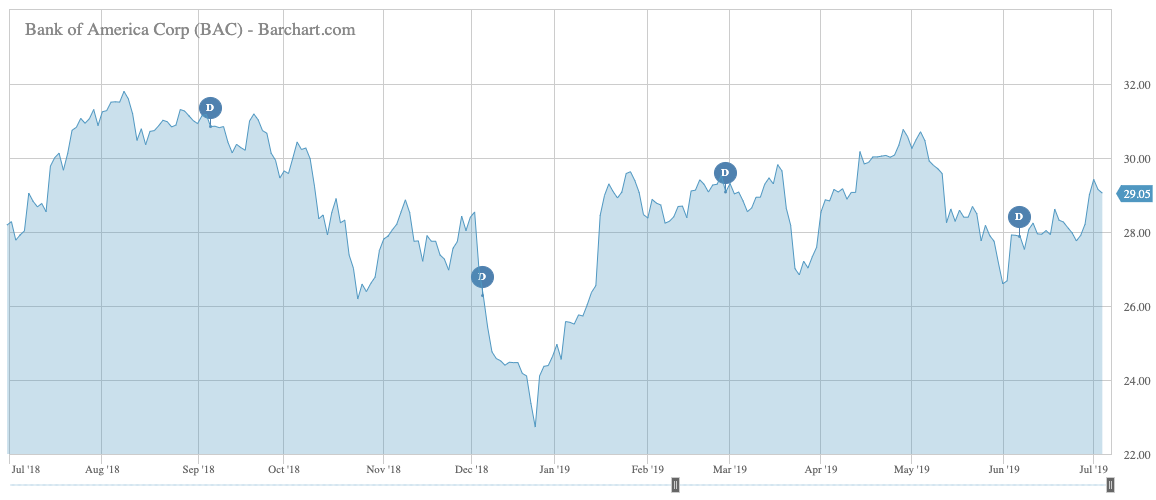

Bank of America (BAC ) has seen its viewership rise 28% over the past two weeks, as the company announced a large increase in its capital return program.

Bank of America, one of the world’s largest banks by assets, said the Federal Reserve approved a total return of $37 billion to shareholders over the next four quarters. The bank will buy back nearly $31 billion of its shares while it increases its dividend by 20%, saying it wants to “prudently” return to shareholders a portion of its excess capital above what it needs for investments to grow the bank.

Of the $87 billion in net income earned since 2015, the bank has returned as much as $62 billion to shareholders via dividends and share buybacks. Bank of America’s current dividend yield stands at more than 2% and its payout ratio is 23%. The bank has grown its dividend over the past five years.

Check out our latest list of the Best Dividend Stocks here.

Wells Fargo

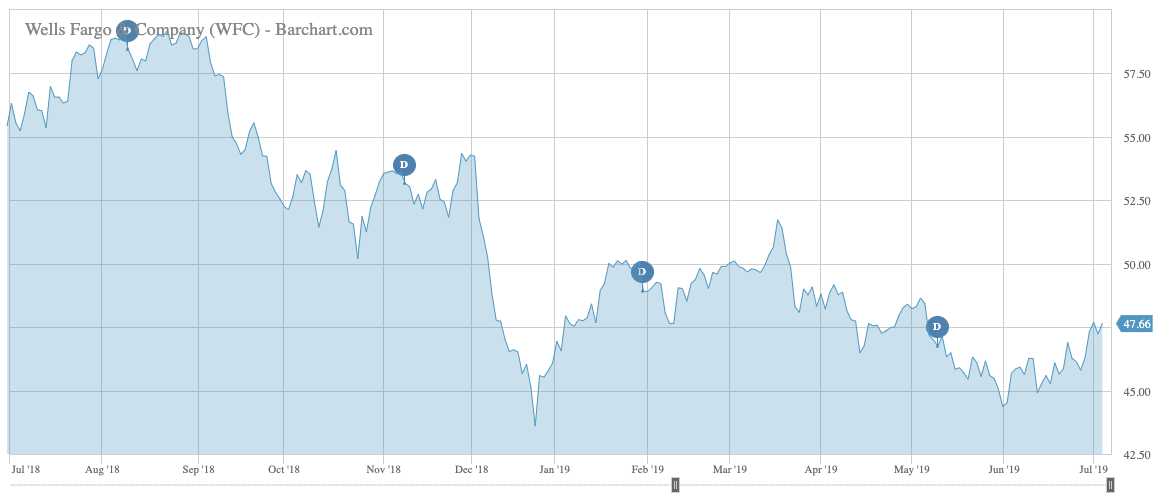

Wells Fargo (WFC ) took the last spot in the list with a rise in viewership of 25%. Similarly to Bank of America, Wells Fargo has also not received any objections to its capital plan for the next four quarters and the bank will now increase its third-quarter dividend to $0.51 per share from $0.45. At the same time, the bank will buy back $23.1 billion of its own shares.

Last month, Wells Fargo, which currently has a dividend yield of 3.8% on a payout ratio of 40%, agreed to pay customers $386 million for car insurance coverage that they did not want or need. The company did not admit wrongdoing but said it does not want to spend resources on litigation. It also seeks to rebuild trust after it has been hit by a series of scandals over how it treats its customers, including the creation of millions of fake accounts.

In addition, Wells Fargo needs to settle its many class action lawsuits before being able to expand given the restrictions imposed by the Federal Reserve in 2018.

The Bottom Line

This week was all about banks. Both Wells Fargo and Bank of America saw their capital allocation plans, which include dividends and share buybacks, greenlighted by the Federal Reserve. Meanwhile, J.P.Morgan Chase shuttered its app aimed at serving Millennials, although it said demand from the market category was strong. AbbVie also hit the headlines after announcing its transformative megadeal with Allergan.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.