Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Chipmaker Broadcom has seen the highest traffic by far these past two weeks after the company warned its revenues will take a hit from the U.S. ban on Chinese-based Huawei Technologies. Second in the list is New York Mortgage Trust, which recently declared a dividend. General Electric is finally benefiting from good news after years of troubles, while Main Street Capital, an investor in growth companies, closes the list.

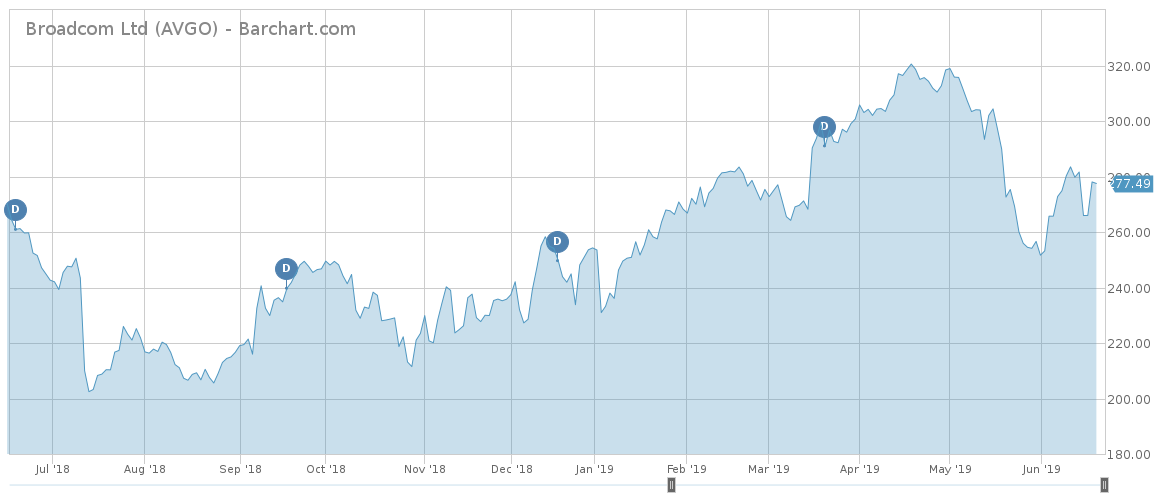

Broadcom

Broadcom (AVGO ) has seen its traffic rise 102% over the past two weeks, by far the most popular subject, after the giant semiconductor producer said its financial results will be negatively impacted by the U.S. ban on exports to Chinese-based Huawei. Broadcom said its revenue will be $2 billion lower as a result of the trade war between the U.S. and China, becoming one of the first large semiconductors to quantify the damage of the ongoing dispute between the two largest economies in the world.

In the previous fiscal year, Broadcom said around $900 million of revenues came from Huawei or around 4.3% of the total. The poor guidance also reflected bigger worries about other customers, many of which are fearful of placing additional orders until they have more visibility on trade.

Shares in Broadcom, which pays a dividend of 3.8%, declined as much as 8% on the news last Thursday but recovered much of the lost ground in the following days. The stock is still up nearly 10% this year, although it declined 12% since its all-time peak reached at the end of April.

The ban on Huawei exports has already hit a range of smaller chip companies, but Broadcom’s warning is the biggest so far in absolute terms. It remains to be seen what will be the impact on Intel (INTC ) and Qualcomm (QCOM ), which last year faced a hostile bid from Broadcom that was eventually foiled by the Trump administration on national security grounds.

Broadcom has been growing its dividend for the past nine years and its payout ratio is currently 59%. The next dividend will be paid July 2 for shareholders of record on June 24.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest DARS ratings are Dividend.com’s current recommendations to investors.

