The analysts here at Dividend.com analyzed the search patterns of visitors to our site during the past week ending October 30, 2015. Below we give an analysis of how intelligently users used Dividend.com to help them in their investment decision-making process.

Kinder Morgan: How Not to Value the Company

We at Dividend.com have always seen an unusually high interest in the Kinder Morgan (KMI ) ticker page. But last week after the company pumped up their dividend by 16%, traffic to its ticker page jumped up 45%.

In today’s trends article we’ve provided a peer analysis of KMI’s two main competitors: Williams Companies Inc. (WMB ) and Enterprise Products Partners L.P. (EPD ).

| Ticker | Company Name | Share Price | Market Capitalization (in bn USD) | P/E | Revenue (in bn USD) | Net Profit (in bn USD) | Dividend | Dividend Yield % |

|---|---|---|---|---|---|---|---|---|

| (KMI ) | Kinder Morgan | 27.28 | $60 | 52 | $16.20 | $2.40 | 1.74 | 7.35 |

| (WMB ) | Williams Companies | 28.57 | $28.90 | 14.12 | $7.60 | $2.30 | 1.4 | 6.68 |

| (EPD ) | Enterprise Products Partners | 27.21 | $54.50 | 20 | $47.90 | $2.80 | 1.45 | 5.77 |

Compared to its competitors, Kinder Morgan looks rather expensive with a P/E of 52. P/E valuation is the first thing that comes to a retail investor’s mind when he or she tries to value a company. However, one cannot value Kinder Morgan using such a valuation; one of the drawbacks of that model is that it cannot be applied to asset-intensive businesses like oil and gas transportation or exploration.

In the 12-month period ending December 31, 2014, KMI had more than $2 billion of depreciation and amortization expenses. The cash flow from operations, or CFO, adds back the depreciation and amortization since it’s considered a noncash expense. Hence a P/CFO per share comparison of KMI with WMB and EPD would be a much more accurate valuation method.

| Ticker | CFO (in mn USD) | Price | Shares Outstanding (mn) | P/CFO per Share (in mn USD) |

|---|---|---|---|---|

| (KMI ) | $4,467 | 22.27 | 2,125 | 22.27/(4,467/2,125) = 10.60 |

| (WMB ) | $2,115 | 38.51 | 747 | 38.51/(2,115/747) = 13.60 |

| (EPD ) | $4,162 | 27.35 | 1,941 | 27.35/(4,162/1,941) = 12.78 |

KMI’s P/CFO per share looks attractive considering it gives $2.4 billion in profit with just 33% of EPD’s sales and the fact that its dividend yield is higher than both its major competitors.

For more detail on KMI and how its business model is defensive in nature, read our analysis of its most recent dividend increase of 16%.

Apple Inc.

Apple (AAPL ) was trending this week on Dividend.com as the company made an earnings announcement.

Following is a quick-hit dividend forecast and a forward P/E valuation of Apple.

| Fiscal Year End | *Consensus EPS Forecast (compiled with 20 analyst estimates) | Estimated Payout Ratio | Dividend per Share | Forward P/E |

|---|---|---|---|---|

| Sep. 2016 | 9.81 | 23% | $2.28 | 12.23 |

| Sep. 2017 | 10.58 | 23% | $2.50 | 11.34 |

Consensus EPS forecast from NASDAQ.

Ford

Ford (F ) went ex-dividend on Wednesday, October 28, along with Morgan Stanley (MS ), Texas Instruments (TXN ) and ConAgra Foods (CAG ).

In this article you will find a complete history of Ford: its annual net income, acquisitions, dividends and the best and the worst trading day ever.

Microsoft

Tech giant Microsoft (MSFT ) was also trending this week. Not only does MSFT pay a quarterly dividend of 36 cents, but the company seems to be sitting in a uniquely strange, but advantageous, situation.

Watching the situation unfold from the cheap seats, Microsoft seems to be relishing the role of playing third fiddle, diligently getting its ducks in a row, while its technological peers, Apple and Google (GOOG) (now Alphabet), engage in a very expensive war for supremacy.

Microsoft’s new Surface book, coupled with the launch of Windows 10, was a quiet shot fired over the bow of Apple — we say “quiet” in the sense that Apple may be far too mired in its war with Alphabet to realize the enormity of Microsoft’s newest release. Both products were met with great fanfare, prompting Time to refer to the new Microsoft machine as the Gorgeous New MacBook Killer.

Further, Microsoft’s quarterly earnings were a sparkling surprise, likely padded by the money saved on salaries from laying off 7,800 employees — another sign that Microsoft is remaining diligent while Google and Apple distract each other.

