Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

After years of being unpopular with investors due to a mishap during the financial crisis, General Motors is slowly regaining favor, with the stock reflecting this renewed interest. GM is first in the list this week, followed by CVS Health, a company hoping for a merger with Aetna, which will bring its lost shine back. Abbvie, another healthcare firm, trended third as it achieved success with an experimental drug. Enbridge was last in the list as the energy transportation firm made headlines with a decision to let shippers book unlimited capacity on its main artery.

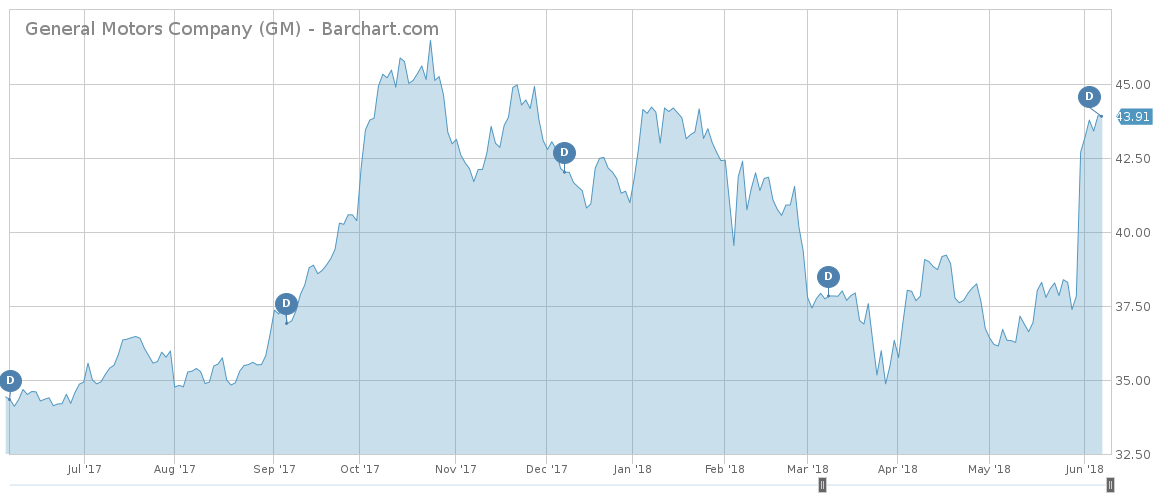

GM Surges on SoftBank investment

General Motors (GM ) is slowly regaining the confidence of investors as it leaves behind its checkered past filled with bankruptcy fears and government bailouts.

The leading U.S. car company has seen its traffic rise 28% in the past five days, almost as much as its stock price. Indeed, GM has surged nearly 20% since May 30 after Japanese investor SoftBank unveiled a more than $2 billion bet on the firm as part of its Vision Fund. To be sure, SoftBank, which is led by Masayoshi Son, an early backer of Alibaba and its founder Jack Ma, invested $2.25 billion in the firm’s self-driving unit, GM Cruise Holdings. As a result of the deal, SoftBank will own nearly 20% of the unit, but the transaction is still subject to regulatory approval.

SoftBank is not the only one getting bullish on GM, which currently has an annual dividend yield of 3.4%. Many investors are piling up on the stock as the firm is on strong footing and relatively undervalued compared to the rest of the market. Indeed, GM’s financial standing is much better now compared to what it was when the financial crisis hit in 2008 when it was bailed out by Uncle Sam. For instance, the company has to sell way fewer cars now to break even, while secular growth in China is likely to soften the blow in case of a recession in the U.S.

A big concern is that the U.S. auto market may be slowing down in the upcoming years after incessantly growing for nearly ten years. Still, GM seems well prepared to weather another crisis.

