Most long-term investors have a love-hate relationship with cryptocurrencies. While their lack of correlation with conventional financial assets offers diversification, the lack of tangible assets backing their value is a tough pill to swallow. However, the industry’s massive growth suggests that there is a lot of value to capture.

Let’s take a look at an asset manager that hopes to enter the space with actively managed exchange-traded funds (ETFs).

See our Active ETFs Channel to learn more about this investment vehicle and its suitability for your portfolio.

Launching Active ETFs

Crypto-linked ETFs are now available in most markets after the U.S. launch of the ProShares Bitcoin Strategy ETF (BITO). In addition, actively managed crypto-adjacent ETFs have made it easy to invest in public companies that hold cryptocurrencies or support cryptocurrency infrastructure (think: graphics card manufacturers).

The BITO ETF saw tremendous volume early on. Source: BarChart.com

Purpose Investments, a Canadian asset management firm specializing in digital assets, recently announced its intent to launch the world’s first actively managed cryptocurrency ETFs. The fund will leverage direct and indirect exposure to a range of cryptocurrencies to provide monthly distributions and long-term capital appreciation.

In other words, the fund aims to trade cryptocurrencies rather than buying and selling stocks adjacent to the space. The move opens the door to some exciting possibilities, such as the use of decentralized finance (DeFi) to generate attractive yields from cryptocurrency holdings—a complex but lucrative endeavor.

Crypto ETFs in the U.S.

Purpose Investments’ new ETFs will trade on Canadian stock exchanges, making them slightly challenging for U.S. investors to purchase. While the SEC recently approved the first crypto-linked ETF, the agency is unlikely to approve actively managed ETFs with direct exposure to cryptocurrencies, at least in the near term.

In the meantime, investors have the option to buy one of many crypto-adjacent active ETFs holding stocks or those investing in cryptocurrency futures contracts like BITO, including:

- Amplify Transformational Data Sharing ETF (BLOK)

- First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT)

- Valkyrie Bitcoin Strategy ETF (BTF)

Investors can also purchase individual stocks with exposure to cryptocurrencies. For example, Riot Blockchain (RIOT) actively mines Bitcoin, and Marathon Digital Holdings (MARA) holds approximately 5,000 Bitcoins that it purchased. In addition, several OTC-listed companies also engage in mining Bitcoin and other altcoins.

Use the Dividend Screener to find high-quality dividend stocks.

Are ETFs Necessary?

Many cryptocurrency experts question the need for ETFs in the crypto space. After all, it’s not especially difficult to create an account on an exchange and directly acquire cryptocurrency. Investors can also avoid the ongoing management fees associated with ETFs while avoiding the potential pitfalls of futures contracts.

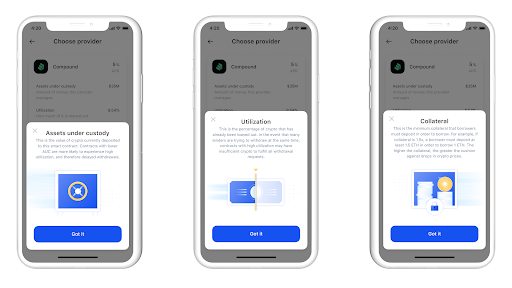

Coinbase Wallet makes DeFi accessible via a mobile app. Source: Coinbase

Most importantly, investing directly in cryptocurrencies opens the door to generating income with DeFi. Many exchanges make it easy to enter into DeFi contracts using their existing long-term holdings as collateral. For instance, Coinbase Pro offers DeFi opportunities directly within its mobile app and insurance against any hacks that it experiences.

Actively managed crypto ETFs, such as Purpose Investments’ funds, are a different story. Rather than simply tracking cryptocurrencies, the fund aims to employ strategies to maximize capital gains and income potential. However, the growing number of altcoins makes income maximization a challenge for investors that take a do-it-yourself approach.

The Bottom Line

Cryptocurrencies continue to be a significant force in the global financial markets. While the ProShares Bitcoin Strategy ETF (BITO) launch in the U.S. offers a crypto-linked fund, many investors still prefer to hold cryptocurrencies directly. But Purpose Investments’ new funds could change the calculus by opening the door to more complex strategies.

Don’t forget to explore our Dividend Guide where you can access all the relevant content and tools available on Dividend.com based on your unique requirements.