Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The last two weeks were rich in earnings releases and dividend cuts. Kraft Heinz Co. and Apple both disappointed investors, with the former issuing poor earnings and the latter ending communications on the number of devices sold. Embattled General Electric made it into the top after it slashed its dividend again. Oil major BP is the only bright spot, reporting blowout earnings on rising oil prices.

Check out our previous Trends edition here.

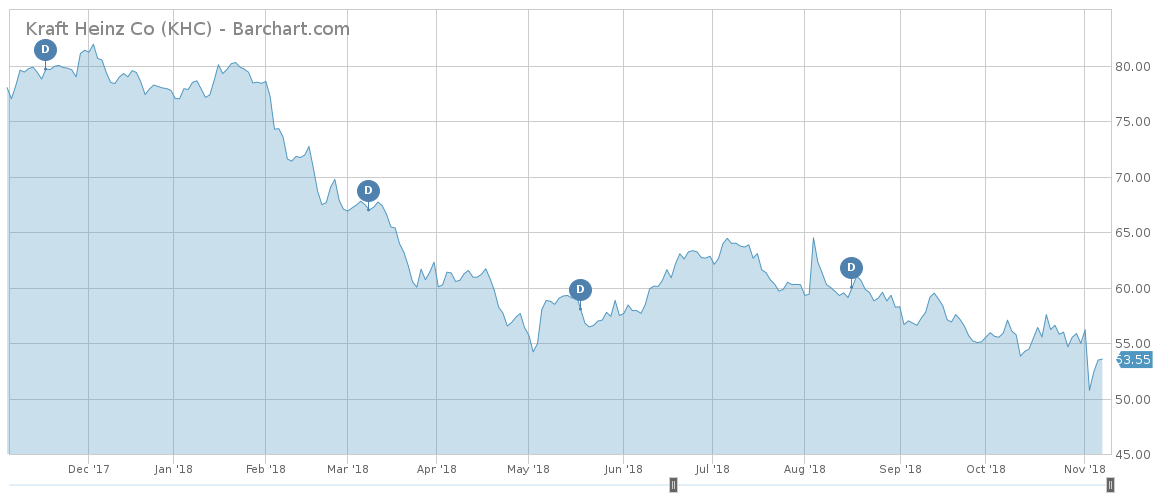

Kraft Heinz Drops on Downbeat Earnings

Kraft Heinz (KHC ), the food giant paying a solid 4.7% dividend, has reported a downbeat third-quarter earnings report, hit by higher commodity costs and promotional activities. As a result, the company, backed by Warren Buffett, took first place in the list this week with a 149% rise in viewership.

For the third quarter, the company’s net sales rose 1.6% from the same period a year ago, a bit above analysts’ expectations. However, net income fell abruptly by 33% to $630 million or $0.51 per share. Adjusted earnings came in at $0.78, 3 cents below expectations. The company put the blame on one-off factors and its desire to ensure customer service, noting that prices declined 2% in stores despite higher input costs.

Shares reacted negatively to the news, tumbling 9% on November 2. Since then, they have recovered some ground and are now down just 4%.

Despite having the support of legendary investor Buffett, Kraft Heinz has been unable to buck the trend in consumer tastes toward healthier options. The stock has steadily dropped 30% this year as the firm failed to grow its businesses and its margins suffered.

Chief Executive Officer Bernardo Hees struck an optimistic tone, saying in a statement that the company is well-positioned to deliver sustainable, profitable growth going forward. To do that, he’ll have to find ways to cater to fickle Millennials while minimizing the impact of rising commodity and transportations costs.

