Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Starbucks has made the headlines in recent weeks as the coffee house chain seems to be losing some of its shine. The company has taken the first position in the list and is followed by telecommunications giant AT&T, which is on track to combine with Time Warner in a blockbuster vertical merger. Royal Dutch Shell is third on the list as the oil major is continuing its asset disposal program, while Realty Income closes the list.

Starbucks Worries Rising

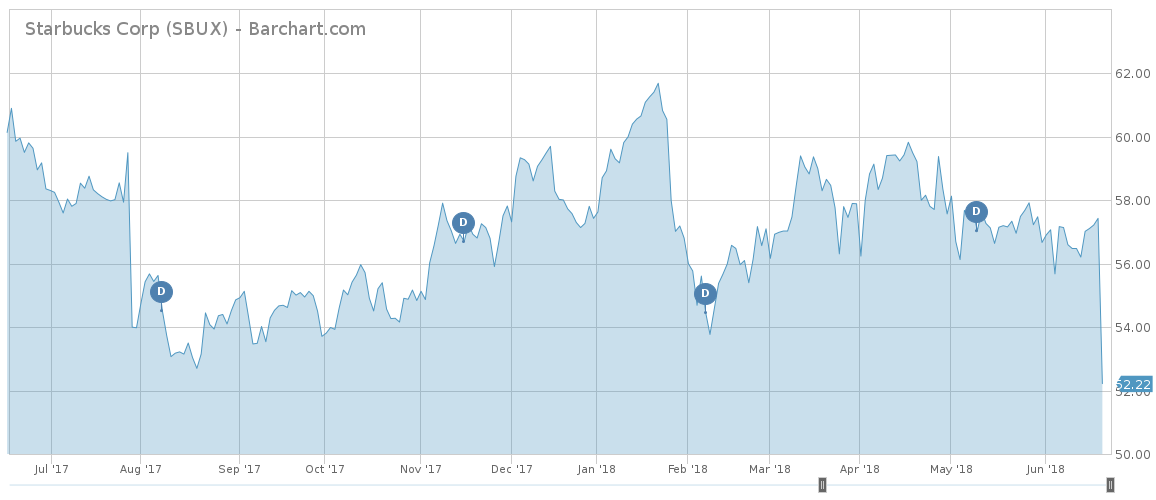

Coffee chain Starbucks (SBUX ) has disappointed investors with a weak comparable sales guidance, raising questions about whether the company is losing its glory.

Starbucks, a cash cow that yields an annual dividend of 2.77%, has seen its traffic rise as much as 35% this week. In a single day on Wednesday, Starbucks dropped as much as 8% after the firm said that its global comparable sales for the third quarter will not rise more than 1%, citing a weaker-than-expected home market and slowing growth in China, where it traditionally grew by 4%. Indeed, due to a weakening home market, the firm plans to close 150 stores, which is about 100 more than in a typical year.

That hardly means a retreat given that Starbucks has 17,000 stores in the Americas, around half of which are company-owned. Starbucks will most likely shut coffee shops in regions where it overextended. An alarming development, however, is the fact that sales of frappuccinos are dropping, as customers seek healthier alternatives. As a result, the firm is complementing its offering with other products, including teas and food.

The company said that the main reason for disappointing sales was low traffic in the afternoon. As such, Starbucks launched a promotional campaign advertising its stores as a good afternoon hop. Still, the legendary coffee chain faces increasing competition from boutique coffee shops, which offer customers a varied alternative.

AT&T Allowed to Proceed with Blockbuster Time Warner Deal

U.S. telecommunications company AT&T (T ) has emerged victorious against the U.S. Department of Justice in a court battle and will be allowed to proceed with a blockbuster buyout of Time Warner (T ), the content creator that owns TV networks HBO and CNN. The victory has hardly helped AT&T’s stock, however, which is down more than 17% since the beginning of the year as investors fret that the merger might put pressure on the group’s capacity to service its debt.

The cash and stock deal, which values Time Warner at $85.4 billion or $107.50 per share, was first announced in October 2017. Typically, the government allows vertical mergers such as this one to proceed, but in this case, it had sought asset sales from either AT&T or Time Warner.

The companies disagreed with the DoJ’s assessment and headed to court. Now the government might decide to ask a higher court to issue a stay of the ruling, although the judge recommended against such a move.

The ruling has the potential to trigger a wave of M&A in the media sector, which feels the threat from deep-pocketed technology insurgents Netflix (NFLX) and Amazon (AMZN). Shortly after the ruling, Comcast (CMCSA ) challenged Walt Disney’s (DIS ) takeover of Twenty-First Century Fox (FOX ). The battle is likely to continue with further rounds of counter offers.

The marriage between AT&T and Time Warner is a combination between a content creator and a distributor, potentially leading to synergies and a better competitive positioning for the industry incumbents.

