Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

U.S. stocks lost momentum this week, as market participants steered clear of riskier bets ahead of Donald Trump’s inauguration. A couple of big names were on the radar, as investors sifted through popular brands and strong dividend stocks at a time of great uncertainty in the global financial markets.

To compare this week’s trend with our previous edition, visit Trending: PepsiCo, a Dividend Giant; Cisco Stock Trades Ex-Dividend.

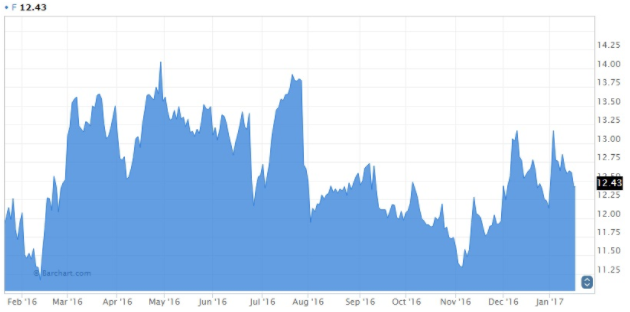

Ford’s Billion-Dollar Special Dividend Resonates With Investors

Exactly one year after announcing a $1 billion special dividend, Ford Motor Co. (F ) tops this week’s list with a 36% rise in traffic. The Big Three automaker went ex-dividend on Wednesday, piquing investors’ interest a time when the company is taking a big leap into the mobility market. To find out Ford’s next ex-dividend date, use our Ex-Dividend Date Search tool.

CEO Mark Fields aims to make Ford into North America’s leader in mobility, connectivity and autonomous driving, having only recently announced a partnership with Amazon.com, Inc. (AMZN). This new partnership will allow Ford SYNC 3 drivers to access Alexa, Amazon’s cloud-based voice service.

Ford ended 2016 on a high note, with sales of the popular F-Series truck reaching 88,000 in December. That was the best month for the F-Series in 11 years. The company’s Lincoln luxury brand also quietly posted its strongest annual growth total since 2007.

To learn more about Ford’s dividend history, click here.

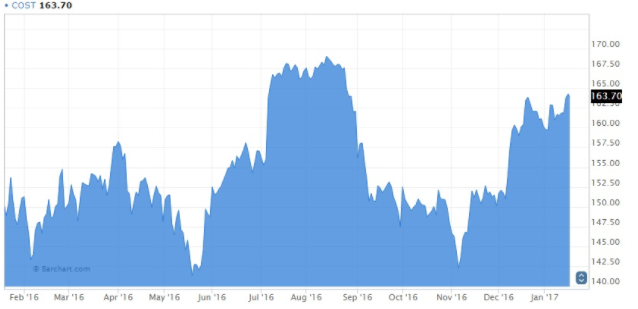

Costco Wholesale Offers Glimmer of Hope for Slumping Retail Sector

Costco Wholesale Corporation (COST ) has emerged as one of investors’ favorite retailers, and for that reason saw its viewership rise 31% during the week. This comes despite a lackluster 2016, where COST shares just barely fell below the break-even point.

At a time when retail chains are closing down underperforming locations, COST has struck a happy medium with its 723 stores. This gives the company plenty of room to scale up strategically not just in the U.S., but internationally. In fiscal 2017, the retailer will open 31 stores – 16 in the U.S. and the rest in Canada, Taiwan, South Korea and elsewhere.

COST shares have outpaced the S&P 500 Index in January and are diverging from the slumping retail sector. The SPDR S&P Retail ETF (XRT) has declined more than 1% since the start of the year and has fallen off nearly 7% over the past month.

Investors on the Prowl for Top Dividend Plays

At a time of great uncertainty, investors are looking to fill their portfolios with historically strong dividend growers. This was reflected in the 27% rise in traffic for best dividend stocks. Dividend.com Premium users can view the top-20 dividend performers based on our proprietary Dividend Advantage Rating System (DARS). To view the full list, sign up for a free 14-day trial for Dividend.com Premium.

Investors’ appetite for consistent dividend payers comes ahead of what’s expected to be a tumultuous year for the global economy. A political transition in the U.S., Brexit negotiations in the U.K. and a spate of high-stakes elections in Europe will dominate the headlines for the foreseeable future.

Dividend plays are also on the radar due to the Q4 earnings season, which is currently under way. For the latest earnings news and analysis, subscribe to our free newsletter.

Investors Are Asking, "Who Owns the World's Most Popular Brands?"

Corporations with a significant presence in key industries offer investors a lot of advantages in the current economic climate. Market participants searching for the most prominent companies to invest in stumbled upon Companies That Own the World’s Most Popular Brands, a 2014 article that takes No. 4 on our weekly list with a 25% rise in viewership.

During the corporate earnings season, understanding who owns what can provide valuable insight into portfolio building. As the article clearly demonstrates, there’s a lot of brand power behind stocks such as (UL ), (PEP ), (PG ) and (KRFT). To learn more about these companies and their respective industries, review our Dividend Stock Screener, which allows you to evaluate companies based on sector, market cap and share type.

The Final Word

This week’s themes demonstrated that investors are revisiting their portfolios in anticipation of Donald Trump’s presidential inauguration. Trump’s campaign promises of faster economic growth via fiscal stimulus, corporate tax cuts and deregulation will be put to the test after he is officially sworn in as President on January 20. For the latest on dividend investment strategies, including how to prepare for the year ahead, check out our Dividend Investing Ideas Center.