The COVID-19 pandemic has killed more than 100,000 Americans over just a few short months. As the country tackles the health crisis, a brewing economic crisis threatens both near-term retail sales and long-term purchasing behaviors that drive consumer spending in a largely consumer-focused economy.

Let’s take a look at how COVID-19 has impacted retail sales, some of the latest victims in the retail industry and the implications for income investors focussed in this space.

Use the Dividend Screener to find high-quality dividend stocks. You can even screen stocks with Dividend.com ratings (previously called DARS) above a certain threshold.

COVID-19's Impact on Retail

Retail sales fell by a record 16.4% between March and April, according to the U.S. Bureau of Economic Analysis, amid both business shutdowns and growing unemployment. While retail sales could rebound as states and localities reopen, overall sales could remain depressed as stimulus spending wears off and unemployment remains high.

The biggest retail sales declines were seen at clothing, electronics and furniture stores, but online sales soared 21.6% year over year as consumers preferred to shop at home. J.Crew, and Neiman Marcus have already filed for bankruptcy protection and UBS estimates that roughly 100,000 stores could close over the next five years.

Big Retailers Curb Dividends

Many publicly traded retailers have cut their dividends and share buyback programs, cut capex spending plans and drew down credit facilities to improve their balance sheets. The survivability of the crisis depends largely on balance sheet strength and a retailer’s ability to pivot to online sales to supplement brick-and-mortar locations.

Don’t forget to check our department store and apparel store pages to explore more stocks.

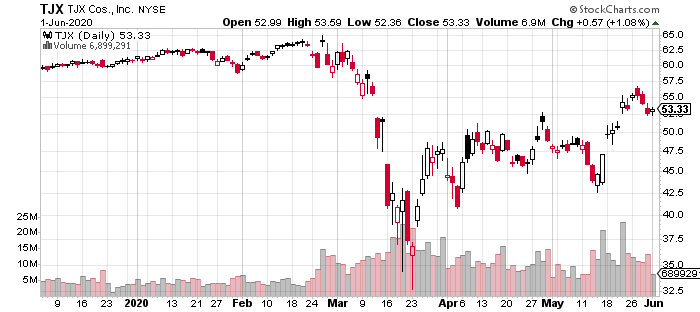

TJX Companies Inc. (TJX), the operator of branded retail stores like Winners, Marshalls, and HomeSense, recently announced that it doesn’t expect to pay a dividend during the first or second quarter. The company also reduced its planned capex from $1.4 billion to between $400-600 million and took action to reduce ongoing variable and discretionary costs. That said, the company ended the quarter with $4.3 billion in cash and anticipates enough liquidity for the remainder of the year.

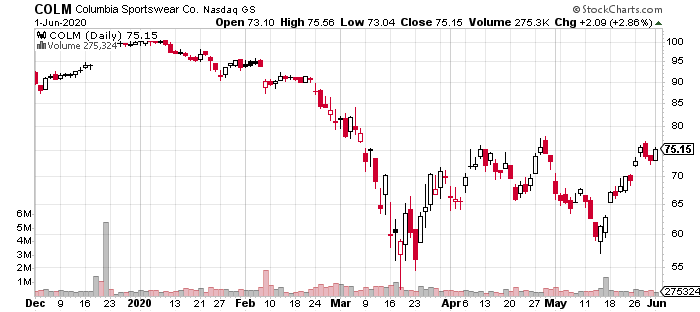

Columbia Sportswear Company (COLM), the maker of outdoor and active apparel and footwear products, suspended its dividends and share repurchases, and took actions to improve its liquidity, cut costs and manage inventory. The company ended its last quarter with about $700 million in cash and equivalents, with $175 million in short-term borrowings and $577 million in inventory as sales fell 13% to $568 million.

Footwear retailer Foot Locker Inc. (FL) temporarily suspended its quarterly dividend and share repurchase program, borrowed $330 million from a credit facility, cut its capex plans in half and reduced salaries for the CEO and senior executives. In addition to reporting more than $1 billion in cash and equivalents on its balance sheet, the company has already reopened 1,400 stores nationwide, which could help boost sales.

Other large retailers that have taken similar actions:

- The omnichannel apparel retailer, Macy’s Inc., (M) suspended its dividend and tapped a $1.5 billion line of credit while suspending its earnings outlook.

- L Brands Inc. (LB), the specialty retailer operating stores under the brand names of Victoria’s Secret and Bath & Body Works, suspended its dividend and drew down a $950 million line of credit to support its liquidity.

- Specialty retailer Abercrombie & Fitch Co. (ANF) temporarily suspended its quarterly cash dividend.

Implications for Investors

Income investors should be cognizant of the challenges facing the retail industry. With COVID-19 hurting sales, many retailers have opted to suspend or slash their dividends to shore up capital. Some of these companies may also face higher bankruptcy risk if consumer spending remains sluggish over the coming year.

Income investors may want to reduce exposure to the retail industry given these challenges and focus on sectors with more sustainable dividends. For example, many utilities continue to pay attractive dividends with their stable income streams. Other conventional dividend-paying industries have faced challenges, such as the energy industry’s struggle with low oil prices.

Follow Dividend.com’s Education section to get answers to all your dividend specific questions.

The Bottom Line

Retail sales fell by a record 16.4% between April and May as store closures and high unemployment reduced consumer spending. In response, many publicly traded retailers cut their dividends and share buybacks, as well as cut capex spending and other variable and discretionary costs.

Be sure to visit our complete recommended list of the Best Dividend Stocks.