*With the Fed raising rates, dividend investors have been left out in the cold. Dividend stocks have faced a double whammy. High interest rates have made bonds and other safer assets like cash very appealing. At the same time, higher borrowing costs and the threat of recession have started to impact payout growth.

The result is that dividend stocks haven’t kept up with the broader market.

But investors may want to ignore the short-term noise and buy some of the dividend bargains today. Outlook for dividend stocks is very rosy, both in terms of long-term payout potential and the ability of dividends to drive much needed returns during the low growth years ahead. For investors, dividend stocks are still very much on the menu.

Share Prices & Payouts Fall

Dividend stocks—which were the market’s darlings during the era of zero interest rates—haven’t been getting much respect from investors these days. The Fed’s path of tightening has certainly taken the wind out of dividend stocks’ sails so far in 2023.

For starters, with rates higher, other ‘safer’ forms of return are available. With T-bills yielding north of 5%, the 10-year bond paying around 4%, and even corporate bonds paying around 5.5%, dividend stocks and their average 2.5% yield aren’t as appealing. Why take on the risk of equity when you can get a guaranteed 5%+ in investment-grade bonds?

As a result, investors have widely ignored dividend payers. For example, the S&P 500 Dividend Aristocrats index—which tracks those firms with long histories of raising their payouts—is up by 5% this year including dividends. That’s not a bad return at all except when you compare it to the rest of the broader market. The broader S&P 500 is up by 19% year-to-date. The NASDAQ is up by roughly double that amount.

At the same time, those higher interest rates are starting to clip payout potential as well.

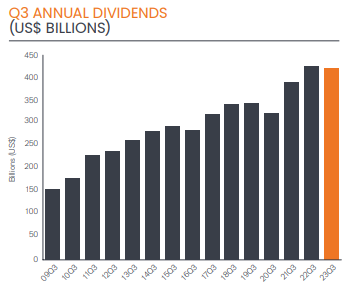

The latest data on global dividends is a little depressing. Asset manager Janus Henderson publishes quarterly dividend payout data and the results for the third quarter of 2023 were not ideal. According to their latest report, global dividends fell slightly by 0.9% to $421.9 billion in the third quarter. You can see from this graph the decline in payouts. 1

Source: Janus Henderson

The reasons for those declines are vast. For one thing, it’s more expensive for firms to expand, run their businesses, and service their own debts. The Fed’s rate hikes affect everyone on this front. There’s simply less cash to give out.

This has affected global dividends in another way: special payouts. According to Janus Henderson, special and one-time payouts have dipped considerably. Special dividends grew large in the wake of the pandemic, as well as energy firms adopting the structure to deal with volatility in oil prices. But with pandemic cash dwindling and crude oil falling, these special payouts have also dipped. During the third quarter, these payouts declined by $10 billion to hit just $8.4 billion. Special dividends are roughly at the level seen in the pre-COVID days.

All in all, shareholders received less in the third quarter than before.

Better Times Ahead

However, while dividends have suffered this quarter, the longer-term outlook is still rosy. The third quarter data needs to be taken in context.

Year-to-date, we’re still higher than 2022’s numbers, with more than 89% of firms raising payouts. The issue is sector-based. Looking at the data, basic material firms and energy stocks have been the ones slashing payouts and this has skewed the average. For example, basic material stocks have slashed payouts by 36%, while energy firms have cut payouts by about 9%. This is easy to understand, as lower commodity prices have caused these firms to cut payouts. Second, these sectors are most likely to have special payouts or dividends directly tied to the price of their commodity produced. Many gold miners peg their dividends to the price of gold.

As a result, it appears that global dividends have fallen. But it’s really a select segment of the market that has skewed the payout. Even with that, Janus Henderson expects dividends to reach $1.63 trillion this year. That’s about 5.5% higher than last year.

Dividend Stocks Are Cheap

The one hand has strong payout growth. What about the other? The stocks themselves. Here again, the data may be pointing to a strong finish and a good new year.

