Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Microsoft has made waves of late as its market capitalization slowly increased this year and at some point surpassed Apple as the most valuable company in the world. General Motors announced that it is closing some plants in the U.S., irking U.S. President Donald Trump. Intel has suffered a blow after an analyst downgraded the stock. Finally, cigarette-maker Altria Group is exploring ventures in the cannabis industry amid slowing sales of its core products.

Be sure to check out the previous edition of trends here..

Microsoft’s Boring Cloud Business Propels Stock Higher

Microsoft (MSFT ) has seen its viewership increase 55% this week, as the legendary technology juggernaut briefly surpassed Apple (AAPL ) as the most valuable company in the world by market capitalization. Microsoft stock managed the feat on November 30, but gave up some gains since then. Apple’s valuation is now higher than any other company, but both Microsoft and Amazon are not far behind.

Microsoft, which pays a dividend yield of 1.70%, has been benefiting greatly from its highly profitable cloud business. The company started to shift its focus to the enterprise segment with the advent of Satya Nadella in the top role. Microsoft was one of the pioneers in the cloud services market, launching in 2011, a few years after Amazon. The company now has a 13% share of the market, still trumped by Amazon’s 33%.

Microsoft surpassing Apple’s market capitalization marks another historic moment for the bitter rivals that spearheaded the personal computer revolution. For a long time, Microsoft had been winning the war and even became the largest company by market capitalization in 2002. However, Apple started to outperform Microsoft after the return of Steve Jobs and the invention of the iPhone, which has been a cash cow for the company for many years.

Microsoft stock has declined more than 2% over the past five days, amid a broad market sell-off. Shares remain up around 26% year-to-date. Apple, meanwhile, advanced just 4% over the same period.

Follow Dividend.com’s Dividend Education section to get answers to all your dividend-specific questions.

General Motors Stirs Political Backlash

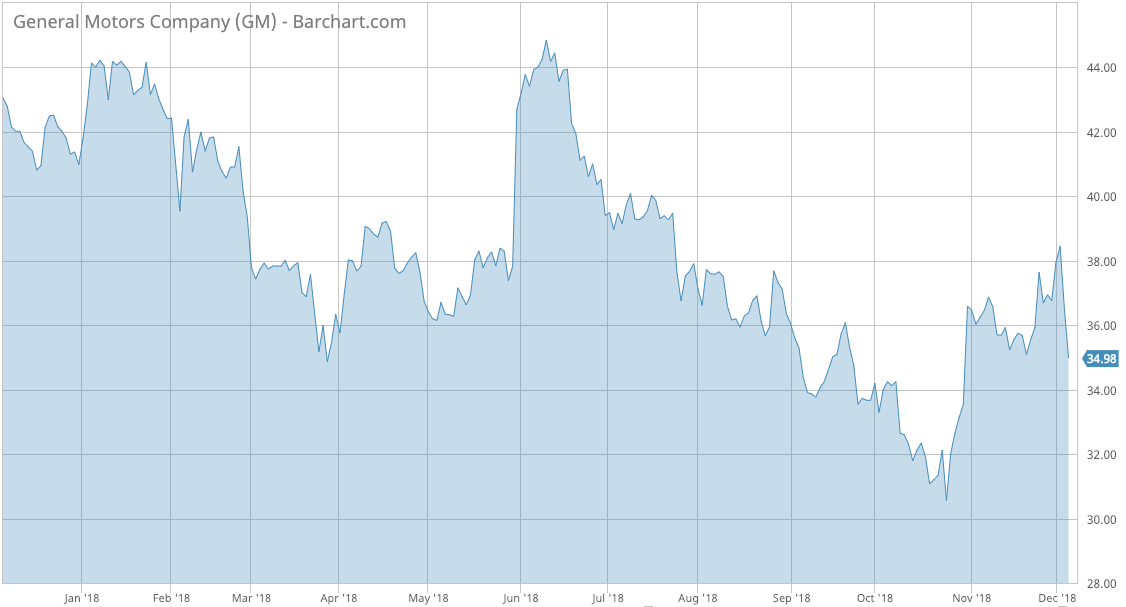

General Motors (GM ), the American car manufacturer, has experienced a 54% advance in viewership, close behind Microsoft. An announcement by GM that it plans to close four plants in the U.S. and lay off around 12,000 workers did not please Washington, which exhibited a rare show of unity and pushed against the move. Both the Democrats and Republicans bemoaned the company for the unexpected move and called on CEO Mary Barra to rethink her decision. Barra now is expected to give explanations.

GM said it is not shifting factories to Mexico or elsewhere. Instead, it wants to halt production of less fashionable models such as the Chevrolet Cruze, Impala and Volt to invest heavily in electric and self-driving cars. GM has been facing increased competition in the car market, particularly as the Model 3 by Tesla (TSLA) gains traction with customers. The company is already behind in developing self-driving cars and electric vehicles, which may be crucial for its future.

President Donald Trump, who campaigned on a platform to bring back manufacturing jobs, was particularly displeased, threatening to cut government subsidies to GM.

The incident has triggered a 5% dive in the stock price Wednesday, extending year-to-date losses to more than 10%.

Click here to learn more about GM’s involvement in self-driving vehicles.