Last, but certainly not least, we believe the company trended largely due to its value. MSFT’s opening price on October 1 was $44.75. At the time of writing (October 30), its stock is sitting at $53.30. That’s a very healthy 19% jump for anyone who bought in early. On the topic of value, for the price of one $711 share in GOOG — which doesn’t pay a dividend — you can buy 13 shares in Microsoft while collecting dividends. Compared with Apple, Microsoft is a half-price sale.

Gilead Sciences

We added this stock to our Best Dividend Stock list a few months ago dues to its tremendous estimated growth in earnings potential, huge cash on its balance sheet for dividend payouts and a valuation that looks extremely attractive.

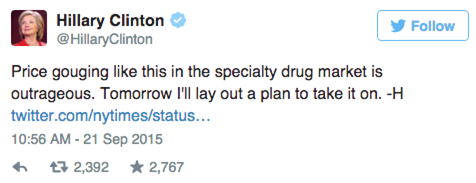

The Gilead Sciences (GILD ) ticker page saw a notable increase as the biotech giant released earnings last week that grew more than 60%. In the recent market turmoil amidst a tweet by Hillary Clinton that smashed the biotech industry this stock firmly stood its ground.

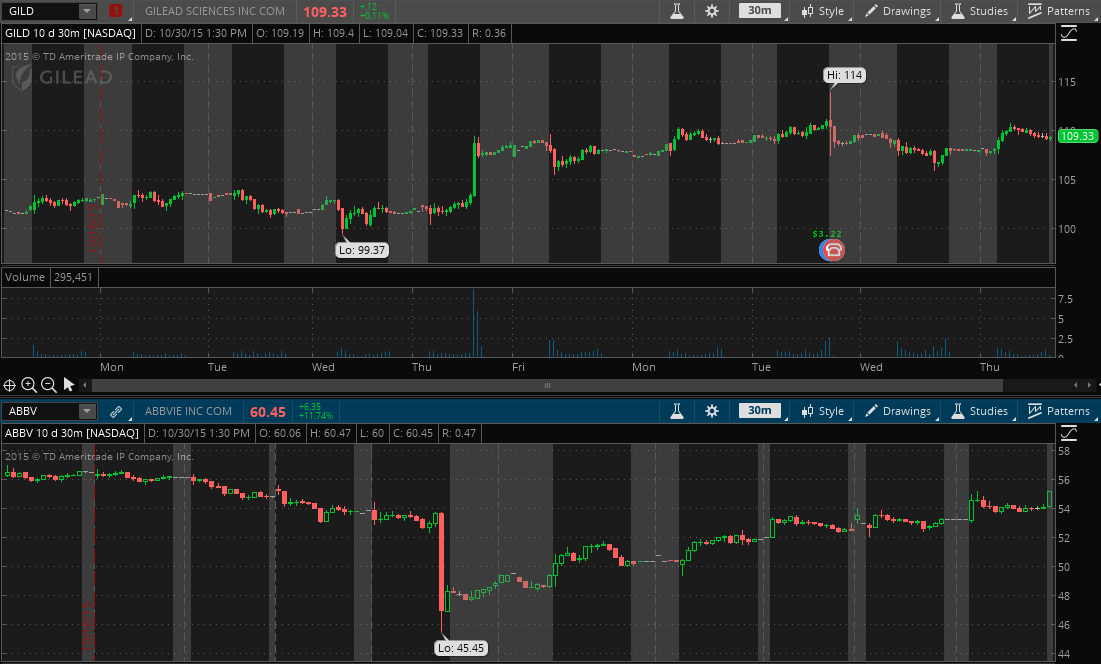

On October 22, the FDA announced that AbbVie’s (ABBV ) Viekira Pak and Technivie, used to treat hepatitis C, could cause serious liver injury, especially in patients with underlying advanced liver disease. AbbVie’s drug was always a cause of worry for Gilead Sciences investors. This announcement made Gilead’s stock rise 6.93% and AbbVie’s decrease 11.5%. However, AbbVie quickly recovered to its pre-FDA announcement levels, which is a sign that smart money entered the stock when markets got bearish on it. Post earnings announcement, the stock gapped up and crossed $60. We recommended AbbVie on March 1, 2013, when it was at $36.69, and the stock still remains on our list.

The above chart takes a look at the movement of Gilead Sciences and Abbvie post announcement.

Dividend Dates

A dividend Investing 101 article on Dividend Dates was trending for the second time in a week as investors and dividend capture strategists tried to make sense of all the different dates that a dividend investor has to know if he or she wants to trade/invest in dividend stocks.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.