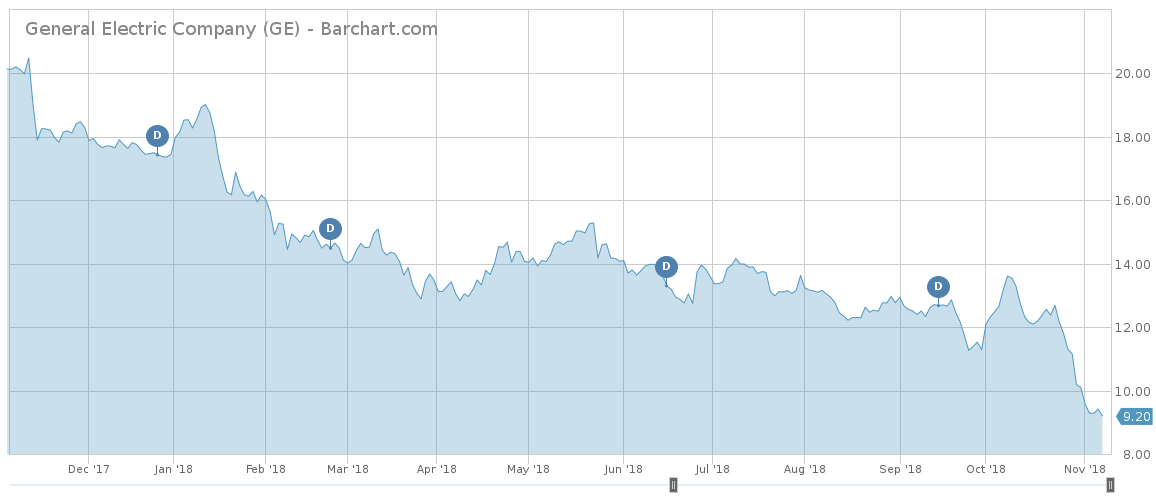

GE Cuts Dividend in Bid to Reverse Fortunes

General Electric (GE ) has reported disappointing results for the third quarter and slashed its dividend for the second time in almost a year, as the newly installed CEO Larry Culp is taking dramatic steps to avoid spiraling out of control. GE, which saw its viewership rise 72%, reduced its quarterly dividend from 12 cents to just 1 cent, while the dividend yield dropped from more than 5% annually to a meager 0.4%. Although it will not help its cash flow significantly, the company may halt the dividend altogether.

Shares in GE declined 9% on the results, extending year-to-date losses to nearly 50%. Adjusted earnings per share, which excludes a write-down of $22 billion, came in at 14 cents per share, a drop of 33% compared to the same period last year.

GE’s power division has been the main culprit for the poor performance, as a shift toward renewable energy and slow demand in emerging markets took a toll on results. Further deteriorating the picture, the U.S. Department of Justice announced an investigation into the write-down, which mostly relates to a 2015 acquisition of Alstom’s energy division.

Culp now aims to split the power division into two units – the gas turbines and the remaining assets. He also wants to remove management layers in the unit so that chief divisions report directly to him.

On the bright side, the unit producing aircraft engines and other parts reported strong performance, with earnings advancing 25% to $1.7 billion. However, there are worries the profitability will be hurt as the business cycle is in its final innings.

Apple Ends Unit Sale Reporting

Technology behemoth Apple (AAPL ) is ending the reporting of its unit sales, a metric that has been key for investors for many years. The decrease of transparency sparked concerns that Apple may try to mask the drop in sales of its flagship product, the iPhone, and triggered an advance of 59% in viewership.

Apple’s poor outlook also disappointed investors, with the company predicting sales will be between $89 and $93 billion for its December quarter compared with $93 billion expected by analysts. Finance Chief Luca Maestri indicated the guidance represented a record for revenues and net income.

Maestri said reporting unit sales was not relevant anymore because the metric is less relevant now than it was in the past. The company will still report revenues by product category. To soothe investors, the company will increase its transparency by providing details about its gross margin in the services business, a move widely seen as an attempt to convince investors that Apple was more of a services business rather than hardware.

Following the results, unveiled around a week ago, Apple briefly lost its status as a trillion-dollar market-cap company. With the stock now trading at around $209 per share, the company is worth $1.01 trillion. Although the stock has dropped 5% in the past five days, it remains up 25% year-to-date.