Royal Dutch Shell Sells Norwegian Fields in Downsizing Effort

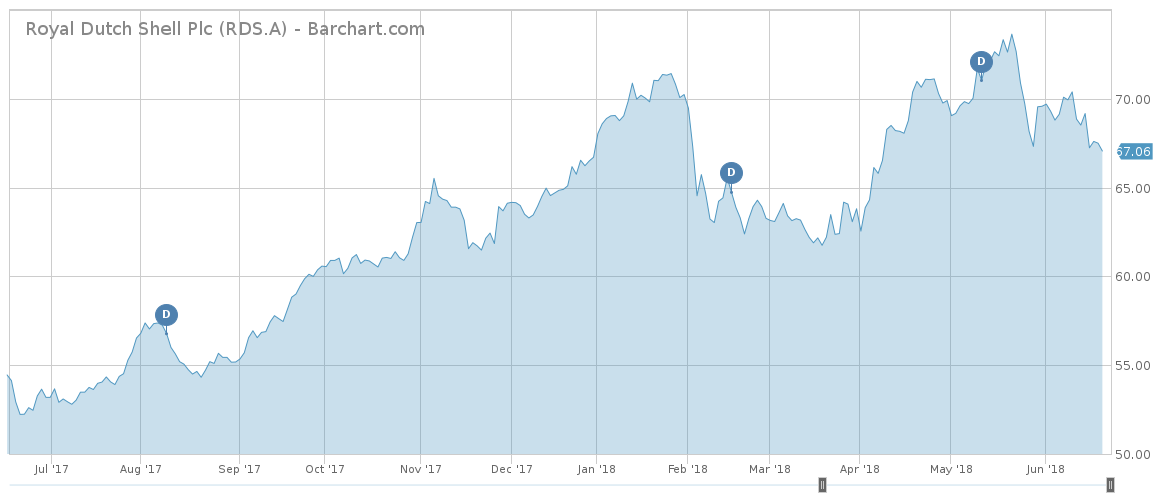

Royal Dutch Shell (RDS-A ) is continuing its downsizing efforts, announcing some asset sales at its Norwegian unit.

RDS has seen its traffic surge 24% this week, as the stock price performed woefully of late. Shares in RDS have dropped more than 3% this week, extending monthly losses to as much as 9%, due to falling oil prices as a potential OPEC agreement to increase supplies is likely. Year-to-date, however, the stock remains up less than 1%.

On the micro level, the company is making progress with its effort to divest $30 billion in assets from the acquisition of BG Group around two years ago. The company agreed to sell two fields in Norway worth around $550 million to private equity-backed firm Okea, which is focused on the region. Despite the asset sale, the company said that it will remain committed to the country and plans to drill two exploration wells in the Norwegian continental shelf later this year.

Realty Income

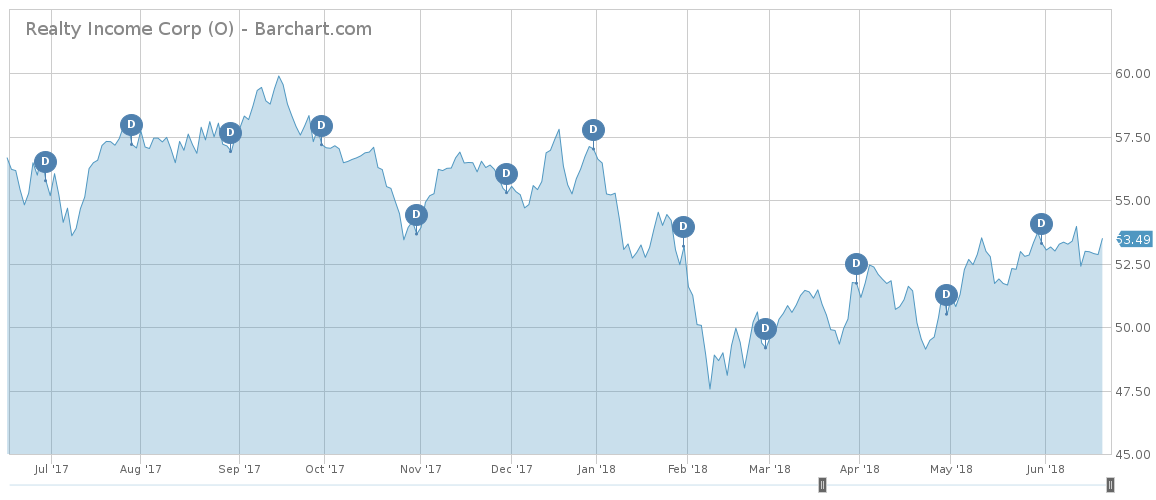

Realty Income (O ), a real estate investment firm largely present in the commercial sector of the United States and Puerto Rico, has taken the fourth spot in the list with a rise in viewership of 18%. Realty Income is providing a strong dividend yield of nearly 5% and is attractive for income investors.

However, rising interest rates are expected to put pressure on the stock, as investors will increasingly switch to safer securities, including government bonds. In addition, the company’s cost of servicing its debt will rise, although the firm aims to finance its operations chiefly by issuing stock. Still, the company’s long-term debt is currently $5.5 billion.

Shares in Realty Income have increased by around 1% in the past five days, extending year-to-date gains to as much as 6%.

The Bottom Line

Disappointing growth guidance provided by coffee chain Starbucks has hit the company’s stock hard. Now, the firm hopes that some of its marketing initiatives will help return the firm to healthy growth levels. Meanwhile, AT&T has won a court battle against the U.S. government to clinch a deal with Time Warner. Royal Dutch Shell has sold some Norwegian assets as part of its ambitious plan to downsize. Realty Income provides a strong dividend yield but rising interest rates present a danger.