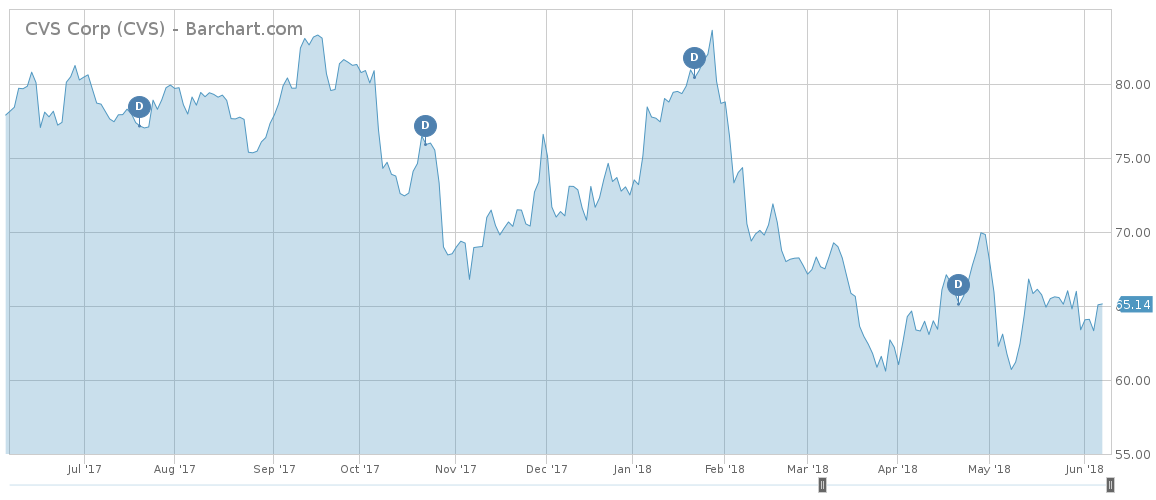

CVS Health Looks to Aetna for Shine

Retail pharmacy company CVS Health (CVS ) is preparing for the next step in its evolution after striking a deal to buy large insurer Aetna in a vertical merger. CVS Health, which pays a dividend yield of 3.06%, has seen its viewership rise 27% this week, as the company unveiled the leadership team of the combined entity.

The deal is expected to close in the second half of this year and, until then, both companies will operate as standalone entities. After the completion of the deal, Aetna will operate as a subsidiary of CVS and be led largely by members of the current management team. Among big management changes, though, CVS’ Chief Financial Officer David Denton will be replaced with Shawn Guertin, who has served as finance chief of Aetna since 2011.

CVS agreed to buy Aetna in December for $69 billion in cash and stock. Although the deal promises a great number of synergies given the vertical integration, investors have not been very rewarded. Since the deal was unveiled on December 3, CVS’s stock has dropped more than 14%, although it initially staged a rise.

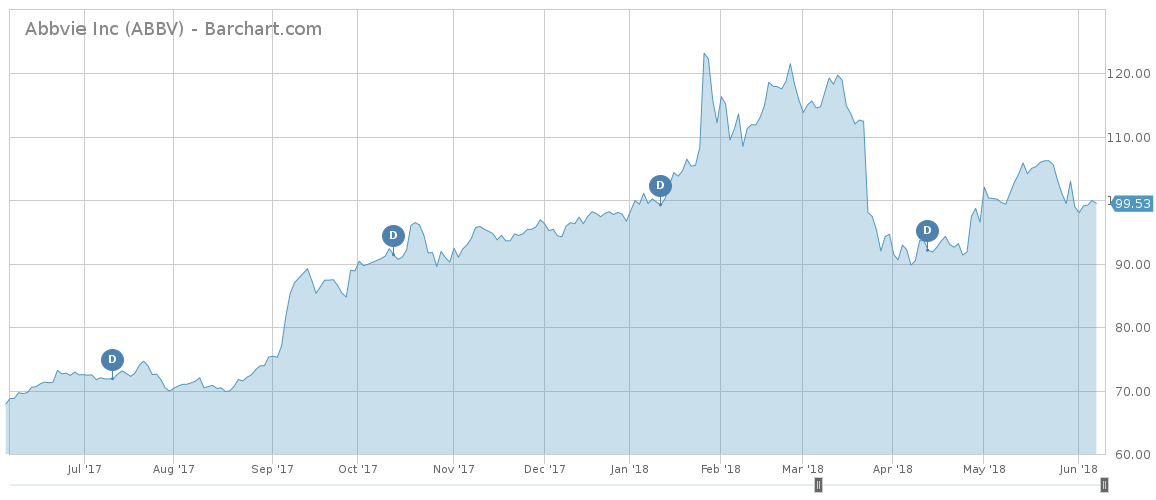

Abbvie Arthritis Drug Successful in Late-Stage Study

Abbvie (ABBV ), the $160 billion pharmaceutical juggernaut, is slowly recovering from a mid-March sell-off, as its drug aiming to stop the advance of rheumatoid arthritis succeeded in a late-stage test. Abbvie, which pays a handsome dividend yield of around 3.85%, has seen its traffic rise 27% in the past week, not far behind CVS and GM. Investors are looking for a hint whether the therapy’s success will lead to a strong recovery in the stock price.