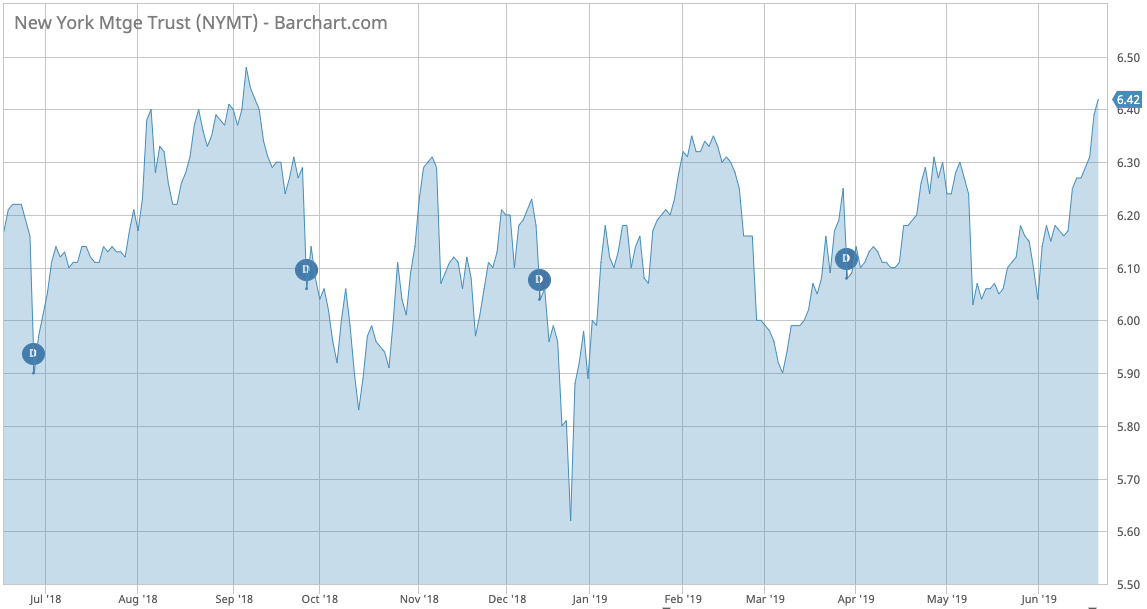

New York Mortgage Trust

New York Mortgage Trust (NYMT ) has seen its viewership advance as much as 39% over the past two weeks, in no small part due to the Federal Reserve’s decision on interest rates.

With an impressive dividend yield of 12.5%, New York Mortgage was further boosted after the central bank strongly signaled its next move would be to cut interest rates. The bank decided to keep its monetary policy unchanged but removed the word “patient” from its statement, a strong indication that a rate cut will come soon. At the same time, the decision to keep interest rates unchanged was not unanimous, with St. Louis Jim Bullard voting for a rate cut.

Mortgage REITs are highly sensitive to interest rates, performing very well in times of falling interest rates as home affordability is high. When interest rates rise, the performance of these instruments typically struggles.

The high dividend is due to the company’s investments in distressed mortgage residential loans as well as traditional mortgage-related investments that generate stable income.

Shares in New York Mortgage have risen more than 2% this week, extending year-to-date gains to nearly 7%. However, for the past five years, the stock remains down 21% as interest rates in the U.S. rose.

