If there has been one driving force for the markets over the last decade or so, it has to be technology’s dominance on returns. Ever since the end of the Great Recession, traders have looked toward the sector for its high-growth potential in a low-growth world. This effect was only exacerbated during the pandemic. Stay-at-home and quarantining efforts only boosted technology’s dominance in our daily lives.

The only problem is with tech’s continued dominance in the market, valuations may have gotten even more stretched. There’s no denying that it isn’t cheap anymore.

The real question is whether or not we can still bet on tech without some of the tech stocks themselves. The answer may be a resounding yes. The truth is, everything these days could be considered a “tech company.” The digital transformation across many industries has plenty of traditional firms looking mighty tech-like in their appearance.

Our Best Dividend Stocks List has 20 of the highest-rated stocks by our proprietary Dividend.com Rating system. Go Premium to find out the entire list.

Traditional Tech-Sector Dominance

It is no secret that the world has gone gaga for technology stocks. The rise of the FAANG stocks is testament to that fact. Apple (AAPL ), Microsoft (MSFT ), Amazon (AMZN) and Google (GOOG) are all trillion-dollar-plus market-capped companies. Technologies weighting the S&P 500 now sit at a whopping 30%. That’s the largest amount in history and even more than during the Dotcom Boom of the 1990s.

The problem is, as we’ve hyped technology stocks in the wake of the Great Recession and pandemic, tech is no longer as cheap as it once was. The latest forward P/E for the sector clocks in at 27. That’s about 6 basis points higher than the broader market according to data from Yardeni. It’s the most expensive sector currently on a forward basis.

Moreover, many of the smaller top-tech names today are back in the “all-revenue, no profit” camp. The vast bulk of cloud-computing names, fintech stocks, mobile developers and the like are being driven solely by their revenue growth. This has distorted valuations further. And we can’t forget about IPO fever. More than 12 firms have launched their initial public offerings this week alone and they’ve all been technology stocks.

While this may not be a rehashing of the dot-com boom/bust,it’s a little concerning. This is especially true for more conservative investors. The recent taper tantrum caused by the Federal Reserve could be a preview of what’s to come. Tech stocks dropped hard mid-August as the Fed’s meeting minutes suggested that the economy was getting stronger and that it would stop supporting the economy with stimulus.

Use the Dividend Screener to find high-quality dividend stocks. Stocks with the highest ratings are Dividend.com’s current recommendations to investors.

Looking Elsewhere for Tech Exposure

The beauty for investors is that our ever more complicated lives revolve around technology. It seems that everything we touch – from our cell phones to our toasters – have some form of microchip inside. Apps and cloud computing drive our entertainment, banking and work life. This is an interesting development for the economy and investors overall.

These days a wide variety of non-tech like industries – from retail and farming to your local burger joint and plumber – are embracing technology in a big way. It is called the digital transformation and it’s about using technology to improve not only processes within a business, but products and end-user experience as well.

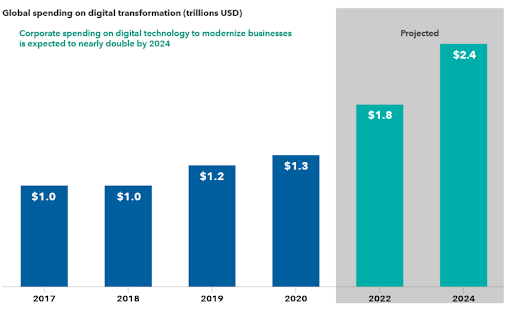

And companies are spending big to do so. You can see in this chart from American Funds the sheer amount of cash that global non-tech firms are spending building-out their digital empires.

Source: Capital Ideas Blog/American Funds

According to data and estimations from Statista, companies are expected to spend more than $2.4 trillion with a “T” on their digital transformations by 2024. That’s up from $1.3 trillion during the pandemic.

And the examples of who is spending are vast.

For example, the trio of McDonald’s (MCD ), Starbucks (SBUX ) and Dominos (DPZ ), are prime examples of restaurant stocks making digital transformations. SBUX has been successful in launching its own app and payment ecosystem. This has provided plenty of data on customer trends, strengthened mobile orders as well as boosted sales. DPZ is in a similar vein. The firm was one of the first to offer online ordering, back in 2007, and these days, its Anywhere platform allows for ordering via more than 15 different methods. It’s even flirting with self-driving cars for delivery. MCD has embraced self-ordering kiosks and digital menus that change-based on temperatures, local conditions and customer’s preferences.

Keep track of all stocks, ETFs and mutual funds from Consumer Discretionary Sector.

Outside of food, Walmart (WMT ), Target (TGT ) and Home Depot (HD ) are leading the retailing world with plenty of omnichannel muscle. All three have continued to post strong growth in digital order. Heck, even tractor and farming firm John Deere (DE ) has unveiled new AI driven tractors and high-tech soil sensors to improve farm yields and reduce labor time for framers.

Tech Is Everywhere Now

The overall point to this is that investors don’t need to buy traditional tech stocks to get exposure to the technology sector anymore. It’s everywhere. And considering the lower valuations in many other sectors, this may seem like a great place for new investments.

For more conservative investors, this is particularly a good idea. A firm like Walmart comes with strong sales, a growing dividend and a hefty dose of new digital/logistics technology. It’s less volatile than, say, buying a start-up cloud-computing stock. With the current market environment and place in the business cycle, that could be warranted.

In the end, tech is making its way into every industry. And that makes some pretty sleepy sectors and stocks into future tech giants. This allows many dividend seekers to find deals these days on some potential high-growth names outside the world of the FAANGs and their kin.

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.