In mid-March, Abbvie lost more than 20% of its value after a high-profile cancer drug candidate missed the mark during a key trial. Abbvie’s stock has increased more than 1% over the past five days, extending year-to-date gains to 3.4%. In the past 12 months, Abbvie’s shares remain up more than 47%.

Abbvie said it plans to submit a marketing application for the arthritis drug called upadacitinib in the second half of 2018. The company is already a leader in treating rheumatoid arthritis with its hit therapy Humira.

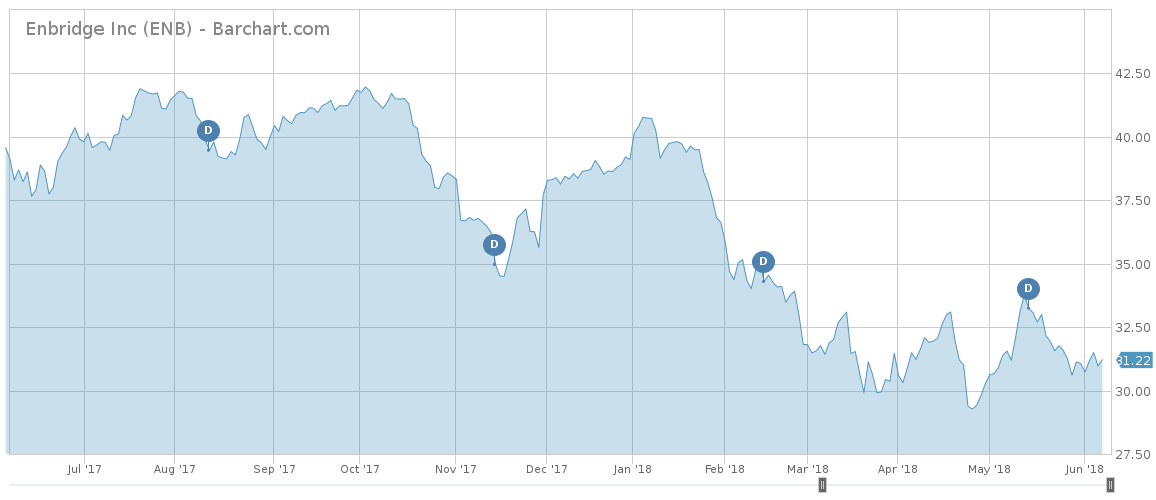

Enbridge Rolls Back Nomination Rules

Enbridge (ENB ), the Canadian energy transportation company with a market capitalization of $50+ billion, made headlines this week after giving crude oil shippers more leeway. Enbridge has seen its viewership advance 19% this week, taking fourth place in the list.

The company rolled back a procedure to block shippers from claiming more space than they can use on a key pipeline connecting Alberta’s oil sands with U.S. refineries, triggering a rise in Canadian crude prices. Rising oil prices has emboldened Canadian oil producers to increase production but the limitation set by Enbridge endangered access to the important U.S. market. After speaking with oil producers, Enbridge said it decided to scrap the rules.

Last month, Enbridge, which pays a dividend in excess of 6%, had said that allotted shipping volumes would be set by the 12-month rolling average plus 15% for heavy crude and 40% for light crude. Customers willing to send more than their predetermined amounts would have to show proofs of volumes. Enbridge said the mainline system continues to be oversubscribed but it works with shippers actively to improve the nomination process.

The Bottom Line

General Motors is regaining the confidence of investors after years of being shunned due to its near-death experience in the aftermath of the financial crisis in 2008. An investment from SoftBank’s Vision Fund certainly helped the company in the area of confidence and lifted the stock price. Meanwhile, CVS Health is hoping a big merger with large insurer Aetna will improve its overall profitability. After failing to secure approval for a key cancer therapy, Abbvie struck gold with an experimental arthritis drug, which is on track for a marketing application in the second half of 2018. Canadian transportation company Enbridge triggered a surge in Canadian crude after scrapping a plan to limit the amount of oil shippers can send south of the border.