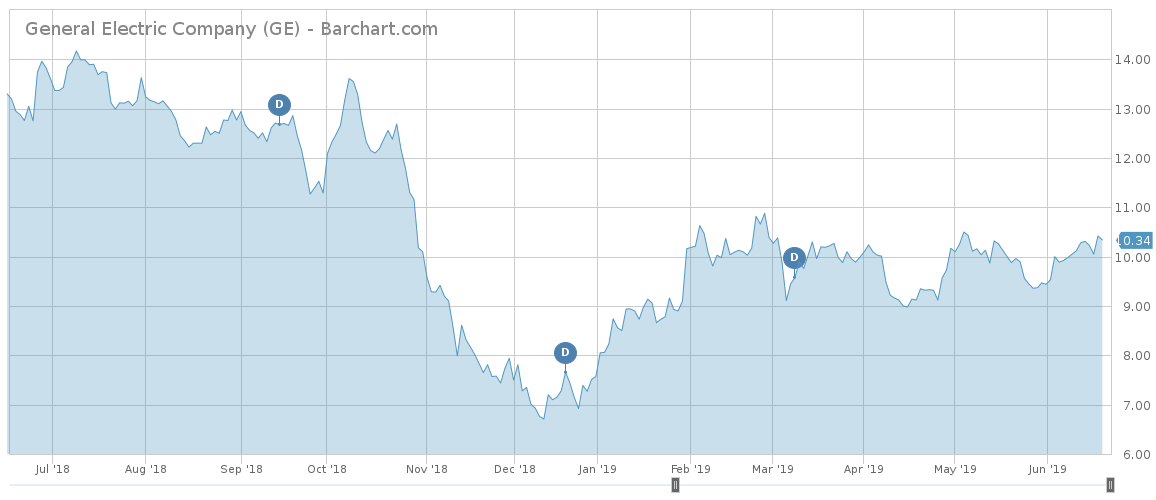

General Electric

General Electric (GE ) is third in the list this week with an advance in viewership of 34%, as the company’s stock has performed extremely well this year on the back of a successful transformation. Shares in GE have jumped 43% this year, beating the S&P 500 by as much as 25 percentage points. However, GE remains down 60% for the past two years, still a long way to a full recovery.

A large part of the transformation was thanks to its aviation business, which has been benefiting from strong demand. Secular tailwinds, as well as increasing market share, have boosted the aviation unit and the company’s overall results. This week alone, GE’s joint venture with Safran, CFM International, won a $20 billion order for jet engines from Indian carrier IndiGo.

To fix its business, GE has been selling off assets in a bid to become more focused and nimble, particularly as investors seem to undervalue conglomerates. The turbine manufacturing business is believed to be the most troubled, while the aerospace unit is the strongest.

Due to its troubles, the company was forced to cut its dividend to a meager 0.4% annual yield. Its payout ratio currently stands at 4.2%.

Check out our latest list of the Best Dividend Stocks here.

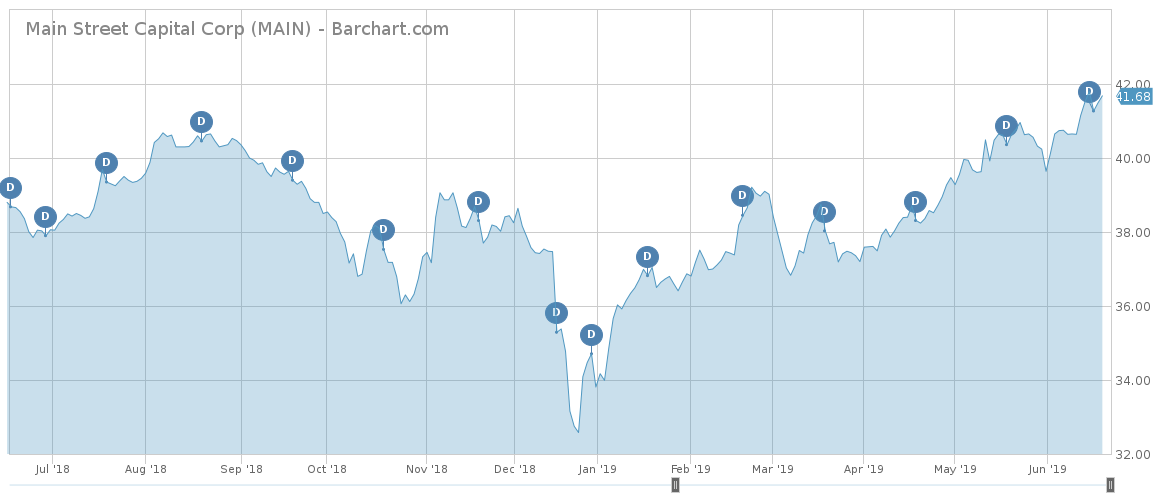

Main Street Capital

Main Street Capital, (MAIN ), a holding firm that invests in small growth companies across a range of industries, has seen its viewership increase 33% for the past two weeks. Main Street pays an annual dividend of $2.46 per share and has grown it for the past eight years. Holding Main Street stock will yield nearly 6% on a payout ratio of 97%.

Earlier this month, Main Street completed a new portfolio investment to facilitate the management buyout of Trantech Radiator Products, a manufacturer of cooling products and transformer radiators. In partnership with Trantech’s senior management, Main Street funded a $15. 1 million in a combination of senior secured debt and equity.

Shares in Main Street have advanced 23% since the start of the year.

The Bottom Line

Broadcom faces pressure on its top and bottom lines after the U.S. government banned sales of equipment to China-based Huawei. New York Mortgage Trust has benefitted from a dovish Federal Reserve, which is likely to cut interest rates soon. General Electric has been lifted by its thriving aviation business, while Main Street Capital recently made a new investment.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.