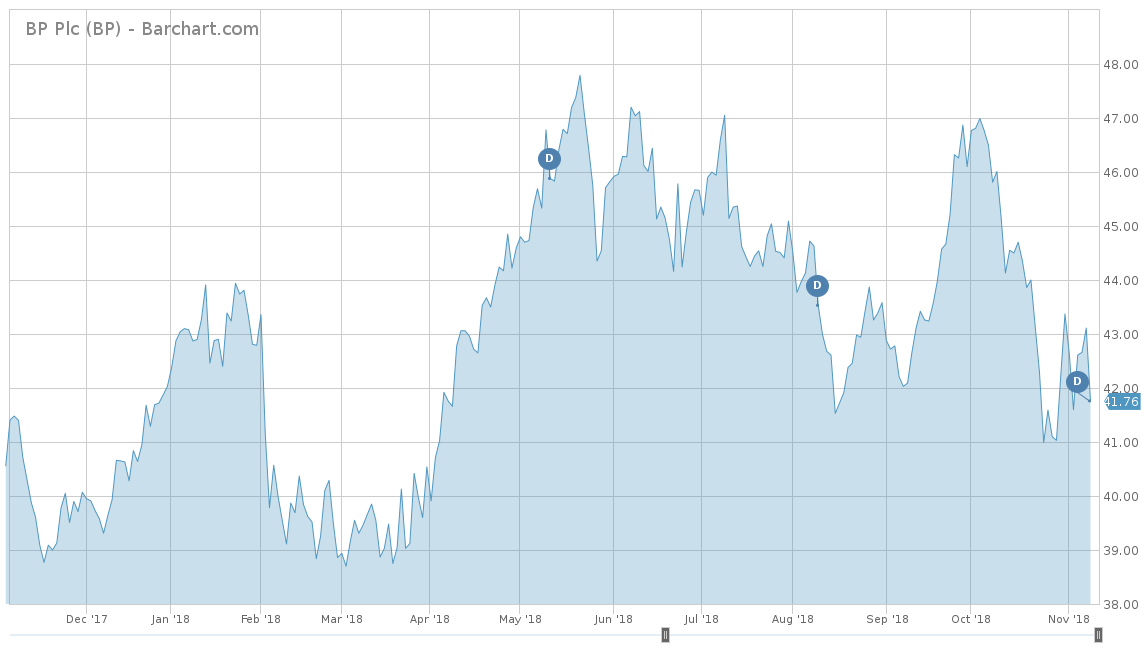

BP Rises on Strong Profits

Oil major BP (BP ) has reported a strong set of results for the three months ending September 30, with net income more than doubling compared to the same period last year thanks to strong oil prices. BP, a highly watched stock for its juicy dividend of more than 5%, saw its viewership edge up 44%.

BP reported a net profit of $3.8 billion, comfortably beating estimates of a little over $3 billion. The company has hiked its oil and gas production and is expected to continue this trend, particularly as the $10 billion acquisition of BHP Billiton’s shale assets allows it to increase revenues and profits.

The strong results came on the back of strong oil prices, with crude advancing more than 17% year-to-date. Going forward, however, concerns about global trade and slowing demand could hit commodity prices. WTI crude already experienced a pullback from a high of $76.90 per barrel in October to around $62 now.

BP stock has risen 1% over the past five days, extending year-to-date gains to as much as 9%.

The Bottom Line

Warren Buffett-backed Kraft Heinz has been losing its glitter and it struggles with a shift in tastes toward healthier alternatives. General Electric slashed its dividend to almost nothing, the second cut in a year. Meanwhile, Apple raised worries after it decided to end reporting unit sales. The only bright spot, BP, rose after reporting blowout earnings thanks to a recent acquisition and rising oil prices.

Check out our complete list of Best Dividend Stocks.