Because investors have loaded up on tech and other income asset classes, dividend stocks are cheaper than the broader market. Right now, the dividend aristocrats can be had for a P/E of around 16. This compares to the 20.5 P/E of the broader S&P 500 and the 27.5 P/E of tech stocks.

When looking at yields, dividend stocks win again, with a 2.6% yield versus just 1.4% and 0.79%, respectively.

That cheapness and yield is better when you consider return expectations for the broader market. Thanks to growing concerns about recession, the potential for stagflation, and overall economic malaise, the power of dividends can’t be ignored. Analysts now predict that once again a larger percentage of returns will come from dividends going forward. This could help the dividend stocks stay steady and be a better return element going forward.

Making a Dividend Buy

While the headlines are for the negative when it comes to dividend stocks, the reality is the sector is a big buy. A few bad apples are upsetting the whole cart. With their yields and cheap prices, investors may want to buy them today.

Our model portfolios here at Dividend.com are full of individual names that offer hefty yields and strong return potential. You can run our screeners as well. Many top dividend names like Target and Microsoft have continued to raise their payouts and yield above sector averages. These represent just some of the opportunities in the dividend stocks.

Dividend Stocks

These stocks are selected based on their YTD total returns, which range from -10% to +55%. They have market cap between $35B and $3003B and they are yielding between 0.5% and 5.5%.

| Ticker | Name | Market Cap | YTD Total Ret (%) | Yield (%) |

|---|---|---|---|---|

| MSFT | Microsoft Corp. | $2.767T | 55.23% | 0.81% |

| AAPL | Apple Inc. | $3.027T | 49.77% | 0.49% |

| WMT | Walmart Inc. | $406.123B | 6.39% | 1.51% |

| MDT | Medtronic PLC | $105.701B | 2.28% | 3.47% |

| DOW | Dow Inc. | $35.824B | 1.36% | 5.47% |

| PG | Procter & Gamble Co. | $341.655B | -4.35% | 2.59% |

| TGT | Target Corp. | $62.541B | -9.1% | 3.24% |

| XOM | Exxon Mobil Corp. | $396.679B | -10.02% | 3.82% |

You could also let someone else do the heavy lifting. There are numerous passive and active funds and ETFs that track those top dividend stocks. Passive management like the iShares Core Dividend Growth ETF provides exposure to the entire dividend sector, while active funds can deliver extra “oomph” by avoiding potential hiccups before they happen.

Dividend ETFs & Mutual Funds

These funds are selected based on their YTD total returns, which range from -1.6% and 16.5%. They have expenses between 0.06% and 0.62% and AUM between $2.8B and $84B. They are currently yielding between 1.2% and 3%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| CGDV | Capital Group Dividend Value ETF | $2.86B | 16.5% | 1.7% | 0.33% | ETF | Yes |

| VIG | Vanguard Dividend Appreciation Index Fund ETF | $83.8B | 7.4% | 1.9% | 0.06% | ETF | No |

| PRDGX | T. Rowe Price Dividend Growth Fund | $22.5B | 7.3% | 1.2% | 0.62% | MF | Yes |

| FEQTX | Fidelity® Equity Dividend Income Fund | $5.91B | 5.3% | 3% | 0.58% | MF | Yes |

| DGRO | iShares Core Dividend Growth ETF | $24.6B | 4.4% | 2% | 0.08% | ETF | No |

| VYM | Vanguard High Dividend Yield ETF | $63B | 0.8% | 2.9% | 0.06% | ETF | No |

| SDY | SPDR S&P Dividend ETF | $22.6B | -1.6% | 2.6% | 0.35% | ETF | No |

All in all, dividend stocks have had a rough go this year, underperforming the broader market and now showing signs of cutting payouts. However, this has made the stocks dirt cheap, while the actual dividend data isn’t as bad as it seems. With that, investors may want to consider buying dividend stocks today.

The Bottom Line

Dividend stocks have been treated unfairly as the Fed has raised rates. However, the data may not be as bad as it seems. Rising payout potential as well as overall cheapness makes dividend equities a big buy. Either individually or through a fund, dividend stocks should be bought.

1 Janus Henderson (November 2023). Janus Henderson Global Dividend Index (Edition 40)