Growth of Global Defense Spending Helps Lockheed’s Earnings and Dividends Take Flight

Several years ago, there was great concern over the U.S. defense industry – including industry giant Lockheed Martin (LMT ) – because sequestration had triggered budget cuts to defense spending. Indeed, Lockheed generates approximately 78% of its total revenue from the U.S. government, either as a prime contractor or a subcontractor. But the resilience of the defense industry has surprised analysts because through this difficult period, the entire industry has performed extremely well.

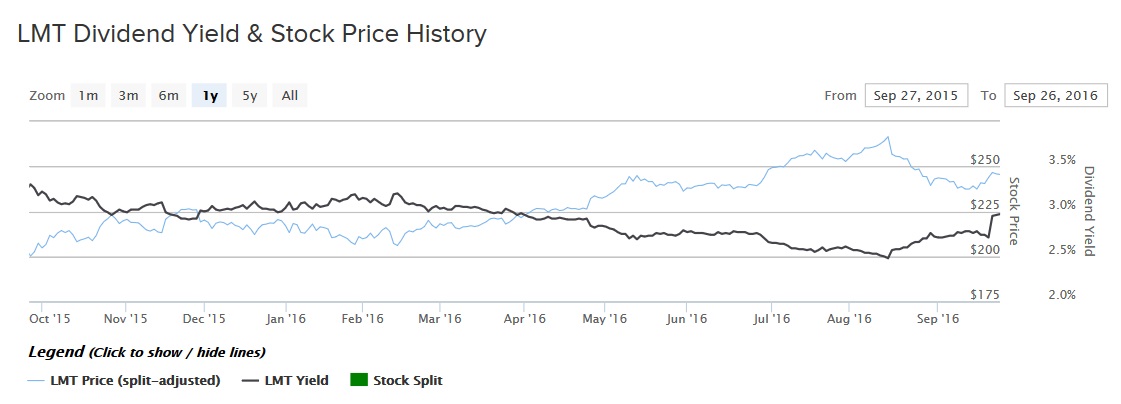

Lockheed’s stock has returned 242% in the past five years. This means investors who bought in 2011 have more than tripled their investment in that time, and that doesn’t even include dividends.

On Sep. 26, the company simultaneously announced a dividend increase and a share repurchase authorization. First, Lockheed declared a new quarterly dividend of $1.82 per share, payable Dec. 30 to shareholders of record on Dec. 1. This represents a 10% increase from the previous dividend rate. The forward annualized dividend rate rises to $7.28 per share, which represents a forward dividend yield of 3%, based on Lockheed Martin’s Sep. 26 closing price of $245.53 per share.

Second, the company approved a new $2 billion addition to its share buyback, which brings the amount of money left in the current share repurchase plan to $4.3 billion.

Strong Business Fundamentals

In addition to Lockheed, other defense contractors have also done extremely well. As the old saying goes, “a rising tide lifts all boats,” and many other defense companies have enjoyed rising profits and have rewarded shareholders with growing dividends and share buybacks. For example, General Dynamics (GD ) stock has returned 156% in the past five years. In March 2016, General Dynamics raised its dividend by 10% and approved a new 10 million share repurchase program, which can be read about here.

The reason for the massive outperformance of the defense stocks is largely because U.S. defense spending did not fall as much as feared and international defense spending continued to rise. While nearly 80% of Lockheed’s total revenue is dependent on the U.S. government, 21% of that business comes from international defense spending as subcontracting. Geopolitical concerns are always present across many parts of the world, and this will likely remain so for the foreseeable future.

In addition, Lockheed has seen great success from its flagship F-35 fighter program, Lockheed’s largest individual program, which by itself represents 20% of its total annual revenue. This program plus others have collectively propelled Lockheed’s impressive financial performance. For example, Lockheed’s diluted earnings per share rose 26% over the past three years.

With such strong earnings growth over a prolonged period, Lockheed is able to return lots of cash to shareholders. One way it does this is by aggressively raising its dividend each year.

Dividend Growth

Lockheed Martin has demonstrated a remarkable track record of high dividend growth rates. The recent dividend increase was the 14th consecutive year that the company increased its quarterly dividend rate by 10% or more. Such a long record of double-digit dividend growth each year is an indication of the strength of Lockheed’s business model.

Lockheed has proven itself to be one of the most impressive dividend stocks in the entire market.

The new annualized dividend of $7.28 per share represents approximately 61% of projected 2016 earnings per share and 54% of projected 2017 earnings per share. These are still healthy payout ratios, especially since Lockheed’s earnings are likely to continue growing, and the company generates huge levels of free cash flow. Last year, Lockheed generated $5.1 billion of operating cash flow and required just $939 million in capital expenditures to sustain the business. That resulted in $4.1 billion of free cash flow for the year.

Future Growth Catalysts

Analysts on average expect Lockheed Martin will earn $13.61 per share in 2017. Analysts forecast the company will achieve 15% earnings growth next year.

Future growth will be supplemented by growth in new markets, primarily achieved through acquisition. For example, Lockheed acquired the Sikorsky Aircraft business from United Technologies (UTX ) for $9 billion.

Lockheed Martin expects the deal will be accretive to annual earnings per share because there are expected cost synergies. The purchase will help Lockheed capitalize on global defense spending even more in the future, because more than 50% of Sikorsky’s annual sales are derived from international markets.

Lockheed ended 2015 with a $99.6 billion project backlog. Its backlog rose 23% in the past five years. This is a significant tailwind for future earnings growth.

The Bottom Line

Lockheed Martin has a very strong business model and generates massive amounts of free cash flow. With its free cash flow, the company rewards shareholders with rising dividends and share buybacks. This makes it an ideal holding for dividend growth investors.