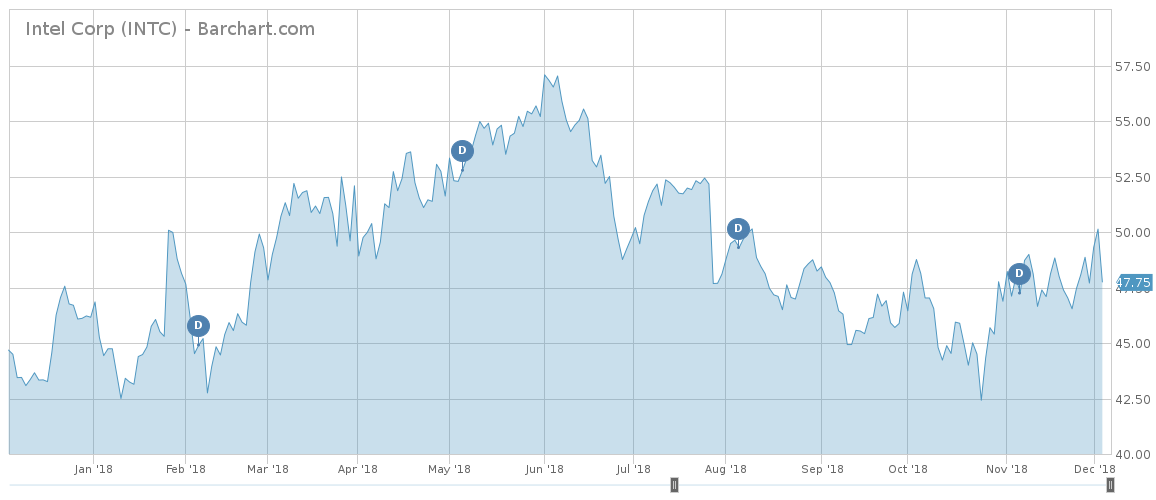

Intel Falls on Downgrade

Intel (INTC ) has seen its viewership rise as much as 45% in the past two weeks, as the company made the headlines for all the wrong reasons. On Tuesday, the company was downgraded from ‘hold’ to ‘underperform’ by Northland Capital Markets analyst Gus Richard, who said the company’s turnaround has been stagnating while it has been losing market share to Advanced Micro Devices. Intel’s stock tanked nearly 5% on Wednesday, bringing year-to-date performance into negative territory.

Intel has also been battling with the departure of CEO Brian Krzanich, who left abruptly in June after he revealed he had consensual relations with an employee. Krzanich was replaced by Robert Swan on an interim basis until the company finds a permanent replacement. “Intel threw the captain overboard six months ago and it remains to be seen if the new leader is Lord Nelson or Captain Queeg,” Richard said in his report.

In addition to rising competition, Intel is facing lower demand due to trade fears.

Altria Group

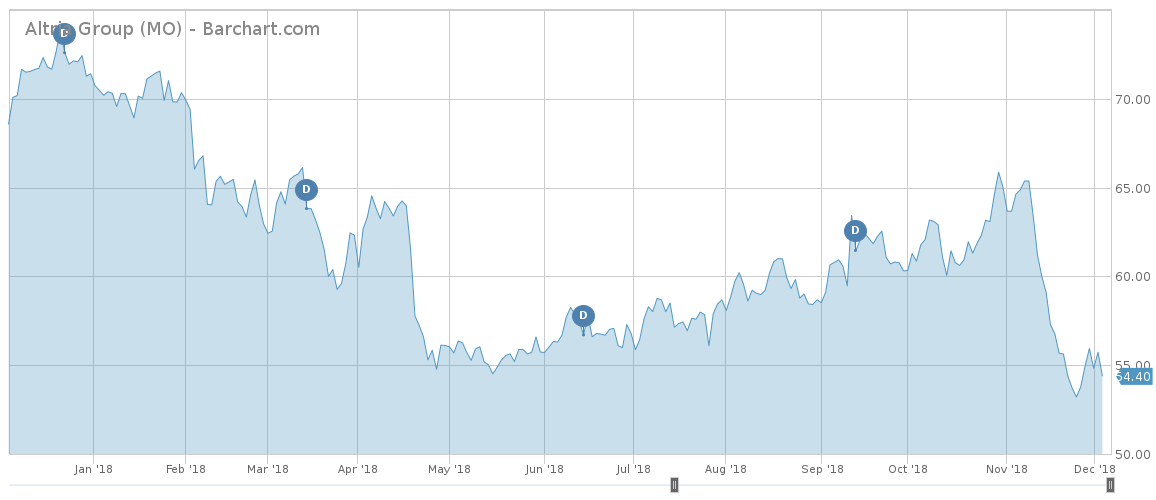

The largest cigarette-maker Altria Group (MO ) is seeking to offset declining cigarette sales with investments in cannabis and vapes. Altria has seen its viewership rise as much as 32%, taking the last place in the list.

Altria is considering investments in Cronos Group, a Canadian cannabis company, and San-Francisco-based Juul, an e-cigarette maker. No deal is imminent, however. Altria’s big tobacco baggage may prevent both companies from accepting a deal. Juul employees were upset about the news of a potential Altria investment, given that the company’s stated mission is to eliminate cigarettes. Cronos, meanwhile, may have a hard time inking deals with food, pharmaceutical and beverage companies if it partners with Altria.

Although Altria’s stock is flat this year, its sales have been dropping by around 4% annually. The company has been countering poor sales with price increases, but the tactic may not be sustainable. Altria needs to pivot.

The Bottom Line

Microsoft’s boring cloud business has quietly mounted a challenge to Apple on valuation, as the company’s stock briefly surpassed the iPhone maker at the end of last month. General Motors has some explaining to do in Washington about its decision to close four plants and lay off thousands. Intel dropped on a downgrade by an influential analyst, while Altria hopes investments in cannabis and e-cigarettes will save it from falling sales.

Be sure to check out Dividend.com’s News section to keep track of the latest dividend-related investing news and strategies.