Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, visitors have been on the lookout for solid dividend yielding companies with good fundamentals, but they were also drawn to the post-Brexit drama unfolding in the banking sector. Retailer Costco Wholesale (COST ) and chipmaker Intel (INTC ) have posted strong performance for various reasons lately, while financials’ Barclays (BCS ) and Blackstone Group (BX ) have been pummeled. In the middle of our top, there is a high dividend-yield leveraged ETF fund, ETRACS Monthly Pay 2XLeveraged Mortgage REIT (MORL).

Costco: Bucking the Trend

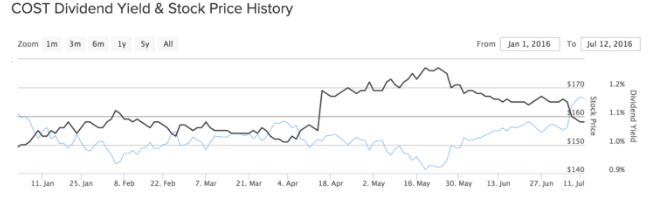

Costco Wholesale has attracted 111% more viewers during the past week compared to the same period a week ago, as the company continued its ascent. The retail firm rose 1.1% over the last week until Friday, extending year-to-date performance to 3.4%.

What has driven traffic to the stock was a report that said sales increased 3% in June compared to the same period a year ago, to $11.33 billion. For the 44 weeks ending July 3, the company posted a 2% rise in sales, despite an overall choppy retail market. The news has been cheered by investors, who were worrying the firm’s sales trend had started to deteriorate. The June report put those concerns at bay, at least temporarily. The firm has been growing sales at a pace of 6-7% for years, but this year it will most likely report a slowdown in growth – although its performance compared to its peers has been strong.

Moreover, the firm said that the U.K. market has been very strong in June. Given that Britain elected to exit the European Union, going forward this market could not perform as well, putting additional strain on the company’s results. The abrupt decline in the British pound will surely prove to be another headwind. To Costco’s advantage, Britain is a relatively small market, and improving conditions at home and in Canada could more than offset Britain’s possible decline.

Barclays: BoE Helps…For Now

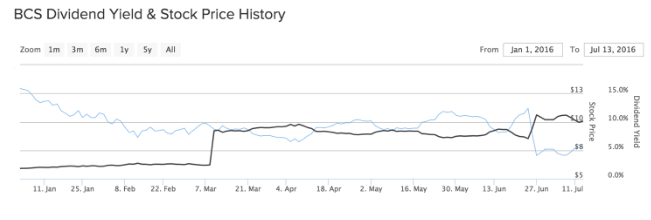

Barclays, together with many other banking stocks, has been volatile lately, with the direction being mostly down. The banking sector’s resurfacing woes following the Brexit debacle attracted 84% more visitors this week compared to the week-ago period. The company’s stock has staged a recovery this week, rising nearly 8%, and cutting year-to-date losses to 38%, following the Bank of England’s decision to hold interest rates still. Since Brexit however, the stock has fallen 26%.

The consistent drop has not been all negative for investors, particularly for those considering investing now. The dividend yield has increased as a result of the debacle to 9.83% annually, representing one of the highest payouts among its peers, which on average yield 5.36%.

Barclays has been one of the worst performers among Britain’s banks in the aftermath of the Brexit vote because of its heavy exposure to the island. A recession will dent the company’s results, as well as cause a decrease in interest rates. The Bank of England did not reduce its benchmark rate at the meeting this Thursday, but signaled stimulus was on its way at the next meeting in August. Although it is still unclear what measures the BoE will take, a cut in interest rates is highly probable – a move expected to reduce Barclays’ profits from loans.

Intel: Reversing Failed Venture

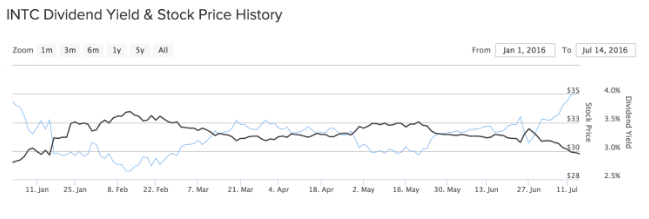

Legendary technology company Intel has seen its traffic rise 80% this past week compared to last, taking the third spot in our list. The chipmaker has risen over 5% since last Thursday on rumors that it is looking into selling its security business. The advance has helped the stock bring year-to-date performance into positive territory, up 2.2%.

McAfee’s antivirus software was acquired in 2010 for $7.7 billion as part of a push into cybersecurity. However, the integration of the business has largely failed, despite solid sales growth of 12% in the most recent quarter. Margins at the business remain much lower than at its legacy chip business. Private equity firms, such as Thoma Bravo and Permira, have expressed interest in the unit; although people familiar with the matter say Intel may choose to keep the business, according to a Bloomberg report.

If a sale takes place, the firm will likely fail to take more than it had paid for the unit, according to analysts. This is due to the fact that McAfee mostly sells antivirus programs for desktop computers, a declining industry.

Intel currently pays a dividend yield of 2.95% on an annual basis, lower than 4.2% of technology average.

ETRACS Monthly Pay 2XLeveraged Mortgage REIT

ETRACS Monthly Pay 2XLeveraged Mortgage REIT, a leveraged exchange-traded fund tracking an index composed of a bunch of real estate companies, has seen its viewership jump 57% this past week compared to the week-ago period. The REIT ETF has a quarter of exposure to Annaly Capital Management (NLY ) and American Capital Agency (AGNC ), and is up 9.5% since the beginning of the year. Over the past five days however, it dropped 2.1%.

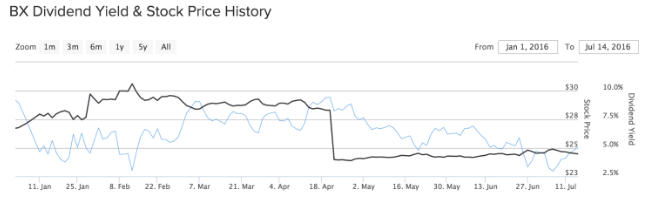

Blackstone Group

Blackstone Group has seen 57% more visitors last week, taking the same fourth place in our list as ETRACS Monthly. Blackstone, which pays an annual dividend yield of 4.5%, has been hit lately along with other financial firms, falling 14% year-to-date. Since last Thursday, the stock has risen 3.4%.

This week’s rise in the stock has been in tandem with the S&P 500, which reached record highs on Thursday, likely boosting many of Blackstone’s portfolio assets and increasing the likelihood of a pickup in deal-making. Last quarter’s results were heavily impacted by the market fallout at the beginning of the year. Next quarter, however, Blackstone’s results could be much more upbeat on the back of returning market optimism.

The Bottom Line

Costco’s June sales growth gave investors reasons for optimism amid a tough retail environment. Barclays, at the same time, has been boosted by the Bank of England’s postponement of a rate decrease, while Blackstone has benefitted from the U.S. stock markets hitting record highs on Thursday. Meanwhile, technology company Intel pleasantly surprised investors by looking into selling its security business and leveraged ETRACS Monthly REIT attracted visitors for its rock-star dividend yield of over 20%.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.