Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

High dividend and well-performing stocks have been trending over the past two weeks. Real estate investment trust Public Storage has taken the first place in the list after it increased its dividend. Second in the list is Pioneer Natural Resources, which pays a fixed plus variable dividend based on free cash flow levels. Carmaker Ford Motor is again trending, this time in the third position, as the company has been in the news due to its cost-cutting measures. Finally, Devon Energy, which has announced a lower dividend than last quarter, closes the list.

Don’t forget to read our previous edition of trends here.

Public Storage Increases Dividend

Public Storage (PSA) has been the most popular ticker this past fortnight, seeing its viewership skyrocket 587%. This is hardly surprising. Public Storage, a self-storage real estate investment trust, has increased its dividend by 50% from a quarterly of $2 to $3. This equates to an annual yield of 4%.

Shares in Public Storage have fallen 27% since peak, but the company’s results have continued to impress. The company’s operating margin stands at about 80%, with net profit margin at more than 50%. Public Storage stock has largely suffered due to rising interest rates affecting the entire real estate market, but the company appears well-positioned for the long term.

The REIT owns and operates more than 2,800 self-storage facilities in the U.S. across 40 states. It also owns one third of shares in a European self-storage REIT.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

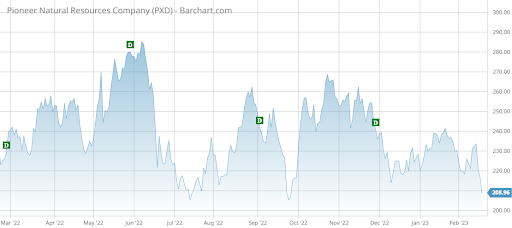

Pioneer Natural Resources Appears to Be a Good Dividend Play

Pioneer Natural Resources (PXD) has taken the second position in the list with an advance in viewership of 84%.

Pioneer, which operates oil wells in the Permian Basin, is an attractive dividend play. The company currently pays a fixed quarterly dividend of $1.10 per share, topping it with a variable dividend, the size of which depends on the amount of free cash flow.

In 2022, the company paid $25.40 per share in dividends, equaling a yield of about 11%. Oil prices stabilized this year and the company’s dividend declined, but in the near term the risks are tilted to the upside. The ongoing Russia-Ukraine conflict and the sanctions on Russian crude oil puts some of the supply at risk. Meanwhile, OPEC-led Saudi Arabia has not shown any interest in boosting supplies to keep a lid on oil prices. Additionally, on the demand side, China has removed all COVID-19-related restrictions.

Source: Barchart.com

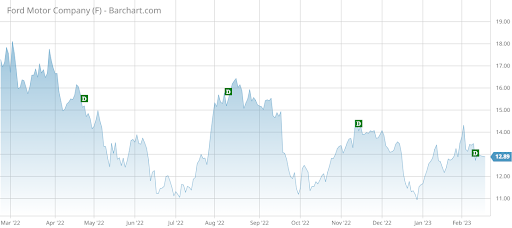

Ford Motor Cuts Jobs in Europe

Ford Motor (F) is third in the list this week, with an advance in viewership of 73%. Ford makes the list for two consecutive fortnights as the company’s issues have continued to attract readers.

Ford, which recently reported downbeat financial results partly due to inefficiencies and poor investments, last week said it will cut more than 3,800 jobs in Europe. The layoffs will be made over two years and include designers and engineers as it cuts production of engine cars in favor of electric vehicles, which are simpler to design.

The company will no longer produce the Fiesta and Focus brands in Europe because it has struggled to turn a profit on them, and it expects to sell only electric cars by 2030.

Ford Motor shares have lost half of their value since reaching a multi-decade peak at the beginning of 2022. The company’s dividend yields 4.6%.

Source: Barchart.com

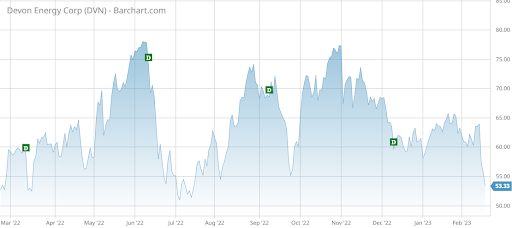

Devon Energy Hikes Base Dividend

Devon Energy (DVN) is fourth in the list with an increase in traffic of 48%. Devon has been in the news after it increased its base dividend by two cents to 20 cents per share. The company also announced it would pay an additional variable 69 cents per share, which is lower than the $1.17 for the prior quarter.

The declining variable dividend was due to lower oil prices. The company’s free cash flow declined to $1.3 billion from $2.1 billion in the prior quarter. Devon is also using its free cash to pay down debt and repurchase shares. Since instituting the latest buyback program, the company bought back $1.3 billion worth of stock.

Source: Barchart.com

The Bottom Line

Public Storage has increased its dividend as results have continued to improve. Pioneer Natural Resources has been paying a strong dividend. Ford Motor is again in the news as it’s cutting jobs in Europe. Devon Energy has increased its base dividend, although the variable part has declined due to declining free cash flows.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.