Dividend investing is synonymous with having a conservative strategy, which is why many income investors tend to favor consumer staple stocks in their portfolios. These companies that are focused on selling everyday consumables and food goods tend to be relatively stable during bull and bear markets since households and businesses need to purchase basic goods, including everything from toothpaste to groceries, regardless of the economic outlook.

What Are Luxury Stocks?

All too often, however, dividend investors tend to overlook the other side of the consumer goods and retail sectors; more specifically, consumer discretionary stocks, which are the companies that sell durable and luxury goods. This tendency is somewhat understandable, because after all, discretionary stocks tend to be more volatile than their staple counterparts, given the greater degree of demand elasticity for their goods.

Plain and simple, luxury stocks are companies that are engaged in the manufacture, distribution, and marketing of consumer discretionary goods and/or services.

Be sure to also see Dividend.com’s Cheatsheet to Analyzing Retail Stocks

How Are Luxury Stocks Classified?

The consumer discretionary sector spans far and wide, and as such, the term “luxury stock” can be associated with a number of industries within the broader market. Here is a brief breakdown of some of the biggest sub-categories for the types of products and services that you are most likely to run into when researching luxury stocks:

Durable Goods – Also know as “hard goods,” companies that operate in this segment are engaged in the business of selling items that have an expected lifespan of over three years; this includes items like jewelry, furniture, and automobiles.

Consumables – Also know as “soft goods,” companies that operate in this segment are engaged in the business of selling products that have an expected lifespan of less than three years; this includes textile items and apparel.

Services – Companies that operate in this segment are engaged in the business of providing luxury services, including hotel and casino operators.

How Do Luxury Stocks Fit Into a Dividend Portfolio?

Although it may see counterintuitive at first, given their volatility, luxury stocks warrant a closer look from dividend investors. This is because they can help boost your portfolio’s total return given their tendency to appreciate more rapidly than their non-luxury, staple counterparts during periods of economic prosperity.

The reason behind this is simple: Because more affluent individuals tend to have more of their wealth tied to the stock market, during times of prosperity their overall level of wealth increases, which translates into more spending on luxury goods such as jewelry and brand name apparel. The same is true for less affluent individuals as well; during times of economic prosperity, they too will see an increase in their purchasing power, which translates into buying more luxury goods they might otherwise not be able to afford.

Companies that sell luxury goods are also more stable than many might suspect, largely because affluent individuals are less likely to change their consumption habits even when economic hardship strikes. Now let’s consider how luxury stocks have performed since the depths of the most recent financial crisis to put their appeal into perspective.

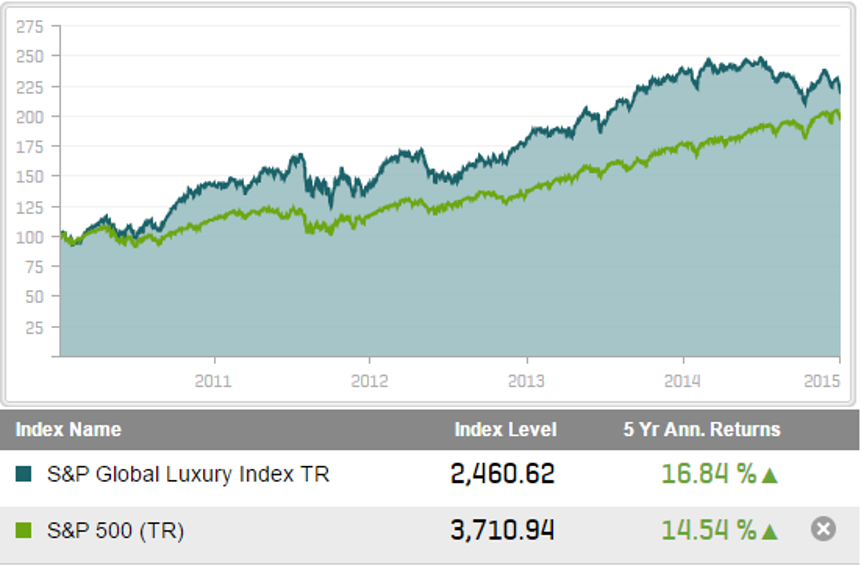

The chart below compares the monthly cumulative returns of the S&P 500 Index and the S&P Global Luxury Index, which is comprised of 80 of the largest companies engaged in the production and/or distribution of luxury goods and services, spanning from January of 2010 through the start of 2015:

While the performance gap is undeniable, on an annualized basis, it’s also worth noting the volatility of each benchmark; notice how the S&P 500′s rise is much smoother than that of the Global Luxury Index, which has experienced a great deal of volatility along the way. This volatility is most easily seen in the second-half of 2011 and again during 2012.

Luxury Companies That Pay Dividends

The performance comparison above is encouraging if you’re warming up to the idea of diversifying into luxury stocks. However, for dividend investors, the above chart might be a little deceiving since not all of the Global Luxury Index constituents pay out a regular distribution.

As such, the table below showcases all of the dividend-paying stocks that are included in the S&P Global Luxury Index:

| Ticker | Name |

|---|---|

| (BF-B ) | Brown-Forman |

| (CCL) | Carnival Corp |

| (COH) | Coach Inc. |

| (DECK) | Deckers Outdoor Corp. Com. |

| (DEO ) | Diageo plc |

| (EL ) | Estee Lauder |

| Liquid error: internal | Ethan Allen |

| (HOG ) | Harley-Davidson |

| (HAR) | Harman International |

| (IPAR ) | Inter Parfums Inc. |

| (LVS ) | Las Vegas Sands |

| (LUX) | Luxottica Group |

| (MPEL) | Melco Crown Entertainment |

| (NKE ) | Nike Inc. |

| (JWN ) | Nordstrom Inc. |

| (PII ) | Polaris Industries |

| (PVH ) | PVH Corp. |

| (RL ) | Ralph Lauren Corp |

| (RCL ) | Royal Caribbean Cruises Ltd. |

| (SIG ) | Signet Jewelers |

| (BID ) | Sotheby's |

| (HOT) | Starwood Hotels |

| (TIF ) | Tiffany & Co. |

| (VFC ) | V.F. Corporation |

| (WSM ) | Williams Sonoma |

| (WYNN ) | Wynn Resorts |

The Bottom Line

Luxury stocks are all too often ignored by dividend investors, seeing as how most deem them to be “too risky” for their income-focused portfolios. The fact of the matter is that some luxury stocks also boast impressive dividend payout track records. For example, companies like V.F. Corporation and Brown-Forman have raised their distributions for 42 and 30 years in a row, respectively. Although they tend to be more volatile than their consumer staple counterparts, luxury stocks still warrant a closer look from dividend investors looking to diversify their portfolio.

Be sure to follow us on Twitter @Dividenddotcom.